Endowment funds are a critical source of financial support for many institutions, including universities, hospitals, museums, and nonprofit organizations. These funds are comprised of financial assets donated by individuals, corporations, or other entities to help support an institution's mission and objectives. The primary goal of an endowment fund is to provide long-term financial stability and support through income generated from the fund's investments. The first step in establishing an endowment fund is to define the fund's objectives and goals clearly. These objectives should align with the institution's mission and strategic plans, ensuring that the endowment fund will support the institution's long-term needs. Goals may include supporting specific programs, providing scholarships or financial aid, funding research, or maintaining facilities. Before establishing an endowment fund, it is essential to understand the legal and regulatory requirements involved. Institutions should consult with legal and financial advisors to ensure they comply with all applicable laws and regulations, including federal and state tax laws, securities regulations, and donor restrictions. A gift acceptance policy is an essential component of an endowment fund, as it outlines the types of gifts the institution will accept and the procedures for accepting and managing those gifts. A comprehensive gift acceptance policy should address various gift types, such as cash, securities, real estate, and personal property. It should also establish guidelines for donor recognition and stewardship and policies for managing restricted gifts and endowed funds. Once the endowment fund's objectives, legal framework, and gift acceptance policy are established, the institution must develop a fundraising strategy to solicit and secure donations. Fundraising strategies may include targeted campaigns, planned giving programs, donor cultivation events, and corporate partnerships. Institutions should tailor their approach to their unique circumstances, leveraging their strengths and networks to engage donors effectively. A well-defined investment policy is crucial to the success of an endowment fund. The policy should outline the fund's investment objectives, risk tolerance, asset allocation, and performance benchmarks. The investment policy should also provide guidance on diversification, liquidity, and investment manager selection. Effective risk management is vital for endowment funds, as it helps protect the fund's assets and ensure the institution's long-term sustainability. Risk management strategies include diversifying investments across asset classes, monitoring market trends, and using risk mitigation tools such as hedges and derivatives. Asset allocation is determining the optimal mix of investments for an endowment fund, considering the fund's risk tolerance, investment horizon, and return objectives. Common asset classes include stocks, bonds, real estate, and alternative investments such as hedge funds, private equity, and venture capital. It is essential to establish performance benchmarks to evaluate the performance of an endowment fund's investments. These benchmarks can help institutions measure the effectiveness of their investment strategies and make informed decisions about adjustments to their portfolios. Institutions must carefully select investment managers and advisors who will oversee the management of the endowment fund's assets. Criteria for selecting investment managers may include their experience, performance track record, investment philosophy, and alignment with the institution's mission and values. Regular monitoring and evaluation of investment performance are critical for ensuring that the endowment fund's assets are managed effectively. Institutions should establish a process for reviewing investment performance, comparing it to established benchmarks, and making necessary adjustments to the portfolio. This process should include regular communication between the institution, investment managers, and advisors to ensure the endowment fund's investment objectives are met. Environmental, Social, and Governance (ESG) factors are increasingly important in the investment management of endowment funds. Many institutions are adopting responsible investing strategies that incorporate ESG considerations, reflecting their commitment to social responsibility and long-term sustainability. These strategies may involve screening investments based on ESG criteria, engaging with companies on ESG issues, and investing in funds or projects that have a positive social or environmental impact. The spending rate of an endowment fund refers to the portion of the fund's assets that are allocated to support the institution's operations and programs each year. Determining the appropriate spending rate is a critical aspect of endowment fund management, as it balances the need for current spending with the fund's long-term growth. There are several approaches to establishing a spending policy for an endowment fund: The constant growth spending policy aims to maintain a stable level of real spending over time, adjusting for inflation. This approach involves setting a fixed percentage of the fund's market value as the spending amount, with adjustments for inflation made periodically. The percentage of market value spending policy sets a fixed percentage of the endowment fund's market value as the spending amount each year. This approach allows for more flexibility in spending, as the spending amount will fluctuate based on the fund's market value. Hybrid spending policies combine elements of the constant growth and percentage of market value approaches, often