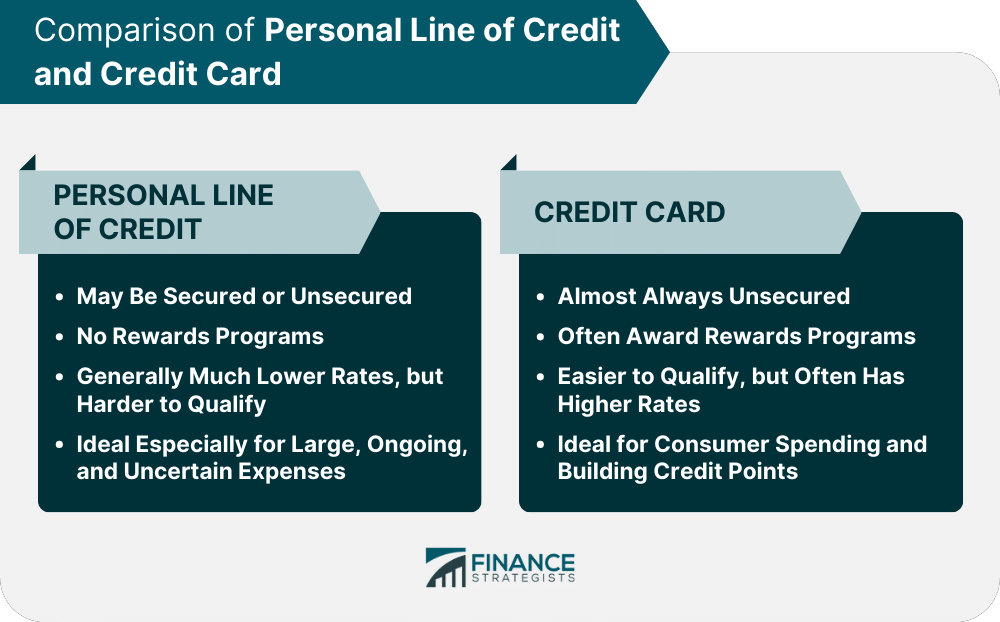

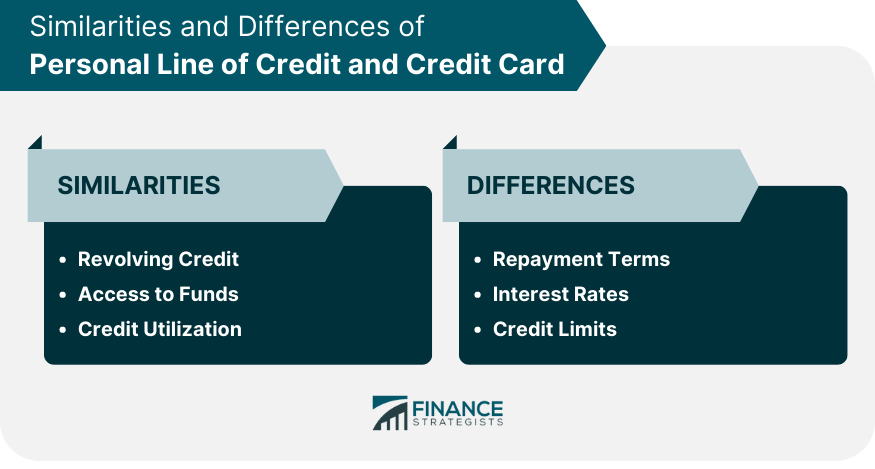

A personal line of credit is a flexible loan from a bank or financial institution that allows an individual to draw funds up to a maximum limit, much like a credit card. It offers a ready source of funds and can be used for various purposes, such as covering unexpected expenses or consolidating debts. A credit card, on the other hand, is a plastic or digital card issued by a financial institution, allowing cardholders to borrow funds to pay for goods and services. Credit cards offer convenience, reward programs, and the ability to build credit when used responsibly. A personal line of credit can be either secured or unsecured, depending on the borrower's creditworthiness and the lender's requirements. Secured lines of credit are backed by collateral, such as a home or a vehicle, which serves as security for the loan. Unsecured lines of credit, on the other hand, do not require collateral and are based primarily on the borrower's credit history and income. Unlike some credit cards or other financial products, personal lines of credit typically do not offer rewards programs. These programs often provide incentives, such as cashback or travel rewards, based on the user's spending patterns. However, personal lines of credit focus more on providing a flexible borrowing option rather than offering rewards for purchases. One of the significant advantages of a personal line of credit is that it generally offers lower interest rates compared to credit cards or other forms of unsecured borrowing. This is because lines of credit are seen as less risky for lenders, as they are typically used for short-term borrowing and can be secured by collateral. However, qualifying for a personal line of credit can be more challenging than obtaining a credit card, as lenders typically require a good credit score, stable income, and a strong financial profile. A personal line of credit is particularly beneficial for individuals who have large, ongoing, or uncertain expenses. It provides a readily available source of funds that can be accessed whenever needed. For example, if you are planning a home renovation project with costs that may vary over time, a personal line of credit can be an ideal financing option. Similarly, if you anticipate irregular income or unpredictable expenses, having a line of credit can offer peace of mind and financial flexibility. Credit cards are typically unsecured, meaning they do not require collateral to be pledged as security for the credit extended. Unlike secured loans or lines of credit that are backed by assets, credit cards are granted based on the borrower's creditworthiness and income. These programs incentivize cardholders by offering various benefits, such as cashback, travel points, or discounts on specific purchases. Rewards programs vary among different credit card issuers and can provide valuable perks for cardholders who actively use their cards for spending. Compared to other forms of borrowing, credit cards are generally easier to qualify for. Lenders often consider a broader range of applicants, including those with limited credit histories or lower credit scores. However, this accessibility can come with higher interest rates, making credit cards a more expensive form of borrowing compared to secured loans or lines of credit. They offer convenience, security, and the ability to make purchases online and in-store. Additionally, responsible use of credit cards can help individuals build their credit history and improve their credit scores. By making timely payments and maintaining a low credit utilization ratio, cardholders can establish a positive credit profile, which may lead to better borrowing opportunities in the future. Both personal lines of credit and credit cards offer revolving credit. This means that once the borrowed amount is repaid, the available credit is replenished, allowing individuals to borrow again. This flexibility enables users to access funds as needed without having to reapply for a new loan or credit card. With a personal line of credit, borrowers can withdraw funds from the available credit limit as needed, either through transfers to their bank account or by using checks or a dedicated card. Similarly, credit cards allow users to make purchases and obtain cash advances up to their credit limit. Credit utilization refers to the percentage of available credit that borrowers are currently using. By keeping credit utilization low, individuals can maintain a favorable credit score and demonstrate responsible borrowing habits, which can positively impact future borrowing opportunities. Personal lines of credit often have more flexible repayment terms compared to credit cards. While credit cards typically require minimum monthly payments, personal lines of credit may offer more flexibility in terms of repayment