A round lot is a standardized number of shares, typically set at multiples of 100, that are traded on financial markets. These lots are universally accepted and widely used as a measure of trade size. Trading in round lots is prevalent in the stock market and other financial markets because it simplifies trading and promotes efficiency. The round lot concept dates back to the early days of stock trading, where buying and selling of stocks in set multiples was necessary due to technological and logistical limitations. Today, with advancements in technology and trading platforms, round lots are not the only option for trading, but they still hold a significant place in wealth management. Round lots play a vital role in wealth management as they facilitate a more structured trading environment. Since they are commonly traded in financial markets, round lots provide investors with better liquidity and lower transaction costs. Additionally, they contribute to more straightforward price discovery and reduced market impact, ensuring smoother trade execution. In wealth management, round lot trading helps financial advisors build diversified portfolios for their clients. The use of round lots also simplifies investment strategies, particularly in the context of index funds and exchange-traded funds (ETFs), where standardized lot sizes are essential to replicate market performance efficiently. Round lots are defined by their specific quantities, which usually represent multiples of 100 shares. These standardized units allow for efficient trading and make it easier for investors to manage their portfolios. As a result, round lots contribute to increased trading activity and higher overall market liquidity. Apart from shares, round lots can also apply to other financial instruments, such as options and futures contracts. In these cases, the lot sizes may vary depending on the specific contract and the underlying asset, but they will still adhere to a standardized format to facilitate trading. The pricing of round lots is generally more competitive compared to odd lots, which are smaller or irregular quantities of shares. Due to their larger size, round lots benefit from economies of scale and provide investors with better prices, thereby reducing the cost of trading. In addition to better prices, round lots are often more transparent in terms of their pricing structure. Market participants can easily assess the value of a round lot based on the available market data, resulting in more accurate price discovery and a fairer trading environment. Trading efficiency is an important aspect of round lots as their standardized quantities lead to a more streamlined trading process. With a set number of shares, round lots facilitate quicker trade execution and reduced slippage, which is the difference between the expected price and the actual price at which the trade is executed. This enhanced efficiency is particularly beneficial for large-scale investors and institutional traders who require efficient execution to manage their substantial positions effectively. Round lots also play a crucial role in algorithmic and high-frequency trading, where speed and accuracy are vital to achieve the desired results. One of the main advantages of round lot trading is its lower transaction costs. When trading in round lots, investors benefit from reduced bid-ask spreads and better prices, as market makers and other liquidity providers prefer to trade in larger, standardized quantities. This ultimately results in lower transaction costs for investors, as they can save on trading fees and other expenses associated with buying and selling shares. Moreover, lower transaction costs are particularly beneficial for long-term investors, as these savings can compound over time, resulting in a more significant impact on their overall investment returns. Round lot trading contributes to enhanced liquidity in financial markets, as these standardized units are more widely traded and readily available. Increased liquidity makes it easier for investors to buy and sell shares at their desired prices and helps minimize the market impact of their trades. This is particularly important for large investors, such as institutional traders and investment funds, who require a high level of liquidity to manage their sizeable positions. Additionally, enhanced liquidity is essential for the overall stability of financial markets, as it allows for smoother price movements and reduced volatility. Trading in round lots can help minimize the market impact of an investor's trades. When an investor buys or sells a large number of shares, it can cause the price to move against them, affecting their trade execution and overall investment returns. By trading in round lots, investors can reduce the market impact of their trades, as these standardized units are more readily absorbed by the market. This reduced market impact is particularly important for institutional investors and large traders, who require efficient trade execution to manage their positions effectively. One of the main challenges associated with round lot trading is the higher initial investment requirement. Since round lots typically consist of larger quantities of shares, investors need a more substantial amount of capital to trade in these standardized units. This can be particularly challenging for small investors, who may not have the financial resources to invest in round lots. In some cases, this higher initial investment requirement can result in limited diversification and increased risk, as small investors are forced to concentrate their investments in a smaller number of assets. Round lot trading can also limit the flexibility of small investors, as they may be unable to trade in smaller or irregular quantities of shares. This can restrict their ability to adjust their portfolio allocations or pursue specific investment strategies that require trading in smaller quantities of shares. In some cases, this limited flexibility can result in suboptimal investment decisions and reduced portfolio performance, particularly for investors who need to react quickly to changing market conditions or take advantage of specific trading opportunities. Another potential limitation of