incorporating a moving average of the fund's market value over several years to smooth out fluctuations in spending. To maintain the long-term sustainability of an endowment fund, institutions must carefully balance spending with the fund's growth. This involves monitoring the fund's investment performance, adjusting the spending rate as needed, and ensuring that the spending policy aligns with the institution's strategic objectives. In times of market volatility or economic uncertainty, institutions may need to adjust their spending policies to protect the endowment fund's assets and ensure financial stability. This may involve temporary reductions in spending, implementing a more conservative spending policy, or exploring alternative sources of funding. Effective governance and oversight of an endowment fund are essential for ensuring its long-term success. Institutions should establish a governing board or committee composed of individuals with expertise in finance, investments, and the institution's mission, to oversee the fund's management. Board members are responsible for setting the strategic direction of the endowment fund, ensuring that it aligns with the institution's mission and objectives. Their responsibilities include developing and implementing investment and spending policies, selecting and monitoring investment managers and advisors, and ensuring transparency and accountability in the fund's management. Institutions must regularly report on the performance and management of their endowment funds to maintain trust and credibility with stakeholders, including donors, staff, and beneficiaries. This includes providing updates on investment performance, spending, and the fund's impact on the institution's programs and operations. Transparency and accountability are critical components of endowment fund governance. Institutions should establish policies and procedures to ensure that the fund's management is transparent, including disclosing investment holdings, fees, and performance metrics. They should also implement internal controls and audit processes to ensure the fund's assets are managed responsibly and in accordance with the institution's policies and legal requirements. Endowment funds that support charitable organizations or educational institutions are typically granted tax-exempt status under federal and state tax laws. This means that the income generated by the fund's investments is not subject to taxation, allowing for the fund's growth and support of the institution's mission. While endowment funds generally enjoy tax-exempt status, they may be subject to Unrelated Business Income Tax (UBIT) if they engage in activities that generate income unrelated to their exempt purpose. Institutions should consult with tax advisors to ensure compliance with UBIT regulations and minimize potential tax liabilities. Donors who contribute to endowment funds can often benefit from tax deductions for their charitable gifts, depending on the donor's individual tax situation and the nature of the gift. Institutions should provide donors with information on the potential tax benefits of their contributions and work with tax advisors to ensure accurate reporting and compliance with tax laws. Institutions managing endowment funds must comply with federal and state regulations governing charitable asset management and oversight. This includes adhering to the Uniform Prudent Management of Institutional Funds Act (UPMIFA) or similar state laws, which establish standards for the investment and spending of endowment funds. Like all investment portfolios, endowment funds face economic and market uncertainties that can impact investment performance and, consequently, the funds' ability to support their institutions. To navigate these challenges, institutions must maintain a well-diversified portfolio, regularly monitor market trends, and adapt their investment strategies as needed. As the philanthropic landscape becomes more competitive, endowment funds must work harder to attract and retain donors. This requires institutions to demonstrate the impact of their endowment funds, cultivate strong relationships with donors, and explore innovative fundraising strategies. Technological advancements, such as artificial intelligence and machine learning, are transforming the investment landscape and presenting both challenges and opportunities for endowment funds. Institutions must stay informed about these advancements and consider how they might be incorporated into their investment strategies to enhance returns and manage risk. For endowment funds to effectively support their institutions, they must be closely aligned with the institutions' goals and strategic plans. This requires ongoing communication and collaboration between the endowment fund's governing board, investment managers, and institutional leadership. Endowment funds play a vital role in supporting the long-term financial sustainability of institutions and their missions. By carefully establishing and managing these funds, institutions can ensure that they have the resources needed to fulfill their objectives and make a lasting impact on the communities they serve. As the philanthropic landscape evolves, endowment funds must adapt to new challenges and opportunities, always striving to align their strategies with their institutions' and stakeholders' needs and values. To optimize the benefits of endowment funds for institutions and donors, seeking professional tax planning services is crucial. These services can help ensure compliance with applicable tax laws, maximize tax benefits for donors, and minimize potential tax liabilities for the endowment fund. What Are Endowment Funds?

