Cryptocurrency is a digital or virtual form of currency that uses cryptography for security, ensuring transactions are secure and that units of the currency cannot be duplicated. The purpose of cryptocurrencies is manifold: to offer a decentralized monetary system, to provide financial freedom and privacy, and to create a new channel for investment. Their decentralized nature allows for peer-to-peer transactions without the need for intermediaries, often leading to faster and cheaper transfers, especially across borders. However, due to their decentralized nature, cryptocurrencies can be highly volatile, leading to significant price swings within short periods. This volatility can make them a risky investment option. Additionally, the lack of regulation and potential for anonymity has made them attractive for illegal activities, including money laundering and tax evasion. In the U.S., the Internal Revenue Service (IRS) classifies cryptocurrencies as property. Consequently, transactions involving these digital assets are subject to capital gains tax. This classification has implications, such as differentiating between short-term and long-term gains. Therefore, staying informed can help ensure compliance and avoid potential financial penalties. This encompasses activities like purchasing, selling, trading between different cryptocurrencies, mining rewards, earnings from staking, gifts received or given, and any purchases made using cryptocurrency for goods or services. For each transaction, ensure you meticulously record: Date and Time: Capture the exact date and time stamp, as this can impact the classification of short-term vs long-term capital gains. Amount: Detail the specific amount of cryptocurrency involved in the transaction. Value in Local Currency: Document the equivalent value in your local currency at the precise moment of the transaction. This will help in determining gains or losses. Transaction Fees: Note any fees associated with the transaction, as these can often be deducted. Counterparty Details: While not always mandatory, maintaining records of the sender or recipient addresses can be useful, especially for larger transactions that might be subject to scrutiny. Exchange or Wallet Platform: Specify the platform or wallet where the transaction took place, as different platforms might have varying fee structures or rates. Selling Cryptocurrency for Fiat: During such transactions, you'll be required to calculate the gain or loss based on the difference between your acquisition cost and the amount received in Fiat. It's essential to keep meticulous records of such conversions, as each sale can have different tax implications based on the holding period. Trading One Cryptocurrency for Another: While you might not be receiving traditional currency, the value of the coin you receive (compared to the coin you traded) determines your gain or loss. This means every swap or trade needs a record of its equivalent fiat value at the time of the trade. Using Cryptocurrency for Purchases: Spending cryptocurrency on goods or services isn't just a simple transaction; from a tax perspective, it's considered a sale of your crypto. The value of the cryptocurrency at the time of the purchase, compared to its acquisition cost, will determine if you incurred a gain or loss. Mining, Staking, and Earning Rewards: These are often taxed at your regular income tax rate rather than the capital gains rate. Additionally, when you eventually sell or trade these mined or staked coins, that transaction will also be taxable, requiring a second round of documentation and calculation. To determine this, for each transaction, subtract the original acquisition cost (known as the "cost basis") of the cryptocurrency from its sale or conversion value. Remember to incorporate associated transaction fees or costs into your calculations. If you held the cryptocurrency for more than a year before selling or transacting, you might be eligible for long-term capital gains rates, which can differ from short-term rates. First In First Out (FIFO): Here, the earliest acquired coins are the first to be sold. By adopting this method, when you sell or trade cryptocurrency, you're essentially disposing of the oldest assets in your possession first. Last In First Out (LIFO): LIFO posits that the most recently acquired coins are the first ones to be sold or traded. For those actively trading and acquiring cryptocurrency, using LIFO can reflect more recent market conditions. This form is where you'll report capital gains and losses. For each cryptocurrency transaction: Provide a description of the property. List the date you acquired the cryptocurrency and the date you sold or disposed of it. Document the proceeds (the sale price in USD or your local currency) from the sale. Include the cost or other basis, which is essentially the original value when you acquired the cryptocurrency. Calculate the gain or loss for each transaction (proceeds minus cost basis). After entering details for all transactions, sum them up to get your total capital gains or losses. Once you've completed Form 8949, you'll transfer the totals to Schedule D. This form aggregates your total capital gains and losses from all sources, not just cryptocurrency. In the case of long-term holdings (assets held for more than one year) and short-term holdings, they need to be separated, as they can be subject to different tax rates. Cryptocurrency received as compensation, whether from mining, staking, or services rendered, is typically considered taxable income. Such earnings should be reported on Schedule 1. Ensure that you list the fair market value of the cryptocurrency on the day you receive it. This value will serve as your cost basis for future transactions involving those assets. Once you've meticulously documented and calculated your financial obligations, it's crucial to finalize and submit the appropriate tax forms in a timely manner. Adhering to the specific tax deadline for your jurisdiction is imperative, as this not only ensures compliance but also helps avoid any late-filing complications. While working on your tax forms, make sure to double-check all entries for accuracy, cross-referencing with your records to prevent discrepancies. After submission, keep a copy of your filed tax documents for future reference or potential audits. A frequent mistake is neglecting certain types of transactions, thinking they're not taxable. For example, many people assume that crypto-to-crypto trades or using crypto to buy goods/services aren't taxable events. Every transaction, regardless of its nature, has potential tax implications and should be documented. Properly calculating capital gains or losses requires accurate cost-basis information. Inaccuracies, such as using the purchase price of the most recent cryptocurrency buy instead of the actual purchase price of the sold asset, can result from misunderstandings. Flipping between FIFO and LIFO from one tax year to another can cause confusion and may be flagged by tax authorities. It's essential to choose a method and stick with it consistently. If you've lost access to your cryptocurrency due to a lost key or if your assets were stolen in a breach, these losses can often be reported and might offer tax deductions. Not addressing these situations can mean missing out on potential deductions. Many individuals engage in crypto mining or staking and receive rewards. Overlooking these rewards, thinking they're mere "bonuses," can lead to underreporting income. Such rewards are typically considered taxable income upon receipt and should be reported at their fair market value at the time of acquisition. Cryptocurrency, a secure digital currency using cryptography, offers a decentralized monetary system, financial freedom, and investment potential. Its rapid, cost-effective transactions overcome borders, yet volatility makes it a risky investment. Reporting demands meticulous documentation of transactions, including dates, amounts, values, and fees. Taxable events cover diverse scenarios like sales, trades, and spending on goods/services. Precise calculation of gains/losses requires selecting an appropriate accounting method. Completing tax forms (Form 8949, Schedule D, Schedule 1) accurately consolidates gains, losses, and income. Timely filing ensures compliance and avoids issues. Mistakes, including neglecting transactions or misjudging cost basis, should be avoided, and mining/staking rewards recognized as taxable income. Thorough understanding, accurate reporting, and consistent adherence to tax regulations are imperative for navigating the cryptocurrency landscape responsibly.What Is Cryptocurrency?

