Commodities risk premium refers to the excess return an investor can expect to earn by holding a diversified portfolio of commodities over a risk-free asset. This premium compensates investors for taking on the risks associated with investing in commodities. The concept of commodities risk premium is rooted in the risk-return tradeoff, which posits that investors should be compensated for taking on additional risk. By investing in commodities, investors expose themselves to unique risks that are not present in other asset classes, such as stocks and bonds. Understanding commodities risk premium is crucial for investors looking to diversify their portfolio and enhance overall returns. By allocating a portion of their investments to commodities, investors can potentially benefit from the unique risk-return characteristics of these assets. Commodities risk premium allows investors to make informed decisions about the allocation of their assets. By understanding the factors that drive this premium, investors can better gauge the potential rewards of investing in commodities relative to the risks they are taking on. The concept of commodities risk premium is based on several key theoretical principles that are fundamental to understanding the financial markets. The risk and return relationship is a fundamental concept in finance, which suggests that higher risk investments should offer higher potential returns. Commodities risk premium is an extension of this principle, as it captures the additional return that investors can expect for taking on the unique risks associated with investing in commodities. The risk and return relationship is particularly important when it comes to constructing a diversified portfolio. By understanding the commodities risk premium, investors can make more informed decisions about how to allocate their investments across different asset classes to achieve their desired risk-return profile. Diversification is a key strategy for managing risk in a portfolio by spreading investments across various asset classes, industries, and geographical regions. Commodities can offer diversification benefits to a portfolio, as their returns often exhibit low or negative correlations with other asset classes. By investing in commodities, investors can potentially reduce the overall risk of their portfolio, as the unique risks associated with these assets are less likely to be correlated with the risks of other investments. This can lead to more stable returns and a lower probability of extreme losses. Commodities are physical goods that are used in the production of other goods and services. They can be categorized as either hard commodities, which include metals and minerals, or soft commodities, which are agricultural products and livestock. Commodities have distinct characteristics compared to other asset classes, such as their sensitivity to supply and demand dynamics, the influence of geopolitical events, and their vulnerability to environmental and climate factors. These unique characteristics contribute to the commodities risk premium. Commodities can be broadly classified into three main categories: energy commodities, agricultural commodities, and metals and minerals commodities. Energy commodities, such as crude oil and natural gas, are essential for powering the global economy. They are subject to various factors, including geopolitical tensions, technological advancements, and environmental regulations, which can all impact their risk premium. Agricultural commodities, like wheat, corn, and soybeans, are vital for feeding the world's population. Weather patterns, disease outbreaks, and changing dietary preferences can all influence the supply and demand dynamics of these commodities, which in turn affect their risk premium. Metals and minerals commodities, including gold, silver, and copper, have numerous industrial and financial applications. Their prices are often influenced by macroeconomic factors, global trade policies, and supply disruptions, contributing to their risk premium. Several factors can impact the risk premium associated with investing in commodities. Supply and demand dynamics play a critical role in determining the prices of commodities. Factors such as population growth, economic development, and changing consumption patterns can all influence the balance between supply and demand, affecting the commodities risk premium. As commodities are often used as inputs in the production of goods and services, their prices can be sensitive to fluctuations in global economic activity. This sensitivity can result in increased volatility and contribute to the risk premium associated with investing in these assets. Macroeconomic factors, such as interest rates, inflation, and exchange rates, can all have a significant impact on commodity prices. These factors can influence the cost of production, storage, and transportation of commodities, which in turn affects their risk premium. For example, a rise in interest rates can increase the cost of borrowing for commodity producers, leading to higher production costs and lower profit margins. This can result in higher volatility in commodity prices and contribute to the commodities risk premium. Geopolitical risks, such as wars, trade disputes, and political instability, can have a profound impact on commodity markets. These events can lead to supply disruptions, changes in trade policies, and