Global Investment Performance Standards are a set of ethical standards that investment firms voluntarily follow to ensure accurate and transparent reporting of their investment performance. GIPS aim to create a standardized, comparable, and transparent way to present investment performance. This enables investors to assess and compare the performance of investment managers with greater confidence and ease. Adopting GIPS fosters trust between investment managers and their clients, leading to increased transparency and credibility. Moreover, GIPS help investment firms establish a competitive edge by adhering to best practices and promoting ethical conduct. GIPS were introduced in 1999 by the CFA Institute, a global association of investment professionals. The standards have since undergone several revisions to keep pace with the evolving investment landscape. The most recent update, GIPS 2020, reflects the changing needs of the investment industry and expands the standards to cover different types of investment strategies and asset classes. This ensures GIPS remain relevant and effective in today's global investment environment. GIPS consist of two main components: the GIPS Standards and the GIPS Guidance Statements. These components provide a comprehensive framework for investment firms to follow when presenting their investment performance. The GIPS Standards are the core set of rules that investment firms must adhere to when claiming GIPS compliance. They cover six essential areas: Fundamentals of Compliance, Input Data, Calculation Methodology, Composite Construction, Disclosure, and Presentation and Reporting. By following the GIPS Standards, investment firms can demonstrate their commitment to fair representation and full disclosure of their investment performance. This helps clients make more informed investment decisions and fosters a greater level of trust between firms and their clients. The GIPS Guidance Statements offer further clarification on specific topics and address unique aspects of various investment strategies, such as real estate, private equity, and pooled funds, as well as the needs of asset owners. These guidance statements ensure that GIPS remain relevant and applicable to a wide range of investment strategies and organizational structures. They also help investment firms navigate the complexities of their specific investment areas while adhering to the overarching principles of GIPS. Achieving GIPS compliance involves a series of steps that investment firms must follow. This section discusses the steps involved in achieving compliance and the benefits of verification. The GIPS compliance process begins with an initial assessment of an investment firm's current performance reporting practices. Firms must then develop policies and procedures that align with GIPS requirements, implement and maintain these policies, and undergo verification to ensure ongoing compliance. Through this process, investment firms demonstrate their commitment to transparency, accuracy, and comparability in performance reporting. Compliance with GIPS enhances an investment firm's credibility and helps build trust with clients. Verification is an optional but recommended step in the GIPS compliance process. It involves an independent third-party review of an investment firm's adherence to GIPS. Verification provides additional credibility to a firm's GIPS claim, as it demonstrates that the firm has undergone an external review of its performance reporting practices. It also helps to identify areas for improvement, leading to enhanced internal controls and greater client trust. While GIPS offer significant benefits to investment firms and their clients, there are challenges and limitations associated with their implementation and interpretation. Implementing GIPS can be resource-intensive and may pose challenges related to data availability and the handling of complex investment strategies. Smaller firms may face resource constraints, while firms with diverse portfolios may encounter difficulties in gathering the necessary data for GIPS compliance. Despite these challenges, the benefits of GIPS compliance often outweigh the obstacles. By investing in the necessary resources and expertise, firms can achieve compliance and demonstrate their commitment to transparency and ethical practices in the investment industry. GIPS, although valuable, have certain limitations. They cannot guarantee future investment performance or predict the success of a particular investment manager. Additionally, GIPS focus on past performance, which may not always be an accurate indicator of future results. Furthermore, there is a potential for misinterpretation of GIPS-compliant presentations by investors. It is essential that investment firms clearly communicate the purpose and limitations of GIPS to their clients to prevent misunderstandings and ensure informed decision-making. Technological advancements, such as artificial intelligence and big data, can significantly impact GIPS by improving the efficiency and accuracy of performance calculations and reporting. These advancements may also lead to the development of new tools and platforms for GIPS compliance and verification. As technology continues to reshape the investment landscape, GIPS must adapt to ensure that they remain effective and relevant in a rapidly changing industry. Embracing technology can help GIPS stay at the forefront of performance measurement and reporting standards. The regulatory environment for the investment industry is constantly evolving, with new rules and requirements being introduced to protect investors and promote transparency. GIPS must remain aligned with these regulatory changes to ensure they continue to serve as a benchmark for best practices in the industry. By staying abreast of regulatory developments and incorporating them into the GIPS framework, the standards can maintain their position as a trusted and respected set of guidelines for investment performance reporting. As more investment firms across the globe adopt GIPS, the standards will continue to shape the investment industry by promoting transparency, comparability, and ethical conduct. Expanding adoption of GIPS can lead to a more level playing field for investment firms and better-informed decision-making by investors. The growing importance of environmental, social, and governance (ESG) factors in the investment decision-making process is a trend that GIPS may need to address. By incorporating ESG considerations into the GIPS framework, the standards can help investment firms to better align their performance reporting with the values and priorities of their clients. Incorporating ESG factors into GIPS would ensure that performance reporting reflects not only financial returns but also the broader social and environmental impacts of investment decisions. This integration can promote more responsible and sustainable investment practices across the industry. As the adoption of GIPS expands across different regions, there is a need for greater collaboration and harmonization of performance reporting standards. This can help to minimize discrepancies and inconsistencies between various jurisdictions and facilitate more seamless comparisons of investment performance on a global scale. Enhancing global collaboration and harmonization of GIPS would involve working closely with local regulators, industry associations, and other stakeholders to promote the adoption of GIPS and to ensure that the standards are consistent and relevant across different markets. The investment landscape is continually evolving, with new asset classes and investment strategies emerging regularly. To remain relevant and effective, GIPS must adapt to address these developments and provide guidance for investment firms navigating these new areas. By updating and expanding the GIPS framework to cover emerging asset classes and investment strategies, the standards can continue to serve as a comprehensive and flexible tool for performance reporting in the ever-changing investment industry. The future of GIPS will depend on their ability to adapt and evolve in response to the shifting landscape of the investment industry. By addressing emerging trends, such as ESG integration, enhancing global collaboration, and covering new asset classes and investment strategies, GIPS can maintain their position as a trusted and respected set of guidelines for investment performance reporting. This will ultimately contribute to increased transparency, comparability, and ethical conduct within the global investment community.Definition of Global Investment Performance Standards (GIPS)

