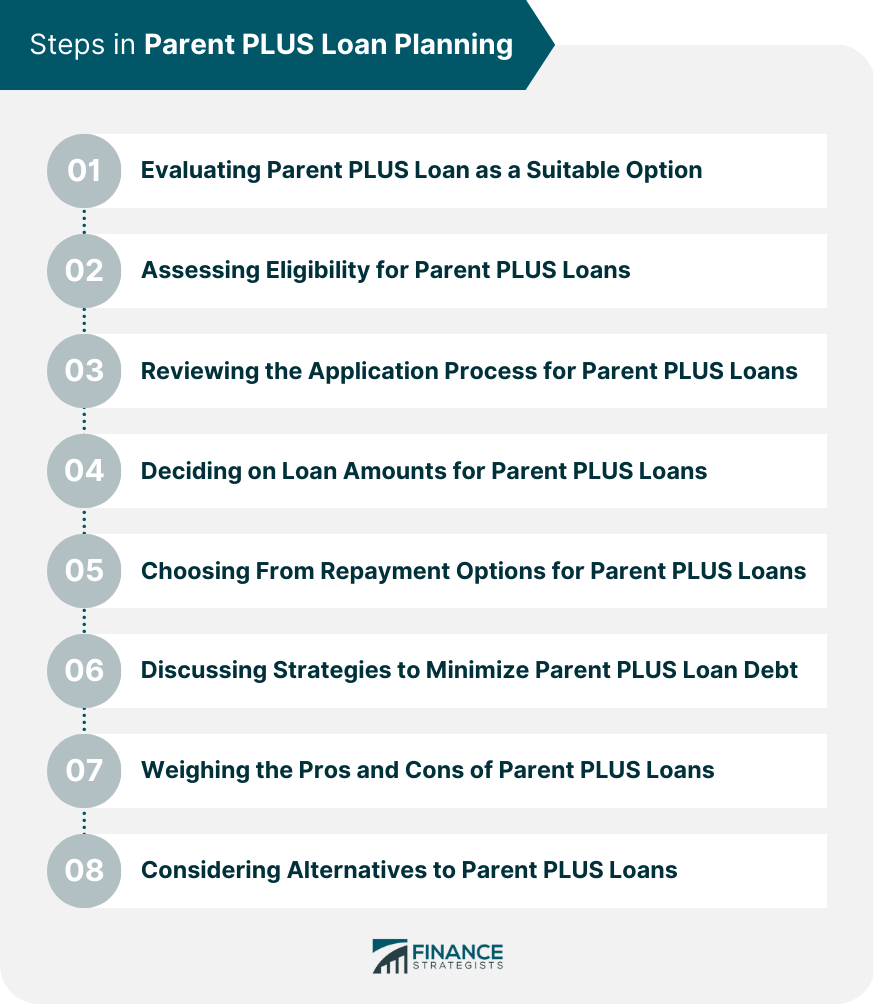

Parent PLUS Loan Planning refers to the process of exploring and managing the options available for Parent PLUS Loans, which are federal loans that parents of dependent undergraduate students can use to help pay for college. This may include assessing the eligibility criteria and application process for the loans, understanding the repayment options available, and considering strategies to minimize the overall cost of borrowing. This may also involve assessing your family's financial needs and circumstances, exploring alternative financial aid options, and estimating the costs associated with borrowing a Parent PLUS Loan. Parent PLUS Loan Planning is crucial for several reasons: Ensuring that you make well-informed decisions about financing your child's education. Helping you assess the affordability and suitability of the Parent PLUS Loan for your family. Minimizing the long-term financial impact on your family while covering your child's educational expenses. To determine if a Parent PLUS Loan is the right option for your family, you must first evaluate your family's financial needs and circumstances. It is essential to consider your family's ability to repay the loan without jeopardizing your financial stability or retirement plans. Before deciding on a Parent PLUS Loan, it is crucial to explore other financial aid options, such as scholarships, grants, and work-study programs. These alternatives can significantly reduce your child's educational expenses and lower the amount you need to borrow through a Parent PLUS Loan. Research federal, state, institutional, and private sources of financial aid to maximize the funding available for your child's education. Parent PLUS Loan Planning also involves estimating the costs associated with borrowing a Parent PLUS Loan, including interest rates, origination fees, and potential repayment options. This estimation will help you understand the total cost of borrowing and make an informed decision about whether a Parent PLUS Loan is the best choice for your family's specific situation. To qualify for a Parent PLUS loan, a parent must be a dependent undergraduate student's biological or adoptive parent. In some cases, stepparents can also qualify. Additionally, the parent borrower must not have an adverse credit history, be a U.S. citizen or eligible noncitizen, and meet general eligibility criteria for federal student aid. Dependent students must be enrolled at least half-time at an eligible school, be U.S. citizens or eligible noncitizens, have a valid Social Security number, and meet general eligibility criteria for federal student aid. Eligibility for a Parent PLUS loan requires that the dependent student be enrolled in an eligible degree or certificate program at an accredited institution. They must also maintain satisfactory academic progress as defined by the school. To apply for a Parent PLUS loan, the student must first complete the Free Application for Federal Student Aid (FAFSA). This form determines eligibility for federal student aid, including grants, work-study, and loans. After completing the FAFSA, parents can apply for a Parent PLUS loan through the StudentAid.gov website. The application will require the parent's personal information, the student's information, and the desired loan amount. During the application process, the parent's credit history will be checked. A parent with an adverse credit history may still qualify for a Parent PLUS loan by obtaining an endorser or demonstrating extenuating circumstances. First-time Parent PLUS loan borrowers may be required to complete loan counseling before receiving the loan. This counseling session helps borrowers understand their rights and responsibilities regarding the loan. When deciding on loan amounts, the first factor to consider is the total cost of attendance for your child's college or university. This amount includes tuition, fees, room and board, books, supplies, and other related expenses. It is essential to have a clear understanding of these costs to determine the loan amount needed to cover your child's education. Consider the financial aid options available to your child, such as scholarships, grants, and work-study programs. By taking advantage of these resources, you can reduce the loan amount needed to cover your child's educational expenses. Be sure to research and apply for financial aid opportunities early to maximize the funding