An accredited tax preparer is a professional who has met the education, training, and experience requirements necessary to obtain certification from an accredited organization, such as the Internal Revenue Service (IRS) or the National Association of Tax Professionals (NATP). Accredited tax preparers have demonstrated their knowledge and expertise in tax laws, regulations, and procedures. They are authorized to prepare tax returns and provide related tax services to individuals and businesses. Tax preparation can be a daunting task for many individuals and businesses, especially regarding the complexity of the tax code and the potential for errors or non-compliance. Hiring an accredited tax preparer can provide peace of mind and save time, money, and potential legal issues. There are several advantages to using an accredited tax preparer to handle tax preparation and related services. Some of the most significant benefits include: These professionals have the knowledge and expertise necessary to prepare tax returns meticulously, ensuring that individuals and businesses receive the maximum allowable deductions and credits while minimizing the chances of errors and penalties. Tax laws and regulations are constantly changing, and an accredited tax preparer is up-to-date with the latest tax codes and requirements. Noncompliance can result in legal and financial issues, and an accredited tax preparer ensures that individuals and businesses adhere to these laws and regulations. Accredited tax preparers have extensive knowledge and training in tax laws, regulations, and procedures. They can provide valuable advice on tax planning, investment strategies, and other financial matters to save individuals and businesses money in the long run. Tax preparation can be tedious and complicated, particularly for businesses with multiple tax obligations. Hiring an accredited tax preparer allows individuals and businesses to focus on their core competencies while ensuring their tax obligations are handled correctly and efficiently. Accredited tax preparers can represent individuals and businesses during IRS audits, providing support and guidance throughout the process. It can be especially valuable for those who may not have the time or expertise to handle an audit independently. Accredited tax preparers can assist with tax issues and disputes, including tax debt relief, payment plans, and negotiations with the IRS. It can be particularly helpful for those who may be struggling with tax debt or other tax-related issues. To become an accredited tax preparer, individuals complete educational and training requirements and undergo certification and accreditation processes. They also continuously educate themselves and build on their knowledge through experience. To qualify for the ATP designation, candidates must have a minimum educational background of a high school diploma or GED. However, the Accreditation Council for Accountancy and Taxation (ACAT) encourages candidates to possess a higher level of education, such as a bachelor's degree in accounting, finance, or a related field. This is because a strong educational foundation is essential for understanding complex tax concepts and regulations. In addition to formal education, candidates must also complete a qualifying tax course. These courses can be taken through community colleges, universities, or approved tax education providers. The course should cover various aspects of tax preparation, including individual income tax, business tax, and tax law. Before becoming an ATP, candidates must have at least three years of relevant work experience in tax preparation. This experience should include preparing various tax returns, such as individual income, business, and payroll tax returns. Many tax preparers also have experience working in related fields, such as bookkeeping or financial planning. One crucial step in the certification process is successfully passing the ATP exam, which is conducted twice a year at designated testing centers nationwide. The exam evaluates candidates' ability to accurately analyze tax-related scenarios and apply the appropriate tax rules and regulations. Furthermore, many accrediting organizations require tax preparers to adhere to a code of ethics and undergo background checks. Learning never stops for accredited tax preparers. They participate in ongoing training and education to maintain their certification and accreditation. It ensures that these professionals remain up-to-date with the latest tax codes and regulations. To apply for an Accredited Tax Preparer designation, you need to go through several steps. First, register with the ACAT, the organization responsible for administering the ATP exam. Next, gather the necessary documentation, including proof of education and experience in tax preparation. Once you have everything ready, submit your completed application and required documents to the ACAT for review. Be sure to pay the application and examination fees, which can vary depending on your professional membership status and other factors. It's crucial to ensure that all the information you provide is complete and accurate to avoid any delays in the approval process. After submitting your application, you'll need to wait for the ACAT to review and approve it, a process that typically takes around four to six weeks. Once approved, you will receive authorization to take the ATP exam and can schedule your examination at a designated testing center. Following these steps will set you on the path to becoming an Accredited Tax Preparer (ATP) and advancing your career in tax preparation. The ATP exam assesses candidates' knowledge and skills in the following content areas: Individual Income Tax: Covers topics such as filing status, exemptions, deductions, credits, and tax calculations for individual taxpayers. Business Tax: Includes concepts related to taxation of sole proprietorships, partnerships, corporations, and other business entities. Payroll tax: Addresses payroll tax concepts, such as withholding, reporting, and depositing requirements for employers. Tax Law and Regulations: Tests candidates' understanding of federal tax laws, regulations, and court rulings that impact tax preparation. Ethics and Professional Responsibility: Assesses candidates' knowledge of ethical standards, professional conduct, and client confidentiality in the tax preparation industry. The ATP exam is a computer-based test consisting of multiple-choice questions, essay questions, and case studies. The multiple-choice questions assess candidates' understanding of fundamental tax concepts and regulations. In contrast, the essay questions and case studies require candidates to apply their knowledge to real-world tax