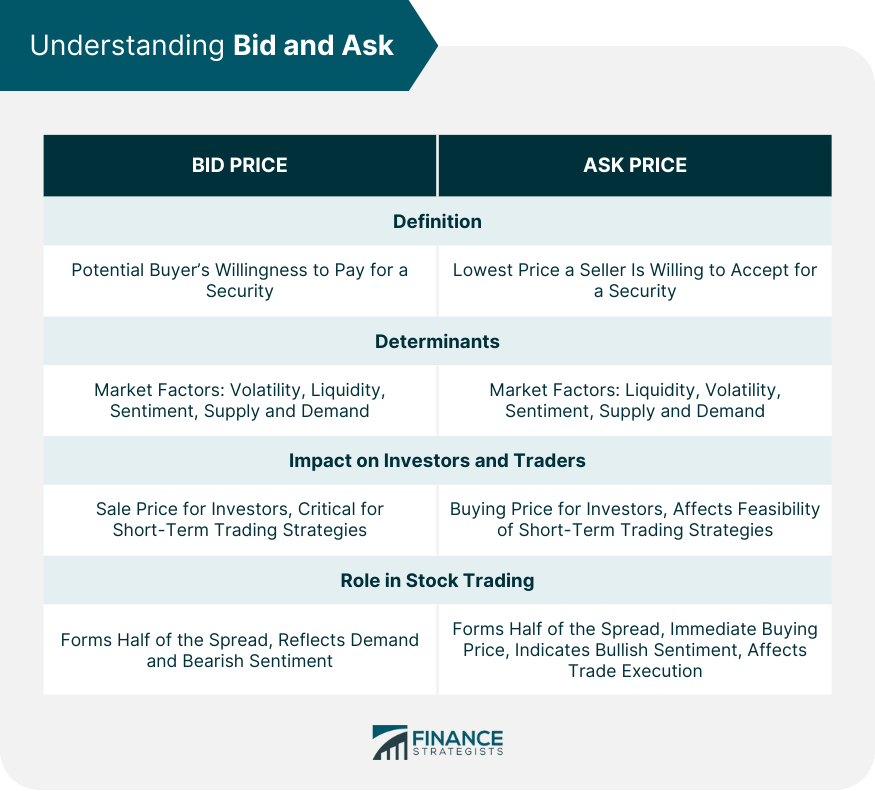

In the financial markets, the terms "bid" and "ask" play a fundamental role in setting the tempo for a myriad of transactions. The "bid" refers to the maximum price a buyer is willing to pay for a security, commodity, or currency. In contrast, the "ask" represents the minimum price a seller is willing to accept for the same. Together, they form the lifeblood of financial market dynamics, setting the stage for trading activities. Understanding the bid and ask prices is pivotal for traders and investors alike. These prices facilitate a seamless transaction process, serving as the bridge between buyers' willingness to pay and sellers' readiness to sell. The interaction between the bid and ask prices determines the liquidity and spread of a market, which significantly influences trading costs. Therefore, understanding these prices becomes critical in executing profitable trades and making informed investment decisions. In financial markets, the bid price serves as an indication of a potential buyer's willingness to pay for a security. For instance, if the bid price for a stock is $20, it means that a buyer is ready to purchase the stock at that price. The bid price forms an integral part of order books, reflecting the demand side of the market equation. The bid price is influenced by various factors, such as market volatility, liquidity, market sentiment, and supply and demand. A higher demand for a security typically translates to a higher bid price, and vice versa. Similarly, a more volatile market may lead to lower bid prices, reflecting the increased risk perceived by buyers. The bid price is of paramount importance to both investors and traders. For investors, it represents a possible sale price for their holdings, especially in the absence of an existing higher bid. For traders, particularly day traders and scalpers, the bid price is critical for their short-term trading strategies as they often aim to profit from small price discrepancies in highly liquid markets. In stock trading, the bid price forms one half of the spread that traders need to overcome to achieve profitability. It also acts as a barometer of demand for a particular stock. A falling bid price may indicate a lack of interest in the stock, possibly suggesting bearish sentiment. The ask price, also known as the offer price, is the lowest price a seller is willing to accept for a security. The ask price, like the bid price, is integral to the order book, illustrating the supply side of the market equation. It signifies potential buying costs for interested investors or traders. Like the bid price, the ask price is influenced by market liquidity, volatility, sentiment, and supply and demand dynamics. An increased supply of a security or a decrease in its demand can lower the ask price. Similarly, a highly volatile market could lead to a higher ask price, reflecting sellers' perceptions of increased risk. For investors, the ask price signifies the price they must pay to buy a security. For traders, the ask price, along with the bid price, helps determine the spread, which affects the feasibility of short-term trading strategies. A higher ask price could indicate bullish sentiment, making it an essential factor in trading and investment decisions. In the stock market, the ask price signifies the immediate price at which one can buy a stock. A rising ask price could indicate increasing interest or bullish sentiment for the stock. It forms one half of the bid-ask spread and affects the immediacy and cost of trade execution. The bid-ask spread refers to the variance between the highest amount a purchaser is prepared to spend on a financial instrument (the bid price) and the minimum amount a seller is ready to take for it (the ask or offer price). For instance, if a security has a bid price of $20 and an ask price of $22, the bid-ask spread is $2 ($22 - $20 = $2). This $2 represents the difference between what a buyer is ready to pay for the security and the price at which a seller is prepared to sell it. A narrow bid-ask spread signifies a highly liquid market, which tends to attract more traders due to lower trading costs. Conversely, a wide spread typically suggests a less liquid market, often deterring traders due to higher trading costs. The bid-ask spread is a critical barometer of market liquidity and trading costs. Multiple factors determine the magnitude of this spread, such as market volatility, liquidity, the number of market participants, and the actions of market makers. Market volatility refers to the rate at which the price of an asset, such as a security, increases or decreases for a set of returns. In a highly volatile market, the bid-ask spread tends to widen as market participants quote bids and asks more conservatively due to the higher price risk. High volatility signifies greater uncertainty and perceived risk in the market. When the market is uncertain, buyers are less willing to pay higher prices, and sellers hesitate to accept lower prices, resulting in a wider bid-ask spread. Volatile markets experience swift and significant price fluctuations. These abrupt changes can discourage market participants from making trades, which can further widen the spread. Market liquidity relates to how easily an asset can be bought or sold without causing a