Thematic investing involves selecting assets based on long-term trends or themes expected to drive growth in the future. This approach focuses on identifying transformative forces that can create investment opportunities across various sectors and industries. Thematic investing is important in portfolio management as it enables investors to capitalize on emerging trends and potentially achieve higher returns. By investing in themes that are expected to grow over time, investors can benefit from long-term growth and improve their portfolio performance. Unlike traditional investing, which typically focuses on asset allocation across market sectors, thematic investing emphasizes specific trends or themes. This approach can help investors identify new investment opportunities that may not be captured by traditional sector-based strategies. Megatrends are large-scale, long-lasting trends that influence global economies and societies. Identifying these trends, such as urbanization, globalization, and digitalization, can help investors uncover potential investment themes and capitalize on their growth potential. Technological innovations and advancements are significant drivers of change and can create lucrative investment opportunities. Investors can participate in the growth of cutting-edge technologies and industries by focusing on areas such as artificial intelligence, renewable energy, or biotechnology. Social and demographic changes, such as an aging population or increasing income inequality, can profoundly impact investment opportunities. Thematic investors can benefit from these trends by identifying and investing in industries and companies that are likely to benefit from these changes. Environmental and sustainability factors, such as climate change and resource scarcity, are increasingly important in investment decisions. Thematic investing can help investors capitalize on these trends by investing in companies and industries that contribute to a more sustainable future. The top-down approach to thematic investing involves identifying macro-level trends and then selecting industries, sectors, or regions that are expected to benefit from these trends. This approach allows investors to capitalize on large-scale global economic and market shifts. The bottom-up approach to thematic investing focuses on identifying companies or assets well-positioned to benefit from a specific theme. Investors using this approach typically rely on fundamental analysis to evaluate these companies' growth potential and competitive advantages. A blended approach to thematic investing combines elements of both top-down and bottom-up strategies. By incorporating macro-level trends and individual company analysis, this approach can provide a more comprehensive understanding of the investment opportunities a particular theme presents. Thematic mutual funds are professionally managed investment vehicles that pool investor capital to invest in a diversified portfolio of assets aligned with a specific theme. These funds can provide investors with exposure to various thematic investment opportunities while offering the benefits of diversification and professional management. Thematic ETFs are exchange-traded funds that track a specific theme or trend, typically by following a thematic index. These funds provide investors with a convenient and cost-effective way to gain exposure to a particular theme through a single, tradeable security. Investing directly in individual stocks and bonds can provide investors with targeted exposure to specific companies or assets that align with a chosen theme. This approach requires a thorough understanding of the companies and industries involved and may involve greater risk than investing in diversified funds. Thematic indexes track the performance of a basket of securities related to a specific theme or trend. Investors can use these indexes as benchmarks to gauge the performance of their thematic investments or as the basis for creating thematic ETFs and other investment products. Fundamental analysis involves examining the financial health, competitive position, and growth prospects of individual companies or assets to assess their potential as thematic investments. This analysis can help investors identify companies that are well-positioned to benefit from a specific theme or trend. Technical analysis involves studying historical price patterns and market data to identify trends and potential investment opportunities. This analysis can be particularly useful in evaluating thematic investments, as it can help investors identify emerging trends and assess the timing of their investment decisions. Evaluating thematic investments requires considering both quantitative factors, such as financial ratios and performance metrics, and qualitative factors, such as management quality, competitive advantages, and industry dynamics. By assessing these factors, investors can develop a more comprehensive understanding of the investment opportunities presented by a particular theme. Thematic investing can enhance portfolio diversification by providing exposure to non-traditional assets and sectors. This approach can help investors manage risk by reducing the impact of market fluctuations and sector-specific events on their portfolios. Thematic investing focuses on long-term trends and themes, which can offer significant growth potential over time. By identifying and investing in these trends early, investors can potentially achieve higher returns than traditional investment strategies. Thematic investing allows investors to align their investments with their personal values and interests. This approach can be especially appealing to investors who are passionate about certain trends or issues and want their investments to reflect those priorities. One of the primary challenges of thematic investing is the potential for concentration risk due to a lack of diversification. Investing heavily in a single theme can result in greater exposure to sector-specific risks and increased portfolio volatility. Thematic investing may be subject to short-term volatility due to market fluctuations and the rapid pace of change in some industries. Investors should be prepared for potential short-term fluctuations in the value of their thematic investments. Predicting future trends and developments is inherently difficult, which can make thematic investing challenging. Investors need to continuously monitor and reassess their investment themes to ensure they remain relevant and have long-term growth potential. Thematic investing involves identifying and capitalizing on trends and themes that have the potential to drive long-term growth and market outperformance. This investment approach can provide investors with a unique way to diversify their portfolios, align investments with personal values, and potentially achieve higher returns. In an increasingly interconnected and dynamic global economy, thematic investing allows investors to stay ahead of the curve by focusing on the underlying forces shaping industries and markets. This approach can help investors identify investment opportunities that traditional investing methods might overlook and better position their portfolios for long-term success. Before embarking on a thematic investing strategy, investors should carefully consider the potential risks and challenges associated with this approach. Expert advisors can help you identify suitable themes, evaluate investment options, and create a well-balanced portfolio tailored to your unique goals and risk tolerance.What Is Thematic Investing?