fluctuations in global demand, all of which can influence the commodities risk premium. Investors need to consider the potential impact of geopolitical risks on their commodity investments, as these events can lead to significant price fluctuations and heightened uncertainty in the markets. Various approaches can be used to measure and estimate the commodities risk premium, ranging from historical data analysis to forward-looking models. One approach to estimating the commodities risk premium is to analyze historical data on commodity prices and returns. By examining the historical performance of different commodities, investors can gain insights into the potential risk and return characteristics of these assets. However, historical data analysis has its limitations, as past performance is not always indicative of future results. Moreover, changes in market conditions, technology, and regulations can all impact the future risk premium of commodities. Forward-looking models, such as econometric and statistical models, can be used to estimate the future risk premium of commodities. These models typically rely on factors such as supply and demand dynamics, macroeconomic variables, and market sentiment to project future commodity prices and returns. While forward-looking models can provide valuable insights into the potential risk premium of commodities, they are also subject to various assumptions and uncertainties. As a result, investors should approach these estimates with caution and consider a range of scenarios when making investment decisions. Investors can employ various strategies to capture the commodities risk premium, including long-only strategies, long-short strategies, and tactical asset allocation. Long-only strategies involve taking a bullish position in commodities, with the expectation that their prices will rise over time. This can be achieved through direct investments in physical commodities, futures contracts, or exchange-traded funds (ETFs) that track the performance of a commodity index. By taking a long-only position in commodities, investors can potentially benefit from the commodities risk premium as they are exposed to the unique risks associated with these assets. Long-short strategies involve taking both long and short positions in commodities, with the aim of profiting from both rising and falling prices. This can be achieved through the use of futures contracts, options, or other derivative instruments that provide exposure to commodity price movements. By employing long-short strategies, investors can potentially capture the commodities risk premium while also reducing their exposure to market risk. This can result in more stable returns and lower portfolio volatility compared to a long-only strategy. Investing in commodities is not without its challenges and risks. Investors need to be aware of the potential pitfalls associated with this asset class, such as volatility and leverage, regulatory and policy risks, and counterparty and credit risks. Commodities can be highly volatile, with prices often experiencing significant fluctuations in response to changes in supply and demand dynamics, geopolitical events, and macroeconomic factors. This volatility can lead to increased risk for investors, particularly if they are using leverage to amplify their returns. Leverage involves borrowing money to increase the size of an investment, which can magnify both gains and losses. While leverage can potentially enhance the commodities risk premium, it can also expose investors to greater risk, particularly during periods of market stress. Regulatory and policy risks can also impact the performance of commodities, as changes in laws, regulations, and trade policies can influence the supply and demand dynamics of these assets. For example, the introduction of new environmental regulations can affect the production and consumption of certain commodities, leading to changes in their risk premium. Investors need to be aware of the potential impact of regulatory and policy risks on their commodity investments, as these factors can have significant implications for the performance of these assets. Counterparty and credit risks are another important consideration for investors in commodities, particularly when investing in derivative instruments such as futures contracts, options, or swaps. These risks arise when the counterparty to a transaction fails to fulfill its obligations, leading to potential losses for the investor. To mitigate counterparty and credit risks, investors can use a variety of risk management techniques, such as diversifying their exposure across multiple counterparties, using collateral to secure transactions, and monitoring the creditworthiness of their counterparties. The commodities risk premium is a crucial concept for investors to understand when allocating funds to this unique asset class. By recognizing the factors that drive this premium and the risks associated with investing in commodities, investors can make more informed decisions about the allocation of their assets and potentially enhance their overall portfolio performance. Future research directions and developments in the field of commodities risk premium can help investors better understand the dynamics of this asset class and improve their ability to capture the potential rewards associated with investing in commodities.Definition of Commodities Risk Premium