significant price change. The level of liquidity directly influences the bid-ask spread. Highly liquid markets, characterized by a large volume of buy and sell orders, generally have a narrow bid-ask spread. This is because the high market depth reduces the potential impact of individual trades on the market price. In less liquid markets, the lack of immediate trading partners can force buyers to raise their bid prices or sellers to lower their ask prices, thus widening the spread. The number of participants in a market can also influence the bid-ask spread. In a market with many participants, competition tends to reduce the bid-ask spread. This is because multiple bids and asks increase the chances of finding a match, thereby facilitating transactions. However, if there is a significant imbalance between buyers and sellers or if information is not equally distributed among participants, the bid-ask spread can widen. Market makers, such as banks or brokerage firms, play a crucial role in maintaining the liquidity and efficiency of the market. Market makers provide liquidity by continuously quoting both bid and ask prices for an asset, ensuring there's always a market for participants to trade. Market makers may adjust their quotes based on prevailing market conditions. In riskier situations, they may widen the bid-ask spread to account for potential losses, while in more stable conditions, they might narrow the spread to encourage more trading activity. In stock markets, bid and ask prices are constantly changing as traders place their orders. These prices are an indicator of the price traders are willing to buy (bid) or sell (ask) a stock at any given point in time. Large bid-ask spreads can indicate lower liquidity and higher potential transaction costs. The forex market, being one of the most liquid markets in the world, often showcases tight bid-ask spreads. Here, currency pairs are quoted with a bid and an ask price, with the former being the price a dealer is willing to buy a currency and the latter being the price the dealer will sell a currency. Cryptocurrency markets, although relatively new, operate similarly to traditional financial markets. Bid and ask prices are essential to crypto trading, and the bid-ask spread may be relatively wide due to the high volatility and lower liquidity compared to traditional markets. In commodities markets, bid and ask prices reflect traders' valuation of commodities like gold, oil, or wheat. These prices can be influenced by a range of factors, including supply and demand dynamics, geopolitical events, and economic indicators. Market makers are intermediaries who buy and sell securities to maintain market liquidity. They quote both bid and ask prices and are ready to transact at these prices. The bid and ask prices they set serve as the market standard. By constantly quoting bid and ask prices and standing ready to trade, market makers enhance market liquidity. They also influence the bid-ask spread, as their profit comes from the difference between the prices they're willing to buy and sell at. Market makers profit from the bid-ask spread by buying securities at the bid price and selling them at the ask price. The spread represents their compensation for the risk and cost of providing liquidity. Market orders are orders to buy or sell a security immediately at the best available price, which will be the bid price for a sell order and the ask price for a buy order. Limit orders are orders to buy or sell a security at a specific price or better. A buy limit order will only be executed at the limit price or lower (at or below the current ask price), and a sell limit order will only be executed at the limit price or higher (at or above the current bid price). Traders need to consider bid and ask prices and the bid-ask spread when developing their trading strategies. For instance, they might prefer markets with tight spreads to reduce trading costs, or they might use limit orders to better control their trading prices. The bid and ask prices can directly impact an investor's decision to buy or sell a security. For instance, a large spread might discourage a trade due to the higher cost of trading, while a rapidly changing ask price could signal increased demand for a security. Investors use bid and ask prices, along with other market data, to help value securities and conduct market analysis. For instance, observing how these prices change over time can provide insights into market sentiment and liquidity. The bid and ask prices, representing the highest price a buyer is willing to pay and the lowest price a seller is willing to accept respectively, are vital to financial markets. Their difference, known as the bid-ask spread, indicates the cost of a transaction. These prices, influenced by market liquidity, volatility, participant count, and overall sentiment, shape trading terms and reflect market depth and fluidity. Grasping these concepts can refine trading strategies and investment decisions, enhancing your financial insight. This knowledge empowers you to adeptly traverse the complex landscape of financial markets. For optimal investment outcomes or comprehensive wealth management, don't hesitate to seek professional guidance. Expert advice can reveal unseen avenues to success in the dynamic world of finance.What Is Bid and Ask?

