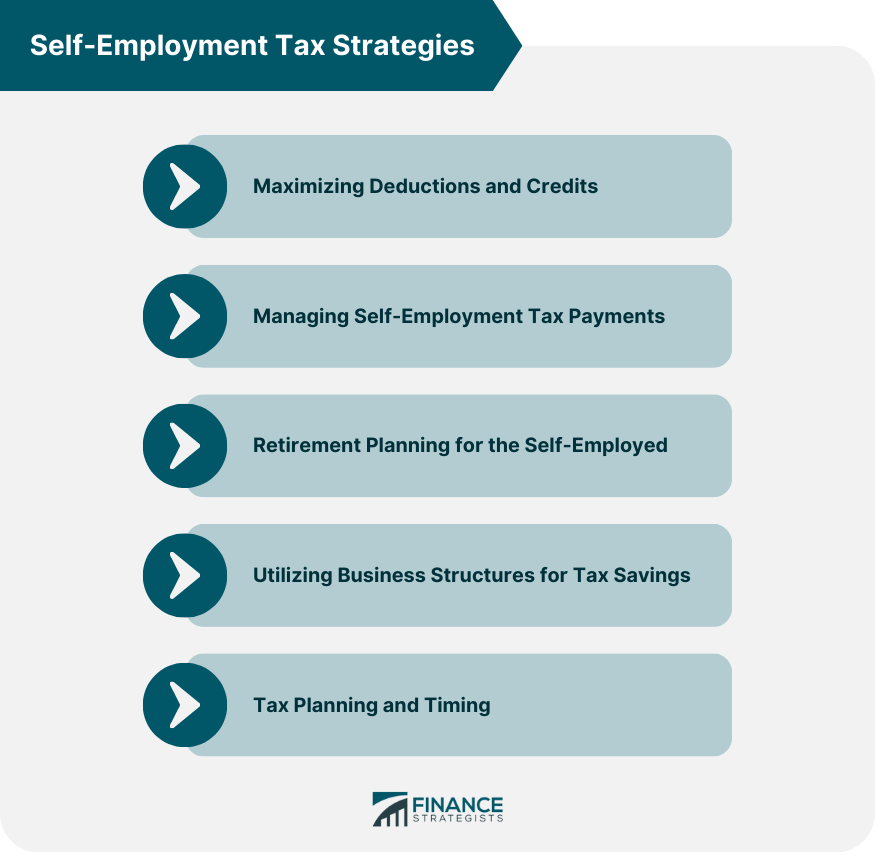

Self-employment tax strategies refer to various approaches that self-employed individuals can utilize to minimize their tax liability and optimize their financial situation. These strategies aim to take advantage of deductions, credits, and exemptions available specifically to self-employed individuals. For example, one key strategy is maximizing deductible business expenses. Self-employed individuals can deduct expenses directly related to their business operations, such as office supplies, equipment, advertising, and professional fees. Keeping accurate records of these expenses is crucial for claiming deductions. Additionally, utilizing retirement plans designed for self-employed individuals, such as SEP-IRAs or Solo 401(k)s, allows for tax-deferred contributions and potential tax savings. These plans offer a means to save for retirement while reducing taxable income. Another strategy is properly categorizing workers as either employees or independent contractors, ensuring compliance with tax regulations and avoiding misclassification penalties. Self-employed individuals can also consider income timing, deferring or accelerating income based on their projected tax liability for the year. Consulting with a tax professional is advisable when implementing self-employment tax strategies to ensure compliance with tax laws and maximize potential benefits. Self-employed individuals can deduct a wide range of business expenses from their taxable income, reducing their overall tax liability. Common business expenses include advertising, supplies, utilities, rent, and professional fees. To be eligible for a deduction, an expense must be both ordinary and necessary for the business. To maximize deductions, it is crucial for self-employed individuals to identify all eligible business expenses and maintain accurate records. Proper documentation and organization can help ensure that no deductions are overlooked and that the individual is prepared in case of an audit. For self-employed individuals who work from home, the home office deduction can provide significant tax savings. To qualify for this deduction, a portion of the home must be used exclusively and regularly for business purposes. The deduction can be calculated using either the simplified method or the regular method, which considers actual expenses related to the home office. By taking advantage of the home office deduction, self-employed individuals can lower their taxable income and reduce their self-employment tax liability. It is essential to understand the requirements and calculation methods for this deduction to ensure compliance with tax laws and maximize potential savings. In addition to common business expenses, self-employed individuals may be eligible for other business-related deductions. These can include costs associated with business travel, meals, and entertainment, as well as expenses related to employee benefits, retirement plans, and insurance. Understanding and taking advantage of these business-related deductions can further reduce taxable income and self-employment tax liability. Proper recordkeeping and documentation are crucial to ensure eligibility for these deductions and to be prepared for potential audits. Tax credits are another way for self-employed individuals to reduce their tax liability. Unlike deductions, which lower taxable income, tax credits directly reduce the amount of tax owed. Some common tax credits available to self-employed individuals include the Earned Income Tax Credit, the Child and Dependent Care Credit, and the Small Business Health Care Tax Credit. To maximize tax savings, self-employed individuals should explore and claim all available tax credits for which they are eligible. Keeping accurate records and documentation related to eligible expenses and activities can help ensure compliance with tax laws and support claims for tax credits. Unlike traditional employees, self-employed individuals do not have taxes withheld from their paychecks. Instead, they are required to make estimated tax payments throughout the year to cover their self-employment tax liability. Estimated tax payments are due quarterly and are calculated based on the individual's expected income and deductions for the year. Understanding the requirement to make estimated tax payments is essential for self-employed individuals to ensure compliance with tax laws and avoid penalties for underpayment or late payment of taxes. To calculate estimated tax payments, self-employed individuals can use Form 1040-ES, which includes a worksheet to determine the amount of each payment. The calculation takes into account the individual's expected income, deductions, and credits for the year, as well as the self-employment tax rate. Submitting estimated tax payments on time and in the correct amount is crucial to avoid penalties and interest. Payments can be made electronically or by mail and must be submitted by the due dates specified by the IRS. Underpayment penalties can be assessed if a self-employed individual does not pay enough in estimated taxes throughout the year. To avoid these penalties, individuals must pay at least 90% of their current year's tax liability or 100% of the prior year's tax liability, whichever is smaller. Monitoring income and expenses throughout the year can help self-employed individuals adjust their estimated tax payments as needed to ensure they meet the minimum payment