How to Report Cryptocurrency on Your Taxes

Understand Your Tax Obligations

Gather Necessary Documentation

Determine Your Taxable Events

Calculate Your Capital Gains or Losses

Select Your Accounting Method

Report on the Appropriate Tax Forms

Form 8949 - Sales and Other Dispositions of Capital Assets

Schedule D (Form 1040) - Capital Gains and Losses

Schedule 1 (Form 1040) - Additional Income and Adjustments to Income

File and Pay Your Taxes

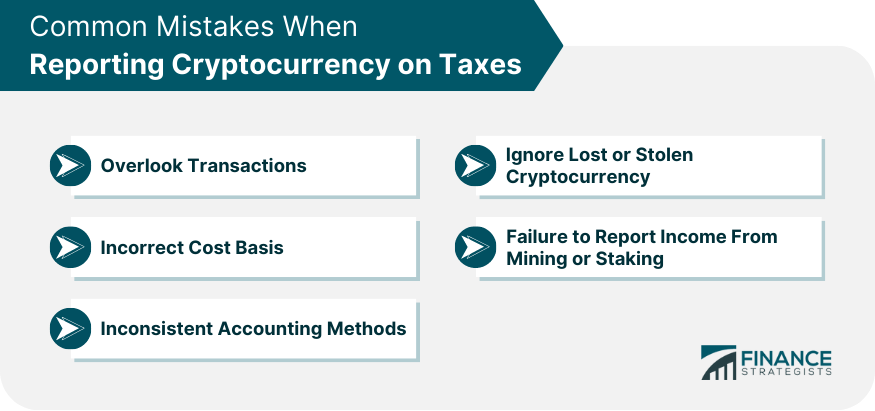

Common Mistakes When Reporting Cryptocurrency on Taxes

Overlook Transactions

Incorrect Cost Basis

Inconsistent Accounting Methods

Ignore Lost or Stolen Cryptocurrency

Failure to Report Income From Mining or Staking

Conclusion

How to Report Cryptocurrency on Your Taxes FAQs

Report cryptocurrency on your taxes by accurately documenting all transactions involving digital assets, including purchases, sales, trades, and rewards. Calculate gains or losses for each transaction and use the appropriate tax forms to report the total results.

You typically use Form 8949 to report capital gains and losses from cryptocurrency transactions. Transfer these totals to Schedule D for aggregation. If you receive cryptocurrency as compensation, report it on Schedule 1.

Record key details for each transaction, such as dates, amounts, values in local currency, transaction fees, counterparties, and the platform used.

You can choose between First In First Out (FIFO) or Last In First Out (LIFO) accounting methods. FIFO sells the earliest acquired coins first, while LIFO sells the most recent ones first.

Accurate reporting ensures compliance with tax regulations, helping you avoid penalties or legal issues. Meticulous documentation and precise calculations prevent discrepancies and provide a clear overview of your cryptocurrency-related financial obligations.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.