A joint bond is a type of debt security issued by two or more entities that share the responsibility of repaying the bond's principal and interest payments. These entities, which can be individuals, corporations, or governments, jointly guarantee the bond, ensuring that if one party defaults, the other parties are responsible for fulfilling the bond's obligations. Joint bonds can be an attractive financing option for entities with complementary credit profiles, as they allow borrowers to pool their resources and creditworthiness to secure more favorable borrowing terms. The primary purpose of a joint bond is to allow multiple entities to access capital by jointly issuing debt securities. By sharing the responsibility of repaying the bond, the entities can benefit from each other's creditworthiness, which can result in lower interest rates and improved financing terms. Joint bonds can be used to finance various projects and ventures, such as infrastructure development, business expansions, or real estate investments. They can also be used by individuals who want to combine their resources to purchase assets, such as property or other investments. Joint bonds are important for several reasons. First, they provide an alternative financing option for entities that may not qualify for individual debt financing or may face higher borrowing costs. By pooling their creditworthiness, entities can access capital at more favorable terms, enabling them to pursue growth opportunities and investments that may not have been possible otherwise. Second, joint bonds can facilitate collaboration and cooperation among entities, promoting the sharing of resources, knowledge, and expertise. This can lead to more efficient and effective project execution, as well as the potential for increased returns on investment. Finally, joint bonds can provide investors with diversified exposure to multiple entities, reducing the risk associated with investing in a single issuer. Joint and several bonds are debt securities in which each issuer is responsible for the entire bond obligation. In the event of a default by one of the issuers, the other issuers are required to fulfill the entire debt obligation, regardless of their individual share of the bond. This type of joint bond offers the greatest protection for bondholders, as it ensures that the bond's principal and interest payments will be made even if one of the issuers defaults. However, it also poses the greatest risk for the issuers, as they may be responsible for a larger portion of the debt than they initially anticipated. Joint tenancy bonds are debt securities issued by two or more entities that hold an equal interest in the bond. Each issuer is responsible for their pro-rata share of the bond's principal and interest payments, and the bond is owned in equal parts by the issuers. In the event of a default by one of the issuers, the other issuers are responsible for covering the defaulting issuer's share of the bond obligation. Joint tenancy bonds offer a more balanced risk-sharing arrangement among the issuers, but they may provide less protection for bondholders compared to joint and several bonds. Tenancy in common bonds are debt securities issued by two or more entities that hold an undivided interest in the bond. Each issuer is responsible for their share of the bond's principal and interest payments, which may not necessarily be equal. This type of joint bond allows for greater flexibility in structuring the bond's ownership and responsibility among the issuers, but it may provide less protection for bondholders compared to joint and several bonds and joint tenancy bonds. By jointly guaranteeing the bond, the issuers can distribute the responsibility of repaying the bond's principal and interest payments, reducing the burden on each individual issuer. This can be particularly beneficial for entities with limited resources or creditworthiness, as it allows them to access capital that may not have been available through individual debt financing. Joint bonds can lead to increased borrowing capacity for the issuers, as they are able to pool their creditworthiness and resources to secure more favorable financing terms. By combining their credit