scenarios. To pass the ATP exam, candidates must achieve a minimum score of 75%. The exam is scored on a scaled basis, with each section weighted according to its importance. Candidates who still need to achieve the minimum passing score may retake the exam after a specified waiting period in accordance with ACAT guidelines. Several resources are available to help candidates prepare for the ATP exam. The ACAT provides a comprehensive study guide that covers the key content areas tested on the exam. Additionally, candidates can access various textbooks, online courses, and practice exams from approved education providers. Candidates must review the exam content outline and familiarize themselves with the relevant tax laws, regulations, and best practices. By utilizing a combination of study materials and resources, candidates can increase their chances of passing the ATP exam on their first attempt. To maximize their chances of success, candidates should develop a structured study plan that allocates sufficient time for each content area. Some recommended study strategies include: Setting specific study goals and deadlines to maintain focus and motivation. Creating a study schedule that balances work, personal commitments, and exam preparation. Actively engaging with the material by taking notes, highlighting key concepts, and discussing topics with peers or mentors. Regularly reviewing previously studied material to reinforce knowledge and understanding. Practicing with sample questions and mock exams to identify areas that require further study. To maintain their ATP designation, professionals must complete several continuing education hours annually. This requirement ensures that ATPs stay current with tax laws, regulations, and best practice changes. Continuing education courses must be taken through ACAT-approved providers and should cover relevant tax topics. ATP professionals must renew their credentials periodically, typically every three years. The renewal process involves submitting documentation of completed continuing education hours and paying a renewal fee to the ACAT. Failure to meet the renewal requirements may result in the suspension or revocation of the ATP credential. Consider the following: It is their primary expertise. They prepare tax returns for individuals and businesses, ensuring such filing requirements are complied with accurately and on time. These include federal and state tax returns, as well as specialty returns such as estate taxes and trust returns. Accredited tax preparers can provide valuable advice on tax planning as well as long and short-term investment strategies, helping individuals and businesses minimize their tax liability and maximize their deductions and credits. If the IRS audits an individual or business, an accredited tax preparer can represent them during the whole process. It can include gathering the necessary documentation and communicating with the IRS on the client's behalf. With their expert knowledge and experience in handling various tax personal and business tax returns, they can provide support and guidance throughout the audit process. Suppose an individual or business disagrees with an IRS decision. In that case, an accredited tax preparer can represent them during the appeals process, including preparing an appeal, presenting evidence and arguments, and negotiating a resolution. Accredited tax preparers can also help individuals and businesses work with the IRS to set up payment plans, negotiate lower tax payments, and help clients avoid wage garnishments or bank levies. You can get in touch with accredited tax preparers through online directories, referrals, state regulatory agencies, and contacting professional organizations. You must verify the credentials of potential tax preparers and meet up with them before hiring their services. You may check the IRS Directory of Federal Tax Return Preparers. The directory allows you to search for tax return preparers authorized to prepare federal tax returns. It provides information on the preparer's credentials, location, and areas of expertise. Note that this directory only includes preparers who have voluntarily submitted their information to the IRS, so not all preparers may be listed. Some states require tax preparers to obtain a state-specific license or certification. Contacting your state’s regulatory agencies can provide a list of licensed or certified tax preparers in your area. The National Association of Tax Professionals, the National Society of Accountants (NSA), and the American Institute of Certified Public Accountants (AICPA) maintain directories of tax professionals, including accredited tax preparers. These organizations have strict standards for their members, so using their directories can ensure that you are working with a qualified expert. Recommendations from friends and family can be an excellent way to find an accredited tax preparer. Ask people you trust if they have hired a tax preparer they would recommend. Word-of-mouth recommendations can help you find an accredited tax preparer with a track record of providing quality services. It is essential to do a background check on potential tax preparers before hiring them. It can be done by verifying their certification with the accrediting organization or by checking with the state regulatory agency. Tax preparers should be able to provide documentary and other proof of their accreditation and certification. It is recommended to meet with potential tax preparers before hiring them. This meeting can provide an opportunity to assess the tax preparer's communication skills and overall professionalism. It is also a chance to ask questions about their qualifications, experience, and fees. Hiring an accredited tax preparer can provide numerous benefits for individuals and businesses, including accuracy in tax preparation, compliance with tax laws and regulations, access to expertise and knowledge, and time savings. Accredited tax preparers have extensive education, training, and experience, as well as undergo continuing education. Accredited tax preparers can provide a wide range of services, including tax preparation, tax planning, and advice, representation during IRS audits, and assistance with tax issues and disputes. Finding an accredited tax preparer can be done through online directories, state regulatory agencies, professional organizations, and referrals from friends and family. Remember to check the credentials and accreditation status and meet with potential tax preparers before hiring. It is important to choose an accredited professional that offers quality tax services to ensure that your obligations are handled correctly and efficiently.What Is an Accredited Tax Preparer?

