Up Volume refers to the measure of trading volume that occurs when the price of a security increases. It is a key metric used in technical analysis to assess the strength of upward price movements. Up Volume provides insights into the level of buying interest and bullish sentiment surrounding a particular security or market. By analyzing Up Volume, traders and investors can gauge the intensity of market demand and potential future price movements. It helps in identifying trends, confirming the strength of upward momentum, and making informed trading decisions. Understanding Up Volume is crucial for readers as it enables them to navigate market dynamics effectively, spot potential buying opportunities, and assess the overall health of the market. It provides a valuable context within which readers can interpret and analyze market trends. Several factors can influence Up Volume, from market news and announcements to economic indicators and investor sentiment. Market news and announcements can drastically affect trading volume. Positive news can often lead to an increase in Up Volume as more investors buy into the asset. Earnings reports and economic indicators can also influence Up Volume. Positive earnings reports or favorable economic indicators can spur an increase in buyer interest, leading to higher Up Volume. Investor sentiment and market psychology can also affect Up Volume. In times of economic optimism, Up Volume tends to increase as more investors are willing to buy assets at higher prices, expecting further price appreciation. Traders use Up Volume in a variety of strategies, integrating it into their technical analysis to optimize their trades and investments. Technical analysts view Up Volume as a confirmation tool. When a price breakout occurs with high Up Volume, it's generally considered a strong signal that the breakout is valid. Swing traders often use Up Volume to identify potential entry points. When an asset's price starts to trend upward with increased volume, it can signal the beginning of a swing, presenting a good buying opportunity. Day traders also utilize Up Volume, especially during the first and last hours of the trading day when the volume is typically highest. A sudden increase in Up Volume can suggest strong buying pressure, providing day traders with valuable insights for their short-term trading decisions. Long-term investors often use Up Volume to confirm the strength of a long-term uptrend. It's also useful for spotting potential market tops when an unusually high Up Volume accompanies a new price high. Up Volume is integral in understanding market trends. It can indicate the strength of bull markets and bear markets and can be used to identify market tops and bottoms. During a bull market, Up Volume, tends to increase. This is because more investors are buying into the market, driving prices higher. During market corrections or bear markets, Up Volume can decrease as investor confidence wanes. However, a sudden increase in Up Volume can sometimes signal a reversal to a bull market. Traders can use Up Volume to help identify market tops and bottoms. An unusually high Up Volume at a new price high can indicate a market top, while a high Up Volume at a new price low can suggest a market bottom. One major advantage of up volume is its ability to provide trend confirmation. High up volume during an upward price movement can validate the strength of the trend, increasing investor confidence. Up volume, particularly when coupled with price analysis, can serve as a crucial tool for identifying potential market reversals, thereby providing traders with early entry or exit signals. The downside to using up volume is the possibility of false signals. Volume spikes may occur due to short-term events, possibly leading traders to misinterpret market sentiment. Understanding up volume requires a deep comprehension of market context. Not all high-volume days indicate bullishness, as volume can increase even in bear markets. The most fundamental difference between Up Volume and Down Volume lies in the direction of price movement. Up Volume refers to the volume associated with increasing prices, indicating buyer dominance in the market. On the other hand, Down Volume is associated with decreasing prices, signaling seller dominance. The difference in market sentiment indication is another key aspect. High Up Volume often signifies bullish market sentiment, as it means more traders are willing to buy the security, pushing its price up. Conversely, high Down Volume usually indicates bearish market sentiment, as more sellers are offloading the security, causing its price to drop. Both Up Volume and Down Volume can offer insights into the strength and sustainability of a trend. High Up Volume in an upward price trend might suggest a strong and potentially sustainable bullish trend. Conversely, if a price increase is accompanied by low Up Volume, the trend may lack strength and could be short-lived. On the flip side, high Down Volume during a downward price trend can imply a strong and possibly sustainable bearish trend. If the price decrease is paired with low Down Volume, however, the bearish trend may not have enough conviction and might reverse soon. Up Volume and Down Volume are used differently in various technical indicators. For instance, the Up/Down Volume Ratio uses both to gauge the overall market sentiment. \ A high ratio (greater than 1) indicates bullish sentiment, while a low ratio (less than 1) suggests bearish sentiment. Lastly, sudden changes in Up Volume and Down Volume can often signal potential market reversals. For example, a sudden surge in Down Volume during an uptrend might suggest a potential reversal to a downtrend. Similarly, a sudden increase in Up Volume during a downtrend could indicate a potential shift to an uptrend. Up Volume plays a critical role in financial markets, acting as a beacon guiding investors through the ebbs and flows of market trends. By distinguishing it from Down Volume and understanding its impact on price movements, one can utilize this tool more effectively in trading strategies. Influenced by various factors, including market news, economic indicators, and investor sentiment, Up Volume can offer substantial insights into market dynamics. However, like any financial tool, it's not without its pitfalls, such as potential false signals and reliance on context. Despite these challenges, Up Volume continues to be integral in trading, from traditional markets to high-frequency trading and the burgeoning field of decentralized finance. As the financial landscape continues to evolve, understanding and effectively applying Up Volume analysis will remain a crucial aspect of successful trading.Definition of Up Volume