profiles, issuers can potentially qualify for larger loans and lower interest rates than they would be able to obtain individually. This can enable the issuers to pursue larger projects or investments, driving growth and value creation. Issuing joint bonds can enhance the creditworthiness of the participating entities, as the joint guarantee demonstrates a commitment to repaying the bond's obligations and a willingness to share the risk associated with the debt. This can lead to improved credit ratings for the issuers, making it easier for them to access capital in the future and potentially lowering their borrowing costs. If an issuer fails to fulfill its obligations, the other issuers are responsible for covering the defaulting issuer's share of the bond obligation. This can create financial strain and potential legal disputes among the joint bondholders, as well as negatively impact their credit ratings. Joint bonds can give rise to conflicts among the issuers, particularly in situations where one issuer believes they are bearing a disproportionate share of the bond's risk or obligations. This can lead to disagreements over the management of the bond, the allocation of resources, or the distribution of proceeds, potentially resulting in legal disputes and delays in the execution of the bond's objectives. While joint bonds allow for the sharing of liability among issuers, they also entail a shared responsibility for the bond's debt. This means that each issuer is ultimately responsible for repaying the bond's principal and interest payments, even if they are not directly involved in the project or investment being financed by the bond. This can expose issuers to risks and liabilities that may not be directly related to their core business activities, potentially impacting their financial performance and credit ratings. The key differences between joint bonds and individual bonds lie in the number of issuers, the distribution of responsibility for the bond's obligations, and the potential impact on the issuers' creditworthiness. Joint bonds involve multiple issuers that share the responsibility of repaying the bond's principal and interest payments, while individual bonds are issued by a single entity that bears the full responsibility for the bond's obligations. Joint bonds offer the advantages of shared liability, increased borrowing capacity, and enhanced creditworthiness, making them a suitable financing option for entities with complementary credit profiles or limited access to capital. However, they also come with the risks of default, conflicts among joint bondholders, and shared responsibility for the bond's debt. Individual bonds, on the other hand, allow issuers to maintain full control over their debt obligations and avoid potential conflicts with other entities. However, they may also result in higher borrowing costs and limited access to capital for entities with weaker credit profiles. When deciding between a joint bond and an individual bond, issuers should consider factors such as their creditworthiness, financial resources, risk tolerance, and the nature of the project or investment being financed. Entities with strong credit profiles and ample resources may prefer individual bonds for their simplicity and control, while those with limited creditworthiness or resources may benefit from the advantages offered by joint bonds. Joint bonds are debt securities issued by two or more entities that share the responsibility of repaying the bond's principal and interest payments. They provide an alternative financing option for entities with complementary credit profiles or limited access to capital, allowing them to pool their creditworthiness and resources to secure more favorable borrowing terms. Joint bonds offer several advantages, such as sharing of liability, increased borrowing capacity, and enhanced creditworthiness. However, they also come with potential disadvantages, including the risk of default, conflicts among joint bondholders, and shared responsibility for the bond's debt. Issuers and investors should carefully weigh the advantages and disadvantages of joint bonds to determine their appropriateness for their financial goals and risk tolerance.What Is a Joint Bond?

