Contingent Convertibles, or CoCos, are unique debt instruments primarily issued by European financial institutions. These bonds have a convertible characteristic that can be activated under specific conditions. When certain circumstances related to the financial health of the organization are met, CoCos can be converted into equity shares of the issuing institution. They are also known as Additional Tier 1 (AT1) Bonds or Enhanced Capital Notes. AT1 Bonds refer to their classification under Basel III regulations, where they are considered part of a bank's Tier 1 capital, the highest quality capital held by a bank. Enhanced Capital Notes emphasize their hybrid nature, combining elements of both debt and equity. CoCos play a crucial role in absorbing losses during periods of financial stress, automatically converting from debt to equity when the bank's capital ratio falls below a specified threshold. CoCos come with several unique features that differentiate them from regular convertible bonds. These characteristics include the conversion trigger, mandatory conversion, and a high-interest rate. One of the defining features of CoCos is the conversion trigger, which is typically tied to the capital adequacy of the issuing bank or financial institution. The bond changes into equity if the bank's capital ratio falls below a predetermined level. This level is set during the issuance of the CoCo and serves as a safety mechanism. It's important to note that these triggers are not uniform and can vary between different issuances based on the specific terms and conditions agreed upon by the issuer and investors. The trigger could be a particular level of capital, a regulatory directive, or a specific event, such as the bank incurring a loss. In contrast to regular convertible bonds, which give bondholders the right to convert their bonds into equity at their discretion, the conversion process in CoCos is mandatory and entirely at the discretion of the issuer. When the predefined trigger event occurs, the CoCos automatically convert into equity, irrespective of whether this is favorable for the bondholders. This mandatory conversion, driven by predefined triggers, is a fundamental feature of CoCos and what makes them such a unique financial instrument. Another notable feature of CoCos is the high coupon or interest rate they carry. Given their inherent risk – particularly the risk of conversion into equity at possibly unfavorable terms – CoCos need to offer a higher potential return to attract investors. This potential return comes in the form of high coupon payments, which serve to compensate investors for the added risk they undertake when investing in these instruments. The coupon rate on CoCos is generally much higher than on regular bonds, making them an attractive investment for those seeking higher yields in the current low-interest-rate environment. However, it's important for investors to understand and be comfortable with the associated risks before investing in CoCos. To understand CoCos, it's important to delve into its operational mechanism, which is intrinsically tied to the financial health of the issuing bank or financial institution. CoCos start their life as bonds, which means they pay regular interest to their holders and have a principal amount that is supposed to be repaid at maturity. However, they carry a unique feature known as a conversion trigger. The conversion trigger is a predefined capital level which, if breached by the issuing institution, automatically converts the CoCos from debt into equity. For instance, a CoCo might have a conversion trigger set at a 7% Common Equity Tier 1 (CET1) ratio. If the bank's CET1 ratio falls below 7%, the CoCo will convert into equity. The strike price in CoCos refers to the predefined price at which the CoCos will be converted into equity once the trigger is activated. This price is set at the time of the issue and often involves a substantial discount to the prevailing market price, thereby providing a cushion against further potential losses. The conversion of CoCos into stock essentially means that the bondholders become shareholders in the issuing bank. This conversion usually happens at a disadvantageous exchange rate for the bondholders, causing them to lose a significant portion of their initial investment. However, the conversion helps to shore up the bank's capital position and allows it to absorb losses without becoming insolvent, thus protecting the broader financial system. When a bank experiences financial distress, its capital ratios decline. If the ratios drop below the predetermined trigger level, the CoCos will convert into equity. This conversion helps the bank shore up its capital, absorb losses, and continue operations without requiring a government bailout or declaring bankruptcy. However, this conversion means that the bondholders will suffer a loss as their debt investment is transformed into equity shares, often at unfavorable exchange rates. CoCos play a critical role in the banking industry, especially in relation to banks' capital structures and their ability to withstand financial crises. CoCos provide an automatic stabilizer to a