A Total Return Swap (TRS) is a type of swap agreement that allows one party to transfer the total return of a specific asset to another party. The total return is the combination of capital gains and income earned from holding an asset. In a TRS, the parties involved agree to exchange cash flows based on the overall return of an asset without transferring ownership of the asset itself. TRS's most common underlying assets are stocks, bonds, and indices. Need help with a Total Return Swap? Click here. The basic concept of a TRS is that one party, the receiver, pays the other party, the payer, a fixed or floating financing rate in exchange for the total return of an asset. The payer is typically a financial institution, such as a bank or a hedge fund. The receiver can be any type of investor, like a pension fund or a wealthy individual. The parties involved can be located in different countries and may have varied currencies. The exchange of cash flows in a TRS occurs periodically, such as monthly or quarterly, and is based on the total return of the underlying asset over the period. For example, if the stock index has a total return of 5% over a three-month period, the bank pays the pension fund 5% of the notional amount of the swap, and the pension fund pays the bank the financing rate. Total return swaps differ from other types of financial instruments, such as futures or options, because they do not involve a transfer of asset ownership. Instead, total return swaps are purely financial agreements that allow parties to benefit from the price movements of an asset without actually owning it. There are several requirements that must be met for a TRS to be entered into. It refers to the amount of the underlying asset that the swap is based on. Both parties must agree on the notional amount of the swap first. For example, if the notional amount of a TRS based on a stock index is $10 million, the cash flows exchanged will be based on the entire return of $10 million worth of the stock index. Secondly, the parties must agree on the total return leg, which is the variable component of the swap based on the underlying asset's total return. It can be based on the underlying stock, index, or bond's price appreciation, dividend payments, or interest payments. It compensates the payer for providing the total return exposure to the receiver. The parties must agree on the financing rate, which is the fixed or floating rate that is paid by the receiver to the payer in exchange for the total return leg. Finally, the parties must decide on the period of time over which the cash flows are exchanged. The duration of a total return swap can range from a few months to several years, depending on the investment objectives of the parties involved. Essentially, the parties involved exchange risks associated with an underlying asset. For example, if a TRS involves a stock index, the receiver of the swap is exposed to the price movements of the index, while the payer is exposed to the credit risk of the receiver. If the underlying asset is a bond, the receiver is exposed to the credit risk of the issuer, while the payer is exposed to the interest rate risk of the bond. Total return swaps can be used to hedge risks associated with an underlying asset, such as price or credit risk. For example, a hedge fund may enter into a TRS agreement with a bank to hedge its exposure to the credit risk of a bond issued by a company. By entering into a total return swap, the hedge fund can transfer the credit risk to the bank and receive a fixed or floating rate instead. Suppose a pension fund wants exposure to the absolute return of a stock index but does not want to hold the actual stocks. It enters into a TRS agreement with a bank, where the latter consents to pay the pension fund the full return of the stock index, and the pension fund compensates the bank with a fixed financing rate. Over a three-month period, the stock index has a total return of 5%. The bank pays the pension fund 5% of the notional amount of the swap, which is $10 million, or $500,000. The pension fund pays the bank the financing rate, which is 2%, or $200,000. At the end of the TRS duration, the swap is settled, and the pension fund receives $300,000 in total return minus the financing rate paid to the bank. In this example, the pension fund benefits from the total return of the stock index without actually owning the stocks, while the bank earns a profit from the financing rate paid by the pension fund. The TRS agreement allows both parties to achieve their investment objectives without actually buying or selling the underlying asset. Consider the following advantages of TRS: It refers to using borrowed funds to increase the potential return on an investment. In a total return swap, the receiver can gain exposure to the total return of an asset with a relatively small investment compared to buying the actual asset. TRS allows the receiver to potentially earn a higher return while minimizing the initial investment required. Total return swaps can provide a stable source of income for the receiver, as the fixed or floating financing rate is defined at the outset of the swap. TRS can be beneficial for investors who are looking for a steady stream of income without taking on the risks associated with owning an underlying stock, bond, or index. By entering into a total return swap, the receiver can transfer the risk associated with an underlying asset to the payer. This can be beneficial for investors who are looking to hedge their exposure to the price or credit risk associated with an asset. Additionally, total return swaps can be used to take short positions on an asset, where the receiver benefits from a decline in the price of the underlying asset. Discussed below are the disadvantages associated with TRS agreements. It refers to the risk that the other party in the swap agreement may renege on their obligations. If the payer in a total return swap defaults, the receiver may not get the total return of the underlying asset or may not receive the financing rate agreed upon. To mitigate counterparty risk, parties in a total return swap may require collateral or enter into credit agreements with each other. If the receiver of the total return swap defaults, the payer may be unable to collect the financing rate agreed upon or may have to sell the underlying asset at a loss. To lessen the risk of the receiver or fund's default, the payer may require the receiver to provide collateral or credit enhancement. It refers to the risk that changes in interest rates may affect the value of the swap. If interest rates increase, the financing rate paid by the receiver may increase, reducing the total return earned. To protect against this risk, parties in a total return swap may enter into interest rate swaps or other hedging strategies. Total return swaps are a type of financial instrument that allows parties to exchange cash flows based on the total return of an underlying asset without exchanging ownership of the asset itself. The notional amount, total return leg, agreement duration, and financing rate form the key requirements of a TRS agreement. Total return swaps can be used to gain exposure to an underlying asset, hedge risks associated with an asset, or take short positions on an asset. While total return swaps offer several benefits, such as leverage, stability, and risk mitigation, they also carry risks, such as counterparty risk, default risk, and interest rate risk. Parties involved in a total return swap should carefully evaluate the risks and benefits before entering into an agreement. Individual investors, banks, and other institutions should consult a qualified financial advisor who offers wealth management services for professional guidance.What Is a Total Return Swap?

