WM/Reuters benchmark rates, often simply referred to as "WM/Reuters rates," represent the standard foreign exchange rates used by many financial institutions, corporations, and individuals worldwide. These rates are generated through a complex process, balancing transaction data from a wide range of sources to provide an accurate and representative snapshot of the global foreign exchange market at specific times during the day. In investment management, benchmark rates like the WM/Reuters rates are crucial. They provide a standard for pricing and valuation, allowing fund managers to evaluate performance, assess risk, and make strategic investment decisions. The rates also aid in transparency and comparability across different investment portfolios, which can ultimately enhance investor confidence. Establishing the WM/Reuters rates involves a robust process to capture a broad spectrum of foreign exchange transactions. This process involves aggregating and analyzing data from numerous sources, including interbank deals, cross rates from global data vendors, and trade and order information from EBS and Thomson Reuters Matching. The WM Company, now a part of State Street Corporation, and Reuters, a leading global financial news and information provider, collaborate to determine the WM/Reuters rates. The WM Company brings its expertise in financial data services, while Reuters contributes its broad reach into global markets and comprehensive data resources. WM/Reuters rates cover a wide array of currencies and are calculated at multiple fixed points throughout the day. The most recognized of these is the 4 p.m. London is close, but rates are also calculated at other key time points, catering to the needs of a global clientele operating in different time zones. WM/Reuters rates are available as both spot and forward rates. Spot rates represent the current exchange rate for immediate delivery of a currency, while forward rates are used for contracts specifying the exchange of currencies at a future date. In wealth management, WM/Reuters rates serve as a critical tool for portfolio valuation and performance measurement. They provide a standard measure against which portfolio performance can be compared, enabling wealth managers to assess their strategies' effectiveness. WM/Reuters rates are also utilized in risk management and hedging strategies. By providing a reliable snapshot of the foreign exchange market, these rates enable wealth managers to anticipate currency fluctuations and adjust their hedging strategies accordingly. The rates also play a pivotal role in asset allocation decisions. Wealth managers use them to determine the relative value of investments in different countries, influencing decisions about distributing assets across various regions and asset classes. In investment management, WM/Reuters rates underpin asset pricing, particularly for assets denominated in foreign currencies. They help determine the true cost or value of these assets, which is essential for making investment decisions and for the functioning of financial markets more generally. For fund managers, the WM/Reuters rates have significant implications. They affect the reported performance of funds, particularly those with international exposure, as fluctuations in exchange rates can impact the value of overseas investments when converted back to the fund's base currency. They also influence the pricing of derivatives and other financial instruments tied to foreign exchange rates. WM/Reuters rates are particularly important in international investments. Investors and fund managers rely on these rates to convert the values of foreign investments back into their home currency, thereby providing a basis for comparison across different markets and asset classes. Given their role as a standard, WM/Reuters rates have a significant influence on foreign exchange markets. They help establish a baseline for trading and provide a reference point for evaluating currency movements and identifying potential trading opportunities. WM/Reuters rates also affect the fixed-income markets. These rates can impact the value of foreign bonds and other fixed-income investments, influencing the investment decisions of fund managers and individual investors. In the equity markets, WM/Reuters rates affect the valuation of international equities. In addition, these rates influence the pricing of various derivative instruments, such as currency futures and options, which are often used to hedge against currency risk. For commodities and alternative investments, WM/Reuters rates can influence the returns for investors, particularly those trading commodities on international markets or investing in foreign real estate or other alternative assets. Like many aspects of the financial industry, the WM/Reuters rates have not been without controversy. Past scandals, such as the foreign exchange market manipulation case in 2013, have raised regulatory concerns about the process used to determine these rates. There have also been critiques of the methodology used to determine the WM/Reuters rates. Some critics argue that the reliance on transaction data leaves the rates vulnerable to manipulation. In contrast, others suggest that the rates may not accurately reflect market conditions during periods of high volatility. In response to these criticisms, there have been reforms and changes to the methodology used to calculate the WM/Reuters rates. These include the introduction of more stringent oversight and incorporation of additional data sources to increase the robustness and integrity of the rates. WM/Reuters Benchmark Rates are a cornerstone in the global financial system, representing standard foreign exchange rates used extensively by financial institutions, corporations, and individuals. Their application extends to wealth management, where they underpin portfolio valuation, performance measurement, risk management, hedging strategies, and asset allocation decisions. These rates also play a vital role in investment management, particularly in asset pricing and international investments. They provide a reliable measure for converting the values of foreign investments back to an investor's home currency, facilitating comparison across markets and asset classes. As the financial landscape evolves, the relevance and influence of WM/Reuters Benchmark Rates are poised to remain significant, marking their continued importance in wealth and investment management strategies.Definition of WM/Reuters Benchmark Rates