requirements and avoid underpayment penalties. Retirement planning is an essential aspect of financial planning for self-employed individuals. Several retirement plan options are available for the self-employed, including Simplified Employee Pension (SEP) plans, Savings Incentive Match Plan for Employees (SIMPLE) IRAs, solo 401(k) plans, and traditional or Roth IRAs. Understanding the various retirement plan options and their features can help self-employed individuals choose the best plan for their needs and maximize their retirement savings. Contributing to retirement plans offers several benefits for self-employed individuals. In addition to providing a means of saving for retirement, contributions to retirement plans can also reduce taxable income, resulting in lower self-employment tax liability. Maximizing contributions to retirement plans can help self-employed individuals achieve their long-term financial goals while also providing immediate tax benefits. Each retirement plan option has its unique features, benefits, and limitations. To select the right plan for their needs, self-employed individuals should consider factors such as contribution limits, tax treatment of contributions and distributions, and administrative requirements. By evaluating and selecting the most appropriate retirement plan, self-employed individuals can optimize their retirement savings and tax strategies. The choice of business structure can have a significant impact on the tax liability of self-employed individuals. Common business structures for the self-employed include sole proprietorships, limited liability companies (LLCs), S corporations and C corporations. Each of these structures has its tax implications, and understanding the differences can help self-employed individuals choose the best structure for their needs and tax situation. Sole proprietorships and LLCs are the simplest business structures and offer pass-through taxation, meaning that business income is reported on the owner's individual tax return. While these structures provide simplicity and flexibility, they do not offer the potential tax savings available through S and C corporations. S corporations also offer pass-through taxation but allow for salary and dividend distributions, which can reduce self-employment tax liability. However, S corporations have more administrative requirements and restrictions on ownership. C corporations are separate legal entities that pay taxes at the corporate level, potentially reducing tax liability for the owner. However, C corporations can also result in double taxation if profits are distributed as dividends. Evaluating the pros and cons of each business structure can help self-employed individuals make an informed decision that aligns with their tax strategy and business goals. Pass-through taxation is a feature of sole proprietorships, LLCs, and S corporations. Under this tax treatment, business income is not taxed at the business level; instead, it "passes through" to the owner's individual tax return, where it is subject to income and self-employment taxes. Understanding pass-through taxation is essential for self-employed individuals to make informed decisions about their business structure and tax strategies. Strategic timing of income and expenses can help self-employed individuals manage their tax liability. By deferring income or accelerating expenses, individuals can reduce their taxable income in a given year, potentially lowering their tax bracket and overall tax liability. To effectively use timing strategies, self-employed individuals must closely monitor their income and expenses and be aware of the tax implications of their financial decisions. Tax deferral strategies can help self-employed individuals reduce their current tax liability by postponing the recognition of income or accelerating deductions. Examples of tax deferral strategies include using retirement accounts, employing the accrual method of accounting, and strategically timing the purchase of equipment or other depreciable assets. Implementing tax deferral strategies can provide immediate tax savings while allowing for future growth and financial planning. Self-employment tax rates are progressive, meaning that higher levels of income are subject to higher tax rates. By managing their taxable income, self-employed individuals can potentially reduce their overall tax liability by staying within lower tax brackets. Careful planning and monitoring of income and expenses can help self-employed individuals optimize their tax bracket and minimize their tax liability. Self-employment tax strategies encompass various approaches to minimize tax liability and optimize financial outcomes for self-employed individuals. These strategies involve maximizing deductible business expenses, utilizing retirement plans, proper worker classification, income timing, and engaging in tax planning. By identifying eligible business expenses, utilizing home office deductions, taking advantage of business-related deductions, exploring available tax credits, and managing self-employment tax payments, individuals can reduce their overall tax burden. Additionally, retirement planning, selecting the right business structure, employing tax deferral strategies, managing tax brackets, and ensuring compliance through accurate recordkeeping and documentation are crucial elements of effective self-employment tax strategies. Overview of Self-Employment Tax Strategies

