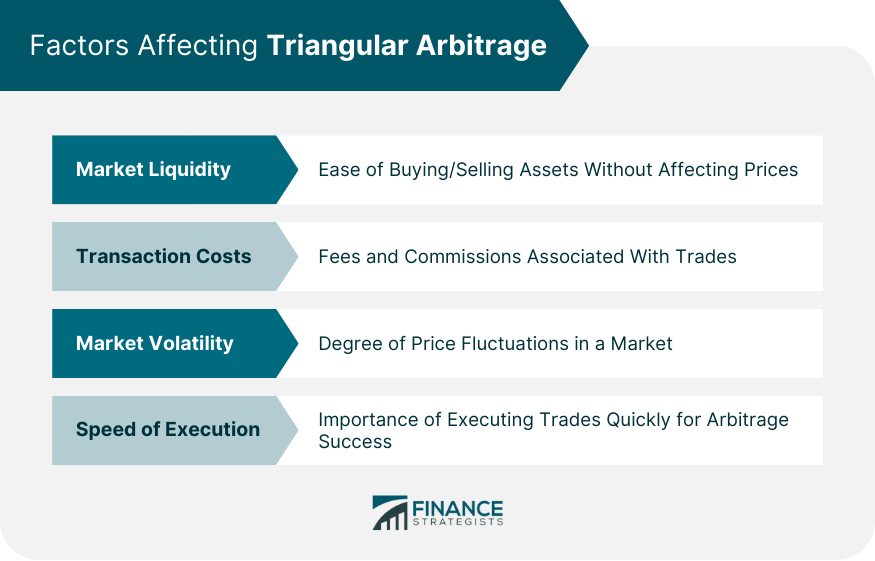

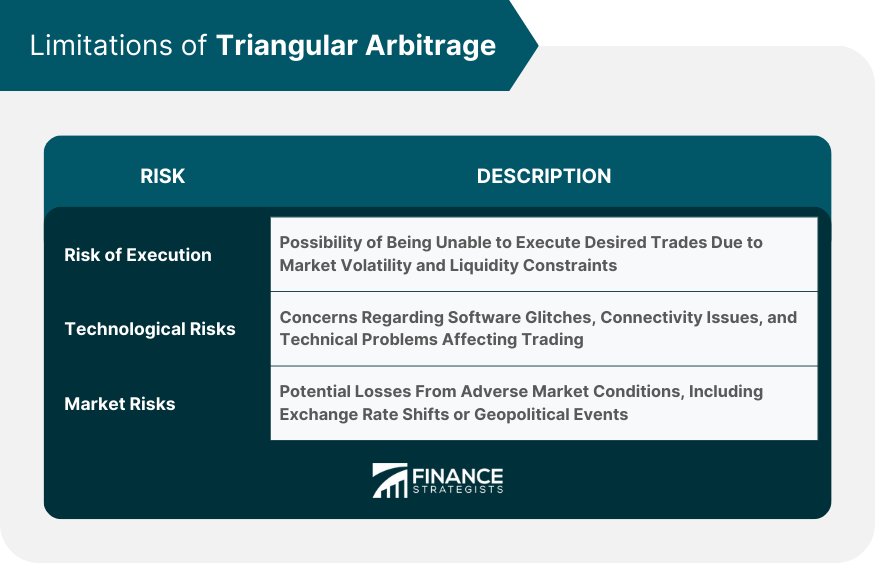

Triangular arbitrage is a risk-free trading strategy aiming to exploit temporary currency exchange rate discrepancies. By taking advantage of small price differences between three currency pairs, traders can profit without any currency risk exposure. This strategy is primarily used in the foreign exchange (forex) market, although it can also be applied to other financial markets, such as cryptocurrencies. In its simplest form, triangular arbitrage involves converting one currency into another, then into a third currency, and finally back into the original currency. This process creates a "triangle" of currency transactions called "triangular arbitrage." The goal is to identify instances where the combined exchange rates of these three transactions result in a profit after accounting for transaction costs. Exchange rates are the relative values of different currencies and play a crucial role in international trade and finance. They are typically expressed as a ratio, such as USD/EUR, representing the amount of US dollars required to purchase one euro. Various factors, including interest rates, inflation, and supply and demand for each currency, determine exchange rates. Triangular arbitrage relies on the presence of market inefficiencies, which can arise from factors such as delayed information, liquidity constraints, and differences in market participants' expectations. These inefficiencies create temporary discrepancies in exchange rates, which savvy traders can exploit to generate risk-free profits. However, it is essential to note that the opportunities for triangular arbitrage are often fleeting, as market forces typically correct these imbalances quickly. The first step in triangular arbitrage is to identify potential opportunities by scanning the market for discrepancies in exchange rates. This process can be done manually or using specialized software constantly monitoring the market for profitable triangular arbitrage setups. Once an opportunity is identified, the trader must execute a series of transactions to complete the triangular arbitrage. This process typically involves the following steps: If the combined exchange rates of these transactions result in a profit, the trader has successfully executed a triangular arbitrage. Market liquidity refers to the ease with which assets can be bought or sold without significantly affecting their price. Highly liquid markets, such as the forex market, are generally more conducive to triangular arbitrage opportunities, allowing traders to execute transactions quickly and at competitive prices. Transaction costs are the fees and commissions associated with executing trades. They can include bid-ask spreads, broker fees, and other expenses. High transaction costs can erode the potential profits of triangular arbitrage, making it essential for traders to minimize these costs wherever possible. Market volatility refers to the degree of price fluctuations in a particular market. While increased volatility can create more opportunities for triangular arbitrage, it can also make it more challenging to execute trades quickly and at favorable prices, potentially reducing the strategy's profitability. A triangular arbitrage strategy's success heavily depends on the speed at which trades can be executed. As market inefficiencies are often short-lived, traders must act quickly to capitalize on these opportunities before disappearing. This is why many triangular arbitrageurs employ algorithmic trading strategies to automate their trades and increase their execution speed. Forex brokers enable traders to participate in the forex market and engage in strategies like triangular arbitrage. They provide the necessary trading platforms and liquidity, ensuring traders can execute their trades quickly and at competitive prices. However, traders need to choose their broker carefully, as the quality of services can vary significantly between different brokers. With the advent of technology, the forex market has become more accessible and efficient. Traders can now access sophisticated trading platforms and software that can automatically scan the market for triangular arbitrage opportunities, execute trades, and manage risk. These tools have made it easier for individual traders to engage in strategies that were once the preserve of large financial institutions. One