The Three Black Crows is a bearish candlestick pattern that is commonly used in technical analysis. It consists of three consecutive long and bearish (downward) candlesticks that open near the previous day's close and close near their low. This pattern is considered a strong indication of a potential reversal in an uptrend. Understanding the Three Black Crows pattern is important in wealth management as it provides valuable insights into potential reversals in the market. By recognizing this pattern, traders and investors can make informed decisions to protect their capital and potentially profit from downward price movements. The Three Black Crows pattern can serve as a powerful tool for timing entry and exit points, managing risk, and adjusting investment strategies. The Three Black Crows pattern is characterized by three consecutive bearish candlesticks with similar characteristics. Each candlestick opens near the previous day's close and closes near its low, forming a long bearish body. The candlesticks ideally have little or no upper wick and a small or no lower wick. The consecutive nature of these candlesticks signifies strong selling pressure and a shift in market sentiment. The bearish candlesticks in the Three Black Crows pattern have long bodies that represent substantial price declines over the respective trading periods. The bodies are typically filled or colored, indicating a close price below the open price. The color is often black or red, symbolizing bearishness and downward momentum in the market. These candlesticks are significant as they demonstrate a consistent and sustained selling pressure over the three trading periods. The consecutive nature of the bearish candles strengthens the bearish signal and suggests a potential reversal in the prevailing uptrend. The Three Black Crows pattern is considered a strong bearish reversal signal which indicates a shift in market sentiment from bullish to bearish. The consecutive bearish candlesticks reflect a significant increase in selling pressure and a loss of upward momentum. Traders interpret this pattern as a warning sign of a potential trend reversal, signaling the start of a downtrend or a significant pullback. The Three Black Crows pattern confirms the presence of a downtrend or a weakening uptrend. It provides evidence that bears are gaining control and overpowering the bulls. The successive declines in price, represented by the three bearish candlesticks, suggest that sellers are dominating the market and pushing prices lower. Traders use this pattern to confirm the downtrend and adjust their trading strategies accordingly. The Three Black Crows pattern reflects a shift in market sentiment from bullish to bearish. It indicates that there is a strong presence of selling pressure in the market, leading to lower prices. The pattern suggests that the market participants who were previously bullish are now liquidating their positions and driving the market down. Understanding the market sentiment and the strength of selling pressure is crucial for wealth management professionals to make informed decisions about their positions and risk management. To identify the Three Black Crows pattern, certain criteria must be met. First, there should be three consecutive bearish candlesticks. Each candlestick should open near the previous day's close and close near its low. The bodies of the candles should be relatively long, indicating substantial price declines. Additionally, the candlesticks should ideally have little or no upper wick and a small or no lower wick. The Three Black Crows pattern is most effective when it occurs after a preceding uptrend. Traders look for this pattern as a confirmation of a potential trend reversal from bullish to bearish. The presence of an established uptrend prior to the pattern strengthens the bearish signal and provides more conviction for traders to take action. Volume is an essential factor to consider when analyzing the Three Black Crows pattern. Traders look for an increase in volume during the formation of the pattern, indicating heightened selling pressure. Higher volume suggests that market participants are actively participating in the selling, reinforcing the bearish sentiment and the potential validity of the pattern. One strategy for incorporating the Three Black Crows pattern in wealth management is to use it as a confirmation for a bearish reversal. Traders can look for this pattern to validate their bearish bias and consider initiating or adding to short positions. The presence of three consecutive bearish candlesticks with strong selling pressure provides a strong indication of a potential downtrend, enabling traders to capitalize on downward price movements. Wealth managers can use the Three Black Crows pattern to identify potential entry and exit points for trend reversal trades. When the pattern emerges after an uptrend, it signals a potential reversal, presenting an opportunity to exit long positions or enter short positions. Traders may choose to enter trades at the close of the third bearish candlestick or wait for additional confirmation from other technical indicators or price action. Incorporating the Three Black Crows pattern in wealth management involves implementing proper risk management techniques. Traders can set stop-loss orders above the high of the third bearish candlestick to protect against potential losses in case the pattern is invalidated. This approach ensures that the risk is controlled and managed effectively, preserving capital in case of unexpected market movements. While the Three Black Crows pattern is a powerful bearish reversal signal, it is not infallible. False signals can occur, leading to losses if the pattern fails to result in a sustained downtrend. Additionally, in highly volatile markets, the pattern's effectiveness may be reduced, as price swings and rapid reversals can invalidate the bearish signal. Wealth managers should consider using the Three Black Crows pattern in conjunction with other technical indicators or analysis techniques. Additional confirmation from indicators such as trendlines, moving averages, or momentum oscillators can enhance the reliability of the signal. This multi-dimensional analysis helps to minimize false signals and increase the probability of successful trades. When incorporating the Three Black Crows pattern in wealth management, it is important to consider the broader market context and fundamental analysis. The pattern's effectiveness can be influenced by factors such as market trends, economic indicators, or company-specific news. Fundamental analysis, along with technical analysis, can provide a comprehensive understanding of the market environment and further validate the bearish signal. The Three Black Crows is a bearish candlestick pattern that serves as a strong indication of a potential trend reversal. It is characterized by three consecutive bearish candlesticks with similar characteristics, representing a shift in market sentiment from bullish to bearish. Incorporating the Three Black Crows pattern in wealth management involves using it as a confirmation for bearish reversals, identifying trend reversal entry and exit points, and implementing effective risk management techniques. Understanding the Three Black Crows pattern is important in wealth management as it provides valuable insights into potential reversals in the market. It allows traders and investors to adjust their strategies, manage risk, and potentially profit from downward price movements.Definition of Three Black Crows

