A mortgage bond is a type of debt security collateralized by a mortgage or a pool of mortgages. These bonds enable investors to receive regular interest payments and help organizations raise capital. Mortgage bonds provide a funding source for lenders, who use the funds to offer loans to homebuyers or businesses. Investors benefit from a steady income stream and the potential for capital appreciation. Mortgage bonds have been a significant component of the financial market since the early 20th century. They gained prominence as a popular investment vehicle in the 1980s due to their relatively lower risk compared to other debt instruments. Residential mortgage bonds are backed by residential properties, such as single-family homes or apartment buildings. These bonds offer investors exposure to the residential real estate market and typically have lower risks compared to other types of mortgage bonds. Commercial mortgage bonds are secured by commercial properties, like office buildings, shopping centers, and industrial facilities. They offer investors access to the commercial real estate sector and may involve higher risk due to the larger loan amounts and varying economic factors. Government-issued mortgage bonds are backed by mortgages that are guaranteed by government agencies, such as the Government National Mortgage Association (GNMA). These bonds are considered low-risk investments due to the government backing and the creditworthiness of the underlying borrowers. Hybrid mortgage bonds combine features of both residential and commercial mortgage bonds. They may include various types of properties, providing investors with diversified exposure to the real estate market and a potentially balanced risk profile. There are several subtypes and variations of mortgage bonds, such as adjustable-rate mortgage bonds and reverse mortgage bonds. Each subtype has its unique features and risk-reward dynamics, catering to different investor preferences. In the primary market, mortgage bonds are issued by financial institutions or government agencies. The process involves pooling mortgages, creating a legal structure, and selling the bonds to investors. Underwriters play a crucial role in the issuance process, as they assess the risks and structure the mortgage bonds. They are responsible for pricing the bonds, marketing them to investors, and ensuring the transaction's legal compliance. The secondary market allows investors to buy and sell existing mortgage bonds. The liquidity of these bonds can vary based on factors like the issuer's credit quality, economic conditions, and market sentiment. Various participants are involved in the secondary mortgage bond market, such as institutional investors, retail investors, broker-dealers, and market makers. These participants contribute to the market's overall liquidity and price discovery. Interest rates have a significant impact on mortgage bond prices. As interest rates rise, bond prices typically decline because investors demand higher yields to compensate for the increased risk. Economic conditions, such as GDP growth and employment rates, affect the credit quality of the underlying mortgages and the overall demand for mortgage bonds. Adverse economic conditions can lead to decreased bond prices. The credit quality of the underlying mortgages directly influences the mortgage bond's risk profile. Higher credit quality implies lower default risk, resulting in more stable bond prices. Government policies, such as changes in interest rates or mortgage regulations, can impact the mortgage bond market. These policies may affect the supply and demand dynamics, as well as the credit quality of the underlying mortgages. Mortgage bonds are sensitive to changes in interest rates, as they affect the bond's yield and price. When interest rates rise, existing bond prices decrease, making them less attractive to investors. Additionally, higher interest rates can lead to increased prepayments, resulting in lower cash flows for investors. Credit risk refers to the risk of default on the underlying mortgages that back the mortgage bonds. If the borrowers default on their loans, it can lead to lower cash flows for investors and decreased bond prices. Lenders can mitigate this risk by assessing the creditworthiness of the borrowers and structuring the mortgage bonds accordingly. Prepayment risk occurs when borrowers pay off their mortgages earlier than expected, reducing the cash flows for investors. This risk is more prevalent when interest rates decline, and borrowers refinance their mortgages at lower rates, leading to increased prepayments. Extension risk is the opposite of prepayment risk and refers to the risk that borrowers will keep their mortgages longer than expected, leading to lower cash flows for investors. This risk is more prevalent when interest rates rise, and borrowers are less likely to refinance their mortgages. Regulatory risk refers to the risk that changes in regulations or policies can impact the mortgage bond market. For example, changes in mortgage regulations can lead