A company-specific risk premium (CSRP) is an additional rate of return that investors expect to earn for bearing the unique, non-systematic risks associated with a particular company. It is a crucial component in estimating the cost of equity capital for businesses and plays a vital role in various financial valuations and models. The CSRP is an essential factor in determining the appropriate discount rate for valuation models such as the Discounted Cash Flow (DCF) model. By accounting for the unique risks associated with a specific company, investors can better estimate the value of the company's shares and make more informed decisions about their investments. Company-specific risk premium is distinct from other risk premiums, such as the market risk premium, which represents the additional return investors expect to earn for bearing the systematic risks associated with the overall market. Together, these risk premiums contribute to the total risk premium required by investors for investing in a particular company. The company-specific risk premium is a critical factor in estimating the cost of equity capital and plays a vital role in various financial valuations and models. Accurately estimating the CSRP allows investors to better understand the unique risks associated with a specific company and make more informed decisions about their investments. Given the challenges and limitations associated with estimating the CSRP, it is essential for analysts to utilize a combination of qualitative and quantitative methods, gather accurate financial data, and continuously update their risk assessments to reflect the evolving business environment. By following these best practices, analysts can minimize estimation errors and provide more reliable and meaningful valuation results. As the business environment continues to evolve, further research into the estimation and application of company-specific risk premiums is necessary. This research should focus on developing more accurate and reliable methods for quantifying company-specific risks and exploring the impact of emerging trends, such as technological advancements and regulatory changes, on the CSRP. The size and market position of a company can greatly influence its CSRP. Larger, more established companies tend to have lower CSRPs as they are perceived to be more stable and less susceptible to idiosyncratic risks. Smaller companies, on the other hand, are often associated with higher CSRPs due to their higher risk profile. In some cases, a company's market position can outweigh its size in determining its CSRP. A company with a dominant market position and strong competitive advantages may have a lower CSRP compared to a larger competitor with weaker market positioning. The level of competition within an industry plays a significant role in determining a company's CSRP. Industries with high levels of market concentration, where a few companies dominate, are typically characterized by lower CSRPs. In contrast, industries with low market concentration and intense competition may have higher CSRPs due to the increased uncertainty and risk associated with the industry dynamics. The presence of barriers to entry within an industry also impacts a company's CSRP. Industries with high barriers to entry, such as those requiring significant capital investments or specialized expertise, tend to have lower CSRPs as new entrants are less likely to disrupt the market. Conversely, industries with low barriers to entry may experience higher CSRPs as new competitors can more easily enter the market, increasing the level of risk. A company's financial health and performance, as measured by various profitability ratios, can significantly influence its CSRP. Companies with strong profitability ratios, such as high return on equity (ROE) or return on assets (ROA), are often associated with lower CSRPs, as they are perceived to be more financially stable and able to weather adverse economic conditions. On the other hand, companies with weak profitability ratios may have higher CSRPs, as investors perceive them to be more susceptible to financial distress and potential bankruptcy. Liquidity ratios, such as the current ratio or quick ratio, are another important factor in determining a company's CSRP. Companies with high liquidity ratios are generally seen as less risky, as they have sufficient short-term assets to cover their short-term liabilities. This financial stability can result in a lower CSRP for the company. Conversely, companies with low liquidity ratios may struggle to meet their short-term obligations, increasing the risk of financial distress and resulting in a higher CSRP. One common method of estimating a company's CSRP is through expert opinion. Financial analysts, industry specialists, or experienced investors may provide their subjective assessments of the unique risks associated with a company. While expert opinions can provide valuable insights, they are also subject to biases and may not always be reliable. Incorporating expert opinions in the estimation of CSRP is particularly useful when quantitative data is limited or difficult to obtain. Another qualitative approach to estimating CSRP is through industry benchmarks. Comparing a company's risk profile to that of its peers within the same industry can provide a useful starting point for determining its CSRP. By identifying companies with similar risk characteristics, analysts can estimate the average CSRP for the industry and adjust it based on the specific company's unique risk factors. This approach assumes that the industry average CSRP provides a reasonable proxy for the company's risk profile. However, this may not always be the case, as individual companies within the same industry can have vastly different risk profiles due to differences