Excess return refers to the return on an investment that surpasses the return of a benchmark or a risk-free rate. It measures the performance of an investment in relation to its expected or required rate of return. The excess return accounts for the additional compensation an investor receives for taking on additional risk or for outperforming a benchmark. It is commonly used to evaluate the success of investment strategies, fund managers, or individual securities. Positive excess returns indicate that an investment has outperformed expectations, while negative excess returns suggest underperformance. Monitoring and analyzing excess returns are crucial for assessing investment performance and making informed investment decisions. In the realm of finance, excess return serves as a critical metric for investors, portfolio managers, and financial analysts. It provides insights into an investment's performance above a benchmark, such as a market index or comparable security. By analyzing excess return, investors can determine if the potential or realized gains from an investment outweigh the inherent risks. Additionally, it aids in comparing the performance of different investments and identifying those that provide the highest return for a given level of risk. Calculating excess return is straightforward. It involves subtracting the return of a benchmark, typically a risk-free rate of return, from the return on the investment. The formula is as follows: The risk-free rate represents the return an investor would expect from a virtually risk-free investment, such as a U.S. Treasury bond. The investment return is the total return from the investment over the period being analyzed. Let's consider an example. Suppose an investor buys shares in a company, and after one year, the return on investment is 12%. If the risk-free rate over the same period is 2%, the excess return on the investment would be 12% - 2% = 10%. This means that the investor earned a 10% return over and above what they could have earned from a risk-free investment. This excess return compensates the investor for the additional risk taken by investing in the shares rather than the risk-free asset. The risk-free rate is an essential component in the calculation of excess return. It's the theoretical return of an investment with zero risk. In practice, short-term government bonds are often used as a proxy for the risk-free rate because they are backed by the full faith and credit of the government, making them virtually risk-free. The investment return is the gain or loss made on an investment over a particular period. It includes any income received from the investment, such as dividends or interest, plus any change in the market value of the investment. The risk premium is the component of excess return that compensates investors for taking on additional risk. It's the difference between the investment return and the risk-free rate. Investors require a risk premium to take on the extra risk associated with an investment, over and above a risk-free investment. Excess return is intrinsically tied to the concept of risk. In financial markets, risk refers to the potential for an investment's actual return to deviate from its expected return. Higher-risk investments have a broader range of potential outcomes, including both higher gains and larger losses. The concept of excess return is grounded in the fundamental principle that risk and return are directly related. This principle, known as the risk-return tradeoff, posits that to achieve higher returns, an investor must be willing to accept a higher level of risk. High-risk investments, such as startup equity, often have the potential for high excess returns. Investors in these ventures expect substantial returns to compensate for the high risk they undertake. For instance, a venture capital firm investing in a technology startup expects a significant excess return because of the high probability of failure associated with startups. If the startup succeeds, the returns can significantly exceed the firm's initial investment, providing a high excess return. The risk-return tradeoff is a fundamental concept in finance that indicates a direct correlation between potential return and the level of risk taken. It's the principle that potential return rises with an increase in risk. According to this principle, to earn higher returns, investors must be willing to accept more risk. It is this principle that underpins the concept of excess return. The excess return compensates the investors for the additional risk they take on when they choose a risky investment over a risk-free one. Stocks, being ownership shares in a company, carry a higher degree of risk compared to risk-free assets, and therefore have the potential to generate significant excess returns. For instance, a rapidly growing technology company's stock may provide substantial excess returns to investors if the company's growth exceeds market expectations. Bonds can also generate excess returns, especially corporate bonds, which carry a higher risk compared to government bonds. A bond's excess return could arise if the issuing company performs exceptionally well, leading to a rating upgrade and a consequent increase in the bond's price. Mutual funds, which are investment vehicles that pool money from many investors to purchase a diversified