Theoretical Foundations of Commodities Risk Premium

Risk and Return Relationship

Diversification Benefits

Characteristics of Commodities

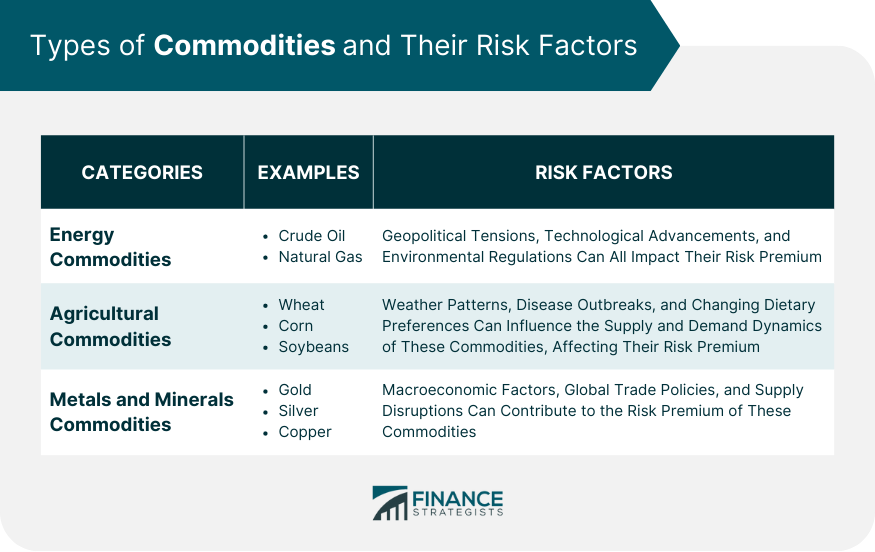

Types of Commodities

Energy Commodities

Agricultural Commodities

Minerals Commodities

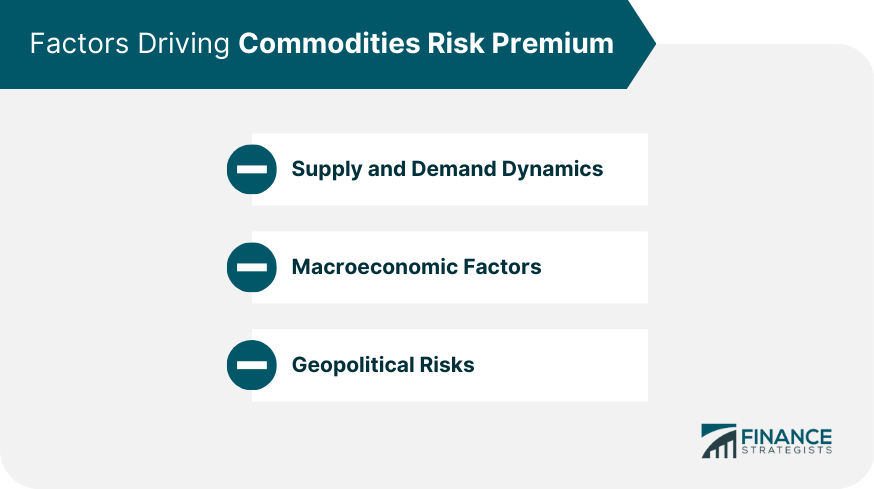

Factors Driving Commodities Risk Premium

Supply and Demand Dynamics

Macroeconomic Factors

Geopolitical Risks

Measuring and Estimating Commodities Risk Premium

Historical Data Analysis

Forward-Looking Models

Strategies for Harvesting Commodities Risk Premium

Long-Only Strategies

Long-Short Strategies

Challenges and Risks in Commodities Investing

Volatility and Leverage

Regulatory and Policy Risks

Counterparty and Credit Risks

Conclusion

Commodities Risk Premium FAQs

It's the excess return an investor expects to earn from investing in commodities, beyond what they would get from investing in risk-free assets.

It's estimated by comparing the returns of commodity investments to those of risk-free investments, and adjusting for factors such as storage costs and market liquidity.

Some strategies include investing in commodity futures, exchange-traded funds (ETFs), and commodity-producing companies.

Risks include price volatility, market liquidity, geopolitical events, and natural disasters that can affect commodity supply and demand.

Commodities typically have a low correlation with traditional asset classes such as stocks and bonds, which makes them a useful diversification tool. However, they can also be more volatile and carry higher risk.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.