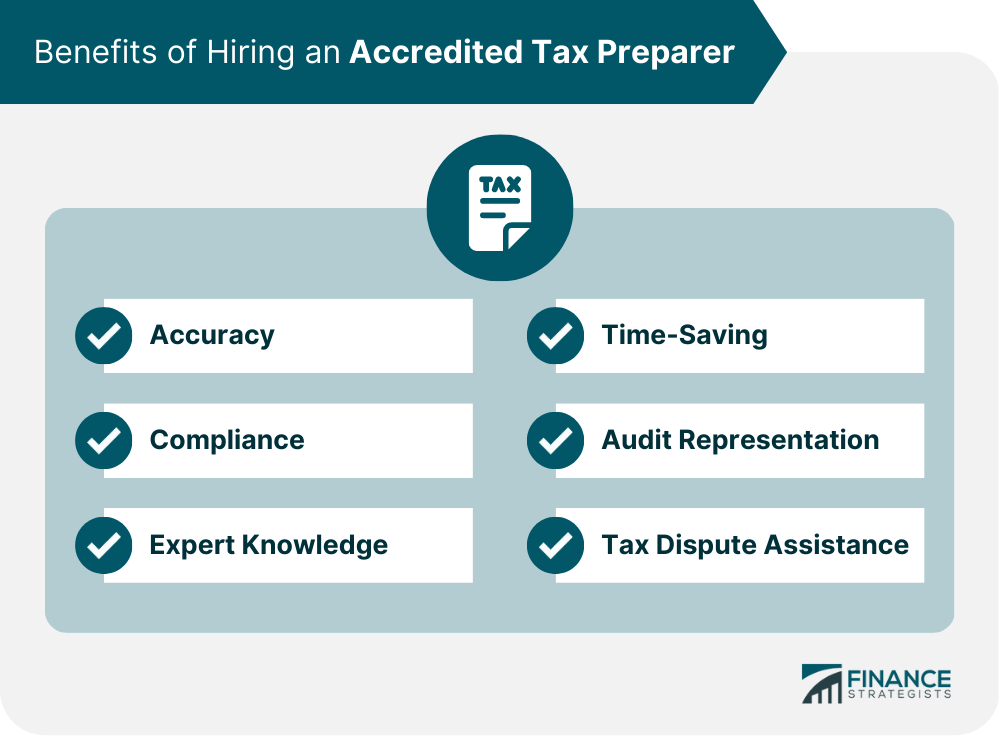

Benefits of Hiring an Accredited Tax Preparer

Accuracy

Compliance

Expert Knowledge

Time-Saving

Audit Representation

Tax Dispute Assistance

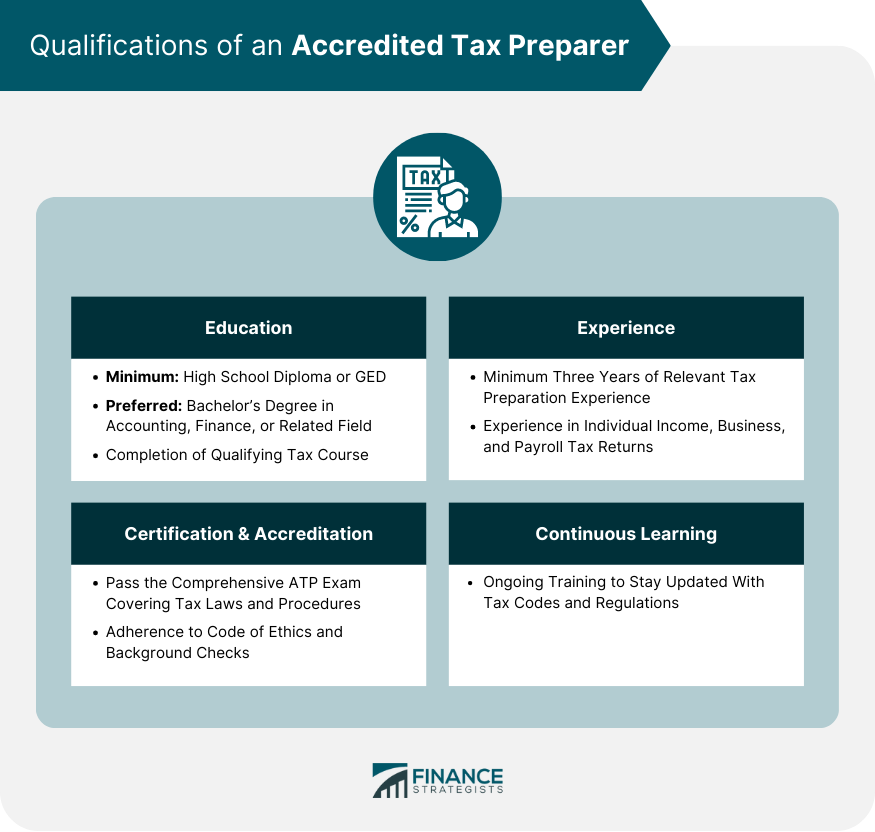

Qualifications of an Accredited Tax Preparer

Education

Experience

Certification and Accreditation

The ATP exam serves as a comprehensive assessment of an individual's knowledge and understanding of tax laws, regulations, and procedures. It covers a wide range of topics, including federal tax filing requirements, deductions, credits, and various tax forms. Continuous Learning