bank's balance sheet. In times of financial stress, when the bank's capital levels fall, the automatic conversion of CoCos to equity helps maintain the bank's capital ratios, thus strengthening its balance sheet. CoCos form a part of a bank's Tier 1 capital, the highest quality capital that a bank holds. This capital acts as a buffer against losses, and the inclusion of CoCos in this category underscores their role as loss-absorbing instruments. CoCos provide a lifeline to undercapitalized banks by serving as a tool for automatic recapitalization. When a bank's capital levels fall dangerously low, CoCos convert into equity, instantly boosting the bank's capital levels and preventing a full-blown capital crisis. By providing a safety net for individual banks, CoCos also contribute to the overall stability of the financial system. Their ability to prevent bank failures helps to avoid wider systemic crises, making them an important tool for financial regulators. CoCos have attracted a range of investors due to their high-yield characteristics. The primary investors in CoCos are institutional investors, such as hedge funds, insurance companies, and pension funds. These investors are attracted by the high returns offered by CoCos, which compensate for the additional risk associated with these instruments. Investors are attracted to CoCos because they offer higher yields than regular bonds, reflecting the higher risk associated with these instruments. Moreover, the potential for capital gains due to the conversion feature of CoCos also adds to their appeal. While CoCos offer attractive returns, they also carry significant risks. The conversion feature means that investors can lose a substantial part of their initial investment if the issuing bank runs into financial trouble. Furthermore, the high yield offered by CoCos is compensation for this risk. CoCos have emerged as an innovative financial instrument that offers various benefits for both banks and investors. CoCos provide banks with a flexible instrument for managing their capital. By issuing CoCos, banks can raise capital that can absorb losses in times of financial distress, thereby enhancing their resilience. The conversion feature of CoCos allows banks to increase their equity capital without having to issue new shares, which may be expensive and dilutive for existing shareholders. For investors, the main attraction of CoCos is their high yields. In a low-interest-rate environment, CoCos offer significantly higher coupon rates compared to traditional bonds, making them an attractive investment for income-focused investors. On a systemic level, CoCos contribute to the stability of the financial system by providing a buffer against bank failures. Their loss-absorbing capacity helps to prevent individual bank failures from escalating into a systemic crises. Despite these benefits, CoCos also carry significant risks that investors must be aware of. The main risk associated with CoCos is the conversion risk. If the issuer's capital levels fall below a certain threshold, CoCos will convert into equity. This conversion can lead to substantial losses for investors, as their debt investment is converted into equity at a potentially unfavorable rate. CoCos are complex financial instruments with unique features that can be difficult to understand. This complexity, coupled with issues around transparency (such as the exact terms and conditions of the conversion triggers), can lead to misunderstanding and mispricing of risks. CoCos can be subject to high market volatility, particularly in times of financial stress. This volatility can lead to significant mark-to-market losses for investors. Moreover, the market for CoCos can be less liquid than for other bonds, meaning that investors may find it difficult to sell their holdings without impacting the price. The regulatory treatment of CoCos can change, which can impact their value. For instance, changes to capital adequacy rules or to the terms under which CoCos can be counted as regulatory capital can affect their attractiveness to both issuers and investors. CoCos are a unique type of debt instrument primarily issued by banks, designed to convert into equity when the issuer's capital ratio falls below a specific level. They serve an essential function in providing banks with an automatic stabilizer to maintain their capital levels during times of financial stress. Key features of CoCos include a conversion trigger based on the issuing institution's capital adequacy, mandatory conversion at the issuer's discretion, and a high coupon rate to compensate for the additional risk taken by investors. While the benefits of CoCos include providing high yields for investors and contributing to the overall stability of the financial system, they also present significant risks. These risks include conversion risk, complexity, and transparency issues, market volatility, liquidity risk, and regulatory risk. Considering these complexities, potential investors should seek advice from professionals specializing in wealth management bonds to fully understand the implications of CoCos investing.What Are Contingent Convertibles (CoCos)?