round lot trading is its impact on trading frequency. Since round lots consist of larger quantities of shares, investors may be less likely to trade frequently due to the higher costs associated with these larger transactions. While reduced trading frequency can be beneficial in some cases, as it can help minimize transaction costs and encourage long-term investing, it can also limit an investor's ability to react to changing market conditions and take advantage of specific trading opportunities. An odd lot is a trade involving a quantity of shares that is not a multiple of 100. In contrast to round lots, odd lots consist of smaller or irregular quantities of shares, making them less standardized and less widely traded in financial markets. While odd lots can offer increased flexibility for small investors, they also come with higher transaction costs and reduced liquidity compared to round lots. Round lot trading and odd lot trading each have their advantages and drawbacks, and the suitability of each approach depends on the investor's specific needs and objectives. Round lots offer lower transaction costs, enhanced liquidity, and reduced market impact, making them more suitable for large investors and institutional traders who require efficient trade execution and a high level of market liquidity. On the other hand, odd lots provide increased flexibility for small investors, who may not have the financial resources to trade in larger, standardized quantities. However, this increased flexibility comes at the cost of higher transaction costs and reduced liquidity, which can impact overall investment returns and portfolio performance. Round lots play a crucial role in portfolio construction, as their standardized quantities allow investors to build diversified portfolios more efficiently. By investing in round lots, investors can ensure that their portfolio allocations are balanced and aligned with their specific risk tolerance and investment objectives. In addition to their role in portfolio construction, round lots also contribute to more straightforward rebalancing and portfolio maintenance, as investors can easily adjust their positions by buying or selling standardized units of shares. One of the main benefits of round lot trading is the diversification it offers. Since round lots are widely traded and readily available, investors can easily diversify their portfolios by investing in multiple round lots of different assets. This diversification can help reduce portfolio risk and enhance overall investment returns by spreading investments across a broader range of assets and sectors. Furthermore, the use of round lots in portfolio construction can also simplify the process of assessing portfolio performance, as investors can easily compare the returns of their round lot investments against relevant market benchmarks. Round lots are particularly important in the context of index funds and exchange-traded funds (ETFs), where standardized lot sizes are essential to replicate market performance efficiently. By investing in round lots, index funds can accurately track the performance of their target indices, ensuring that investors receive the market returns they expect. Additionally, the use of round lots in index funds can also help minimize tracking error and reduce transaction costs, resulting in more accurate and cost-effective fund performance. In the context of brokerage services, round lots play a crucial role in trade execution and order management. Since round lots are widely traded and readily available, they provide brokers with better liquidity and more efficient trade execution, ensuring that their clients' orders are executed quickly and at the best possible prices. Furthermore, the use of round lots in brokerage services can also help reduce operational risks, as these standardized units simplify the trade settlement process and minimize the potential for errors and discrepancies. For financial advisors, round lots are an essential aspect of portfolio management and investment strategy. By incorporating round lots into their clients' portfolios, advisors can ensure that their clients benefit from the lower transaction costs, enhanced liquidity, and reduced market impact associated with these standardized units. In addition to these benefits, financial advisors also need to be aware of the potential limitations of round lot trading, such as the higher initial investment requirement and limited flexibility for small investors. By taking these factors into account, advisors can develop tailored investment strategies that meet their clients' specific needs and objectives. Educating clients about the benefits and drawbacks of round lot trading is an essential part of wealth management services. By providing clients with a comprehensive understanding of round lots and their role in investment strategies, financial advisors can empower their clients to make informed decisions and manage their portfolios more effectively. This client education and guidance should include information on the advantages of round lot trading, such as lower transaction costs and enhanced liquidity, as well as the potential challenges and limitations associated with these standardized units. A round lot refers to a standard trading unit or quantity of a particular security that is typically required for efficient trading on an exchange. It represents a predetermined number of shares or units that are traded together as a single transaction. Round lots play a vital role in investment strategies, wealth management services, and the overall functioning of financial markets. While they offer numerous benefits, such as lower transaction costs and enhanced liquidity, they also come with some limitations, such as higher initial investment requirements and limited flexibility for small investors. By understanding the advantages and challenges of round lot trading, investors and financial advisors can develop tailored investment strategies that meet their specific needs and objectives. As financial markets continue to evolve, round lots will likely remain a critical aspect of investment management, contributing to more efficient and effective portfolio construction and management.What Is a Round Lot?

