Risk-Adjusted Return On Capital, commonly known by its acronym RAROC, is a risk-based profitability measurement framework for analyzing risk-adjusted financial performance and providing a consistent view of profitability across businesses. The concept originated in the late 1970s as part of the broader move towards the incorporation of risk in valuation models. The primary purpose of RAROC is to provide a firm with a clear picture of the risks it undertakes compared to the returns it expects to receive. By taking into account potential risks along with anticipated returns, RAROC allows financial institutions to better evaluate their decision-making and to make more informed decisions regarding capital allocation and risk management. The RAROC model consists of three main components: expected returns, risk adjustment, and capital allocation. This refers to the profits a firm expects to receive from a given business unit or investment. These expected returns are typically derived from the firm's own projections or from analyst estimates. Risk adjustment in RAROC accounts for the fact that higher risk should be associated with higher expected returns. This process involves identifying and measuring the various risks that a firm faces and then adjusting the expected returns based on these risks. Capital allocation involves distributing the firm's capital across its various business units or investments based on the risk-adjusted returns of these units or investments. In essence, RAROC encourages the allocation of capital to those areas that provide the highest risk-adjusted return. RAROC has a variety of applications in financial decision making. These applications generally fall into three main categories: capital budgeting, performance evaluation, and risk management. RAROC is used to evaluate the potential profitability of different investment options or projects. By taking into account both the expected returns and the associated risks, it helps firms decide where to allocate their capital in order to maximize their risk-adjusted return. RAROC serves as a useful metric for evaluating the performance of different business units within a firm. Since it adjusts for risk, it allows for a more fair comparison between units that have different risk profiles. RAROC plays an important role in identifying and managing risk. By taking into account potential losses due to risk in its calculation of return, it incentivizes firms to manage their risks more effectively. The use of RAROC provides several benefits to a firm. By taking into account the risk-adjusted return of different business units or investments, RAROC encourages the efficient use of capital. It incentivizes firms to allocate their capital to those areas that provide the highest risk-adjusted return. RAROC helps firms identify and manage their risks more effectively. By including potential losses due to risk in its calculation of return, it pushes firms to mitigate their risks and to make decisions that align with their risk appetite. Traditional profitability measures, such as return on investment (ROI) or return on equity (ROE), do not take into account the risk associated with an investment or a business unit. By adjusting for risk, RAROC provides a more holistic view of profitability. Despite its benefits, the use of RAROC also has several limitations. The calculation of RAROC can be complex and requires detailed data on both the expected returns and the associated risks of different business units or investments. This can make it difficult for smaller firms or those with less sophisticated data systems to effectively implement RAROC. If not properly understood, RAROC can lead to misinterpretation and poor decision-making. For example, a high RAROC does not necessarily mean that a business unit or investment is "good" – it simply means that it provides a high return for its level of risk. The accuracy of RAROC depends on the accuracy of the underlying assumptions and models used to estimate expected returns and measure risk. If these assumptions or models are flawed, then the calculated RAROC will also be flawed. RAROC is often compared to other financial metrics, such as Return on Equity (ROE) and Economic Capital. ROE is a measure of a firm's profitability that compares net income to shareholders' equity. Unlike RAROC, ROE does not adjust for risk. This means that while ROE can provide a useful snapshot of a firm's profitability, it does not provide as comprehensive a view of the firm's financial health as RAROC does. Economic Capital is a measure of the amount of capital that a firm needs to stay solvent and meet its obligations. It is often used in conjunction with RAROC – the firm aims to maximize its RAROC while maintaining an adequate level of Economic Capital. Risk-Adjusted Return On Capital is a crucial measure for financial institutions, enabling a comprehensive view of profitability by factoring in risk. It serves as a pivotal tool for capital allocation, performance evaluation, and risk management. Despite its complexity and data requirements, the insights gained from RAROC make it a valuable instrument for decision-making. However, as it is based on model assumptions, its accuracy can be affected by flawed inputs. It's also vital to remember that while RAROC offers a more encompassing perspective than traditional metrics like Return on Equity (ROE), it should be utilized alongside other financial metrics such as Economic Capital for a complete financial analysis. In the continuously evolving financial industry, RAROC remains a vital element in optimizing risk-adjusted returns and robust risk managementWhat Is Risk-Adjusted Return On Capital (RAROC)?