to decreased demand for mortgage bonds, leading to lower prices. Market risk refers to the general risk associated with investing in any financial instrument. The mortgage bond market can be impacted by various factors, such as economic conditions, investor sentiment, and global events, leading to increased volatility and decreased prices. Credit ratings play a critical role in determining the risk profile of mortgage bonds. They provide investors with an indication of the likelihood of default on the underlying mortgages and the overall risk associated with the bond. Several rating agencies, such as Moody's, Standard & Poor's, and Fitch, provide credit ratings for mortgage bonds. These agencies assess the creditworthiness of the underlying mortgages and assign ratings based on various factors. The rating agencies consider several factors when assigning credit ratings, including the credit quality of the underlying mortgages, the loan-to-value ratio, and the structure of the mortgage bonds. These factors provide an overall indication of the bond's risk profile. Credit ratings are typically assigned on a scale from AAA to D, with AAA being the highest rating and D indicating the bond has defaulted. Higher-rated bonds typically offer lower yields and lower risks, while lower-rated bonds offer higher yields and higher risks. Mortgage-backed securities (MBS) are similar to mortgage bonds in that they are also collateralized by mortgages. However, MBS are pools of mortgages packaged together and sold as securities, whereas mortgage bonds are individual bonds backed by one or more mortgages. There are several types of MBS, including pass-through securities, collateralized mortgage obligations (CMOs), and stripped mortgage-backed securities. Each type of MBS has its unique features and risk-reward dynamics. MBS and mortgage bonds differ in terms of their risk-reward profiles. MBS offer higher potential returns but also come with higher risk due to the larger pool of mortgages and other factors that can impact the performance of the securities. MBS and mortgage bonds play important roles in the financial market. They provide investors with access to the real estate market while offering lenders a source of funding. MBS are also a significant component of the fixed-income market, representing a substantial portion of many institutional portfolios. Mortgage bonds can provide diversification benefits to an investor's portfolio, as they have low correlation with other asset classes, such as equities and commodities. This can help to reduce overall portfolio risk. Mortgage bonds offer a stable income stream to investors, making them an attractive investment for those seeking regular cash flow. The interest payments on mortgage bonds are typically fixed, providing a predictable income stream. Mortgage bonds tend to have lower volatility compared to equities, making them a more stable investment option for risk-averse investors. They are less susceptible to sudden price movements and market fluctuations. Mortgage bonds may offer tax advantages to investors, such as tax-exempt status for bonds issued by certain organizations, like government agencies or municipalities. This can help to increase the after-tax returns of the investment. Mortgage bonds played a significant role in the 2008 financial crisis, as the housing bubble burst and the underlying mortgages defaulted, leading to a widespread economic downturn. This event highlighted the risks associated with mortgage bonds and raised concerns about their transparency and complexity. Mortgage bonds can be complex and difficult to understand, making it challenging for investors to assess their risks and rewards accurately. Additionally, the underlying mortgages that back the bonds may be difficult to evaluate, leading to a lack of transparency in the market. There are ethical concerns surrounding mortgage bonds, particularly when it comes to subprime mortgages. The practice of selling subprime mortgages to borrowers who cannot afford them can lead to a higher risk of default, impacting the performance of mortgage bonds. Mortgage bonds play a crucial role in the financial market, providing investors with access to the real estate market and offering lenders a source of funding. While there are risks associated with investing in mortgage bonds, such as interest rate risk and credit risk, they can provide benefits like diversification, stable income, and tax advantages. However, mortgage bonds are not without their challenges and criticisms, including their role in the 2008 financial crisis and the complexity and lack of transparency in the market. As the financial market continues to evolve, new innovations and trends, such as green mortgage bonds and technological advancements, will impact the mortgage bond market. Despite the challenges and risks, mortgage bonds remain an important component of the fixed-income market, providing a valuable investment opportunity for investors seeking a stable income stream with potentially lower volatility than equities.What Is a Mortgage Bond?

