A biweekly mortgage payment plan is a repayment strategy where borrowers make half of their regular monthly mortgage payment every two weeks, instead of the full payment once per month. This results in a total of 26 half-payments per year, equivalent to 13 full monthly payments. Biweekly payment plans can help borrowers pay off their mortgages faster, save on interest costs, and better align mortgage payments with their pay schedules. In a biweekly mortgage payment plan, borrowers split their monthly mortgage payment in half and make a payment every two weeks. This results in 26 half-payments per year, which is equivalent to 13 full monthly payments. By making extra payments through a biweekly payment plan, borrowers can reduce their loan term and decrease the overall amount of interest paid on their mortgage. Reducing Loan Term: The extra payment each year reduces the principal balance more quickly, shortening the time it takes to pay off the mortgage. Decreasing Interest Paid: With a lower principal balance, less interest accrues, leading to significant savings over the life of the loan. Biweekly payment plans can help borrowers pay off their mortgage faster by making an extra full payment each year. This can help reduce the loan term by several years, allowing borrowers to own their home outright sooner. Because borrowers are making extra payments, the principal balance on the loan is reduced faster than it would be with a monthly payment plan. This means that less interest accrues over time, resulting in a lower overall cost for the loan. Biweekly payments are timed to coincide with the borrower's paychecks, which can help with budgeting. Instead of making one large monthly payment, borrowers make smaller payments every two weeks, which can be easier to manage. Biweekly payments can help reduce the risk of missed payments, as borrowers are making payments more frequently. This can help avoid late fees and protect the borrower's credit score. Biweekly payment plans offer flexibility, as borrowers can choose to enroll in the plan at any time, or switch back to a monthly payment plan if needed. Some lenders may also allow borrowers to make additional payments on top of the biweekly payments if they want to pay off their mortgage even faster. Some lenders may charge fees to set up a biweekly payment plan, or may require borrowers to pay an upfront fee to enroll. These fees can add to the overall cost of the loan and may offset some of the savings from the biweekly payments. Once a borrower enrolls in a biweekly payment plan, they are committed to making the payments every two weeks. This can be challenging for some borrowers who may have unexpected expenses or income fluctuations that make it difficult to make payments on a strict schedule. While many lenders offer biweekly payment plans, not all do. Borrowers may need to shop around to find a lender that offers this option. Some lenders may charge penalties for early payoff of the mortgage. If a borrower is using a biweekly payment plan to pay off their mortgage early, they should check to see if their lender charges early payoff penalties. If a borrower has other debts with higher interest rates, such as credit card debt or personal loans, it may be more financially advantageous to pay those debts off first before making extra mortgage payments. Some lenders offer biweekly payment plans as an option for their borrowers. If available, borrowers should inquire about any fees or special requirements associated with the plan. For borrowers whose lenders do not offer biweekly payment plans, third-party payment services can set up and manage the plan. However, these services often charge fees and may require careful research to ensure they are reputable and trustworthy. Borrowers can also create their own biweekly payment plan by making an extra principal payment each month, equivalent to half of their regular monthly payment. This DIY approach requires discipline and careful tracking of payments but can save borrowers from incurring additional fees. Borrowers can make additional principal payments each month or periodically throughout the year to achieve similar results as a biweekly payment plan without the commitment to a fixed schedule. Refinancing a mortgage to a shorter loan term, such as a 15-year term, can also help borrowers pay off their mortgage faster and save on interest costs. However, refinancing may come with additional fees and may not be suitable for all borrowers. Applying a lump-sum payment, such as a tax refund or work bonus, towards the mortgage principal can also help reduce the loan term and interest paid. This approach offers flexibility, as borrowers can choose when and how much to contribute towards their mortgage. Borrowers should regularly review their mortgage statements to ensure their biweekly payments are being applied correctly and that their principal balance is decreasing as expected. Making timely payments is crucial for maintaining a good credit score and avoiding late fees. Borrowers should set up reminders or automatic payments to ensure they never miss a biweekly payment. Before committing to a biweekly mortgage payment plan, borrowers should consider how it may affect their other financial goals, such as saving for retirement, building an emergency fund, or paying off other debts. Understanding the benefits and drawbacks of biweekly mortgage payment plans can help borrowers determine if this repayment strategy is right for them. By paying off their mortgage faster and saving on interest costs, borrowers can achieve greater financial freedom and stability. Each borrower's financial situation and goals are unique, and the best mortgage payment strategy may vary accordingly. By carefully evaluating their options and seeking guidance from qualified professionals, borrowers can make informed decisions about which mortgage payment plan will best serve their needs and help them achieve their financial goals.What Are Biweekly Mortgage Payment Plans?