Identifying Investment Themes

Megatrends and Macroeconomic Factors

Technological Innovations and Advancements

Social and Demographic Changes

Environmental and Sustainability Factors

Thematic Investing Strategies

Top-Down Approach

Bottom-up Approach

Blended Approach

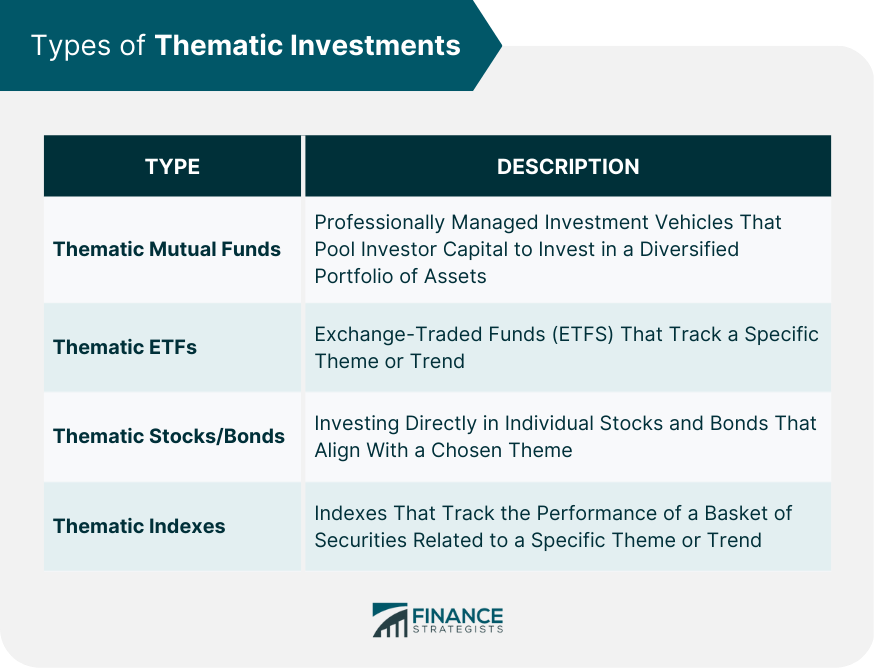

Types of Thematic Investments

Thematic Mutual Funds

Thematic Exchange-Traded Funds (ETFs)

Thematic Stocks and Bonds

Thematic Indexes

Evaluating Thematic Investments

Fundamental Analysis

Technical Analysis

Quantitative and Qualitative Factors

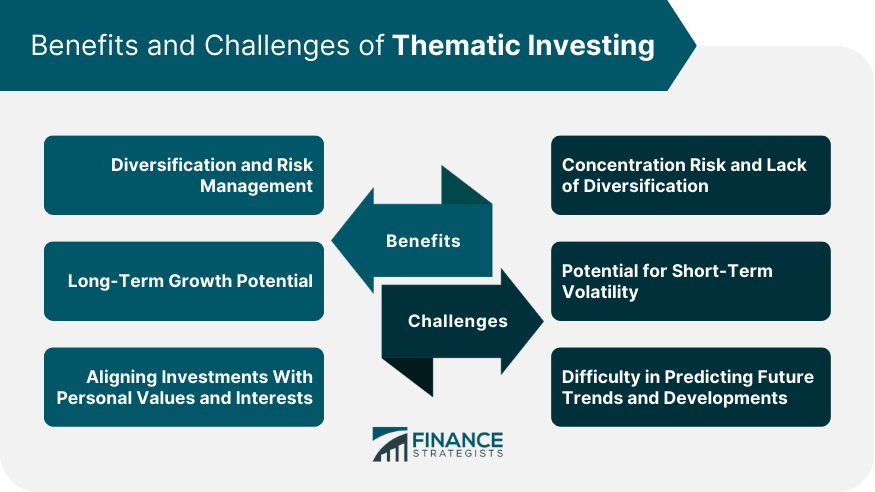

Benefits of Thematic Investing

Diversification and Risk Management

Long-Term Growth Potential

Aligning Investments With Personal Values and Interests

Challenges and Risks of Thematic Investing

Concentration Risk and Lack of Diversification

Potential for Short-Term Volatility

Difficulty in Predicting Future Trends and Developments

Final Thoughts

Thematic Investing FAQs

Thematic investing management is the process of selecting investments based on underlying trends and themes that have the potential for long-term growth. It is important because it allows investors to capitalize on significant market opportunities and align their investments with personal values and interests.

A wealth management service can provide expert guidance on identifying appropriate investment themes, evaluating thematic investments, and constructing a diversified portfolio to minimize risk and maximize potential returns.

Thematic investing management can offer several benefits, such as portfolio diversification, long-term growth potential, and the opportunity to invest in line with personal values and interests.

Yes, there are risks associated with thematic investing management, such as concentration risk, short-term volatility, and difficulty in predicting future trends. However, these risks can be mitigated through proper research, analysis, and diversification.

Yes, thematic investing management can be combined with traditional investing approaches, allowing investors to benefit from both strategies. This blended approach can help create a well-rounded, diversified portfolio that meets individual investment goals and risk tolerance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.