Financial Engineering is a multidisciplinary field that combines mathematical and statistical methods, financial theory, and computational tools to design and develop new financial products, devise investment strategies, and manage risk. It involves the use of complex models and financial instruments to solve problems in finance, including pricing derivatives, managing portfolios, optimizing investment strategies, and mitigating financial risks. Financial engineering is used in various areas of finance, such as investment banking, risk management, wealth management, and financial regulation. The history of financial engineering dates back to the early 20th century when mathematicians and economists began developing quantitative models for financial markets. One of the pioneers of financial engineering was Louis Bachelier, who in 1900 published his Ph.D. thesis, "The Theory of Speculation," where he introduced the concept of Brownian motion in finance. Over the years, financial engineering evolved as new mathematical models were developed, such as the Black-Scholes option pricing model in 1973, which revolutionized the derivatives market. In recent years, financial engineering has advanced significantly due to the increasing use of technology and data. This has led to the development of sophisticated quantitative models, algorithmic trading strategies, and innovative financial products. Today, financial engineering is an integral part of investment management, as it allows investors and wealth managers to navigate complex financial markets, manage risks, and achieve superior returns. Quantitative methods are fundamental to financial engineering. These methods include mathematical and statistical techniques, such as probability theory, stochastic calculus, linear algebra, and optimization theory, used to model financial markets, price financial instruments, and manage risk. Quantitative methods are essential for understanding the behavior of financial assets and constructing optimal investment strategies. Risk management is a critical component of financial engineering. It involves identifying, measuring, and mitigating the risks associated with financial assets and investment portfolios. Some common types of risk include market risk, credit risk, liquidity risk, and operational risk. Financial engineering helps investors and wealth managers to quantify and manage these risks through the use of quantitative models and risk mitigation techniques. Financial engineering is responsible for the development and pricing of a wide range of financial instruments, including derivatives such as options, futures, and swaps. These instruments allow investors and wealth managers to hedge risks, speculate on market movements, and create customized investment solutions. Derivatives are essential tools for managing risk and enhancing portfolio performance in modern financial markets. Portfolio optimization is a key application of financial engineering in investment management. It involves the selection and allocation of assets to create an optimal portfolio that maximizes expected returns for a given level of risk or minimizes risk for a given level of expected return. Financial engineering techniques, such as mean-variance optimization and the Black-Litterman model, enable investors and wealth managers to construct well-diversified portfolios that balance risk and return. Asset pricing models are essential tools in financial engineering for determining the fair value of financial assets and assessing their risk-return characteristics. Some widely used asset pricing models include the Capital Asset Pricing Model (CAPM), the Arbitrage Pricing Theory (APT), and the Black-Scholes option pricing model. These models help investors and wealth managers to make informed investment decisions and build efficient portfolios. Algorithmic trading is another important application of financial engineering in investment management. It involves the use of computer algorithms to execute trades in financial markets, often at high speed and with minimal human intervention. Financial engineering provides mathematical models and techniques for developing algorithmic trading strategies, which can exploit market inefficiencies, reduce transaction costs, and improve execution quality. One of the benefits of financial engineering is the creation of customized financial products. These products, often in the form of structured products or derivatives, can be tailored to meet specific investment objectives, risk tolerances, and return expectations. For instance, a principal-protected note can be engineered to provide full capital protection while offering potential upside from a risky asset. Financial engineering also plays a crucial role in wealth accumulation and preservation strategies. Through the use of advanced mathematical models and financial instruments, investors can achieve a more efficient allocation of their assets, optimize their returns, and protect their wealth against market downturns and other risks. Financial engineering provides the tools and techniques for constructing robust investment strategies that can help individuals grow and preserve their wealth over time. Furthermore, financial engineering can contribute to estate planning and tax optimization. It can help devise strategies to minimize estate taxes, facilitate wealth transfer, and ensure the financial security of heirs. Similarly, through the intelligent design of investment structures, financial engineering can assist in optimizing tax efficiency, potentially increasing net investment returns. A key function