Understanding the Bid

The Bid in Financial Markets

Determinants of the Bid Price

Impact of the Bid Price on Investors and Traders

Role of the Bid Price in Stock Trading

Understanding the Ask

Explanation of the Ask in Financial Markets

Determinants of the Ask Price

Impact of the Ask Price on Investors and Traders

Role of the Ask Price in Stock Trading

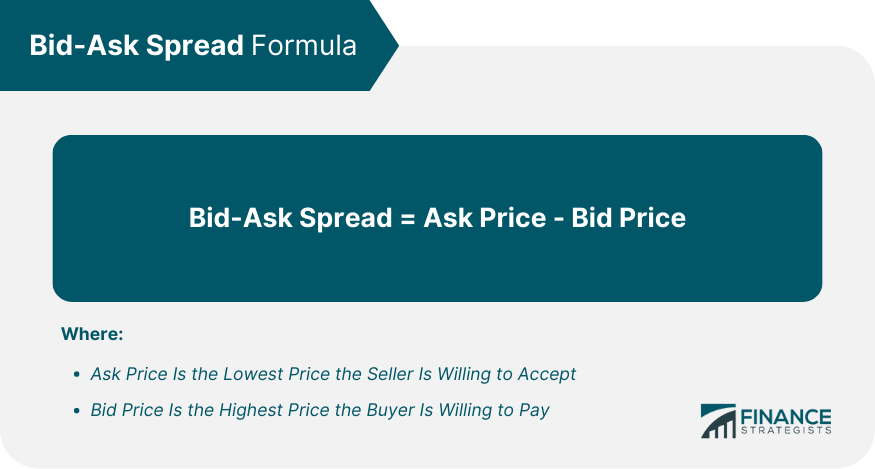

The Bid-Ask Spread

Definition and Calculation of the Bid-Ask Spread

Interpretation and Significance of the Bid-Ask Spread

Factors Influencing the Bid-Ask Spread

Market Volatility

Uncertainty and Risk Perception

Price Fluctuations

Market Liquidity

Market Depth

Immediacy of Transactions

Number of Market Participants

Competitive Pricing

Information Asymmetry

Actions of Market Makers

Providing Liquidity

Risk Management

Bid and Ask in Different Financial Markets

Stock Markets

Forex Markets

Cryptocurrency Markets

Commodities Markets

Market Makers and the Bid-Ask Process

Role of Market Makers in Setting Bid and Ask Prices

Impact of Market Makers on Liquidity and the Bid-Ask Spread

How Market Makers Profit From the Bid-Ask Spread

Bid and Ask in Market Orders and Limit Orders

Relationship Between Bid, Ask, and Market Orders

Relationship Between Bid, Ask, and Limit Orders

Strategies for Traders Considering Bid and Ask Prices

Impact of Bid and Ask on Investment Decisions

How Bid and Ask Prices Can Affect Buying and Selling Decisions

Use of Bid and Ask Prices in Valuation and Analysis

Final Thoughts

Bid and Ask FAQs

Bid and ask refer to the prices at which a buyer is willing to purchase and a seller is willing to sell a security, respectively.

Bid and ask prices are determined by market supply and demand, with the bid price set by buyers and the ask price set by sellers.

The bid-ask spread is the difference between the bid and the ask price. It represents the market maker's profit and the cost of trading for investors.

Bid and ask prices are important because they determine the price at which trades can be executed. They also provide indications of a market's liquidity and trading costs.

In an efficient market, the bid price should not exceed the ask price. If it does, it's often due to temporary market inefficiencies or errors in order processing.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.