Key Components of GIPS

GIPS Standards

GIPS Guidance Statements

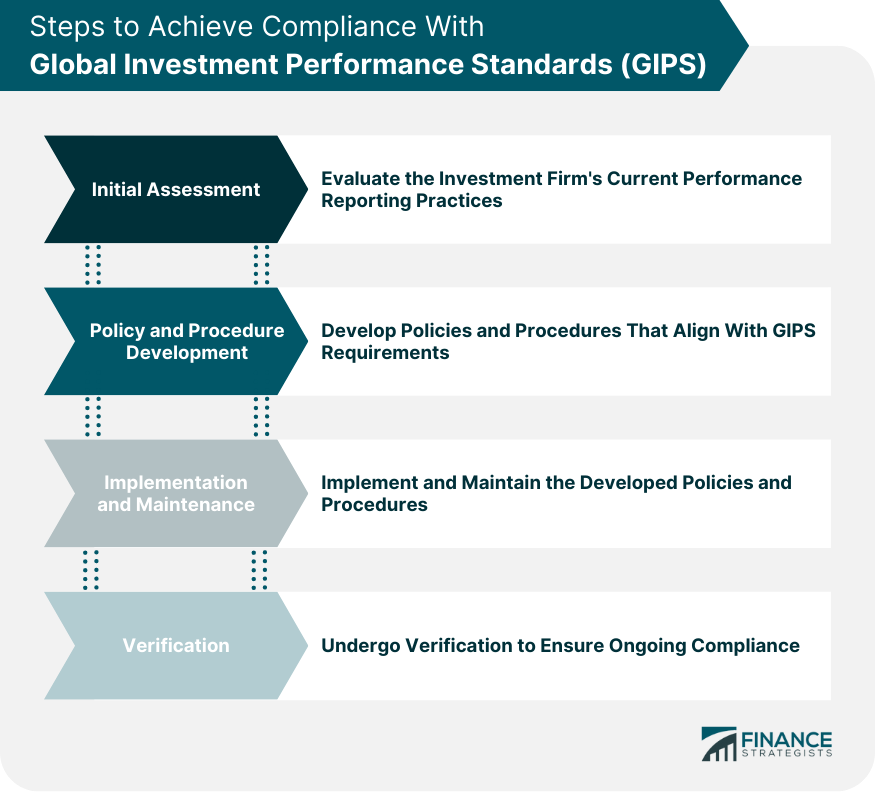

GIPS Compliance Process

Steps to Achieve Compliance

Benefits of Verification

Challenges and Limitations of GIPS

Implementation Challenges

Limitations of GIPS

The Future of GIPS and Global Performance Standards

Integration of Environmental, Social, and Governance Factors

Final Thoughts

Global Investment Performance Standards (GIPS) FAQs

Global Investment Performance Standards (GIPS) are a set of ethical principles that establish guidelines for reporting investment performance.

GIPS are used by investment management firms and financial institutions around the world to ensure consistency and accuracy in performance reporting.

GIPS compliance helps firms build trust with clients by demonstrating a commitment to transparency and accuracy in performance reporting.

To become GIPS compliant, firms must adhere to the established standards and undergo an independent verification process by a third-party verifier.

GIPS compliance can help firms attract and retain clients, improve operational efficiencies, and maintain a competitive edge in the marketplace.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.