A collar strategy is an options trading strategy that involves holding a long position in an underlying asset while simultaneously buying a protective put option and selling a covered call option. This strategy is designed to limit the downside risk while generating income from the call option premium. The primary purpose of the collar strategy is to protect an investor's long position in an underlying asset from significant declines in value while providing additional income through the sale of call options. It is particularly useful for investors seeking to preserve capital and generate income in uncertain or volatile market conditions. A protective put option is a financial contract that gives the holder the right, but not the obligation, to sell the underlying asset at a specified strike price before the option's expiration date. This component of the collar strategy provides downside protection, allowing investors to limit potential losses if the value of the underlying asset declines. A covered call option involves selling the right to buy the underlying asset at a specific strike price before the option's expiration date. Investors who implement this strategy receive a premium from selling the call option, which can provide additional income and help offset the cost of the protective put option. Investors create a collar strategy by combining protective put and covered call options. This strategy establishes a price range within which the underlying asset's value can fluctuate, providing downside protection while generating income from the call option premium. It effectively caps both potential gains and losses, making it a conservative strategy suitable for risk-averse investors. When implementing a collar strategy, investors should choose a suitable underlying asset, typically a stock or an exchange-traded fund (ETF). The underlying asset should have a relatively stable value and be expected to generate income, such as a dividend-paying stock. Investors must select appropriate strike prices and expiration dates for the protective put and covered call options. These choices depend on the investor's risk tolerance, market outlook, and desired income level. Generally, strike prices should be close to the current market price of the underlying asset, and expiration dates should align with the investor's investment horizon. To establish a collar, investors must purchase the protective put option and sell the covered call option simultaneously. This process involves paying the premium for the put option while receiving the premium from the call option, often partially or entirely offset the cost of the protective put. Investors should regularly monitor their collar strategy to ensure it remains aligned with their investment objectives and market conditions. Adjustments may be necessary, such as rolling the options to different strike prices or expiration dates or closing the collar entirely if the investor's outlook or risk tolerance changes. A zero-cost collar is a variation of the collar strategy in which the premium received from selling the covered call option is equal to the premium paid for the protective put option. This results in no net cost to establish the collar but may require selecting strike prices further away from the current market price of the underlying asset, which can impact the degree of protection and potential income generation. The reverse collar, also known as the reverse iron condor, involves holding a short position in the underlying asset while simultaneously buying a call option and selling a put option. This strategy aims to profit from increased volatility in the underlying asset's price, as opposed to the traditional collar strategy, which seeks to minimize volatility and downside risk. A dynamic collar is a variation of the collar strategy that involves regularly adjusting the strike prices and expiration dates of the protective put and covered call options. This allows investors to capitalize on changing market conditions and maintain an optimal balance of downside protection, income generation, and potential capital appreciation. The protective put strategy involves holding a long position in an underlying asset while simultaneously buying a put option to protect against downside risk. While this strategy provides downside protection similar to the collar strategy, it does not generate income through the sale of call options, making it less effective in offsetting the cost of the put option. The covered call strategy involves holding a long position in an underlying asset while selling call options against that position. This strategy generates income through the sale of call options but does not provide the downside protection offered by the collar strategy, as it does not include the purchase of put options. The iron condor strategy is an advanced options strategy that involves selling two out-of-the-money options (one call and one put) and buying two further out-of-the-money options (one call and one put) to create a range within which the underlying asset's price is expected to remain. While this strategy can generate income and limit risk, it is more complex and requires a higher level of options trading expertise compared to the collar strategy. One of the main advantages of the collar strategy is its ability to provide downside protection. The protective put option ensures that the investor can limit losses if the underlying asset's value declines, making it an attractive risk management tool. The collar strategy generates income through the sale of covered call options, which can help offset the cost of the protective put option or even result in net income. By implementing a collar strategy, investors can effectively reduce the overall volatility of their portfolio. The combination of protective put options and covered call options helps stabilize the underlying asset's value, making it less susceptible to significant price fluctuations. The collar strategy is versatile and can be adapted to various market conditions. Depending on the investor's outlook, the options' strike prices and expiration dates can be adjusted to provide more or less downside protection and income generation, allowing for a tailored approach to risk management. While the collar strategy provides downside protection, it also limits the upside potential of the underlying asset. If the asset's value increases significantly, the investor's gains are capped by the covered call option's strike price, as the option may be exercised by the buyer. Purchasing protective put options can be expensive, particularly for options with longer expiration dates or lower strike prices. This cost may offset the income generated from selling covered call options, potentially reducing the strategy's overall effectiveness. The collar strategy is more complex than simply holding a long position in an underlying asset. It requires ongoing monitoring and adjustments, which can be time-consuming and may require a deeper understanding of options trading. The collar strategy can have tax implications, as the sale of covered call options and the exercise of protective put options may trigger taxable events. Investors should consult with a tax professional to understand the specific tax implications of implementing a collar strategy. Understanding the collar strategy is essential for investors seeking to manage risk and generate income in their portfolios. This strategy offers a combination of downside protection and income generation, making it a valuable tool in uncertain or volatile market conditions. Investors should carefully consider the benefits and risks of using a collar strategy, as it may limit upside potential and involve costs associated with purchasing put options. Additionally, ongoing monitoring and adjustments are required to maintain the effectiveness of the strategy. Before implementing a collar strategy, investors should assess the current market conditions and their own investment objectives. This will help determine the most appropriate strike prices, expiration dates, and variations of the collar strategy to achieve their desired balance of protection and income generation. Given the collar strategy's complexities and ongoing management requirements, investors may benefit from seeking professional guidance. A financial advisor or wealth manager can help investors implement and monitor collar strategies while considering their unique investment goals and risk tolerance.What Is Collar Strategy?