in their size, market position, and other factors. Regression analysis is a quantitative method that can be used to estimate a company's CSRP by examining the relationship between the company's risk factors and its stock returns. By analyzing historical data, analysts can identify patterns and trends that can help determine the extent to which various risk factors impact the company's risk premium. The main advantage of using regression analysis is its ability to provide a more objective, data-driven estimate of the company's CSRP. However, this approach relies on the availability and accuracy of historical data, which may not always be accessible or reliable. Monte Carlo simulation is a quantitative technique that involves generating a large number of random scenarios to estimate the probability distribution of a company's future cash flows or returns. By simulating various potential outcomes, this method helps analysts estimate the likelihood of different risk scenarios and their potential impact on the company's CSRP. This approach has the advantage of providing a more comprehensive view of the potential risks faced by a company, but it also requires a significant amount of data and computational power. Additionally, Monte Carlo simulations are only as accurate as the assumptions and inputs used in the model, which can be subject to uncertainty and estimation errors. The CSRP plays a critical role in the discounted cash flow valuation method, which is widely used to estimate the intrinsic value of a company. By incorporating the company-specific risk premium into the discount rate, the DCF model accounts for the unique risks associated with the company, providing a more accurate estimate of its value. In the DCF model, the CSRP directly affects the present value of future cash flows, with a higher CSRP leading to a lower valuation and vice versa. Therefore, accurately estimating the CSRP is essential for obtaining reliable and meaningful valuation results. The weighted average cost of capital (WACC) represents a company's average cost of financing, taking into account both debt and equity sources. The CSRP is a key component of the cost of equity, which in turn affects the overall WACC. A higher CSRP increases the cost of equity, and subsequently, the WACC, which can have significant implications for a company's investment decisions and capital structure. Accurately estimating the CSRP is therefore crucial for optimizing a company's financial strategy and maximizing shareholder value. One of the main challenges in estimating the CSRP is the inherent subjectivity involved in the process. As company-specific risks can be difficult to quantify, analysts often rely on qualitative assessments, expert opinions, or industry benchmarks, which can be prone to biases and inconsistencies. Furthermore, even when using quantitative methods, the accuracy of the CSRP estimate depends on the quality of the data and the assumptions made in the analysis. Estimation errors can have significant implications for a company's valuation and financial decision-making, making it crucial for analysts to be aware of these limitations and exercise caution when estimating the CSRP. The accuracy of the CSRP estimate is heavily reliant on the availability and accuracy of financial data. Incomplete, outdated, or unreliable data can lead to inaccurate risk assessments and mispriced investments. This issue is particularly relevant for smaller or privately-held companies, where financial data may be less accessible or transparent. Analysts should therefore make an effort to gather the most accurate and up-to-date financial information available and be aware of potential data limitations when estimating the CSRP. Another challenge in estimating the CSRP is the constantly evolving business environment. Changes in market conditions, industry dynamics, or regulatory landscapes can all impact a company's risk profile and subsequently its CSRP. As a result, analysts must continuously monitor and update their risk assessments to ensure that their estimates remain relevant and accurate. This challenge highlights the importance of incorporating both historical and forward-looking information in the estimation of the CSRP and adapting the risk assessment to reflect the changing business environment. In conclusion, the company-specific risk premium is a critical factor in estimating the cost of equity capital and plays a vital role in various financial valuations and models. Accurately estimating the CSRP allows investors to better understand the unique risks associated with a specific company and make more informed decisions about their investments. However, there are challenges associated with estimating the CSRP, such as subjectivity and estimation error, dependence on accurate financial data, and the constantly evolving business environment. To mitigate these challenges, analysts should use a combination of qualitative and quantitative methods, gather accurate financial data, and continuously update their risk assessments to reflect the evolving business environment. Furthermore, as the business environment continues to evolve, further research into the estimation and application of company-specific risk premiums is necessary to develop more accurate and reliable methods for quantifying company-specific risks and exploring the impact of emerging trends. Ultimately, accurately estimating the company-specific risk premium is crucial for providing reliable and meaningful valuation results and optimizing a company's financial strategy. By understanding the factors that influence the CSRP and employing the best practices for estimation, investors can better estimate the value of a company's shares and make more informed investment decisions.Definition of Company-Specific Risk Premium