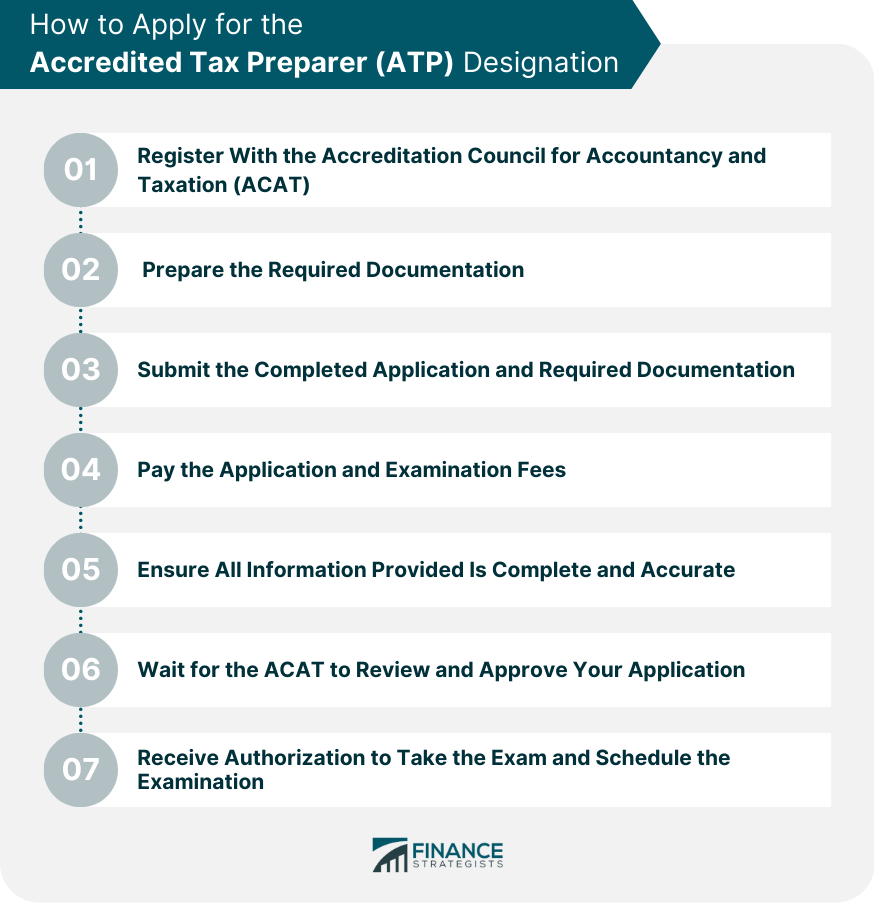

ATP Application Process

ATP Exam

Exam Content Areas

Exam Format

Scoring and Passing Criteria

Preparing for the ATP Exam

Study Materials and Resources

Recommended Study Strategies

Maintaining the ATP Credential

Continuing Education Requirements

Renewal Process

Services Offered by an Accredited Tax Preparer

Tax Preparation for Individuals and Businesses

Tax Planning and Advice

Representation During IRS Audits

Assistance With Tax Issues and Disputes

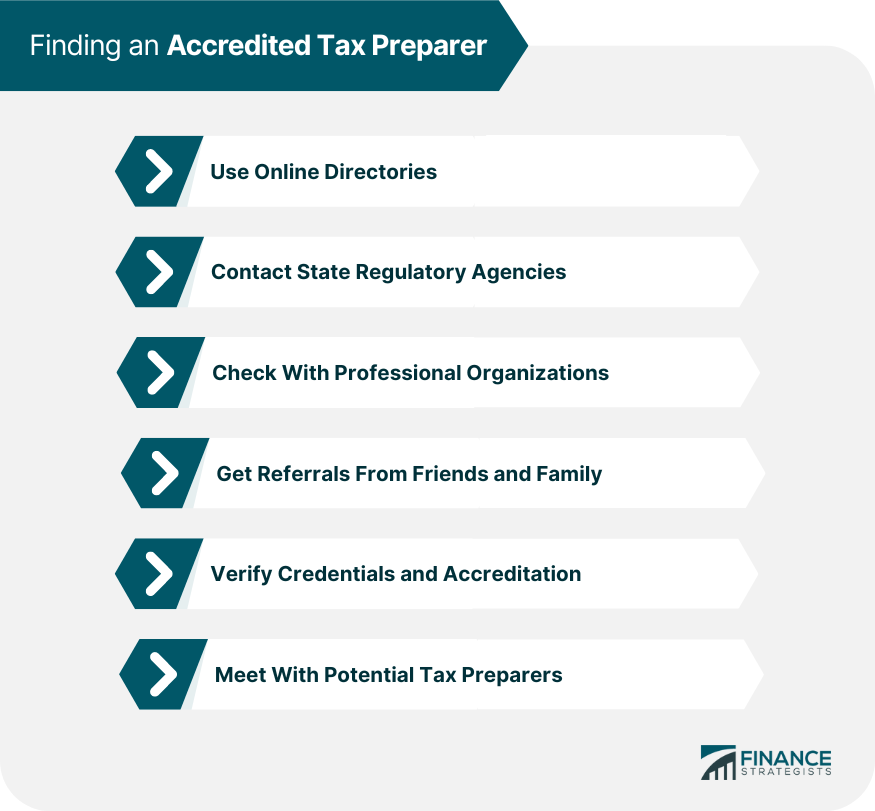

Finding an Accredited Tax Preparer

Use Online Directories

Contact State Regulatory Agencies

Check With Professional Organizations

Get Referrals from Friends and Family

Verify Credentials and Accreditation

Meet With Potential Tax Preparers

Final Thoughts

Accredited Tax Preparer FAQs

An accredited tax preparer is a tax professional who has met specific education, training, and experience requirements and obtained certification or accreditation from an accredited organization such as the Internal Revenue Service (IRS) or the National Association of Tax Professionals (NATP). Accredited tax preparers have demonstrated knowledge and expertise in tax laws, regulations, and procedures.

Using an accredited tax preparer can provide numerous benefits, including accuracy in tax preparation, compliance with tax laws and regulations, access to expertise and knowledge, time-saving for individuals and businesses, representation during IRS audits, and assistance with tax issues and disputes.

To become an accredited tax preparer, individuals must typically complete a basic tax preparation course, have extensive training and experience in tax preparation, pass a rigorous examination that tests their knowledge of tax laws and procedures, and participate in ongoing training and education to maintain their certification and accreditation.

Accredited tax preparers offer a wide range of tax-related services, including tax preparation for individuals and businesses, tax planning and advice, representation during IRS audits, assistance with tax issues and disputes, and more. They can also provide advice on tax planning, investment strategies, and other financial matters that can help individuals and businesses minimize their tax liability and avoid future tax issues.

There are several ways to find an accredited tax preparer, including using online directories, getting referrals from friends and family, checking with state regulatory agencies, checking with professional organizations such as the NATP or AICPA, verifying credentials and accreditation, and meeting with potential tax preparers before hiring.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.