of financial engineering in risk management is identifying and quantifying risk. This involves the use of quantitative models to measure various types of risk, including market risk, credit risk, liquidity risk, and operational risk. Risk measures such as Value-at-Risk (VaR), Conditional Value-at-Risk (CVaR), and stress testing are commonly used in financial engineering to quantify risk and assess the potential losses of an investment portfolio under adverse market conditions. Financial engineering also provides the methods and instruments for implementing risk mitigation strategies. This can include the use of derivatives for hedging market risk, the application of credit risk models for managing counterparty risk, and the use of liquidity management techniques to ensure sufficient liquidity under stress scenarios. By managing risk effectively, financial engineering can help investors and wealth managers to improve their portfolio performance and protect their wealth. Derivatives are an essential tool in financial engineering for hedging risk. Options, futures, swaps, and other derivatives can be used to hedge against various risks, including price risk, interest rate risk, and currency risk. For example, an investor can use a put option to hedge against the risk of a stock price decline or a currency swap to hedge against the risk of currency fluctuation. By using derivatives for hedging, investors can reduce their risk exposure and achieve more stable returns. Financial engineering plays a significant role in strategic asset allocation, which involves the long-term allocation of assets based on an investor's investment objectives, risk tolerance, and time horizon. Financial engineering techniques, such as mean-variance optimization and the Black-Litterman model, can help investors to determine the optimal allocation of assets that maximizes expected returns for a given level of risk. In addition to strategic asset allocation, financial engineering is also crucial for tactical asset allocation, which involves short-term adjustments to the asset allocation based on market conditions and investment opportunities. Financial engineering provides quantitative models and techniques for assessing market trends, identifying investment opportunities, and adjusting asset allocation accordingly. Furthermore, financial engineering can facilitate dynamic asset allocation, which involves continuously adjusting the asset allocation in response to changing market conditions and investment opportunities. Through the use of advanced mathematical models and algorithmic trading strategies, financial engineering can enable investors to dynamically manage their portfolios and capture market opportunities while managing risk. In the realm of performance measurement, financial engineering offers a range of metrics and benchmarks to evaluate the performance of investment portfolios. These include absolute return measures, such as total return and annualized return, as well as risk-adjusted return measures, such as the Sharpe ratio, the Sortino ratio, and the Treynor ratio. Financial engineering also provides benchmarks, such as market indices and peer group comparisons, to assess the relative performance of investment portfolios. Risk-adjusted returns are a key performance measure in financial engineering, which takes into account both the return and the risk of an investment portfolio. By adjusting returns for risk, investors can compare the performance of different portfolios on a like-for-like basis and select the portfolio that provides the best return per unit of risk. Financial engineering techniques, such as the Sharpe ratio and the Sortino ratio, can help investors to calculate risk-adjusted returns and make more informed investment decisions. The field of financial engineering is subject to a complex regulatory landscape, which includes regulations on financial markets, financial institutions, and financial products. These regulations aim to ensure the fairness, transparency, and stability of financial markets, protect investors, and prevent financial crimes. Financial engineers must understand and comply with these regulations in their work. In addition to regulatory considerations, financial engineering also involves ethical issues and professional conduct. Financial engineers have a responsibility to act with integrity, competence, and diligence, and to put the interests of clients first. They must also uphold the highest standards of professional conduct and avoid any actions that could harm the reputation of the financial engineering profession. Financial engineering is a multidisciplinary field that combines mathematical and statistical techniques with financial theory to solve problems in wealth and investment management. Its scope encompasses a wide range of areas, from portfolio optimization and risk management to financial product development and regulatory compliance. The core concepts in financial engineering include quantitative methods, risk management, and financial instruments. These concepts provide the foundation for understanding and applying financial engineering techniques in wealth and investment management. Financial engineering plays a crucial role in investment strategies. It helps investors and wealth managers to construct optimal portfolios, price financial assets, execute trades efficiently, and manage risks effectively. With the continued advancement of technology and mathematical modeling, financial engineering is set to play an even greater role in wealth and investment management in the future.What Is Financial Engineering?