available. Lastly, assess your family's ability to repay the Parent PLUS Loan without jeopardizing your financial stability or retirement plans. Consider your current financial obligations, income, and savings when determining the appropriate loan amount. Remember that borrowing more than you can comfortably repay may result in long-term financial stress and impact your future financial goals. Under the standard repayment plan, borrowers make fixed monthly payments over a period of up to 10 years. This plan results in the lowest overall interest cost but may have higher monthly payments compared to other plans. The graduated repayment plan starts with lower monthly payments that increase every two years. The repayment period is up to 10 years, and borrowers may pay more interest over the life of the loan compared to the standard plan. For borrowers with more than $30,000 in outstanding Direct Loans, the extended repayment plan allows for lower monthly payments over 25 years. This plan can result in higher overall interest costs compared to the standard plan. The Income-Contingent Repayment (ICR) plan calculates monthly payments based on the borrower's adjusted gross income, family size, and total loan amount. The repayment period is up to 25 years, and any remaining balance may be forgiven after this time. Note that Parent PLUS loans must be consolidated into a Direct Consolidation Loan to qualify for ICR. Encourage students to apply for scholarships and grants, as these funds do not need to be repaid and can reduce the need for loans. Work-study and part-time jobs can help students contribute to their education expenses, reducing the burden on parents and the need for loans. Consider using tax-advantaged savings plans, such as 529 plans, to save for college expenses and reduce the need for loans. Refinancing Parent PLUS loans with a private lender may result in lower interest rates or more favorable repayment terms, reducing the overall cost of the loan. Parent PLUS loans can help bridge the gap between the cost of attendance and other financial aid received by the student, such as grants, scholarships, and work-study. Compared to private loans, Parent PLUS loans may offer lower interest rates, ensuring more affordable financing options for parents. Parent PLUS loans offer several repayment plans, including standard, graduated, extended, and income-contingent repayment options, allowing parents to choose the plan that best suits their financial situation. Interest paid on Parent PLUS loans may be tax-deductible, potentially reducing the overall cost of borrowing. Taking out a Parent PLUS loan may affect the parent's credit score, potentially impacting their ability to secure future credit or loans. Parent PLUS loans have limited deferment and forbearance options compared to other federal student loans, making it more challenging to suspend payments in times of financial hardship temporarily. Parent PLUS loans are generally not eligible for popular loan forgiveness programs, such as Public Service Loan Forgiveness or Teacher Loan Forgiveness. Private student loans may offer competitive interest rates and flexible repayment options, but they typically lack the borrower protections and benefits of federal loans. Parents may consider using a home equity loan to finance their child's education, which can offer lower interest rates and potential tax deductions. However, this option requires using the home as collateral, which may put the home at risk if loan payments cannot be made. Personal loans can be used to finance education expenses, but they typically have higher interest rates and shorter repayment terms compared to federal loans. Many colleges and universities offer interest-free payment plans that allow parents to pay tuition and fees in monthly installments. This option can help avoid taking out loans and accruing interest. Parent PLUS loan planning is crucial for parents and students seeking financial assistance for higher education. Families can make informed decisions about financing college expenses by understanding the eligibility criteria, benefits, application process, and repayment options. Exploring alternative options to finance higher education can help reduce the financial burden associated with loans. Early planning and informed decision-making can significantly impact the affordability and success of a student's college experience.Overview of Parent PLUS Loan Planning