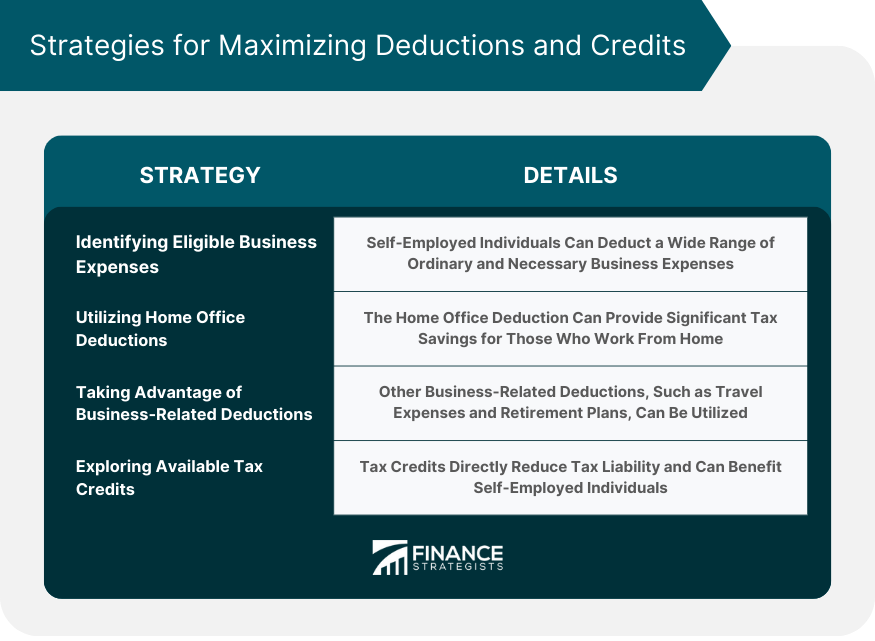

Maximizing Deductions and Credits

Identifying Eligible Business Expenses

Utilizing Home Office Deductions

Taking Advantage of Business-Related Deductions

Exploring Available Tax Credits

Managing Self-Employment Tax Payments

Understanding Estimated Tax Payments

Calculating and Submitting Estimated Tax Payments

Avoiding Underpayment Penalties

Retirement Planning for the Self-Employed

Overview of Retirement Plan Options

Benefits of Contributing to Retirement Plans

Evaluating and Selecting the Right Retirement Plan

Utilizing Business Structures for Tax Savings

Comparison of Different Business Structures

Pros and Cons of Sole Proprietorship, LLC, S Corporation, and C Corporation

Understanding Pass-Through Taxation

Tax Planning and Timing

Timing Income and Expenses Strategically

Utilizing Tax Deferral Strategies

Managing Self-Employment Tax Brackets

Conclusion

Self-Employment Tax Strategies FAQs

Self-Employment Tax Strategies refer to approaches that self-employed individuals can use to minimize tax liability and optimize their financial situation.

Proper worker classification ensures compliance with tax regulations and helps avoid misclassification penalties. It is essential to correctly categorize workers as employees or independent contractors.

Self-employed individuals can strategically defer or accelerate income based on their projected tax liability for the year. Timing income can help optimize tax planning and potentially reduce overall tax liability.

Common examples of self-employment tax strategies include maximizing deductible business expenses, utilizing retirement plans for self-employed individuals, proper worker classification, income timing, and engaging in tax planning to optimize deductions and credits available to self-employed individuals.

A tax professional can offer guidance on identifying and claiming eligible tax deductions, managing estimated tax payments, selecting and setting up retirement plans, and navigating tax law changes.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.