Historical Evolution of Financial Engineering

Early Developments

Recent Trends and Innovations

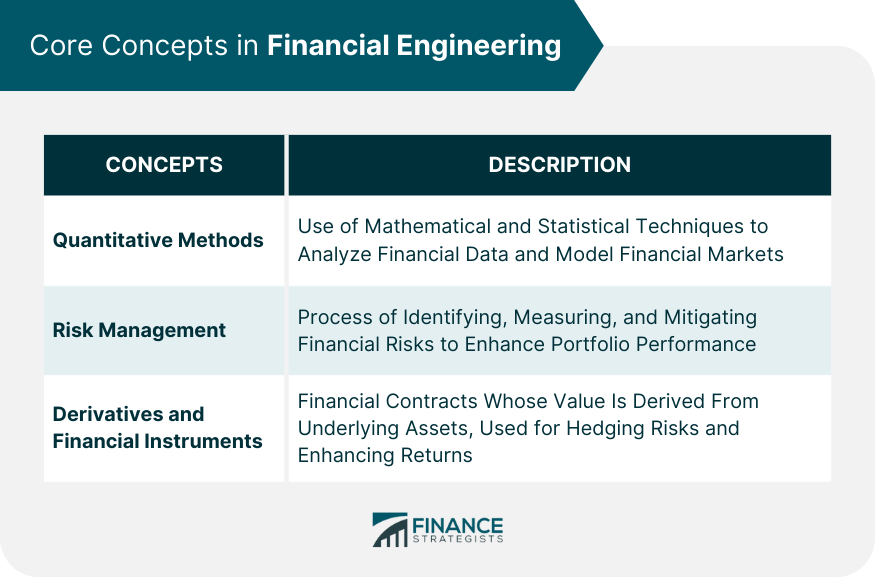

Core Concepts in Financial Engineering

Quantitative Methods

Risk Management

Derivatives and Financial Instruments

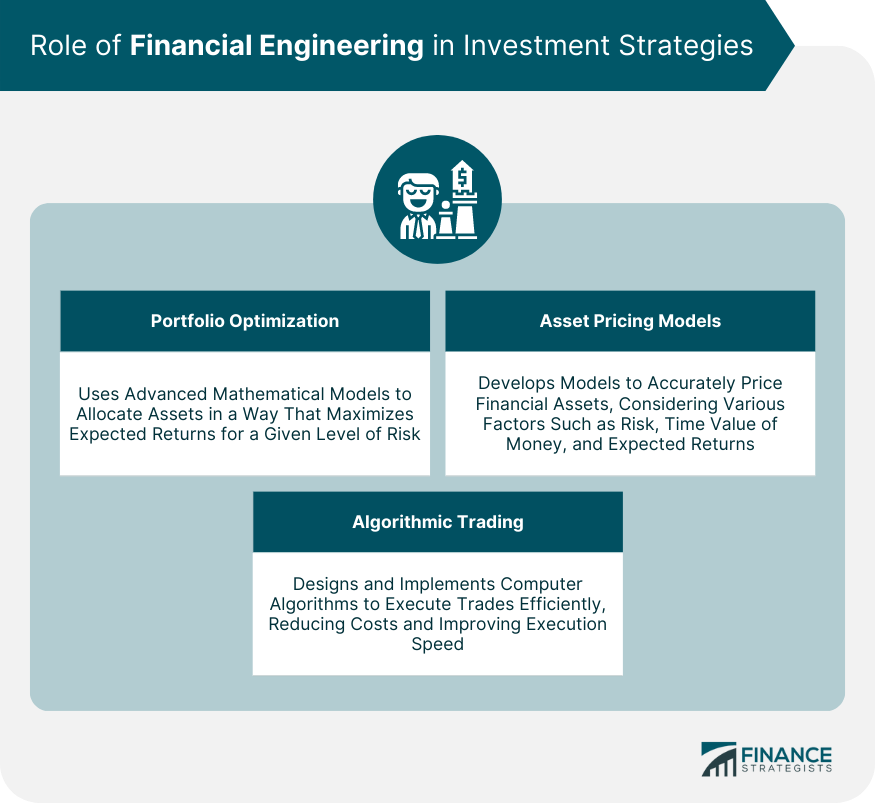

Financial Engineering and Investment Strategies

Portfolio Optimization

Asset Pricing Models

Algorithmic Trading

Financial Engineering in Wealth Management

Customized Financial Products

Wealth Accumulation and Preservation Strategies

Estate Planning and Tax Optimization

Financial Engineering and Risk Management

Identifying and Quantifying Risk

Risk Mitigation Strategies

Use of Derivatives for Hedging

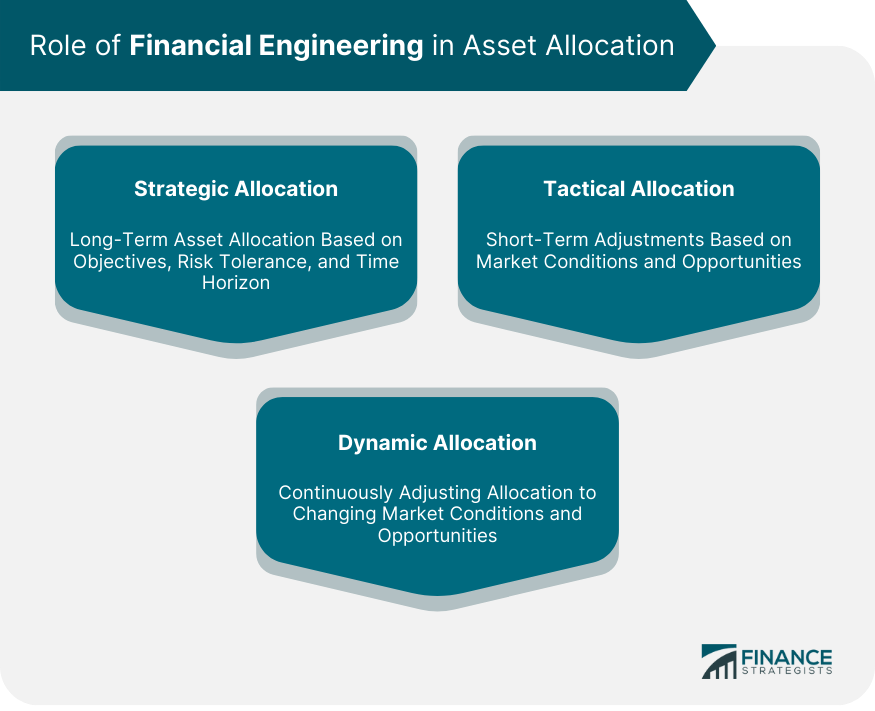

Role of Financial Engineering in Asset Allocation

Strategic Asset Allocation

Tactical Asset Allocation

Dynamic Asset Allocation

Financial Engineering and Performance Measurement

Performance Metrics and Benchmarks

Risk-Adjusted Returns

Regulatory and Ethical Considerations in Financial Engineering

Regulatory Landscape

Ethical Issues and Professional Conduct

Conclusion

Financial Engineering FAQs

Financial engineering is crucial in wealth and investment management as it provides mathematical and statistical techniques for creating new financial products, optimizing portfolios, and managing risks. It enables wealth managers and investors to construct efficient investment strategies that maximize returns and minimize risks.

Financial engineering plays a significant role in risk management by identifying, quantifying, and mitigating various investment risks. It uses quantitative models and risk mitigation techniques to measure and manage risks such as market risk, credit risk, liquidity risk, and operational risk. Financial engineering also employs derivatives for hedging against specific risks.

Financial engineering is applied in various investment strategies such as portfolio optimization, asset pricing, and algorithmic trading. It provides mathematical models and techniques for creating optimal portfolios, pricing financial assets accurately, and executing trades using computer algorithms, respectively.

Future trends in financial engineering include the increasing use of artificial intelligence and machine learning in financial modeling and trading, the growing importance of ESG factors in investment decisions, and the rising demand for customized financial solutions. Challenges include managing the increasing complexity of financial markets, developing more accurate and robust quantitative models, and navigating the evolving regulatory landscape.

Financial engineering involves ethical issues and demands professional conduct. Financial engineers must act with integrity, competence, and diligence, prioritize client interests, and uphold professional standards. Misuse of financial engineering techniques can lead to financial crises and failures, underscoring the need for transparency and ethical conduct.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.