Asset protection refers to the various legal and financial strategies employed to safeguard an individual's or entity's assets from potential claims by creditors, litigants, and other potential claimants. In today's litigious society, it is crucial for individuals and businesses to have a well-thought-out asset protection plan to minimize the risk of financial loss. Protecting one's assets is essential for maintaining financial stability and ensuring long-term financial goals are met. A solid asset protection strategy not only shields assets from potential legal claims but also helps manage risk, minimize tax liability, and streamline estate planning. The primary goal of asset protection strategies is to safeguard one's wealth from potential financial threats. These strategies aim to minimize exposure to potential lawsuits, limit personal liability, and ultimately preserve one's assets for future generations. Real estate is often one of the most valuable personal assets. This includes primary residences, vacation homes, rental properties, and undeveloped land. It is crucial to protect these assets, as they can be subject to claims in the event of litigation or financial hardship. Financial assets include bank accounts, stocks, bonds, mutual funds, retirement accounts, and other investments. These assets must be carefully assessed to determine their vulnerability and to develop appropriate protection strategies. Items such as cars, boats, jewelry, artwork, and collectibles are considered personal belongings. While these assets may not have the same level of financial value as real estate or investments, they can still be targeted by creditors or litigants and should be included in an asset protection plan. For businesses, intellectual property (IP) can be a valuable asset. This includes patents, trademarks, copyrights, and trade secrets. Protecting IP is crucial for maintaining a competitive edge and ensuring the long-term success of a business. Businesses often have significant investments in inventory and equipment. These assets are crucial for day-to-day operations and should be protected from potential financial threats. Accounts receivable represents the money owed to a business by its customers. This asset can be vulnerable to claims by creditors and should be considered in any asset protection strategy. Understanding the vulnerability of one's assets is essential for developing an effective asset protection plan. Factors to consider include the type of asset, its current ownership structure, and any existing legal claims or potential threats. C-corporations are separate legal entities that can provide significant asset protection benefits. They shield owners' personal assets from corporate liabilities, such as lawsuits or debts. However, they are subject to double taxation, meaning the corporation's profits are taxed, and the shareholders are taxed on dividends received. S-corporations offer similar asset protection benefits as C-corporations but avoid double taxation. Profits and losses are passed through to the shareholders, who report them on their personal income tax returns. S-corporations have specific requirements and limitations that must be considered when choosing this structure for asset protection. LLCs combine the asset protection benefits of a corporation with the tax advantages of a partnership. Owners, known as members, have limited liability for business debts and obligations. Profits and losses are passed through to the members, avoiding double taxation. LPs consist of general partners and limited partners. General partners have management authority and unlimited liability for the partnership's debts and obligations, while limited partners have limited liability and no management authority. LPs can be an effective asset protection strategy when structured properly, with limited partners holding most of the assets and general partners holding minimal assets. A revocable living trust is a legal arrangement where assets are transferred into a trust, managed by a trustee for the benefit of the beneficiaries. The trust can be altered or revoked by the grantor during their lifetime. While revocable living trusts can be beneficial for estate planning purposes, they do not provide significant asset protection. Irrevocable trusts, once established, cannot be altered or revoked by the grantor. Assets transferred into an irrevocable trust are no longer considered the grantor's property, providing a higher level of asset protection. However, this also means the grantor loses control over those assets. Asset protection trusts are a specific type of irrevocable trust designed to shield assets from potential creditors. These trusts often include provisions such as spendthrift clauses, which restrict the ability of creditors to access the trust's assets. Asset protection trusts can be established domestically or offshore, depending on the grantor's goals and circumstances. Homeowners insurance protects against damage to one's home and personal property, as well as liability claims resulting from injuries or property damage sustained by others on the insured property. It is crucial to have adequate coverage to protect one's real estate assets. Automobile insurance covers damage to one's vehicle and liability claims arising from accidents involving the insured vehicle. Ensuring proper coverage is essential to protect personal assets in the event of an accident. Life insurance provides financial protection for one's dependents in the event of the insured's death. The death benefit can help cover expenses, pay off debts, and maintain the financial stability of one's family, making it a vital component of asset protection. Umbrella liability insurance provides additional coverage beyond the limits of one's homeowners and automobile insurance policies. This extra layer of protection can be essential in the event of a significant liability claim that exceeds the limits of the primary policies. Regularly reviewing and updating insurance coverage is crucial for ensuring adequate asset protection. Factors to consider include the value of one's assets, potential liability risks, and any changes in circumstances, such as the acquisition of new assets or changes in family structure. Regular insurance reviews can help identify gaps in coverage and ensure that one's insurance policies remain up-to-date and effective in protecting assets. Offshore trusts are asset protection trusts established in foreign jurisdictions, often with favorable asset protection laws. These trusts can provide a higher level of protection from potential creditors, but they may also be subject to complex regulations and additional costs. Offshore banking involves opening bank accounts in foreign jurisdictions. This strategy can provide asset protection benefits by diversifying one's financial holdings and potentially shielding assets from domestic legal claims. Offshore investment accounts allow individuals to invest in foreign markets and assets, providing diversification and potential tax advantages. These accounts can also offer asset protection benefits by placing assets outside the reach of domestic creditors. While offshore asset protection strategies can provide significant benefits, they also come with potential risks and drawbacks. These may include increased costs, complex regulations, and potential negative perceptions. Careful consideration and professional guidance are essential when deciding whether to incorporate offshore strategies into one's asset protection plan. Regular maintenance and proper management of assets, such as real estate and vehicles, can help reduce the risk of accidents and liability claims. This proactive approach can be an essential component of an effective asset protection strategy. Implementing risk management practices in both personal and business activities can help minimize the likelihood of liability claims. This may include training employees on safe work practices, regularly reviewing and updating safety procedures, and implementing appropriate security measures. Ensuring that legal and financial documents, such as contracts, wills, and trusts, are up-to-date and accurately reflect one's intentions can help prevent disputes and potential liability claims. Regular reviews and updates are essential for maintaining an effective asset protection plan. Consulting with professionals, such as attorneys, financial advisors, and insurance agents, can help ensure that one's asset protection strategies are comprehensive, effective, and compliant with applicable laws and regulations. A will is a legal document that outlines how an individual's assets will be distributed upon their death. Probate is the legal process through which a will is validated and assets are distributed. Proper estate planning can help ensure that one's assets are protected and passed on to the intended beneficiaries with minimal delays and costs. Incorporating trusts into an estate plan can provide additional asset protection benefits, as well as help avoid the probate process. Trusts can be tailored to meet an individual's specific needs and goals, making them a valuable tool for estate planning and asset protection. Strategically gifting assets to family members during one's lifetime can be an effective asset protection strategy, as it can remove those assets from the donor's estate and reduce potential liability exposure. However, it is essential to consider tax implications and potential loss of control over the assets. Charitable giving can provide tax benefits and potentially protect assets from potential creditors. Charitable remainder trusts, donor-advised funds, and private foundations are examples of giving strategies that can be incorporated into an asset protection plan. Proactively planning and implementing asset protection strategies is essential for safeguarding one's wealth and ensuring long-term financial goals are achieved. Waiting until a threat arises can limit the available options and result in significant financial losses. As circumstances change, it is crucial to regularly review and update one's asset protection strategies to ensure their continued effectiveness. This may include revisiting legal structures, insurance coverage, and estate planning documents. Asset protection planning can be complex and requires a thorough understanding of applicable laws and regulations. Engaging professionals such as attorneys, financial advisors, and insurance agents can help ensure that one's asset protection strategies are comprehensive, effective, and compliant with the law.Asset Protection Strategies: Overview

