The "Hot Hand" is a term borrowed from sports, where it's used to describe a player who seems to be on a streak of good fortune, success, or high performance. Transferred into the context of wealth management, the Hot Hand signifies an investor or investment strategy that has been successful for a string of trades, leading to the assumption that this success will continue in future transactions. The Hot Hand concept originated from the observation of basketball players who seem to have streaks of success during games. Researchers Thomas Gilovich, Robert Vallone, and Amos Tversky popularized the term in their 1985 paper, where they analyzed shooting data from the Philadelphia 76ers and concluded that the Hot Hand was just a cognitive illusion. This concept was then applied to various fields, including wealth management, where it became a contentious topic of discussion. In wealth management, the Hot Hand can significantly impact investment decisions. Investors may lean heavily into a successful strategy or hot-performing asset class, expecting the trend to continue. However, this perception can also lead to risky behavior, as investors overlook market volatility, underlying risks, and the role of chance in investment success. The Hot Hand fallacy is the mistaken belief that a person who has experienced success with a random event has a greater chance of further success in additional attempts. In the context of wealth management, the Hot Hand fallacy can lead investors to make irrational decisions based on recent successes, overlooking the inherent randomness and risk in financial markets. In wealth management, the Hot Hand fallacy can lead to overconfidence and risky investment behavior. For instance, an investor who has had a successful run with tech stocks might believe that they have a unique skill or strategy that will continue to produce high returns. They may then over-invest in tech stocks, disregarding the principles of diversification and risk management. One common misconception associated with the Hot Hand fallacy is that past performance guarantees future results. However, in reality, financial markets are influenced by a myriad of factors, and past successes do not ensure future performance. The main risk associated with this fallacy is the potential for significant financial loss. If an investor over-commits to a particular strategy or asset class based on recent successes, they may be poorly positioned to withstand market volatility or a downturn in that particular investment. Behavioral finance is an area of study that combines psychology and economics to explain why and how investors make decisions. This field acknowledges that investors are not always rational and that cognitive biases can significantly influence investment decisions. The Hot Hand concept is a perfect example of how cognitive biases can affect investment decisions. It illustrates the recency bias - the tendency to weigh recent events more heavily than earlier events. When an investor is "hot," they may attribute their success to skill rather than luck, reinforcing their belief in their investing prowess and potentially leading to riskier investment decisions. Understanding the influence of the Hot Hand in investing can help investors mitigate its effects. By recognizing this bias, investors can strive to make more balanced and rational decisions. For instance, instead of chasing hot investments or strategies, they can stick to a disciplined investment approach that includes a well-diversified portfolio and regular portfolio rebalancing. This way, they can manage risk effectively, regardless of whether they're currently "hot" or "cold." Diversification – spreading investments across different asset classes – is one of the most effective ways to counter the Hot Hand fallacy. By owning a mix of assets, you reduce the risk of your portfolio's value falling significantly if one asset or sector performs poorly. A disciplined investment strategy involves sticking to predefined rules for investing, regardless of market conditions or recent performance. This might involve regularly rebalancing your portfolio, sticking to a specific asset allocation, or investing a fixed amount at regular intervals (dollar-cost averaging). Financial advisors can provide an objective perspective, helping you to avoid emotional decision-making and cognitive biases like the Hot Hand fallacy. They can guide you in maintaining a disciplined investment approach and a well-diversified portfolio. The "Cold Hand" is the opposite of the Hot Hand. It refers to a string of losses or poor performance, leading to the belief that this trend will continue into the future. Just like the Hot Hand fallacy, the Cold Hand can lead to irrational investment decisions, such as panic selling or avoiding investment opportunities due to recent losses. While the Hot Hand can lead to overconfidence and risky investment behavior, the Cold Hand often results in excessive caution, fear, and missed opportunities. Both can lead to suboptimal investment outcomes if not managed properly. Managing the Cold Hand involves understanding that streaks of losses are part of the investing process. It's essential to stick to your long-term investment plan, resist the urge to make drastic changes based on short-term performance and seek independent financial advice. The "Hot Hand" in wealth management refers to the notion that an investor or investment strategy that has recently experienced success will continue to do so. However, this often leads to the Hot Hand fallacy, where investors become overconfident and make risky investment decisions based on their recent success, disregarding the inherent volatility and unpredictability of financial markets. However, understanding and countering the Hot Hand fallacy can significantly improve investment outcomes. Strategies to counter the Hot Hand fallacy include diversification, maintaining a disciplined investment strategy, and seeking independent financial advice. These approaches can help manage risks, maintain a balanced portfolio, and make rational investment decisions based on comprehensive financial analysis rather than recent performance. The concept of the Hot Hand and its counterpart, the Cold Hand, underscores the importance of psychological factors in wealth management. If you want to better understand the Hot Hand and other behavioral finance concepts, or if you need help managing your investments, consider seeking the services of a professional wealth manager. What Is the Hot Hand?