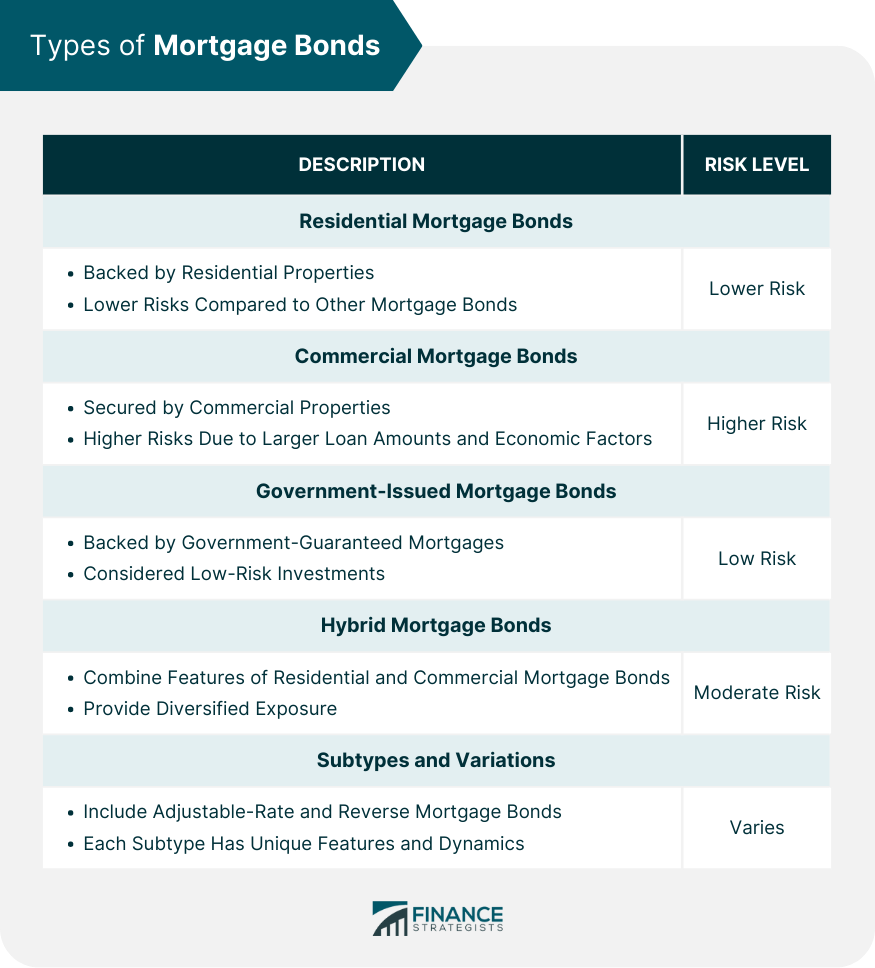

Types of Mortgage Bonds

Residential Mortgage Bonds

Commercial Mortgage Bonds

Government-Issued Mortgage Bonds

Hybrid Mortgage Bonds

Subtypes and Variations

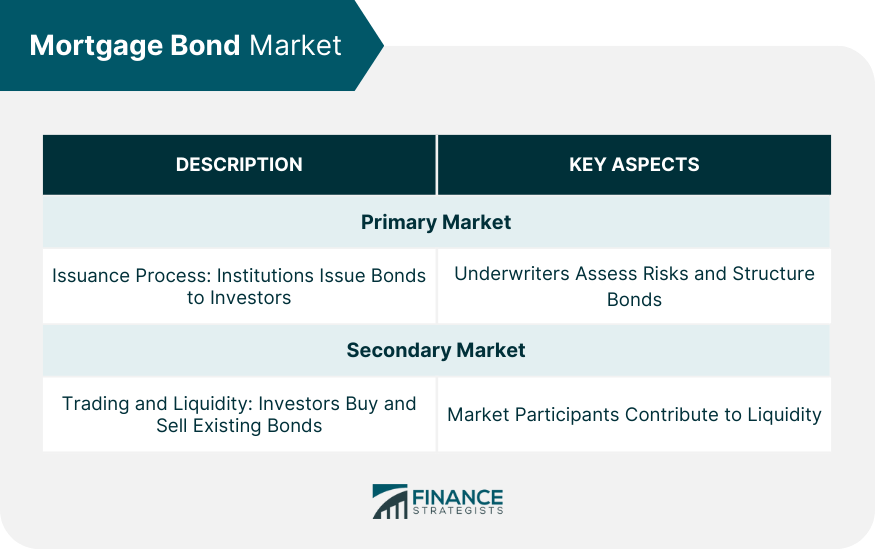

Mortgage Bond Market

Primary Market

Issuance Process

Role of Underwriters

Secondary Market

Trading and Liquidity

Market Participants

Factors Affecting Mortgage Bond Prices

Interest Rates

Economic Conditions

Credit Quality of the Underlying Mortgages

Government Policies

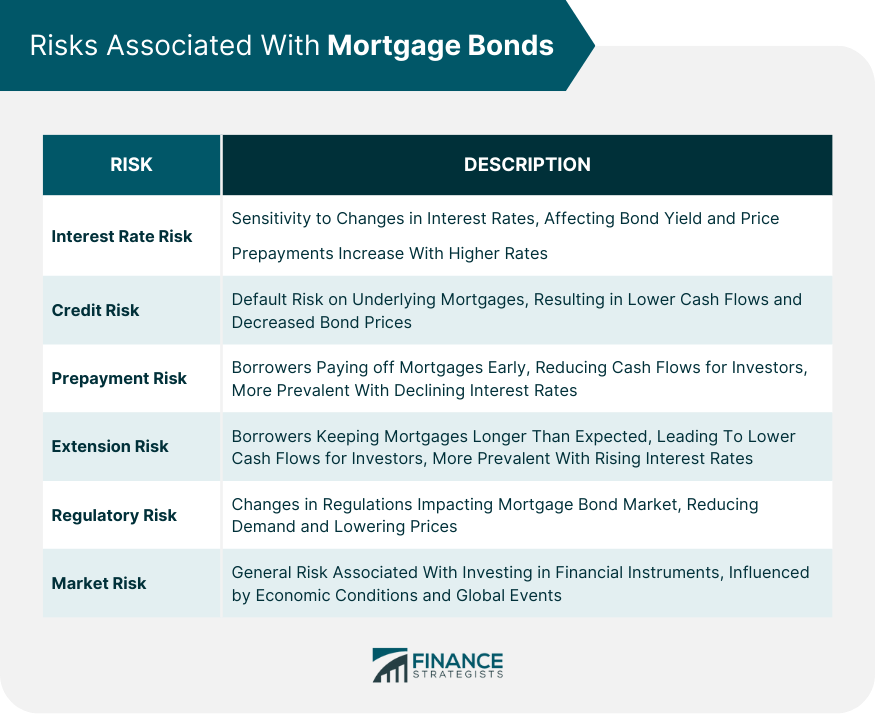

Risks Associated With Mortgage Bonds

Interest Rate Risk

Credit Risk

Prepayment Risk

Extension Risk

Regulatory Risk

Market Risk

Mortgage Bond Ratings

Importance of Credit Ratings

Rating Agencies

Factors Influencing Ratings

Rating Categories

Mortgage-Backed Securities (MBS) vs Mortgage Bonds

Definitions and Differences

Types of MBS

Risks and Rewards Comparison

Role in the Financial Market

Benefits of Investing in Mortgage Bonds

Diversification

Stable Income

Lower Volatility Compared to Equities

Tax Advantages

Challenges and Criticisms of Mortgage Bonds

Role in the 2008 Financial Crisis

Complexity and Lack of Transparency

Ethical Concerns

Final Thoughts

Mortgage Bond FAQs

Mortgage bonds are a type of debt security collateralized by a mortgage or a pool of mortgages. They enable investors to receive regular interest payments and help organizations raise capital.

Some of the risks associated with investing in mortgage bonds include interest rate risk, credit risk, prepayment risk, extension risk, regulatory risk, and market risk.

Mortgage-backed securities (MBS) are pools of mortgages packaged together and sold as securities, while mortgage bonds are individual bonds backed by one or more mortgages. MBS and mortgage bonds differ in terms of their risk-reward profiles.

Some benefits of investing in mortgage bonds include diversification, stable income, lower volatility compared to equities, and tax advantages.

Some challenges and criticisms of mortgage bonds include their role in the 2008 financial crisis, complexity and lack of transparency, and ethical concerns surrounding subprime mortgages.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.