of the main risks associated with triangular arbitrage is the risk of execution. This refers to the possibility that a trader may not be able to execute all the necessary trades at the desired prices due to factors such as market volatility and liquidity constraints. They could incur a loss if the market moves against the trader before they can complete the arbitrage. Technological risks are another significant concern for triangular arbitrageurs. These can include software glitches, internet connectivity issues, and other technical problems that can disrupt trading activities. Therefore, traders must have reliable trading systems and backup plans in place to mitigate these risks. Market risks refer to the potential losses that can arise from adverse changes in market conditions. For example, sudden shifts in exchange rates, changes in interest rates, or geopolitical events can all impact the profitability of a triangular arbitrage strategy. Triangular arbitrage is a risk-free trading strategy used in the forex market to exploit temporary currency exchange rate discrepancies. By taking advantage of small price differences between three currency pairs, traders can generate profits without exposing themselves to currency risk. Successful execution of triangular arbitrage relies on factors such as market liquidity, transaction costs, market volatility, and the speed of execution. Traders need highly liquid markets to execute trades quickly and at competitive prices, while minimizing transaction costs is crucial to preserve potential profits. Market volatility presents both opportunities and challenges, and traders must act swiftly to capitalize on fleeting market inefficiencies. Additionally, there are risks associated with execution, including market volatility and liquidity constraints. Technological risks, such as software glitches and connectivity issues, can disrupt trading activities. Market risks, such as sudden shifts in exchange rates or geopolitical events, can impact the profitability of triangular arbitrage strategies.What Is Triangular Arbitrage?

Principle of Triangular Arbitrage

Understanding Exchange Rates

Concept of Market Inefficiency

Mechanics of Triangular Arbitrage

Identifying Opportunities

Step-By-Step Process

1. Convert the base currency into the second currency at the prevailing exchange rate.

2. Convert the second currency into the third currency at the prevailing exchange rate.

3. Convert the third currency back into the base currency at the prevailing exchange rate.Factors Affecting Triangular Arbitrage

Market Liquidity

Transaction Costs

Market Volatility

Speed of Execution

Triangular Arbitrage in the Forex Market

Role of Forex Brokers

Use of Technology in Forex Arbitrage

Limitations of Triangular Arbitrage

Risk of Execution

Technological Risks

Market Risks

Conclusion

Triangular Arbitrage FAQs

Triangular arbitrage is a trading strategy used to profit from temporary currency exchange rate discrepancies by taking advantage of small price differences between three currency pairs.

In triangular arbitrage, traders convert one currency into another, then into a third currency, and finally back into the original currency, creating a triangle of currency transactions. The goal is to identify instances where the combined exchange rates of these transactions result in a profit after accounting for transaction costs.

Triangular arbitrage is often considered risk-free because it involves exploiting temporary market inefficiencies without exposure to currency risk. However, there are other risks to consider, such as execution risk, technological risks, and market risks, which can impact profitability.

Several factors influence the success of triangular arbitrage, including market liquidity, transaction costs, market volatility, and the speed of execution. Traders need liquid markets, low transaction costs, favorable market conditions, and the ability to execute trades quickly to maximize profits.

Yes, there are limitations to triangular arbitrage. Opportunities for profitable arbitrage are often short-lived, and market forces quickly correct temporary exchange rate discrepancies. Traders also face risks such as execution risk, technological risks (software glitches, connectivity issues), and market risks (volatility, geopolitical events), which can impact the effectiveness of the strategy.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.