An offsetting transaction is a critical financial strategy that involves executing a trade to counterbalance the risk associated with an existing position in the market. This risk-neutralizing trade can be executed on the same asset (direct offsetting) or a related one (indirect offsetting). The significance of offsetting transactions in financial markets is far-reaching. They serve as powerful tools in managing exposure to market volatility, safeguarding potential losses, and ensuring more stable returns. Furthermore, they find extensive applications across various market types, including stocks, commodities, forex, and derivatives. In a financial landscape marked by frequent fluctuations, offsetting transactions are integral to maintaining a balance between risk and return, making them an essential component of effective investment and trading strategies. Offsetting transactions serve as critical risk management tools. They help manage exposure to price fluctuations, limit potential losses, and stabilize returns. The utility of offsetting transactions extends across various financial markets, including stocks, commodities, forex, and derivatives. The fundamental premise of offsetting transactions is risk management. They offer a mechanism to control exposure to market volatility. The principle of offsetting transactions is rooted in the need to limit exposure to market risk. For example, if an investor holds a long position in a volatile stock, they can offset the risk by initiating a short position in the same stock. This way, if the stock price falls, the loss from the long position would be countered by the profit from the short position, and vice versa. Offsetting transactions and risk management are inherently linked. By initiating an offsetting transaction, an investor or trader essentially manages the risk of adverse price movements, thereby reducing potential losses. Offsetting transactions can be classified into direct and indirect transactions based on their approach to risk neutralization. A direct offsetting transaction is where an investor initiates an opposite trade on the same asset. For instance, if an investor has a long position in gold futures and fears a price drop, they can initiate a short position in gold futures, thereby offsetting the risk. An indirect offsetting transaction involves taking a position in a related asset. Suppose an investor holds shares of an oil company. If they anticipate a decline in oil prices, they could short a futures contract on crude oil. This way, they can potentially profit from the futures contract if oil prices fall, offsetting the loss from the shares. The process of executing an offsetting transaction involves careful market analysis, strategy formulation, and trade execution. The first step involves identifying the risk exposure of the existing position. Next, the investor needs to decide whether to use a direct or indirect offsetting transaction based on the market dynamics and risk tolerance. Once decided, the offsetting trade is executed, and the risk is neutralized. Key considerations include the correlation between assets, potential transaction costs, market volatility, and the investor's risk tolerance and investment goals. It's also important to remember that while offsetting transactions can limit losses, they can also limit potential gains. The concept of offsetting transactions applies across various financial markets, each with its unique characteristics and considerations. In the stock market, offsetting transactions often involve short selling or trading derivatives like options. For example, an investor holding a stock can buy a put option on the same stock, which gives them the right to sell the stock at a predetermined price, thereby limiting their downside risk. In the commodity market, traders often use futures contracts to offset risk. For instance, a farmer expecting a harvest in a few months might sell futures contracts on the crop to lock in a price and protect against the risk of price decreases. Conversely, a food processing company might buy futures contracts to secure a stable price and protect against price increases. In the forex market, offsetting transactions often involve trading different currency pairs that are closely correlated. For example, if a trader has a long position in EUR/USD and expects the Euro to weaken, they might initiate a short position in another pair involving the Euro, such as EUR/GBP, to offset the risk. In the derivatives market, offsetting transactions can be quite complex, involving various instruments like futures, options, and swaps. For example, an investor who has bought a call option (betting the price will rise) might sell a put option (betting the price won't fall) on the same asset to offset the risk. Offsetting transactions form the cornerstone of various hedging strategies, which aim to reduce risk and stabilize returns. Hedging involves taking an investment position to offset potential losses that may be incurred from another investment position. Offsetting transactions are a key tool in this process, allowing investors to balance their exposure and manage risk. Offsetting transactions are used in various hedging strategies. For example, in a pairs trading strategy, an investor might go long on an undervalued stock and short on an overvalued stock in the same industry, expecting the price difference to converge. This strategy uses offsetting transactions to limit market risk. While offsetting transactions can provide significant benefits, they also come with potential drawbacks. Offsetting transactions can effectively manage and reduce risk, stabilize returns, and offer flexibility in response to market changes. They allow investors to maintain their market positions while limiting their exposure to price volatility. However, offsetting transactions can also limit potential profits, involve transaction costs, and require careful monitoring and management. They also rely on the assumption that the assets involved will move in relation to each other as expected, which may not always hold true. Offsetting transactions, while useful, must be conducted within the legal and regulatory framework of the financial market. Regulatory bodies like the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) have rules regarding short selling, derivatives trading, and other activities involved in offsetting transactions. Investors must ensure compliance to avoid penalties. Legally, issues can arise if offsetting transactions are used for manipulative practices, such as creating artificial market movements. Investors could face lawsuits or regulatory action in such cases. With the rise of artificial intelligence and machine learning, predictive analytics are becoming more sophisticated. These technologies can potentially improve the effectiveness of offsetting transactions by providing more accurate forecasts and risk assessments. Automated trading systems can also execute offsetting transactions more swiftly and accurately. As financial markets become more interconnected and complex, the importance of effective risk management tools like offsetting transactions will likely grow. However, it's also possible that new forms of risk will emerge, requiring further evolution of offsetting strategies. Offsetting transactions, a fundamental risk management tool, involve initiating a trade that neutralizes or counters the risk of an existing market position. Their use is paramount across various financial markets, including stocks, commodities, forex, and derivatives, where they help manage exposure to price fluctuations, limit potential losses, and stabilize returns. There are primarily two types of offsetting transactions—direct and indirect. In a direct offsetting transaction, an investor takes an opposite trade on the same asset, while an indirect offsetting transaction involves taking a position in a related asset. Given their critical role in risk management and their widespread application in different financial markets, understanding and effectively utilizing offsetting transactions is key for successful investing and trading.Definition of Offsetting Transactions