Hot Hand in Wealth Management

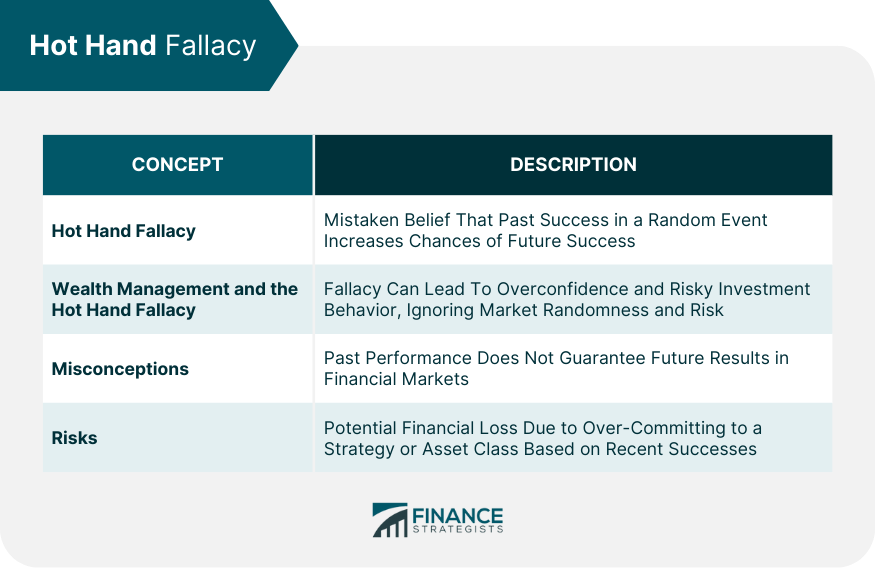

Hot Hand Fallacy

Understanding the Hot Hand Fallacy

Hot Hand Fallacy in Wealth Management

Misconceptions and Risks

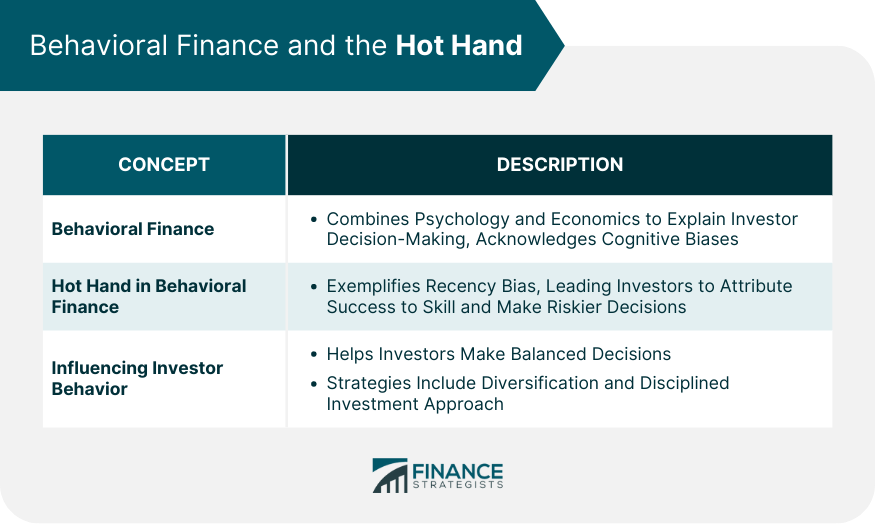

Behavioral Finance and the Hot Hand

Introduction to Behavioral Finance

Role of the Hot Hand in Behavioral Finance

Influencing Investor Behavior

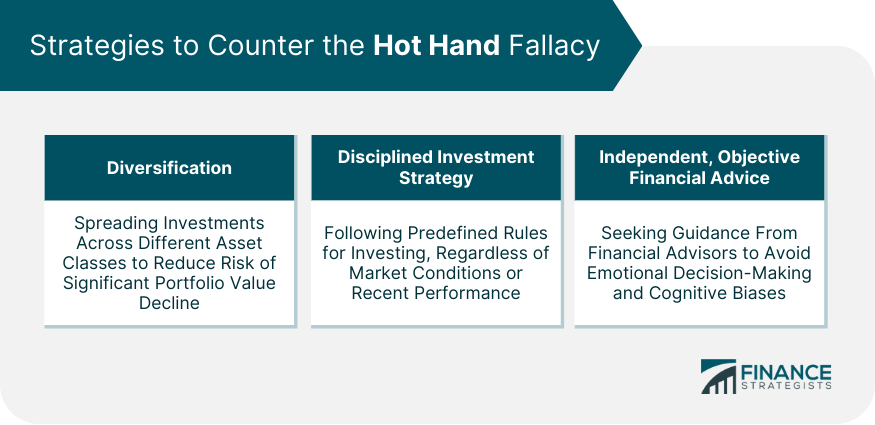

Strategies to Counter the Hot Hand Fallacy

Importance of Diversification

Role of a Disciplined Investment Strategy

Significance of Independent, Objective Financial Advice

Cold Hand in Wealth Management

Understanding the Cold Hand

Differences Between Hot Hand and Cold Hand

Managing the Cold Hand in Wealth Management

Final Thoughts

Hot Hand FAQs

The Hot Hand concept in wealth management refers to the perception that an investor or investment strategy that has recently been successful will continue to be so.

The Hot Hand fallacy can lead to overconfidence and risky investment decisions. Investors may over-invest in a successful strategy or asset, ignoring the inherent risk and volatility of markets.

Strategies to counter the Hot Hand fallacy include diversification of investments, maintaining a disciplined investment strategy, and seeking independent, objective financial advice.

While the Hot Hand refers to a string of successes leading to overconfidence, the Cold Hand refers to a string of losses leading to excessive caution and fear, potentially causing missed investment opportunities.

Wealth management services can provide objective financial advice, helping investors to avoid emotional decision-making and cognitive biases like the Hot Hand fallacy. They guide investors in maintaining a disciplined and diversified investment approach.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.