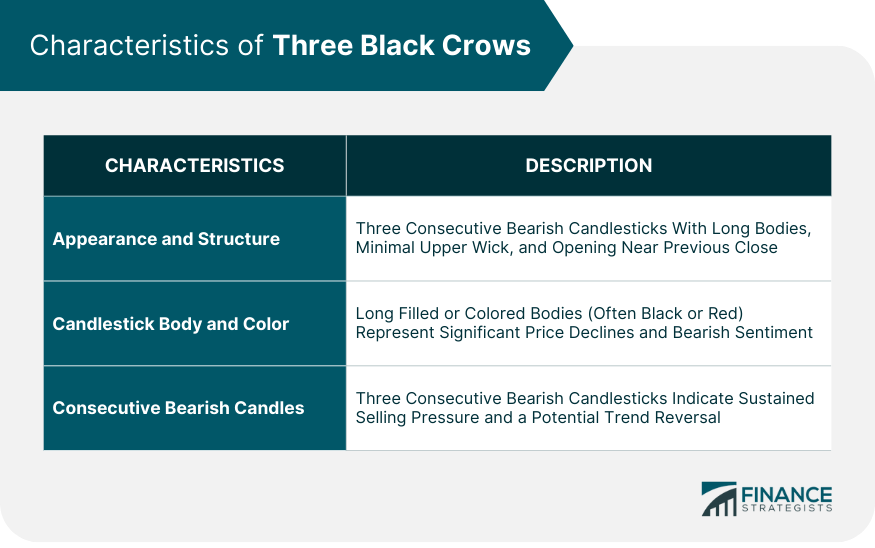

Characteristics of Three Black Crows

Appearance and Structure

Candlestick Body and Color

Consecutive Bearish Candles

Interpretation of Three Black Crows

Bearish Reversal Pattern

Confirmation of Downtrend

Market Sentiment and Selling Pressure

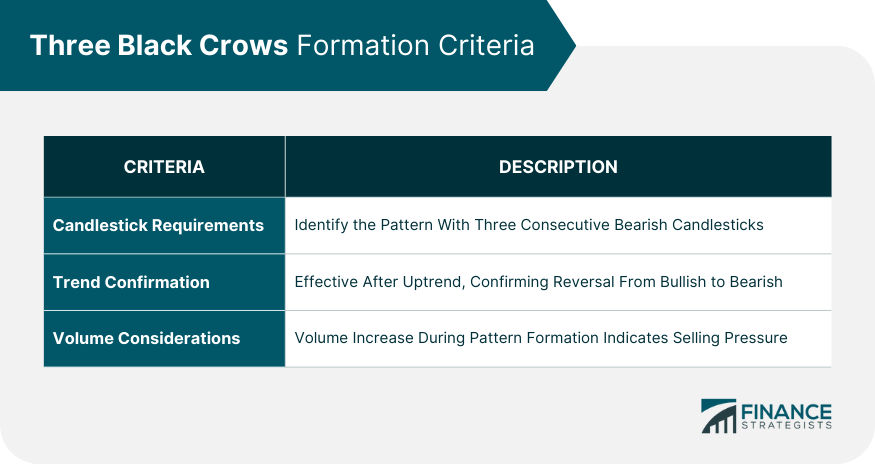

Three Black Crows Formation Criteria

Candlestick Requirements

Trend Confirmation

Volume Considerations

Strategies for Incorporating Three Black Crows in Wealth Management

Bearish Reversal Confirmation

Trend Reversal Entry and Exit Points

Risk Management and Stop Loss Placement

Limitations and Considerations in Using Three Black Crows

False Signals and Market Volatility

Confirmation With Other Technical Indicators

Market Context and Fundamental Analysis

Conclusion

Three Black Crows FAQs

The Three Black Crows pattern is a bearish candlestick pattern consisting of three consecutive bearish candlesticks that open near the previous day's close and close near their low. It indicates a potential reversal from an uptrend to a downtrend.

The Three Black Crows pattern can be used as a confirmation of a bearish reversal, to identify trend reversal entry and exit points, and to implement effective risk management techniques in wealth management strategies.

While the Three Black Crows pattern is a strong bearish signal, it is not infallible. False signals can occur, and market volatility can impact its effectiveness. It is important to consider additional confirmation from other indicators and perform thorough analysis.

Incorporating the Three Black Crows pattern in wealth management should involve considering other technical indicators, market context, and fundamental analysis. Additional confirmation can enhance the reliability of the pattern and minimize false signals.

Yes, the Three Black Crows pattern can be applied to various financial markets, including stocks, commodities, and forex. Its bearish nature makes it useful for identifying potential reversals and managing risk across different markets.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.