portfolio of stocks, bonds, or other assets, can also produce excess returns. A mutual fund managed by a skilled portfolio manager can outperform the benchmark index, leading to an excess return for the fund's investors. Exchange-Traded Funds (ETFs), like mutual funds, can also generate excess returns. ETFs that track specific sectors or themes can deliver excess returns if those sectors or themes outperform the broader market. Real estate investments can yield excess returns when property values increase significantly or when rental income is higher than expected. For instance, an investor who purchases properties in a rapidly gentrifying neighborhood could earn substantial excess returns as property values in the area rise. Excess return and absolute return are two distinct ways of measuring an investment's performance. While excess return measures the return of an investment above a benchmark, absolute return measures the return of an investment over a certain period, regardless of market conditions. An absolute return strategy aims to produce positive returns irrespective of whether markets are rising or falling. Total return includes all gains from an investment, including capital gains, dividends, and interest, while the excess return is the portion of total return that exceeds the risk-free rate. It provides a comprehensive measure of an investment's performance, while excess return indicates how much of that performance can be attributed to taking on additional risk. Alpha is a measure of an investment's performance relative to a benchmark, adjusted for risk. It's similar to excess return, but while excess return may be driven by higher risk, alpha indicates outperformance due to the skill of the investor or portfolio manager. A positive alpha indicates that an investment has outperformed its benchmark on a risk-adjusted basis. In portfolio management, the excess return is a key metric used to evaluate the performance of a portfolio. It helps determine if the portfolio's investments are performing well relative to their risk levels. A portfolio with a high excess return is generally seen as well-managed, as it indicates the manager's ability to generate returns above the expected given the portfolio's risk profile. Excess returns can significantly influence an investment strategy. For instance, investors looking for high excess returns may be inclined to adopt aggressive strategies, investing in high-risk assets such as growth stocks, emerging markets, or startup ventures. Conversely, risk-averse investors may focus on strategies that aim to generate modest excess returns with less volatility, such as investing in blue-chip stocks or high-quality bonds. Diversification, the strategy of spreading investments across various types of assets to reduce risk, can also impact excess return. A well-diversified portfolio can help mitigate losses from any single investment, potentially leading to higher long-term excess returns. It's important to note, however, that while diversification can help reduce risk, it does not guarantee higher excess returns. One of the key criticisms of excess return is that it can be misinterpreted. For instance, a high excess return may lead an investor to believe that an investment or a portfolio manager has performed exceptionally well without considering the additional risk taken to achieve those returns. Therefore, excess return should always be viewed in conjunction with risk measures to gain a complete understanding of an investment's performance. The time horizon can significantly impact excess return calculations. In the short term, an investment might yield high excess returns due to market volatility or specific events. However, these high excess returns might not be sustainable in the long run. Therefore, when evaluating investments based on excess return, it's essential to consider the time horizon and the sustainability of those returns. Another criticism of excess return is the challenge of selecting the appropriate risk-free rate. In theory, the risk-free rate is the return on investment with zero risk, but in practice, even the safest investments carry some degree of risk. Thus, the choice of a risk-free rate can impact the calculation of excess return and potentially lead to inaccurate assessments of an investment's performance. Excess return, an integral concept in finance, signifies the additional return that an investment provides over a risk-free rate or a benchmark. Calculated by deducting the risk-free rate from the total return of an investment, it allows for the quantification of rewards earned for taking on extra risk. Key components include the risk-free rate, the investment return, and the risk premium, each playing a pivotal role in determining the excess return. Various financial instruments like stocks, bonds, ETFs, mutual funds, and real estate can generate excess returns. For instance, high-growth stocks or real estate in gentrifying neighborhoods can yield significant excess returns. It's important to note, however, that the potential for high excess return usually accompanies greater risk. Understanding excess return and its components helps investors and financial professionals assess the performance of an investment relative to its risk, guiding more informed investment decisions across different financial instruments.What Is Excess Return?