Importance of Round Lots in Wealth Management

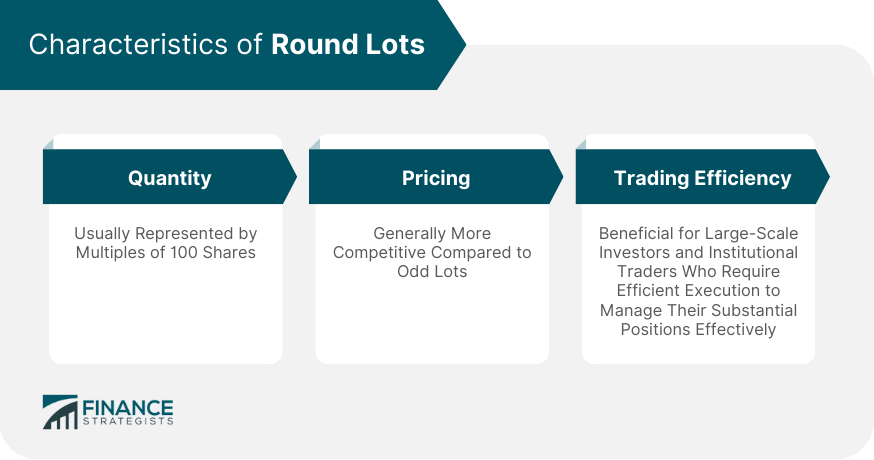

Characteristics of Round Lots

Quantity

Pricing

Trading Efficiency

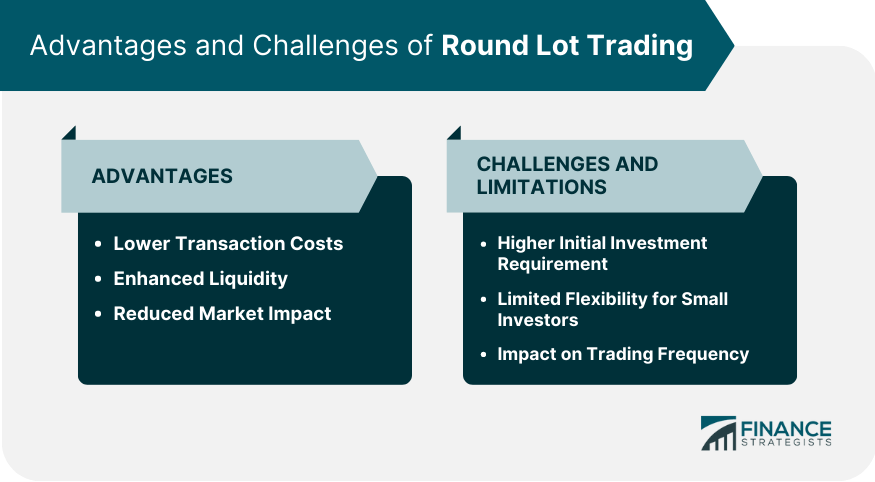

Advantages of Round Lot Trading

Lower Transaction Costs

Enhanced Liquidity

Reduced Market Impact

Challenges and Limitations of Round Lot Trading

Higher Initial Investment Requirement

Limited Flexibility for Small Investors

Impact on Trading Frequency

Round Lot vs Odd Lot

Definition of Odd Lots

Comparison of Round Lots and Odd Lot Trading

Round Lots in Investment Strategies

Portfolio Construction

Diversification Benefits

Implementation in Index Funds

Round Lots in Wealth Management Services

Role in Brokerage Services

Considerations for Financial Advisors

Client Education and Guidance

Final Thoughts

Round Lot FAQs

A round lot is a standardized number of shares, typically set at multiples of 100, that are traded on financial markets.

Round lot trading offers lower transaction costs, enhanced liquidity, and reduced market impact, making it more efficient and cost-effective for investors.

Some of the drawbacks of round lot trading include higher initial investment requirements and limited flexibility for small investors.

Round lots consist of standardized quantities of shares, typically multiples of 100, whereas odd lots consist of smaller or irregular quantities of shares.

Round lots are important in wealth management because they facilitate efficient portfolio construction and management, allowing investors to benefit from lower transaction costs, enhanced liquidity, and reduced market impact.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.