What Is Asset Protection?

The Importance of Protecting One's Assets

Goals and Objectives of Asset Protection Strategies

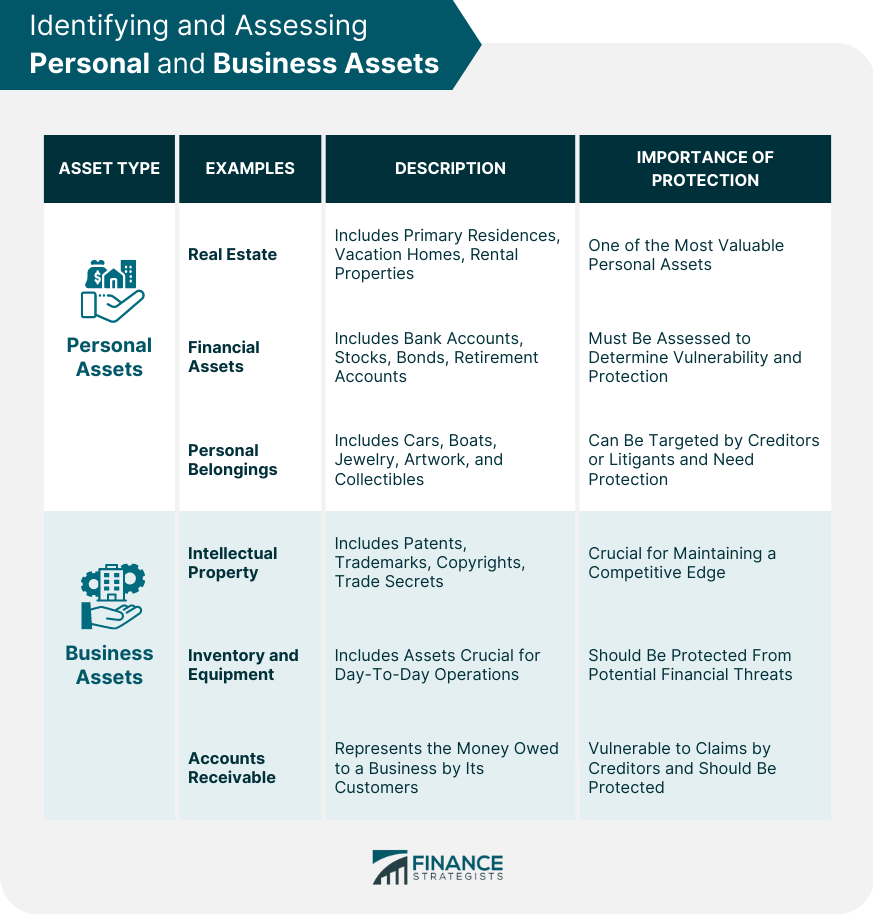

Identifying and Assessing Personal and Business Assets

Personal Assets

Real Estate

Financial Assets

Personal Belongings

Business Assets

Intellectual Property

Inventory and Equipment

Accounts Receivable

Assessing the Vulnerability of Assets

Legal Structures for Asset Protection

Corporations

C-Corporations

S-Corporations

Limited Liability Companies (LLCs)