Importance of Excess Return in Finance

Calculation of Excess Return

Formula and Method for Calculating Excess Return

Examples of Excess Return Calculation

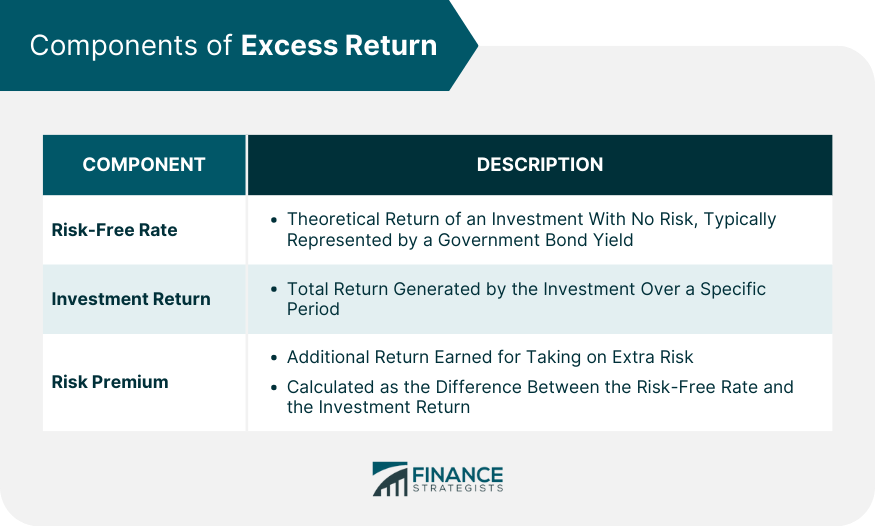

Components of Excess Return

Risk-Free Rate

Investment Return

Risk Premium

Excess Return and Risk

Understanding the Relationship Between Excess Return and Risk

High-Risk Investments and Potential for High Excess Return

Concept of the Risk-Return Tradeoff

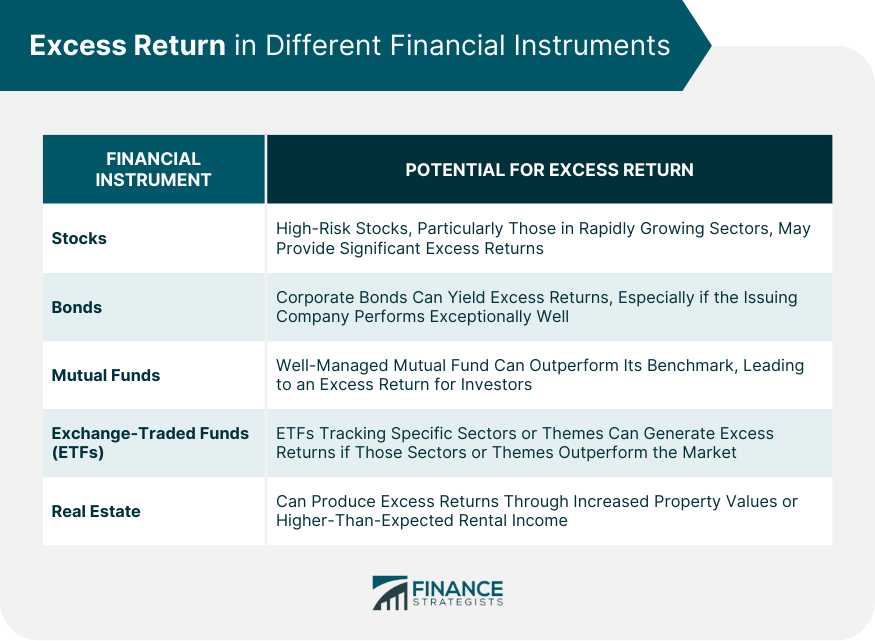

Excess Return in Different Financial Instruments

Stocks

Bonds

Mutual Funds

ETFs

Real Estate

Comparison of Excess Return and Other Performance Metrics

Excess Return vs Absolute Return

Excess Return vs Total Return

Excess Return vs Alpha

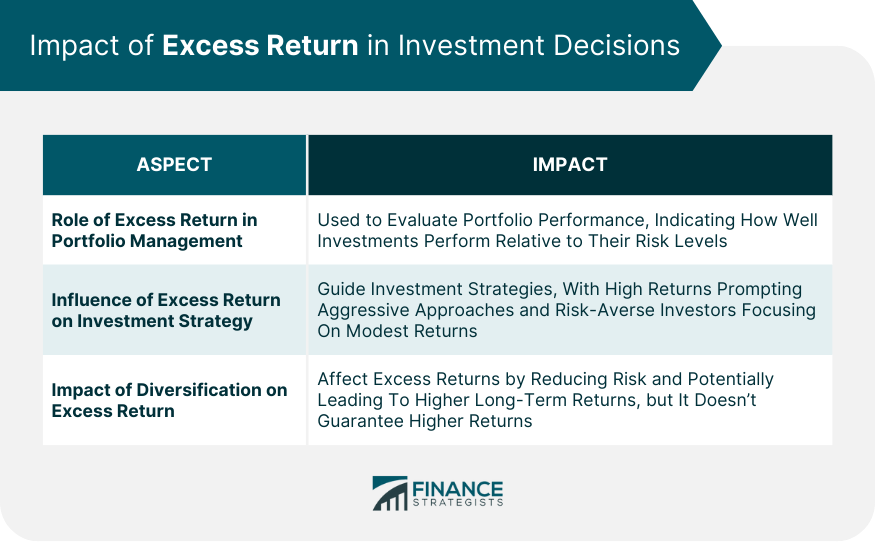

Using Excess Return for Investment Decisions

Role of Excess Return in Portfolio Management

How Excess Return Influences Investment Strategy

Diversification and Its Impact on Excess Return

Criticisms and Limitations of Excess Return

Potential Misinterpretations of Excess Return

Impact of Time Horizons on Excess Return

Challenges in Determining the Appropriate Risk-Free Rate

Bottom Line

Excess Return FAQs

Excess return, also known as abnormal return or alpha, is the difference between an investment's actual return and the expected return, given its level of risk. It measures how much an investment outperforms or underperforms a benchmark or a risk-free investment over a certain period.

Excess return is calculated by subtracting the risk-free rate from the investment return. The risk-free rate represents the return an investor would expect from a virtually risk-free investment, such as a U.S. Treasury bond. The investment return is the total return from the investment over the period being analyzed.

Excess return is closely tied to the concept of risk. In financial markets, risk refers to the potential for an investment's actual return to deviate from its expected return. The principle of risk-return tradeoff posits that higher potential returns come with a higher level of risk. Therefore, excess return serves as compensation for investors taking on additional risk beyond a risk-free investment.

Excess return can significantly shape an investment strategy. For example, investors seeking high excess returns might adopt aggressive strategies, investing in high-risk assets. Conversely, those who are risk-averse may focus on strategies that aim to generate modest excess returns with less volatility.

Some potential criticisms and limitations of excess return include potential misinterpretations, the impact of time horizons, and challenges in determining the appropriate risk-free rate. For instance, high excess returns might lead an investor to believe that a portfolio manager has performed exceptionally well, without considering the additional risk taken. Moreover, the choice of a risk-free rate can affect the calculation of excess return, potentially leading to inaccurate assessments of an investment's performance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.