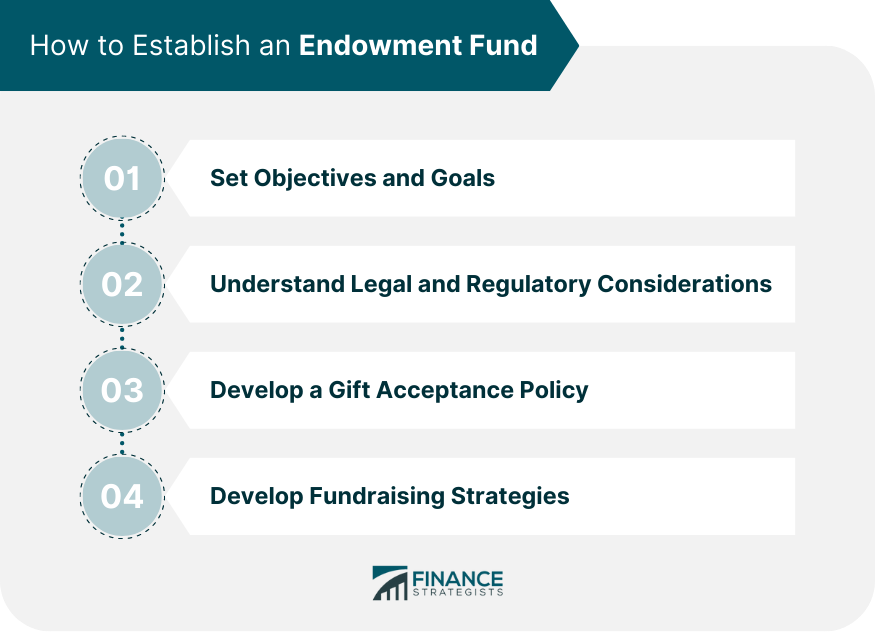

How to Establish an Endowment Fund

Step 1: Set Objectives and Goals

Step 2: Understand Legal and Regulatory Considerations

Step 3: Develop a Gift Acceptance Policy

Step 4: Develop Fundraising Strategies

Investment Management of Endowment Funds

Investment Policy and Guidelines

Risk Management

Asset Allocation

Performance Benchmarks

Selecting Investment Managers and Advisors

Monitoring and Evaluating Investment Performance

Responsible Investing and ESG Considerations

Endowment Fund Spending Policy

Spending Rate Determination

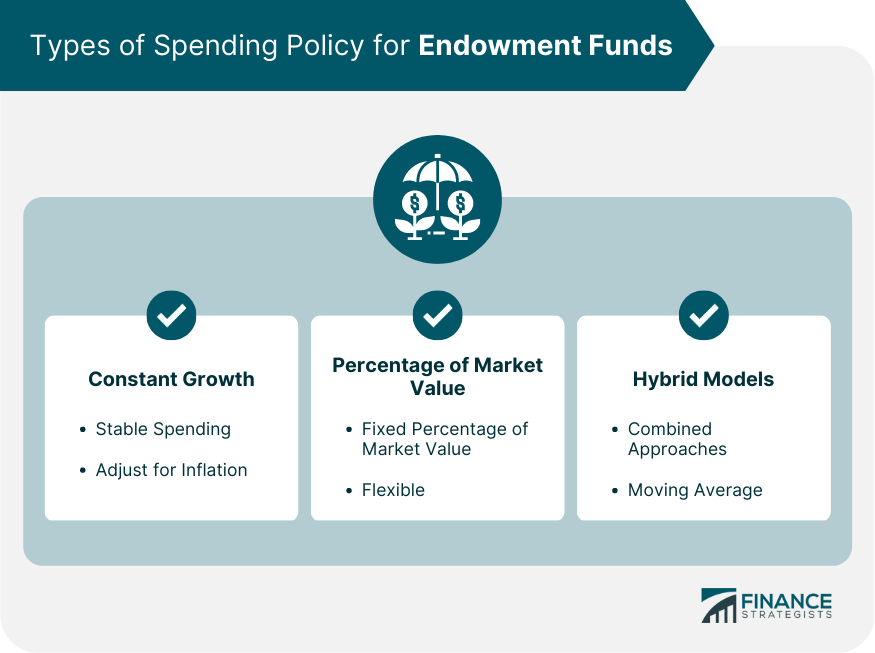

Types of Spending Policies

Constant Growth

Percentage of Market Value

Hybrid Models

Balancing Spending With Fund Growth

Adjusting Spending Policies in Response to Market Conditions

Governance and Oversight of Endowment Funds

Establishing a Governing Board or Committee

Roles and Responsibilities of Board Members

Regular Reporting and Communication With Stakeholders

Ensuring Transparency and Accountability

Tax Implications and Regulations

Tax-Exempt Status of Endowment Funds

Unrelated Business Income Tax (UBIT)

Donor Tax Deductions and Benefits

Compliance With Federal and State Regulations

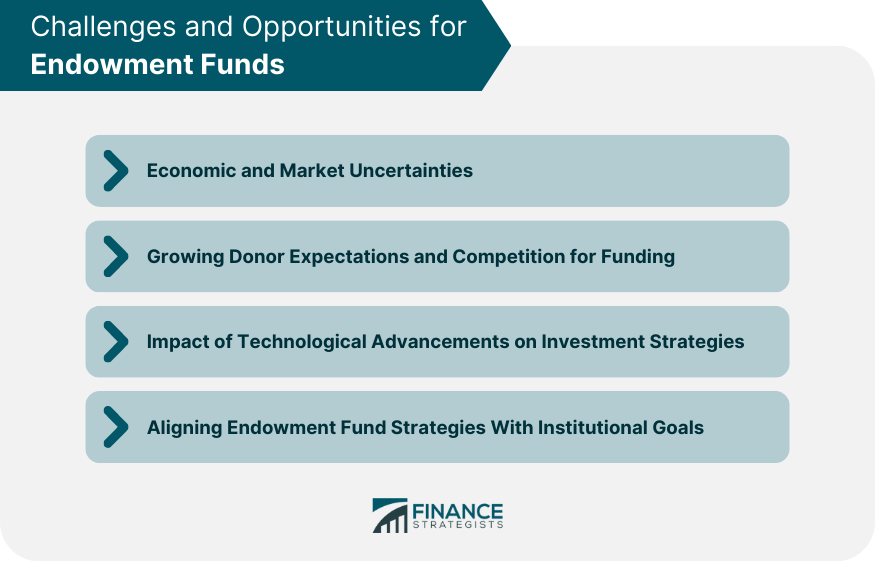

Challenges and Opportunities for Endowment Funds

Economic and Market Uncertainties

Growing Donor Expectations and Competition for Funding

Impact of Technological Advancements on Investment Strategies

Aligning Endowment Fund Strategies With Institutional Goals

Final Thoughts

Endowment Funds FAQs

Endowment funds are financial assets donated to support an institution's mission and objectives, providing long-term financial stability and support through income generated from the fund's investments. They are crucial for the sustainability of many institutions, including universities, hospitals, museums, and nonprofit organizations.

Institutions must set clear objectives and goals that align with their mission, comply with legal and regulatory requirements, develop a gift acceptance policy, and implement fundraising strategies tailored to their unique circumstances.

Effective investment management involves establishing an investment policy and guidelines, managing risks, selecting investment managers and advisors, monitoring and evaluating investment performance, and considering responsible investing and ESG considerations.

Institutions can establish spending policies that maintain a stable level of real spending over time, set a fixed percentage of the endowment fund's market value as the spending amount each year, or use hybrid models that combine elements of both approaches. They must balance spending with the fund's growth and adjust policies in response to market conditions.

Endowment funds face economic and market uncertainties, growing donor expectations and competition for funding, and the impact of technological advancements on investment strategies. Institutions must align endowment fund strategies with their goals, staying informed and adaptable to new challenges and opportunities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.