Importance of Joint Bond

Types of Joint Bonds

Joint and Several Bonds

Joint Tenancy Bonds

Tenancy in Common Bonds

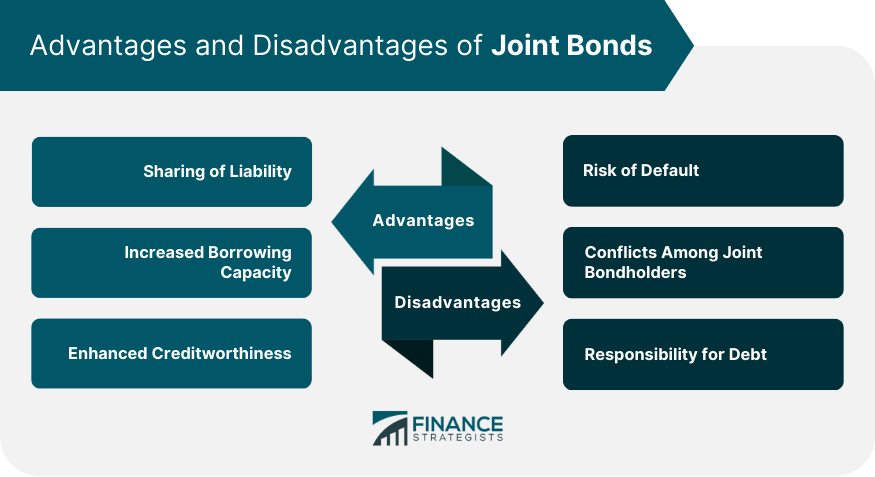

Advantages of Joint Bonds

Sharing of Liability

Increased Borrowing Capacity

Enhanced Creditworthiness

Disadvantages of Joint Bonds

Risk of Default

Conflicts Among Joint Bondholders

Responsibility for Debt

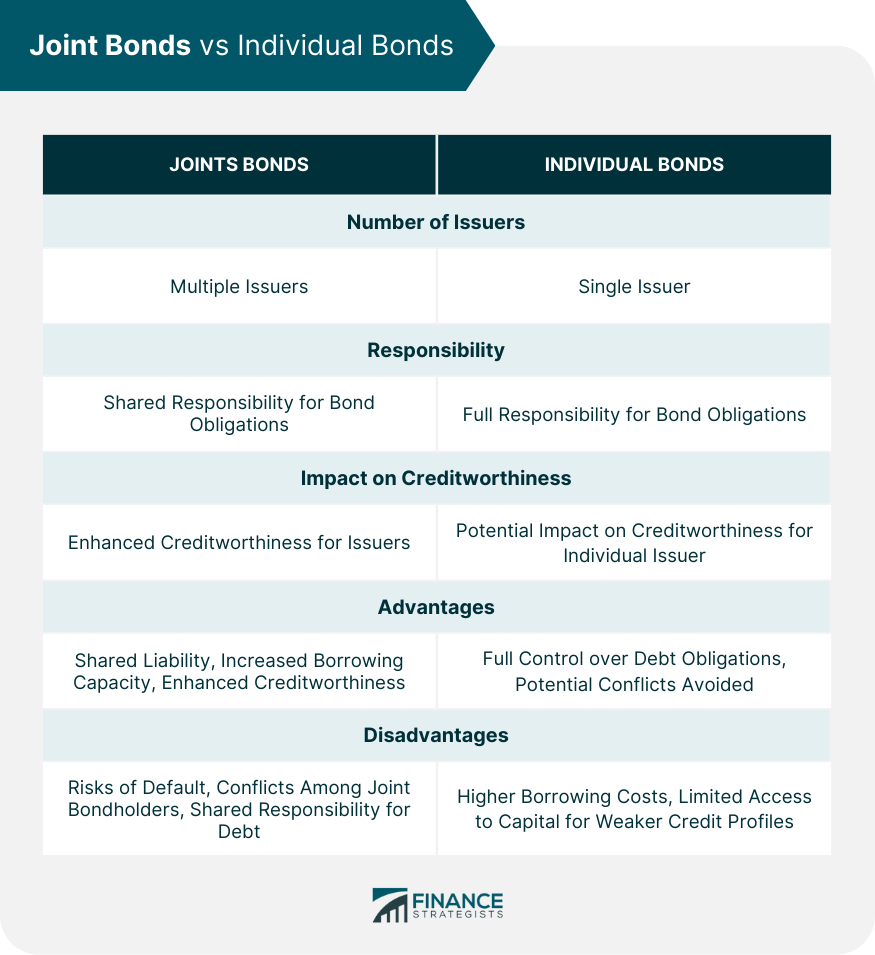

Joint Bond vs. Individual Bond

Key Differences

Pros and Cons of Each Option

Factors to Consider

The Bottom Line

Joint Bond FAQs

Joint Bond is a type of bond issued by two or more entities who share liability for the debt.

There are three types of Joint Bonds: Joint and Several Bonds, Joint Tenancy Bonds, and Tenancy in Common Bonds.

Joint Bonds offer advantages such as sharing of liability, increased borrowing capacity, and enhanced creditworthiness.

Disadvantages of Joint Bonds include the risk of default, conflicts among joint bondholders, and responsibility for debt.

Joint Bonds are issued jointly by two or more entities who share liability for the debt, while individual bonds are issued by a single entity who is solely responsible for the debt.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.