In the realm of personal finance and investing, micro-investing is a modern practice that allows individuals to invest small amounts of money regularly. It’s a form of investment that focuses on facilitating the participation of those who may not have significant capital to start with, thus democratizing the investment world. Micro-investing provides an excellent opportunity for people to engage in the investment landscape by breaking down financial barriers. Micro-investing platforms are digital platforms that facilitate micro-investing. They make the process easy and accessible for all, often requiring minimal initial investment and offering user-friendly interfaces. These platforms aim to make investing as straightforward as possible, reducing the complexities traditionally associated with investment. In the contemporary financial world, micro-investing platforms are revolutionizing how people interact with investment. By enabling people to invest with minimal funds, these platforms are breaking down the barriers to entry for investing, leading to increased financial literacy and independence. They are a driving force in democratizing investment, making it more inclusive and accessible. At its core, micro-investing is about regular, small investments. It operates on the concept of "investing the change," where small amounts of money are automatically invested over time. This could be as simple as rounding up your purchases to the nearest dollar and investing the difference. Micro-investing takes advantage of the principle of compound interest, where even small investments can grow significantly over time. Micro-investing plays a critical role in financial planning. It offers a practical and accessible way for individuals to start investing and build wealth over time. With micro-investing, individuals can start investing without needing a significant amount of disposable income. It is a great starting point for those who are new to investing and want to learn more about the process without significant financial risk. Micro-investing platforms are digital applications that simplify the investment process. They are designed with user-friendliness in mind, providing easy-to-navigate interfaces and straightforward investment options. These platforms handle all the complexities of investing, allowing users to invest their money with just a few clicks. Micro-investing platforms operate by facilitating small-scale investments into various assets. They provide a platform where users can link their bank accounts, set their investment preferences, and start investing. Most platforms automate the investment process, either by rounding up transactions and investing the difference or by enabling scheduled investments. Acorns is a popular micro-investing platform known for its 'round-up' feature. It rounds up the user's purchases to the nearest dollar and invests the difference in a diversified portfolio of ETFs. Stash offers micro-investing options alongside traditional investment accounts. It allows users to purchase fractional shares of stocks and ETFs, making it possible to own parts of high-priced securities with less capital. While not traditionally a micro-investing platform, Robinhood has made a name for itself by offering commission-free trades and the option to buy fractional shares, making investing more accessible. M1 Finance offers a hybrid model combining robo-advisory and self-directed investing. Users can invest in 'pies,' which are custom or pre-built portfolios that include various securities. Each platform offers unique features, varying fees, and a different user experience. Acorns and Stash focus on micro-investing, while Robinhood and M1 Finance provide more comprehensive investment options. In terms of fees, Acorns and Stash charge a monthly fee, while Robinhood and M1 Finance offer free trades. As for the user experience, it largely depends on personal preference. All four platforms offer intuitive interfaces and are highly rated for user experience. Micro-investing platforms democratize the world of investing by providing an easy and accessible entry point. They lower the barriers of entry, making it possible for the wider population to get started with investing, even with small amounts of money. This democratization breaks down the perception that investing is only for the wealthy, and it enables individuals from various economic backgrounds to partake in wealth-building. One of the key strengths of micro-investing platforms is their automated features. These systems often offer automatic transfers and round-up features that help users to save and invest consistently. This aspect of 'set-it-and-forget-it' can be instrumental in building wealth over time, fostering disciplined and habitual investing, even if the amounts are small. Micro-investing platforms also offer the advantage of diversification. Many of these platforms allow users to invest in a variety of assets, such as stocks, bonds, Exchange-Traded Funds (ETFs), and even cryptocurrencies. Diversification reduces risk by spreading investments across different asset classes and sectors, thus reducing the impact of any single poor-performing investment. One of the potential risks associated with micro-investing platforms pertains to their fee structures. Many of these platforms charge fees that can seem low in absolute terms but are quite high relative to the size of the investments being made. These fees can eat into small investments significantly and reduce the net returns for the investor. While micro-investing platforms do allow for some diversification, they often provide a more limited range of investment options compared to traditional brokerages. This can restrict the ability of investors to tailor their portfolios precisely to their financial goals and risk tolerance levels. Micro-investing is an excellent way to get started with investing and develop the habit of saving. However, due to the small investment amounts typically involved, it may not be sufficient for meeting long-term financial goals such as retirement savings. Individuals who solely rely on micro-investing platforms for their investment needs may find that they are not accumulating wealth at a pace that is consistent with their long-term financial objectives. Micro-investing platforms have made investing more accessible, allowing more individuals to participate in the financial market. They've also increased financial literacy by providing educational resources and simplifying the investing process. These platforms have disrupted the investment industry by lowering the barriers to entry for investing. They've forced traditional brokerages to adapt, many of which now also offer fractional shares and no-fee trades. The advent of micro-investing platforms has also affected the wider economy. They've led to an increase in investment activity, bringing more capital into the market. By enabling more individuals to invest, they're promoting wealth creation and economic growth. Micro-investing platforms, through their democratizing influence, have redefined the landscape of investing. By breaking down traditional barriers to entry, they have made investing a more inclusive practice. These platforms are characterized by their user-friendly interfaces, diversified investment options, automation features, and fee structures. Prominent platforms such as Acorns, Stash, Robinhood, and M1 Finance have each carved out their niche in the micro-investing world, offering unique features and experiences tailored to different types of investors. The impact of these platforms has been significant. On an individual level, they've made investing more accessible and increased financial literacy. On an industry level, they've disrupted traditional brokerages and forced them to adapt. On a broader economic scale, they've increased investment activity and contributed to economic growth. If you're interested in starting your investment journey or diversifying your investment portfolio, micro-investing platforms are worth considering. However, it's also crucial to understand that they are not a one-size-fits-all solution. Depending on your financial goals and risk tolerance, you might also want to consider seeking professional wealth management services.What Are Micro-Investing Platforms?