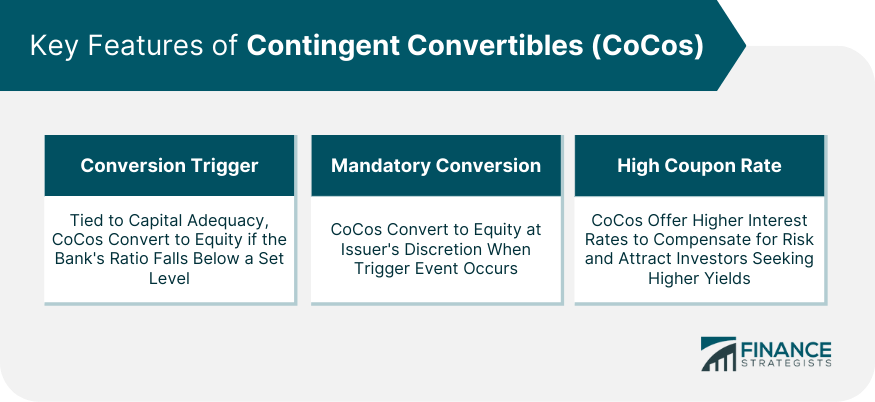

Key Features of CoCos

Conversion Trigger Based on Capital Adequacy

Mandatory Conversion at Issuer's Discretion

High Coupon Rate

Mechanism of CoCos

How CoCos Work

Strike Price in CoCos

Conversion of Bond Into Stock

Scenario When a Bank Struggles Financially

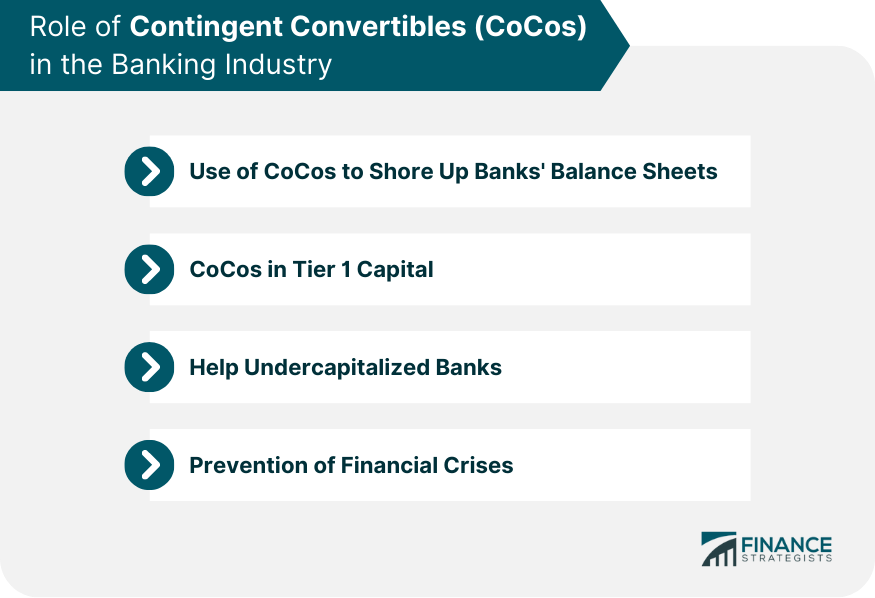

Role of CoCos in the Banking Industry

Use of CoCos to Shore Up Banks’ Balance Sheets

CoCos in Tier 1 Capital

Help Undercapitalized Banks

Prevention of Financial Crises

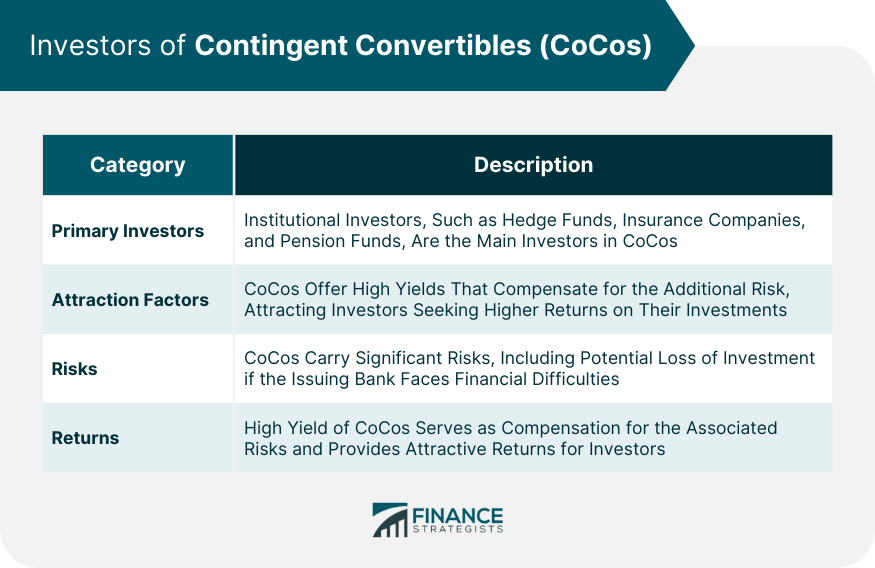

Investors of CoCos

Primary Investors of CoCos

Why Investors Choose CoCos

Risks and Returns for Investors

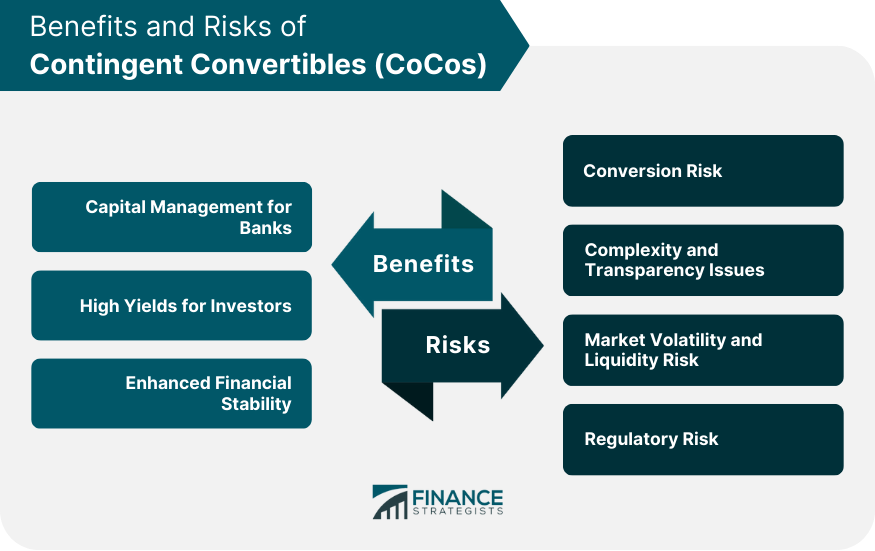

Benefits of CoCos

Capital Management for Banks

High Yields for Investors

Enhanced Financial Stability

Risks of CoCos

Conversion Risk

Complexity and Transparency Issues

Market Volatility and Liquidity Risk

Regulatory Risk

Final Thoughts

Contingent Convertibles FAQs

Contingent Convertibles (CoCos) are a type of debt instrument that can be converted into equity if the issuing bank's capital ratio falls below a predetermined level.

CoCos work by converting from debt to equity when a specific trigger event, usually related to the issuer's capital adequacy, occurs. This conversion is mandatory and is at the discretion of the issuer.

Key features of CoCos include a capital adequacy-based conversion trigger, mandatory conversion at the issuer's discretion, and a high coupon rate to compensate for the additional risk.

The main benefit for investors is the high yield offered by CoCos compared to other types of bonds. Additionally, CoCos can contribute to the overall stability of the financial system.

Risks include conversion risk (which could lead to substantial losses for investors), complexity and transparency issues, market volatility, liquidity risk, and regulatory risk.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.