How Biweekly Mortgage Payment Plans Work

Structure of Biweekly Payment Plans

Impact on Loan Term and Interest

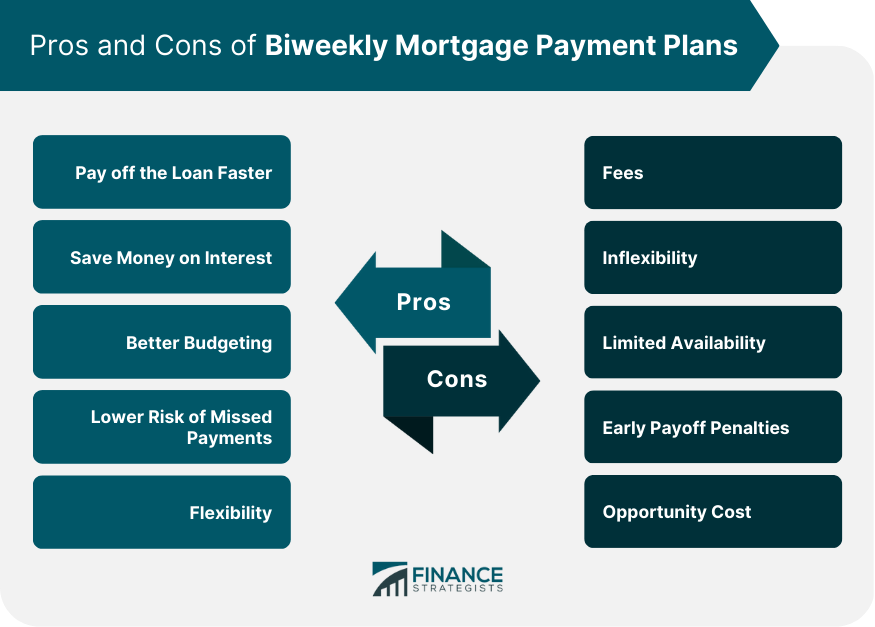

Pros and Cons of Biweekly Mortgage Payment Plans

Pros

Pay off the Loan Faster

Save Money on Interest

Better Budgeting

Lower Risk of Missed Payments

Flexibility

Cons

Fees

Inflexibility

Limited Availability

Early Payoff Penalties

Opportunity Cost

Setting up a Biweekly Mortgage Payment Plan

Lender-Offered Plans

Third-Party Payment Services

Do-It-Yourself Approach

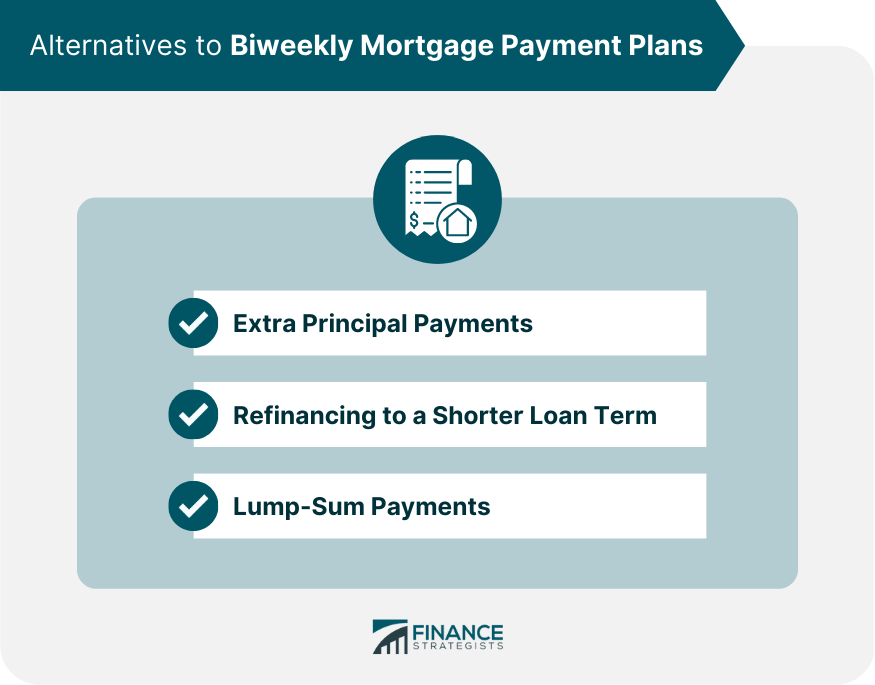

Alternatives to Biweekly Mortgage Payment Plans

Extra Principal Payments

Refinancing to a Shorter Loan Term

Lump-Sum Payments

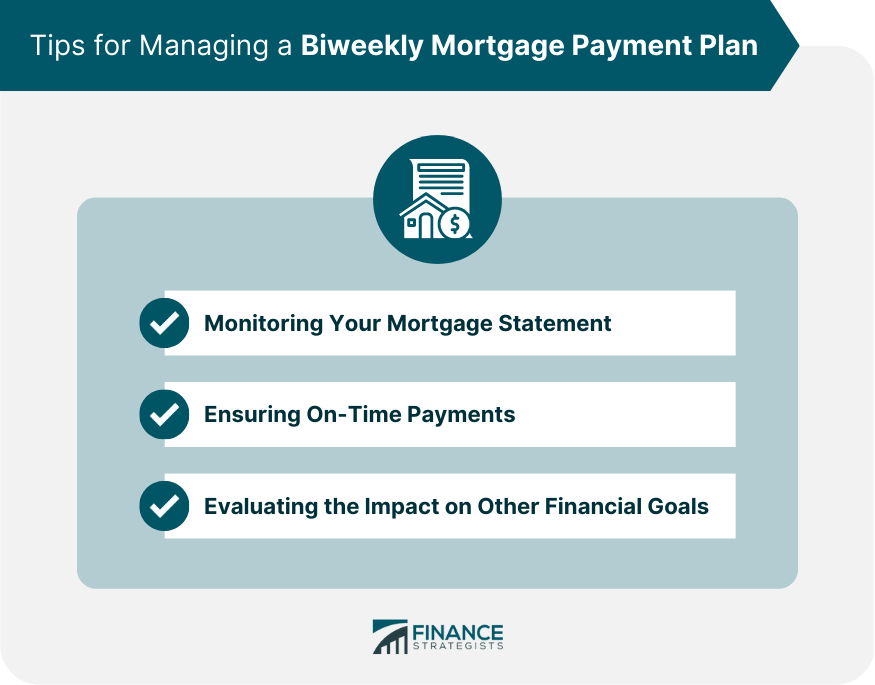

Tips for Managing a Biweekly Mortgage Payment Plan

Monitoring Your Mortgage Statement

Ensuring On-Time Payments

Evaluating the Impact on Other Financial Goals

Conclusion

Importance of Understanding Biweekly Mortgage Payment Plans

Making Informed Decisions on Mortgage Payment Strategies

Biweekly Mortgage Payment Plans FAQs

A biweekly mortgage payment plan is a payment system where instead of making monthly mortgage payments, you make half of the monthly payment every two weeks. This results in 26 half-payments a year, which is equivalent to 13 full payments.

There are several benefits to using a biweekly mortgage payment plan. First, you can pay off your mortgage faster and save money on interest over the life of the loan. Second, you can build equity in your home more quickly. Finally, it can be a good budgeting tool because it helps you spread out your mortgage payments over the course of the month.

A biweekly mortgage payment plan does not directly affect your credit score. However, making your mortgage payments on time and paying off your mortgage faster can have a positive impact on your credit score over time.

Some lenders may charge a fee for setting up a biweekly mortgage payment plan. However, many lenders do not charge a fee for this service. It's important to check with your lender to see if there are any fees associated with setting up a biweekly payment plan.

Yes, you can typically cancel a biweekly mortgage payment plan at any time. However, it's important to check with your lender to see if there are any penalties or fees for canceling the plan. Additionally, if you cancel the plan, you will need to resume making monthly payments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.