Understanding How RAROC Works

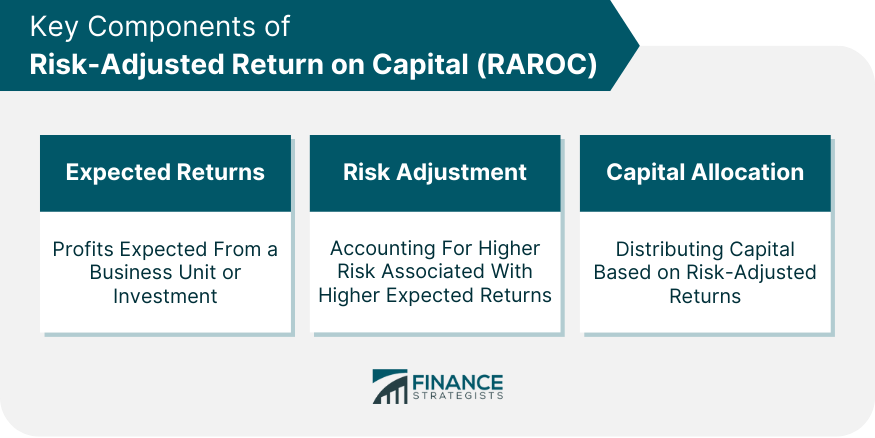

Key Components

Expected Returns

Risk Adjustment

Capital Allocation

Calculation of RAROC

Practical Application of RAROC in Financial Decision Making

Capital Budgeting

Performance Evaluation

Risk Management

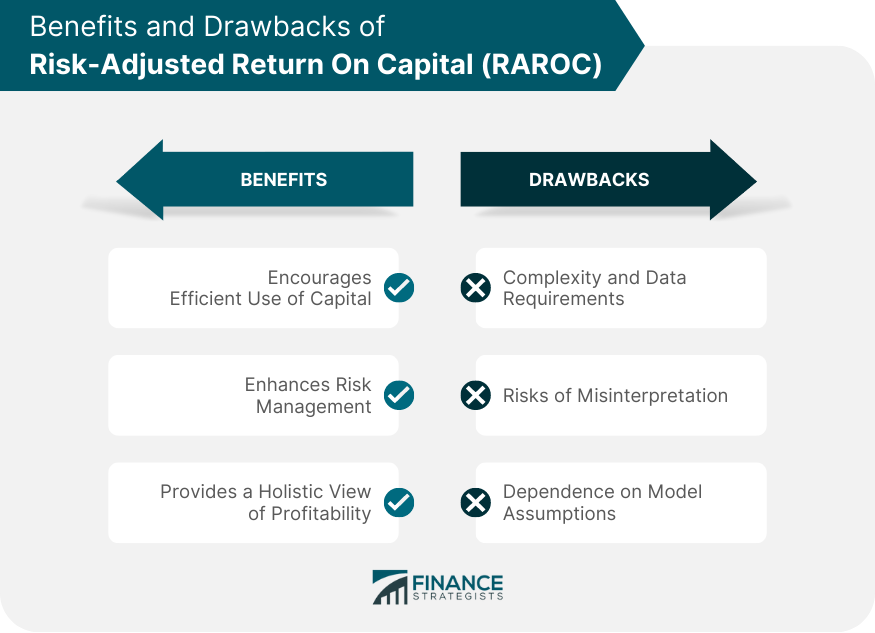

Benefits of RAROC

Encourages Efficient Use of Capital

Enhances Risk Management

Provides a Holistic View of Profitability

Drawbacks of RAROC

Complexity and Data Requirements

Risks of Misinterpretation

Dependence on Model Assumptions

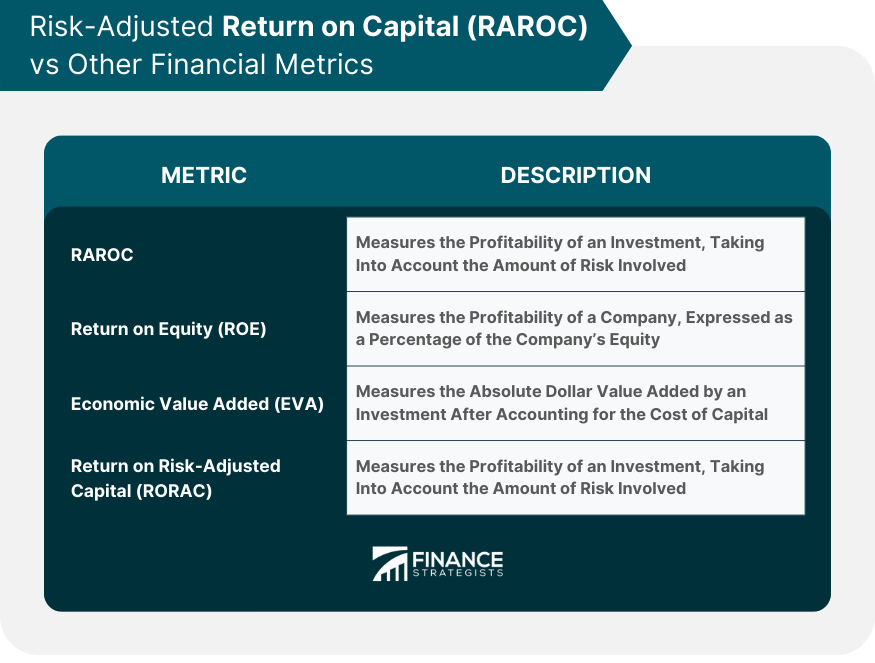

Comparing RAROC With Other Financial Metrics

Contrast With Return on Equity (ROE)

Differences From Economic Capital

Bottom Line

Risk-Adjusted Return On Capital (RAROC) FAQs

RAROC, or Risk-Adjusted Return On Capital, is a risk-based profitability measurement framework. It's important because it allows financial institutions to evaluate the expected returns from a business unit or investment in relation to the level of risk involved. This helps firms make more informed decisions regarding capital allocation and risk management.

RAROC is primarily used by financial institutions due to its focus on assessing the risk-adjusted profitability of investments. However, any business that needs to evaluate investments or projects based on potential returns and associated risks can benefit from using RAROC. It helps in making informed decisions regarding capital allocation and risk management.

RAROC offers several benefits. It encourages efficient use of capital by incentivizing firms to allocate capital to areas providing the highest risk-adjusted returns. It enhances risk management by factoring potential risk-related losses into its return calculations. Furthermore, by adjusting for risk, RAROC provides a more comprehensive view of profitability than traditional measures.

RAROC's limitations include complexity and significant data requirements, which can challenge smaller firms or those with less sophisticated data systems. There's also a risk of misinterpretation if RAROC is not well understood, potentially leading to poor decision-making. Finally, the accuracy of RAROC depends on the underlying assumptions and models used to estimate returns and measure risk, meaning flawed inputs lead to flawed results.

Unlike RAROC, Return on Equity (ROE) does not adjust for risk, providing a snapshot of profitability but not a comprehensive view of financial health. Economic Capital, on the other hand, is a measure of the capital a firm needs to stay solvent. It's often used alongside RAROC to maximize risk-adjusted returns while maintaining an adequate level of capital.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.