Limited Partnerships (LPs)

Trusts

Revocable Living Trusts

Irrevocable Trusts

Asset Protection Trusts

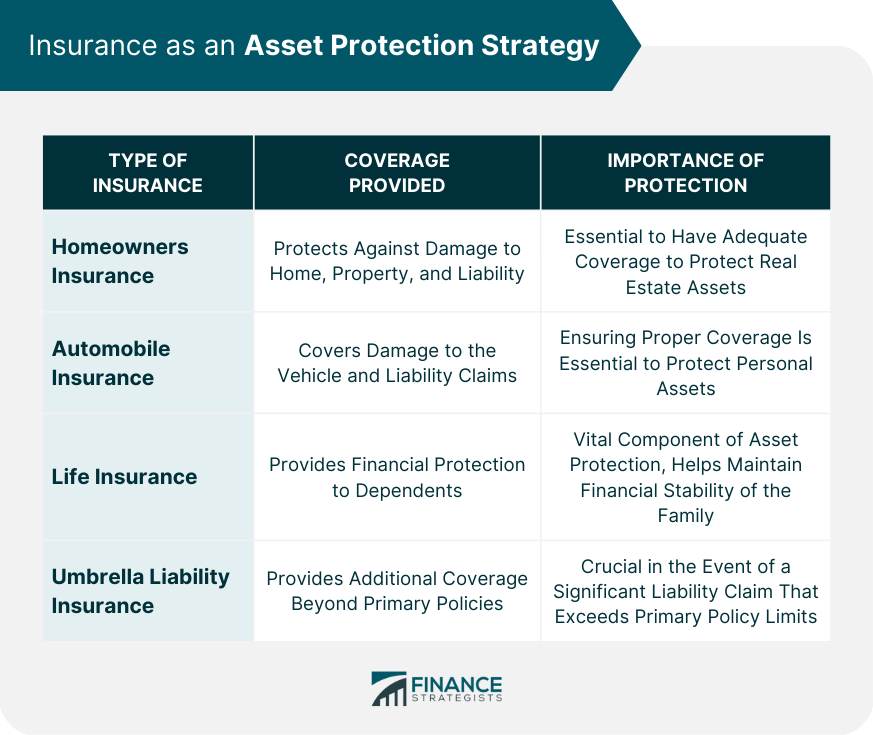

Insurance as an Asset Protection Strategy

Types of Insurance Coverage

Homeowners Insurance

Automobile Insurance

Life Insurance

Umbrella Liability Insurance

Assessing Insurance Needs and Coverage Limits

Importance of Regular Insurance Reviews

Offshore Asset Protection Strategies

Offshore Trusts

Offshore Banking

Offshore Investment Accounts

Pros and Cons of Offshore Strategies

Strategies for Minimizing Liability Exposure

Properly Maintaining and Managing Assets

Implementing Risk Management Practices

Regularly Reviewing and Updating Legal and Financial Documents

Engaging Professionals for Guidance

Estate Planning and Asset Protection

Wills and Probate

Trusts and Estate Planning

Gifting Assets to Family Members

Charitable Giving Strategies

Conclusion

Asset Protection Strategies FAQs

Asset protection strategies refer to legal techniques and practices that help individuals or businesses safeguard their assets from potential lawsuits, creditors, or other financial risks. These strategies may include setting up trusts, creating limited liability companies (LLCs), purchasing insurance, and using exemptions provided by state and federal laws.

Asset protection is important because it helps individuals and businesses to reduce their exposure to financial risks and potential loss of assets due to lawsuits or other liabilities. By implementing effective asset protection strategies, you can help protect your hard-earned assets and preserve your financial stability and security.

Some common asset protection strategies include establishing trusts, creating LLCs, purchasing liability insurance, using retirement accounts, and transferring assets to family members or other entities. It's important to work with a qualified attorney or financial advisor to determine the most effective asset protection strategies for your specific situation.

Not all asset protection strategies are legal. Some techniques that are designed solely to hide or shield assets from creditors or legal judgments may be considered fraudulent or illegal. It's important to work with a qualified attorney or financial advisor who can help you choose legal and effective asset protection strategies.

Asset protection strategies can benefit anyone who has assets that could be at risk from potential lawsuits, creditors, or other financial risks. This includes individuals, small business owners, real estate investors, medical professionals, and high net worth individuals. Implementing effective asset protection strategies can help to safeguard your assets and protect your financial future.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.