Components of a Collar Strategy

Protective Put Options

Covered Call Options

Combining Protective Puts and Covered Calls to Create a Collar

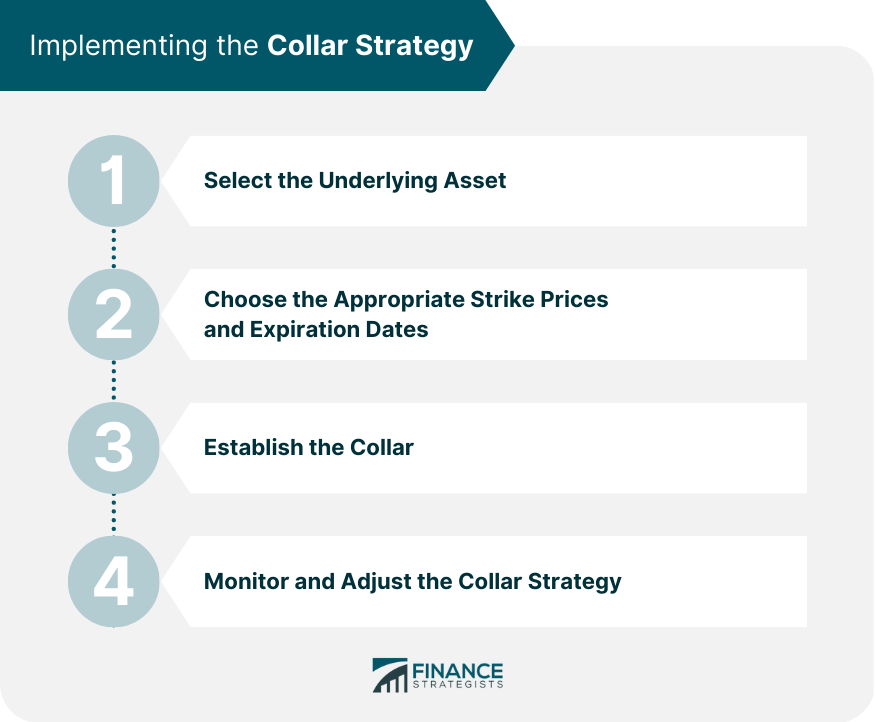

Implementing the Collar Strategy

Selecting the Underlying Asset

Choosing the Appropriate Strike Prices and Expiration Dates

Establishing the Collar

Monitoring and Adjusting the Collar Strategy

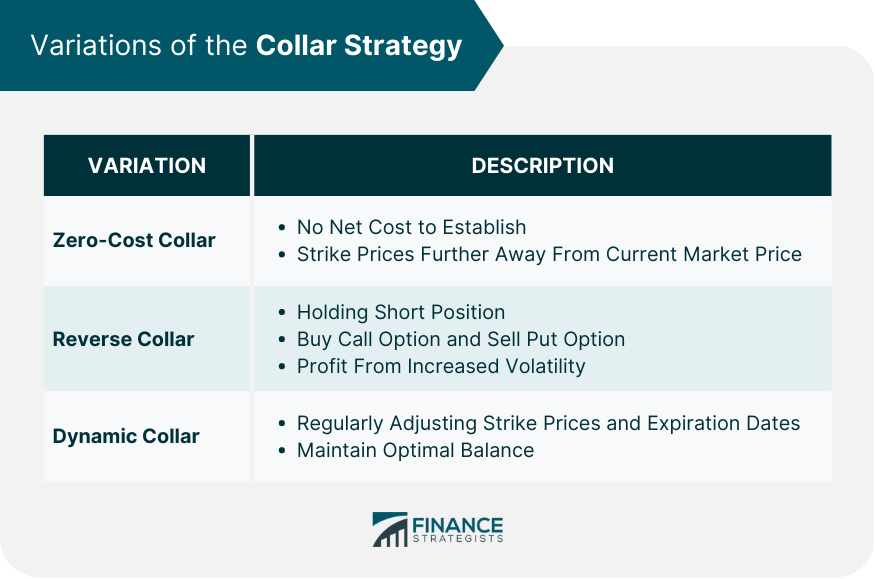

Variations of the Collar Strategy

Zero-Cost Collar

Reverse Collar

Dynamic Collar

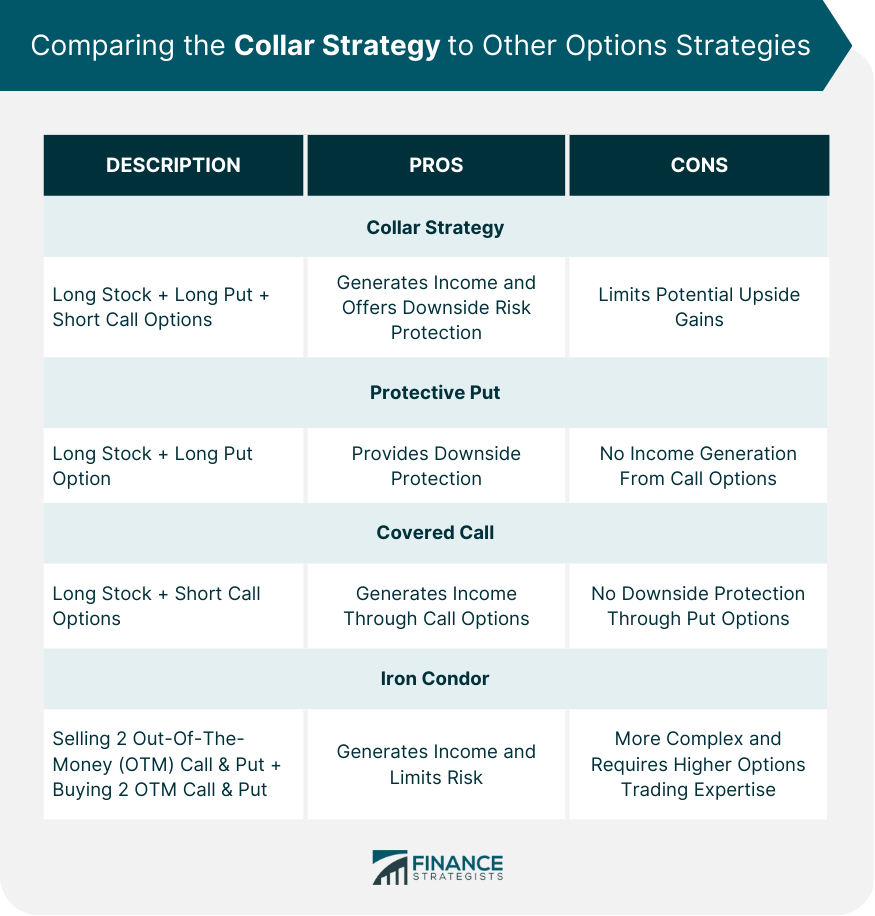

Comparing the Collar Strategy to Other Options Strategies

Protective Put Strategy

Covered Call Strategy

Iron Condor Strategy