Factors Influencing Up Volume

Market News and Announcements

Earnings Reports and Economic Indicators

Investor Sentiment and Market Psychology

Up Volume and Trading Strategies

Integrating Up Volume in Technical Analysis

Up Volume and Swing Trading

Up Volume and Day Trading

Up Volume and Long-Term Investing

Up Volume and Market Trends

Relationship Between Up Volume and Bull Markets

Up Volume During Market Corrections and Bear Markets

Using Up Volume to Identify Market Tops and Bottoms

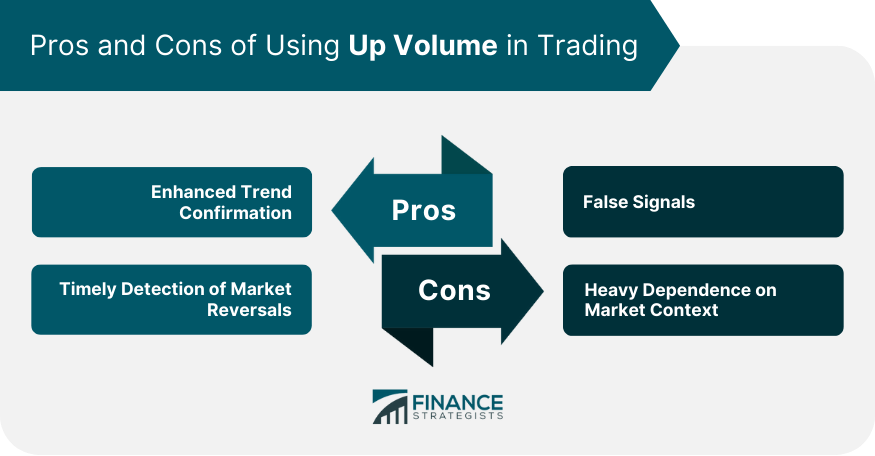

Pros of Using Up Volume in Trading

Enhanced Trend Confirmation

Timely Detection of Market Reversals

Cons of Using Up Volume in Trading

False Signals

Heavy Dependence on Market Context

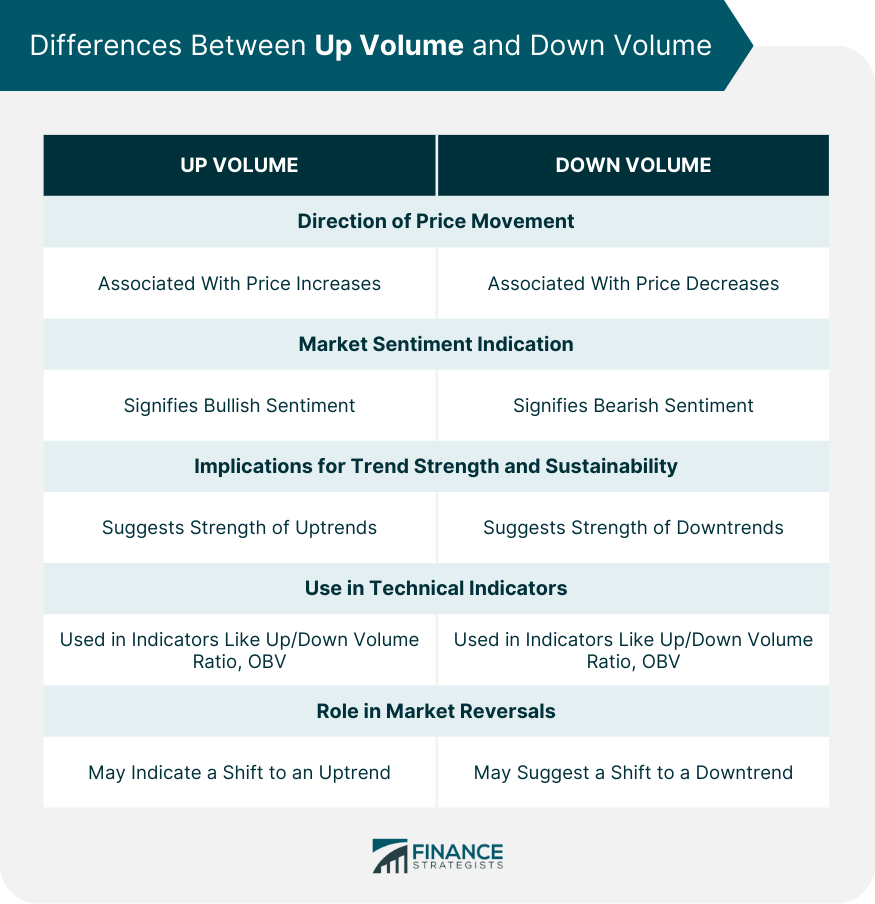

Differences Between Up Volume and Down Volume

Direction of Price Movement

Market Sentiment Indication

Implications for Trend Strength and Sustainability

Use in Technical Indicators

Role in Market Reversals

Final Thoughts

Up Volume FAQs

Up Volume refers to the total volume of an asset traded during a period of rising prices within a specific timeframe. It signifies a bullish trend in the market, indicating strong buyer interest and potential price appreciation.

Up Volume occurs when the volume of an asset increases during an uptrend, signifying strong buying pressure. On the other hand, Down Volume represents the volume of an asset traded during a period of falling prices, indicating stronger selling pressure.

Several factors can influence Up Volume, including market news and announcements, earnings reports, economic indicators, and overall investor sentiment. Any factor that affects buyer interest can impact Up Volume.

Traders incorporate Up Volume into their technical analysis to confirm the strength of a price trend, identify potential market reversals, and optimize entry and exit points. It is used in various trading strategies, including swing trading, day trading, and long-term investing.

While Up Volume can provide valuable insights into market trends and buyer interest, it also has limitations. It can sometimes give false signals, particularly in volatile markets. Also, an increase in Up Volume doesn't always guarantee a continuing uptrend. Therefore, it's essential to combine Up Volume with other market indicators for a comprehensive market analysis.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.