How Total Return Swaps Work

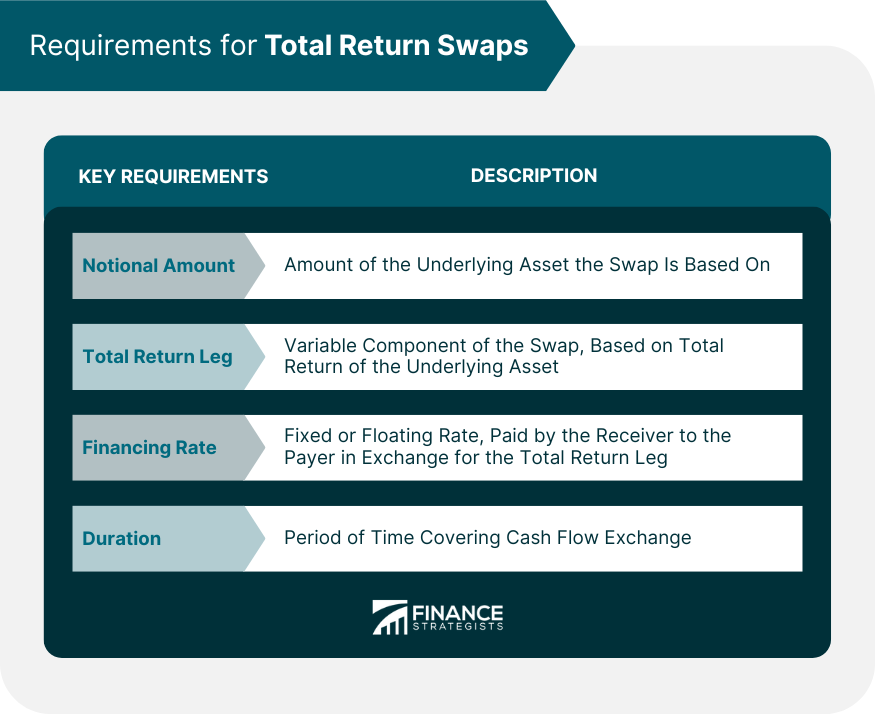

Requirements for Total Return Swaps

Notional Amount

Total Return Leg

Financing Rate

TRS Duration

Risk Exchange in a Total Returns Swap

Total Return Swap Example

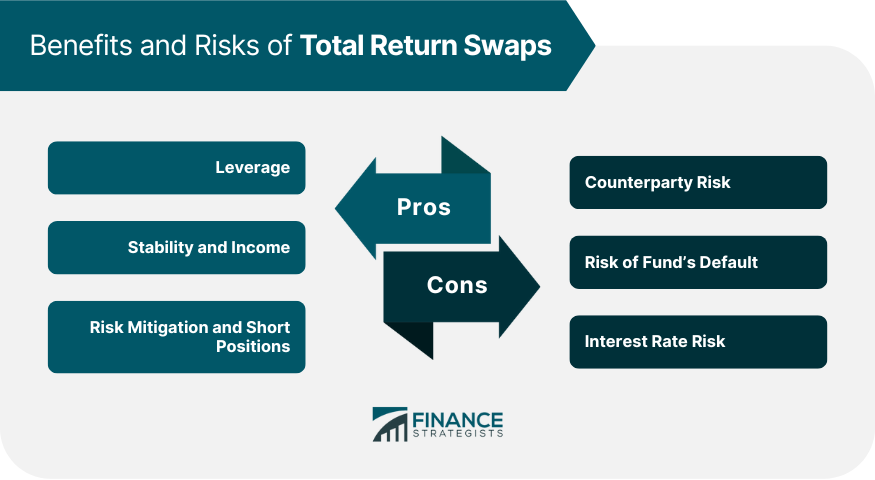

Benefits of Total Return Swap

Leverage

Stability and Income

Risk Mitigation and Short Positions

Risk of Total Return Swap

Counterparty Risk

Risk of Fund’s Default

Interest Rate Risk

Final Thoughts

Total Return Swap (TRS) FAQs

A Total Return Swap (TRS) is a financial instrument that allows parties to exchange cash flows based on the total return of an underlying asset without exchanging ownership of the asset itself.

Financial institutions such as banks or hedge funds usually participate as the payer, while investors such as pension funds or wealthy individuals participate as the receiver.

Various assets can be used in a Total Return Swap, including stocks, bonds, and indices.

Some potential risks associated with Total Return Swaps include counterparty risk, default risk, and interest rate risk.

The benefits of Total Return Swaps include leverage, stability, risk mitigation, and the ability to take short positions on an asset.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.