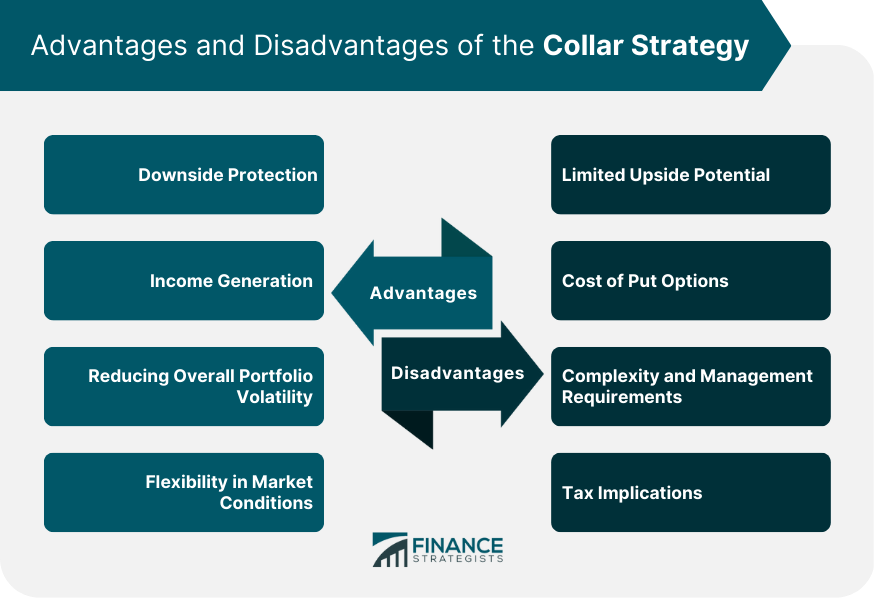

Advantages of the Collar Strategy

Downside Protection

Income Generation

Reducing Overall Portfolio Volatility

Flexibility in Market Conditions

Challenges and Risks of the Collar Strategy

Limited Upside Potential

Cost of Put Options

Complexity and Management Requirements

Tax Implications

Final Thoughts

Collar Strategy FAQs

A collar strategy is an options trading strategy that combines a protective put option with a covered call option to limit downside risk while generating income from the call option premium.

The collar strategy establishes a price range within which the underlying asset's value can fluctuate, providing downside protection while generating income from the call option premium. It effectively caps both potential gains and losses.

The collar strategy provides downside protection, generates income through call options, reduces overall portfolio volatility, and offers flexibility in market conditions.

The collar strategy limits upside potential, can be costly due to purchasing protective put options, requires ongoing management, and has tax implications.

Variations include the zero-cost collar, reverse collar, and dynamic collar. The collar strategy can also be compared to other options strategies such as the protective put, covered call, and iron condor strategies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.