The Role and Importance of Offsetting Transactions in Financial Markets

The Concept Behind Offsetting Transaction

The Rationale for Offsetting Transactions

The Link Between Offsetting Transactions and Risk Management

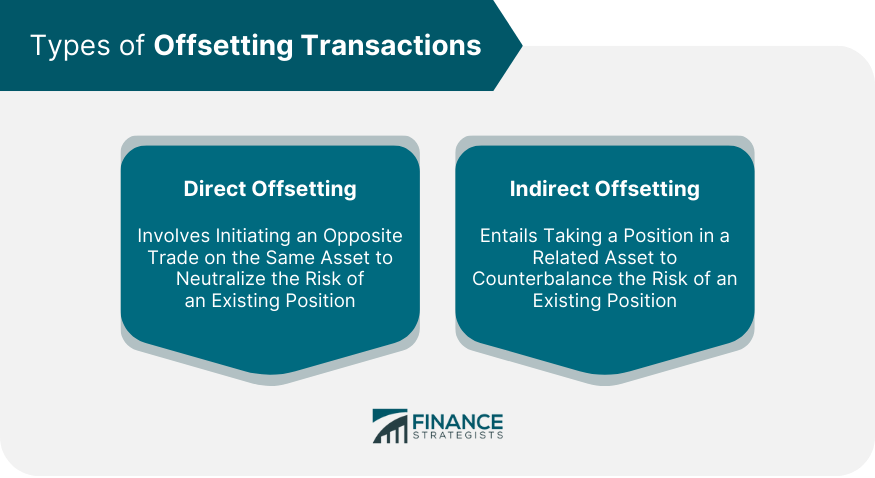

Types of Offsetting Transactions

Direct Offsetting Transaction

Indirect Offsetting Transaction

How Offsetting Transactions Work

The Process of Executing an Offsetting Transaction

Factors to Consider Before Initiating an Offsetting Transaction

Offsetting Transaction in Different Financial Markets

Offsetting Transactions in the Stock Market

Offsetting Transactions in the Commodity Market

Offsetting Transactions in the Forex Market

Offsetting Transactions in the Derivatives Market

The Role of Offsetting Transactions in Hedging

Understanding Hedging and Its Relation to Offsetting Transactions

Use of Offsetting Transactions in Hedging Strategies

Benefits and Drawbacks of Offsetting Transactions

Advantages of Offsetting Transactions

Potential Disadvantages and Risks of Offsetting Transactions

Regulatory and Legal Implications of Offsetting Transactions

Regulatory Considerations

Legal Implications and Potential Issues

Future Trends and Predictions for Offsetting Transactions

Impact of Technology and AI on Offsetting Transactions

The Future of Offsetting Transactions in Evolving Financial Markets

Conclusion

Offsetting Transactions FAQs

Offsetting transactions refer to trades that are executed to neutralize or counterbalance the risk associated with an existing position in the financial market. They can be direct (on the same asset) or indirect (on a related asset).

Offsetting transactions are critical for managing exposure to market volatility, limiting potential losses, and stabilizing returns. They serve as a vital risk management tool in various markets, including stocks, commodities, forex, and derivatives.

There are two main types of offsetting transactions: direct and indirect. Direct offsetting involves initiating an opposite trade on the same asset, while indirect offsetting entails taking a position in a related asset.

Offsetting transactions work by reducing the risk of an existing position. If the market moves against the initial position, the offsetting transaction helps to counterbalance the loss, thereby mitigating risk and stabilizing returns.

Yes, while offsetting transactions can effectively manage and reduce risk, they also have the potential to limit gains. This is because any profit from the initial position could be offset by a loss from the offsetting transaction, especially in volatile market conditions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.