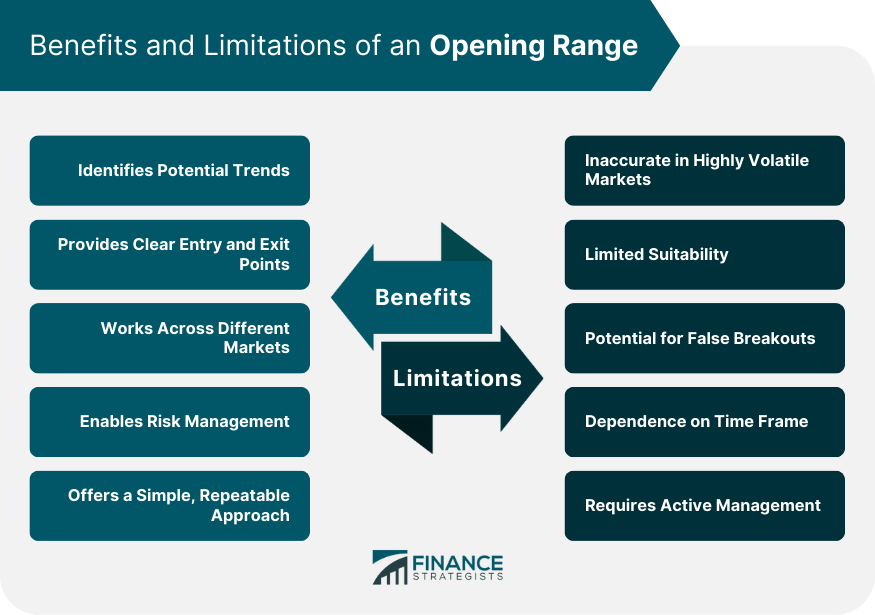

Opening range is a critical concept in technical analysis that refers to the range of price levels that a security, such as a stock or a commodity, trades within during the first few minutes to hours of the trading day. This range, which is defined by its highest and lowest points, serves as a technical indicator that many traders use to predict price movements and formulate trading strategies. It acts as a thermometer, measuring the early market sentiment. The high and low of the opening range often serve as support and resistance levels for the day's trading session. If the price breaks above the opening range, it's considered bullish, indicating an upward trend. Conversely, a break below suggests a bearish, downward trend. Day traders heavily rely on the opening range. It provides them with crucial price points to set entry and exit strategies. An opening range breakout, for instance, is a common day trading strategy, which involves buying a security when its price moves above the opening range and selling it when the price falls below. The opening high refers to the highest price point that a security reaches during the established opening range period. For example, if a trader sets the opening range to be the first 15 minutes of the trading day, the opening high would be the highest price that the security achieves during those first 15 minutes of trading. In the context of day trading, the opening high serves as a pivotal level of resistance. If a security's price rises above this point after the opening range period, it may indicate a strong buying pressure and potential for a continued upward trend. On the flip side, the opening low is the lowest price point that a security dips to during the opening range period. Using the same example, within the first 15 minutes of trading, the lowest price attained by the security would be the opening low. This opening low is often viewed as a significant level of support in technical analysis. If the security's price drops below this level after the opening range period, it may suggest strong selling pressure and possibility for a continued downward trend. To calculate the opening range, traders first determine its time frame. While there isn't a universally agreed-upon time frame, many traders consider the first 15 to 60 minutes of the trading day. The chosen time frame should align with the trader's strategy and risk tolerance. Once the time frame is set, determining the opening high and low is straightforward. The opening high is the highest traded price, and the opening low is the lowest traded price within the chosen time frame. Despite its simplicity, calculating the opening range requires attention to certain factors. Market volatility, economic news, and pre-market trading activity can influence the opening range. Traders should consider these factors and remain flexible in their approach. Day traders and technical analysts use various strategies based on the opening range to capitalize on potential price movements in securities. Here are three popular opening range strategies: This strategy is based on the premise that a security's price movement beyond the opening range signals a continuation of that trend for the rest of the trading session. Traders using the ORB strategy will buy when the price moves above the opening high and sell short when the price drops below the opening low. The key is to identify the breakout point accurately and make a move promptly. It's also crucial to set a stop-loss order near the opposite end of the opening range to mitigate potential losses if the price reverses. The opening range reversal strategy operates on the assumption that the initial price trend will reverse. Traders utilizing this strategy will watch for the price to reach the opening high or low and anticipate a price reversal. For instance, if a security's price hits the opening high and shows signs of a downward reversal, a trader would open a short position, expecting the price to fall. On the contrary, if the price hits the opening low and indicates an upward reversal, a trader would go long, predicting a rise in the price. It is a strategy that aims to capitalize on small price movements within the opening range. Traders using this strategy will make multiple trades, buying at the opening low and selling at the opening high. This strategy requires a high level of attention and quick execution, as profits come from relatively small price fluctuations. Like other strategies, risk management, including the use of stop-loss orders, is crucial to protect against significant losses. One of the primary benefits of the opening range is its ability to identify potential price trends at the start of the trading session. By recognizing the direction of the price movement early, traders can position themselves to take advantage of the trend, increasing the likelihood of profitable trades. The opening range provides clear entry and exit points for trades, based on the opening high and low. This clarity aids in formulating effective trading strategies. For example, in an opening range breakout strategy, traders buy when the price exceeds the opening high and sell when it falls below the opening low. The opening range can be applied across various markets, including stocks, forex, futures, and more. This allows traders to use a consistent strategy in diverse market scenarios. The opening range also facilitates effective risk management. Since it provides defined boundaries (opening high and low), traders can place stop-loss orders near these points to limit potential losses if the market moves against their positions. The opening range provides a straightforward method for observing and interpreting market action. This simplicity makes it easier to incorporate into a daily trading routine and apply consistently, a crucial factor in successful trading. In highly volatile markets, the opening range might not accurately represent the day's price movements. Significant news events, economic data releases, or market sentiment shifts can lead to rapid, unpredictable price fluctuations that diverge from the opening range's expectations. While the opening range is a valuable tool for day traders, it might not be as useful for long-term investors or swing traders. These traders typically focus more on larger trends and fundamental analysis rather than intra-day price fluctuations. Breakouts from the opening range do not always guarantee a continuation of the trend. Sometimes, a price might move outside the opening range but then reverse direction—a phenomenon known as a false breakout. This can lead to losses for traders who rely solely on the opening range for their trading decisions. The effectiveness of the opening range can depend heavily on the chosen time frame. There's no universally agreed-upon time frame for the opening range, so traders might miss potential opportunities if they choose a time frame that doesn't align with the market's volatility. Using the opening range effectively requires active management and constant attention to the market. This might not be feasible for traders who cannot dedicate the necessary time and effort. The opening range is a fundamental concept in technical analysis that defines the price range within which a security trades during the initial minutes or hours of the trading day. It serves as a crucial indicator for traders, offering insights into market sentiment and acting as support and resistance levels throughout the day. Day traders heavily rely on the opening range to set entry and exit points for their trades, with strategies such as opening range breakout, reversal, and scalping being commonly employed. The opening range provides benefits such as identifying potential trends, offering clear entry and exit points, working across different markets, enabling risk management, and providing a simple and repeatable approach to trading. However, it also has limitations, including its potential inaccuracy in highly volatile markets, limited suitability for long-term investors or swing traders, the possibility of false breakouts, dependence on the chosen time frame, and the requirement for active management. Traders should consider these factors when incorporating the opening range into their trading strategies.What Is an Opening Range?