Importance of Company-Specific Risk Premium in Valuation

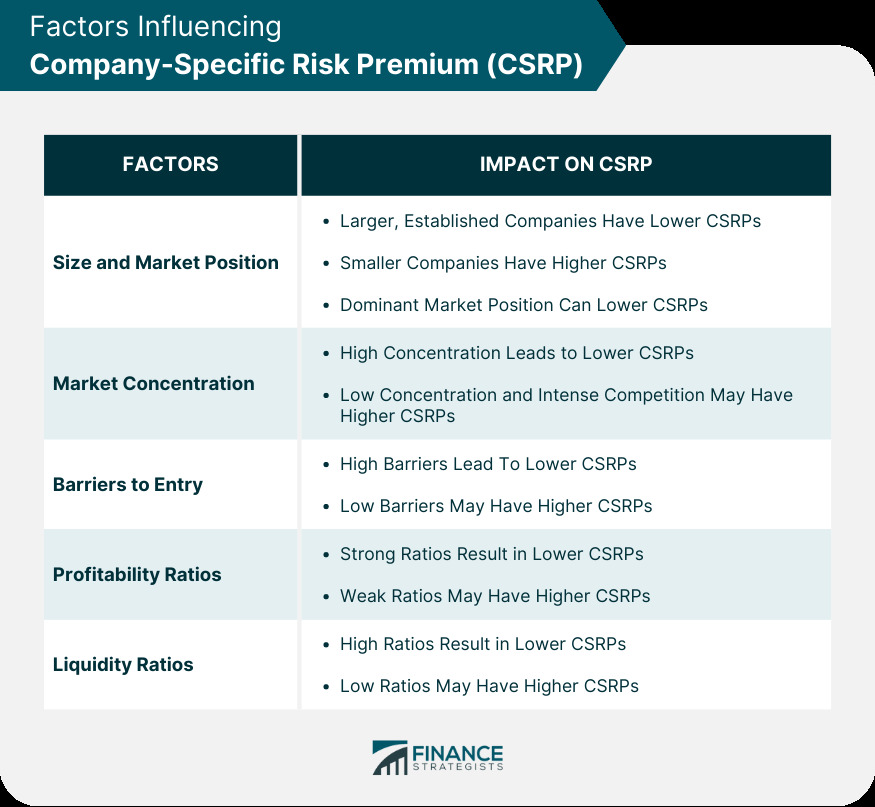

Factors Influencing Company-Specific Risk Premium

Size and Market Position

Market Concentration

Barriers to Entry

Profitability Ratios

Liquidity Ratios

Calculating Company-Specific Risk Premium

Expert Opinion

Industry Benchmarks

Regression Analysis

Monte Carlo Simulation

Applications of Company-Specific Risk Premium

Discounted Cash Flow Valuation

Weighted Average Cost of Capital

Limitations and Challenges of Company-Specific Risk Premium

Subjectivity and Estimation Error

Dependence on Accurate Financial Data

Evolving Business Environment

Conclusion

Company-Specific Risk Premium FAQs

A company-specific risk premium is an additional return investors require to compensate for risks specific to a particular company.

The company's industry, financial condition, management quality, and competitive position are some of the factors that can impact the risk premium.

The risk premium can be calculated using various approaches, such as the Capital Asset Pricing Model (CAPM) or the Build-Up Method.

Understanding the risk premium helps investors make informed decisions when valuing a company's equity and assessing its investment potential.

Yes, the risk premium can change as a company's financial condition, competitive position, or other factors affecting risk evolve over time.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.