schedules and options. Borrowers may have the choice to make interest-only payments or repay the balance over a longer period, depending on the terms agreed upon with the lender. In general, personal lines of credit tend to have lower interest rates compared to credit cards. This is because personal lines of credit are often secured by collateral or require a higher creditworthiness threshold for approval. On the other hand, credit cards are unsecured and typically come with higher interest rates, especially for users with lower credit scores. Personal lines of credit often have higher credit limits compared to credit cards, as they are intended for larger borrowing needs. The credit limit for a personal line of credit is typically determined based on the borrower's creditworthiness, income, and the value of any collateral provided. Credit card limits, on the other hand, may be lower and are determined by the credit card issuer based on the cardholder's credit history and income. Personal lines of credit offer flexibility, allowing individuals to borrow funds up to a maximum limit, similar to credit cards. They can be secured or unsecured, with lower interest rates, making them suitable for larger and ongoing expenses. Qualifying for a personal line of credit may be more challenging, requiring a strong credit profile and stable income. Credit cards, on the other hand, provide unsecured borrowing options with easier qualification criteria. They often come with rewards programs that offer incentives for cardholders and are ideal for consumer spending and building credit points. There are several similarities between personal lines of credit and credit cards, such as revolving credit, access to funds, and the need to manage credit utilization. However, there are also notable differences, including repayment terms, interest rates, and credit limits. Ultimately, the choice between a personal line of credit and a credit card depends on individual financial needs, borrowing preferences, and creditworthiness.Overview of Personal Line of Credit vs Credit Card

Personal Line of Credit

May Be Secured or Unsecured

No Rewards Programs

Generally Much Lower Rates, but Harder to Qualify

Ideal Especially for Large, Ongoing, and Uncertain Expenses

Credit Card

Almost Always Unsecured

Often Award Rewards Programs

Easier to Qualify, but Often Has Higher Rates

Ideal for Consumer Spending and Building Credit Points

Similarities of Personal Line of Credit vs Credit Card

Revolving Credit

Access To Funds

Credit Utilization

Differences of Personal Line of Credit vs Credit Card

Repayment Terms

Interest Rates

Credit Limits

Final Thoughts

Personal Line of Credit vs Credit Card FAQs

A Personal Line of Credit is a pre-set amount of money offered to you by your lender, with which you can draw funds up to that limit as needed. The interest rate is usually fixed for this loan product. On the other hand, a credit card allows you to borrow up to a certain limit but with revolving terms. Your total balance is due at the end of each billing cycle and any new purchases increase your overall debt. Credit cards may also offer extra perks such as rewards programs or cashback offers.

A Personal Line of Credit typically has a lower interest rate than a credit card, so it can be cheaper to borrow from this loan product. However, the cost will depend on your specific circumstances and lender terms so you should compare products between different financial institutions before making a decision on which product is best for you.

You should consider using a Personal Line of Credit if you need to borrow a large amount of money or anticipate needing to make multiple transactions over time. It's also beneficial if you want greater control over your repayment plan since there are usually fixed terms and conditions associated with this loan product. Conversely, if you need to make a quick purchase and don't mind paying more in interest, then a Credit Card might be the better option.

Yes, both products can carry certain risks depending on how you use them. For example, if you are unable to repay your Personal Line of Credit balance in full and on time, then you may face additional fees or penalties from your lender. Likewise, if you consistently exceed the credit limit on your card and fail to pay off the outstanding balance each month, then it could lead to high-interest charges and debt accumulation.

Although the criteria and requirements may differ between lenders, it is usually not too difficult to obtain a Personal Line of Credit. However, you will need to provide financial documents such as bank statements to prove your creditworthiness before any loan agreement can be made. Also, keep in mind that some lenders may request additional information or impose higher interest rates if you have a poor credit history.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.