The Foreign Housing Exclusion (FHE) is a tax provision that allows U.S. citizens and resident aliens working abroad to exclude certain housing expenses from their taxable income. This provision aims to alleviate the financial burden of maintaining a residence in a foreign country while earning income abroad. The main purpose of the FHE is to provide tax relief to U.S. citizens and resident aliens who incur housing expenses while living and working in a foreign country. By excluding these expenses from taxable income, taxpayers can potentially save a significant amount of money on their U.S. income tax liability. To qualify for the FHE, taxpayers must meet specific eligibility requirements, including having U.S. citizen or resident alien status, a tax home in a foreign country, and earned income from foreign sources. Additionally, taxpayers must pass either the Bona Fide Residence Test or the Physical Presence Test. To claim the FHE, taxpayers must be either a U.S. citizen or a resident alien of the United States. Nonresident aliens are not eligible for this exclusion. Taxpayers must meet either the Bona Fide Residence Test or the Physical Presence Test to qualify for the FHE. The Bona Fide Residence Test requires taxpayers to establish a genuine residence in a foreign country for an uninterrupted period that includes an entire tax year. The Physical Presence Test requires taxpayers to be physically present in a foreign country for at least 330 full days during a consecutive 12-month period. To qualify for the FHE, taxpayers must have their tax home in a foreign country. A tax home is defined as the general area of an individual's main place of business, employment, or post of duty, regardless of the location of their family home. The FHE can only be applied to earned income from foreign sources, such as wages, salaries, professional fees, or self-employment income. It does not apply to passive income, such as interest, dividends, or capital gains. Taxpayers can exclude qualifying housing expenses from their taxable income. These expenses include: Rent and utilities: The cost of rent, as well as reasonable utility expenses, such as electricity, gas, water, and heat. Repairs and maintenance: Expenses related to the maintenance and repair of the taxpayer's residence. Property and liability insurance: The cost of insurance coverage for the taxpayer's residence and its contents. Nonrefundable security deposits: Nonrefundable deposits paid to secure a lease on a foreign residence. There are limitations on the amount of housing expenses that can be excluded: Base housing amount: The exclusion is limited to the excess of housing expenses over a "base housing amount," which is a percentage of the foreign earned income exclusion. Foreign Earned Income Exclusion impact: The maximum housing exclusion is also impacted by the Foreign Earned Income Exclusion (FEIE), as the FHE cannot exceed the taxpayer's foreign earned income minus the FEIE. To illustrate the calculation of the FHE, consider the following example: A taxpayer has $100,000 in foreign earned income and qualifies for both the FEIE and FHE. The taxpayer claims the maximum FEIE of $126,500 (for 2024), resulting in $0 of taxable foreign earned income. The taxpayer has $22,500 in qualifying housing expenses. The base housing amount for 2024 is 16% of the FEIE maximum ($126,500 x 0.16 = $20,240). The taxpayer's housing expenses exceed the base housing amount by $2,260 ($22,500 - $20,240). The taxpayer can exclude the $2,400 excess from their taxable income using the FHE. To claim the FHE, taxpayers must file either Form 2555 (Foreign Earned Income) or Form 2555-EZ (Foreign Earned Income Exclusion). Form 2555-EZ is a simplified version of Form 2555 and can be used by taxpayers who meet specific eligibility criteria. Both forms require taxpayers to provide detailed information about their foreign earned income and housing expenses. When claiming the FHE, taxpayers should be prepared to provide documentation to support their housing expenses, such as rental agreements, utility bills, and receipts for repairs and maintenance. Keeping thorough records can help ensure a smoother process when filing tax returns. Taxpayers must report the FHE on their individual income tax return (Form 1040 or Form 1040-SR) and include the amount of housing expenses excluded on the appropriate line. This will reduce their taxable income and ultimately lower their U.S. income tax liability. While the FHE allows taxpayers to exclude qualifying housing expenses from their taxable income, self-employed individuals can claim a foreign housing deduction instead. The deduction reduces the taxpayer's taxable income, while the exclusion directly removes qualifying housing expenses from the income subject to tax. To qualify for the foreign housing deduction, self-employed individuals must meet the same eligibility criteria as those claiming the FHE. This includes having U.S. citizen or resident alien status, a tax home in a foreign country, and earned income from foreign sources. The calculation for the foreign housing deduction is similar to that of the FHE. Self-employed taxpayers must determine their qualifying housing expenses, apply the base housing amount limitation, and consider the impact of the FEIE on their deduction. The foreign housing deduction is claimed on Schedule C (Profit or Loss from Business) of the individual income tax return. Navigating the complexities of the FHE can be challenging for taxpayers. It is advisable to consult with a tax professional who has expertise in international taxation to ensure compliance with U.S. tax laws and to maximize tax savings. Taxpayers should keep detailed records of all housing expenses, including rent receipts, utility bills, and repair invoices. Maintaining organized records can help simplify the process of claiming the FHE and provide documentation in case of an IRS audit. Tax laws and exclusion limits may change from year to year. Staying informed about these changes can help taxpayers make the most of the FHE and ensure they are compliant with current tax regulations. The Foreign Housing Exclusion is a valuable tax provision for U.S. citizens and resident aliens working abroad. By understanding the eligibility requirements, calculating the exclusion amount, and properly claiming the FHE on their tax return, taxpayers can potentially save a significant amount of money on their U.S. income tax liability. As tax laws and exclusion limits may change, it is essential to stay informed and consult with a tax professional to ensure compliance and maximize tax savings. The FHE, along with other provisions like the Foreign Earned Income Exclusion, can help U.S. citizens working abroad minimize their tax burden and make the most of their international work experience. Navigating the complexities of international taxation can be challenging, but with the help of a tax professional and careful record-keeping, taxpayers can take full advantage of the benefits offered by the Foreign Housing Exclusion.Definition of the Foreign Housing Exclusion