Importance of Parent PLUS Loan Planning

Evaluating Parent PLUS Loan as a Suitable Option

Assessing Financial Needs and Circumstances

This assessment involves estimating the total cost of attendance, including tuition, room and board, books, and other expenses for your child's college or university.Exploring Alternative Financial Aid Options

Estimating the Costs of Borrowing a Parent PLUS Loan

Assessing Eligibility for Parent PLUS Loans

Parent Borrower Qualifications

Dependent Student Qualifications

Additionally, the student must maintain satisfactory academic progress to continue receiving Parent PLUS loans.Enrollment and Academic Requirements

Reviewing the Application Process for Parent PLUS Loans

Completing the FAFSA

Applying for a Parent PLUS Loan Through StudentAid.gov

Credit Check Requirements

Loan Counseling

Deciding on Loan Amounts for Parent PLUS Loans

Total Cost of Attendance

Available Financial Aid Options

Family's Ability to Repay the Loan

Choosing From Repayment Options for Parent PLUS Loans

Standard Repayment Plan

Graduated Repayment Plan

Extended Repayment Plan

Income-Contingent Repayment (ICR) Plan

Discussing Strategies to Minimize Parent PLUS Loan Debt

Applying for Scholarships and Grants

Encouraging Work-Study or Part-Time Jobs for the Student

Utilizing Tax-Advantaged Savings Plans

Refinancing Parent PLUS Loans

Weighing the Pros and Cons of Parent PLUS Loans

Benefits of Parent PLUS Loans

Covers Unmet Financial Needs

Potential for Lower Interest Rates

Flexible Repayment Options

Possible Tax Deductions

Potential Drawbacks of Parent PLUS Loans

Impact on Parent's Credit Scores

Limited Deferment and Forbearance Options

Difficulty Qualifying for Loan Forgiveness Programs

Considering Alternatives to Parent PLUS Loans

Private Student Loans

Home Equity Loans

Personal Loans

College Payment Plans

Conclusion

Parent PLUS Loan Planning FAQs

Parent PLUS Loan Planning is the process of understanding, evaluating, and managing the Parent PLUS Loan program, a federal loan program designed for parents of dependent undergraduate students to help cover college expenses.

Parent PLUS Loan Planning is important because it allows parents to make informed decisions about funding their child's education, while also considering their own financial situation and long-term goals.

Parent PLUS Loan Planning involves assessing your family's financial needs and circumstances, exploring alternative financial aid options, and estimating the costs associated with borrowing a Parent PLUS Loan. By engaging in this planning process, you can make a more informed decision about whether a Parent PLUS Loan is the best choice for your family's specific situation.

When engaging in Parent PLUS Loan Planning, the main factors to consider when deciding on loan amounts include the total cost of attendance for your child's college or university, other available financial aid options (such as scholarships, grants, and work-study programs), and your family's ability to repay the loan without jeopardizing your financial stability or retirement plans.

Incorporating Parent PLUS Loan Planning into your overall financial plan involves evaluating all available financial aid options, calculating the total amount needed to cover college expenses, and determining the most suitable loan repayment plan. By integrating this planning process with your broader financial strategy, you can ensure that your child's education is adequately funded while minimizing the long-term financial impact on your family.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.