Concept of Micro-Investing

Understanding Micro-Investing

Role of Micro-Investing in Financial Planning

Micro-Investing Platforms

Description of Micro-Investing Platforms

How Micro-Investing Platforms Operate

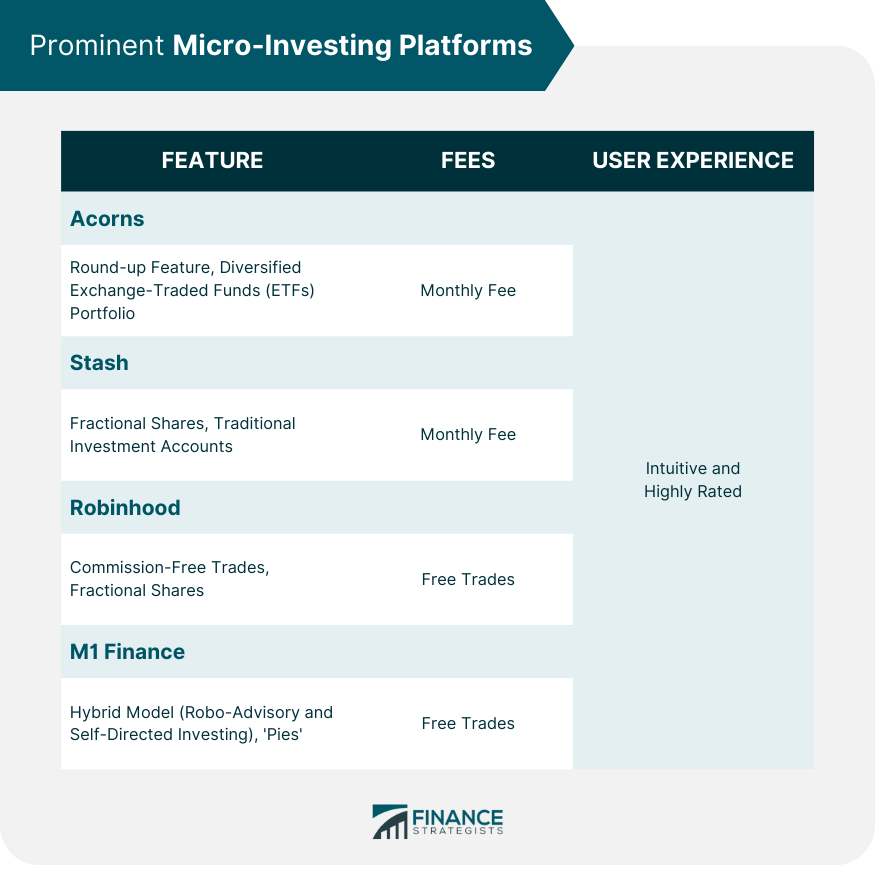

Prominent Micro-Investing Platforms

Overview of Leading Micro-Investing Platforms

Acorns

Stash

Robinhood

M1 Finance

Comparison of These Platforms in Terms of Features, Fees, and User Experience

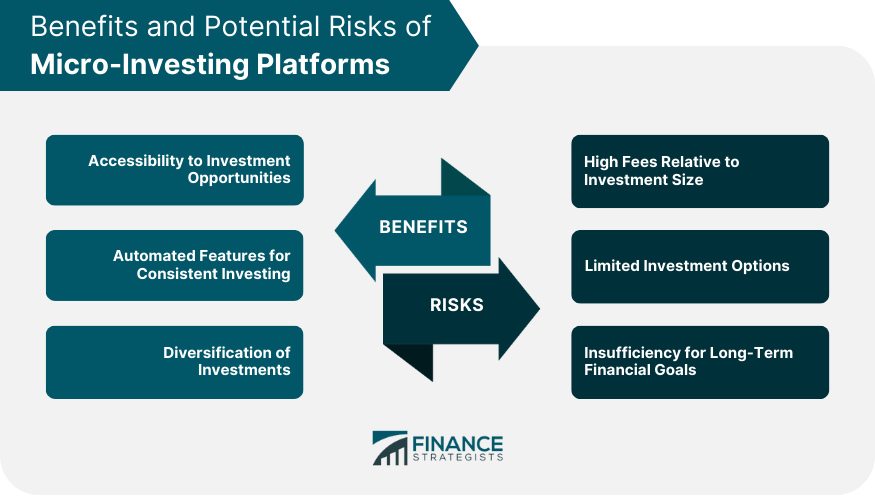

Benefits of Using Micro-Investing Platforms

Accessibility to Investment Opportunities

Automated Features for Consistent Investing

Diversification of Investments

Potential Risks and Drawbacks of Micro-Investing Platforms

High Fees Relative to Investment Size

Limited Investment Options

Insufficiency for Long-Term Financial Goals

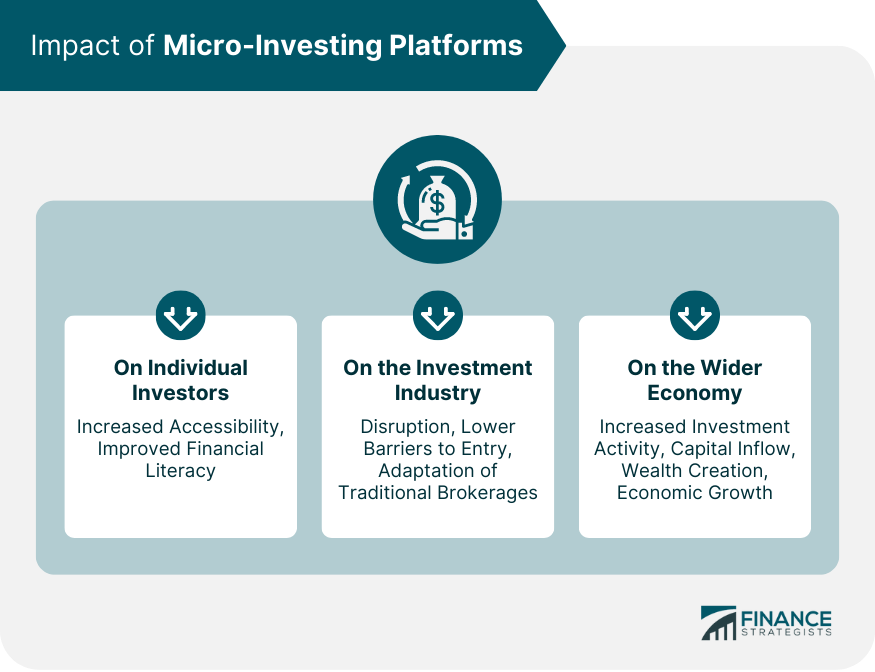

Impact of Micro-Investing Platforms

On Individual Investors

On the Investment Industry

On the Wider Economy

Final Thoughts

Micro-Investing Platforms FAQs

Micro-investing platforms are digital platforms that facilitate small, regular investments. They're designed to make investing accessible to all, regardless of financial background.

Micro-investing platforms work by allowing users to invest small amounts of money regularly. This can be done through automatic round-ups on purchases or scheduled contributions.

Micro-investing platforms are ideal for beginners or those with limited capital who want to start investing. They're also suitable for those looking to build good financial habits.

Most micro-investing platforms are safe and are regulated by financial authorities. However, as with any investment, there's always a degree of risk involved.

Yes, you can make money with micro-investing platforms. However, it's important to remember that investing always comes with risk, and returns are not guaranteed.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.