Purpose and Benefits for US Citizens Working Abroad

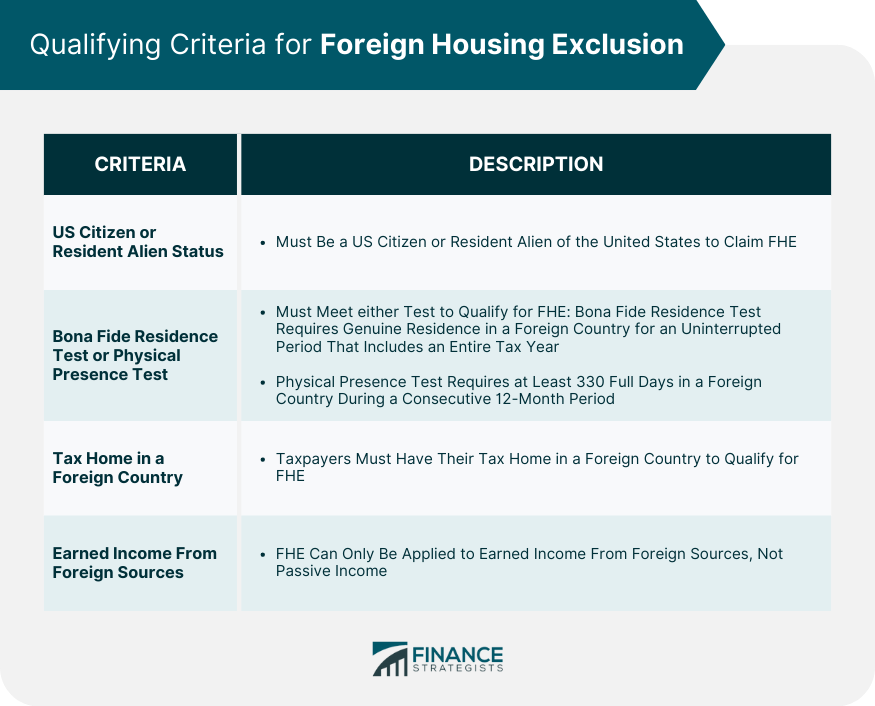

Eligibility Requirements

Qualifying for Foreign Housing Exclusion

US Citizen or Resident Alien Status

Bona Fide Residence Test or Physical Presence Test

Tax Home in a Foreign Country

Earned Income From Foreign Sources

Calculating Foreign Housing Exclusion

Qualifying Housing Expenses

Limitations on Exclusion

Example Calculations

Claiming Foreign Housing Exclusion

Filing Form 2555 or Form 2555-EZ

Providing Necessary Documentation

Reporting Exclusion on Individual Income Tax Return

Foreign Housing Deduction for Self-Employed Individuals

Differences Between Exclusion and Deduction

Qualifying Criteria for Deduction

Calculating and Claiming the Deduction

Tips and Best Practices

Consulting With a Tax Professional

Keeping Thorough Records of Housing Expenses

Monitoring Changes in Tax Laws and Exclusion Limits

Conclusion

Foreign Housing Exclusion FAQs

The Foreign Housing Exclusion (FHE) is a tax benefit that allows eligible taxpayers to exclude certain foreign housing expenses from their taxable income.

US citizens, resident aliens, and qualifying nonresident aliens who have foreign earned income and meet either the bona fide residence or physical presence test may be eligible for the FHE.

Qualifying expenses include rent, utilities, and other reasonable expenses related to housing in a foreign country. However, the expenses must exceed a base amount calculated by the IRS.

The maximum amount of the FHE is based on the foreign earned income exclusion and varies depending on the location and duration of the taxpayer's stay in a foreign country. The exclusion is calculated by subtracting the base amount from the eligible foreign housing expenses.

The Foreign Housing Exclusion is a separate benefit from the Foreign Earned Income Exclusion, and both can be claimed by eligible taxpayers. While the FEIE excludes foreign earned income from taxable income, the FHE excludes certain housing expenses from taxable income.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.