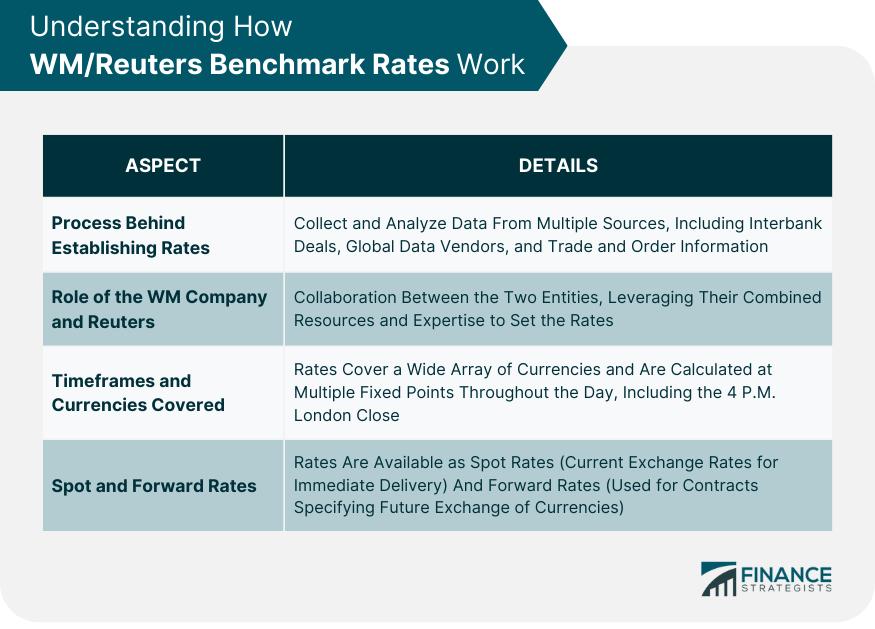

Understanding How WM/Reuters Benchmark Rates Work

Process Behind Establishing WM/Reuters Benchmark Rates

Role of the WM Company and Reuters in Setting the Rates

Timeframes and Currencies Covered by WM/Reuters Rates

Understanding Spot and Forward WM/Reuters Rates

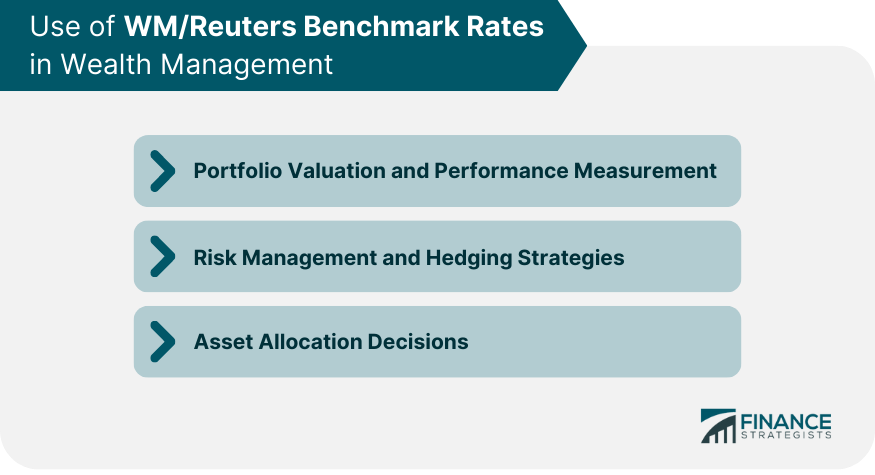

Use of WM/Reuters Benchmark Rates in Wealth Management

Use in Portfolio Valuation and Performance Measurement

Use in Risk Management and Hedging Strategies

Use in Asset Allocation Decisions

WM/Reuters Benchmark Rates and Investment Management

Role of WM/Reuters Rates in Asset Pricing

Implications of WM/Reuters Rates for Fund Managers

Application of WM/Reuters Rates in International Investments

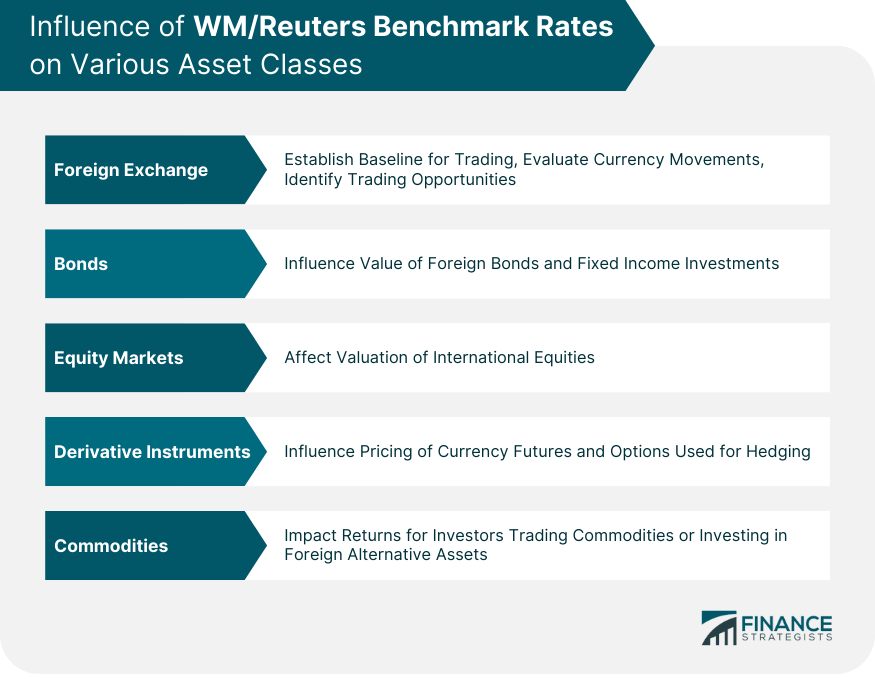

Influence of WM/Reuters Benchmark Rates on Various Asset Classes

Impact on Foreign Exchange Markets

Impact on Bonds and Fixed Income Investments

Impact on Equity Markets and Derivative Instruments

Impact on Commodities and Alternative Investments

Controversies and Critiques Surrounding WM/Reuters Benchmark Rates

Bottom Line

WM/Reuters Benchmark Rates FAQs

WM/Reuters Benchmark Rates are standard foreign exchange rates used globally by various financial institutions, corporations, and individuals. They provide an accurate representation of the foreign exchange market at specific times throughout the day, helping in the pricing and valuation of assets, performance measurement, and making strategic investment decisions.

WM/Reuters Benchmark Rates are determined through a comprehensive process that involves collecting and analyzing data from numerous sources, including interbank deals, global data vendors, and trade and order information. The rates are produced in collaboration between the World Markets Company (WM Company) and Reuters, leveraging their combined expertise and resources.

WM/Reuters Benchmark Rates play a crucial role in investment management. They are used in portfolio valuation, performance measurement, risk management, hedging strategies, and asset allocation decisions. Furthermore, these rates are fundamental in pricing assets, particularly those denominated in foreign currencies.

The WM/Reuters Benchmark Rates faced controversies, most notably the foreign exchange market manipulation case in 2013. Critics have also questioned the methodology used in determining these rates, arguing that reliance on transaction data may leave the rates susceptible to manipulation and may not accurately reflect market conditions during periods of high volatility.

Emerging trends like the rise of algorithmic trading, regulatory changes, and the growth of emerging markets, as well as advancements in technology, particularly digital currencies, and blockchain technology, could influence the future of WM/Reuters Benchmark Rates. These factors might lead to new methods of determining benchmark rates or creating new types of benchmarks.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.