Components of an Opening Range

Opening High

Opening Low

Calculation of the Opening Range

Determining the Time Frame

How to Calculate the Opening High and Low

Considerations in Calculation

Strategies Based on the Opening Range

Opening Range Breakout (ORB)

Opening Range Reversal

Opening Range Scalping

Benefits of an Opening Range

Identifies Potential Trends

Provides Clear Entry and Exit Points

Works Across Different Markets

Enables Risk Management

Offers a Simple, Repeatable Approach

Limitations and Risks of an Opening Range

Inaccurate in Highly Volatile Markets

Limited Suitability

Potential for False Breakouts

Dependence on Time Frame

Requires Active Management

Final Thoughts

Opening Range FAQs

The opening range is significant in technical analysis as it provides traders with key price levels that can be used to predict price movements and formulate trading strategies. It serves as a thermometer for early market sentiment and often acts as support and resistance throughout the trading session.

To calculate the opening range, traders first determine the time frame they want to consider, typically ranging from the first 15 to 60 minutes of the trading day. Within this time frame, the opening high is the highest traded price, and the opening low is the lowest traded price.

There are several common opening range strategies employed by traders. These include the Opening Range Breakout (ORB), where traders buy when the price moves above the opening high and sell short when it drops below the opening low. The Opening Range Reversal strategy anticipates a reversal in the initial price trend, and the Opening Range Scalping strategy aims to profit from small price movements within the opening range.

Yes, the opening range concept is versatile and can be applied across various markets, including stocks, forex, futures, and more. This allows traders to use a consistent strategy regardless of the market they are trading in.

While the opening range is a valuable tool, it has limitations. In highly volatile markets, it may not accurately represent the day's price movements. Additionally, the opening range is more suitable for day traders and may not be as useful for long-term investors or swing traders who focus on larger trends. Traders should also be aware of false breakouts, where a price moves outside the opening range but then reverses direction, and the dependence on the chosen time frame, which can affect its effectiveness. Active management and constant attention to the market are necessary when using the opening range for trading decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.