A lien waiver, primarily used in the construction industry but applicable in other fields, is a legal document issued by parties such as contractors, subcontractors, and suppliers involved in a construction project. It states that they forfeit any future lien rights against the improved property up to a certain date, thereby relinquishing their right to place a lien for the specified amount once payment has been received. Lien waivers are essential risk management tools in financial transactions, especially in real estate and construction. They help prevent disputes that may arise from double payments if a general contractor fails to compensate subcontractors or suppliers. By securing these waivers, project owners and lenders can ensure a smooth payment flow, protecting themselves from potential financial and legal difficulties. There are typically four types of lien waivers, divided into two major categories: unconditional and conditional. Each has a specific application and carries different implications for the involved parties. Unconditional lien waivers become effective as soon as they are signed and delivered, irrespective of whether the payment is made. This waiver applies when the claimant receives a payment for a portion of their contracted work or materials. It signifies that the claimant waives any right to a lien for the work done or materials provided up to the specified date, whether they've been paid or not. The Unconditional Lien Waiver on Final Payment is used when the claimant receives their final payment and waives any right to place a lien on the property, regardless of actual payment. This waiver should be used with caution as it can lead to a loss of lien rights without receiving payment. Contrary to unconditional waivers, conditional waivers are contingent upon the occurrence of a specific event, usually the claimant's receipt of payment. This waiver is used when a progress payment is made but not yet received by the claimant. It stipulates that rights to a lien are waived to the extent of the received payment. A Conditional Lien Waiver on Final Payment is used when the final payment is made but not yet received. It relinquishes the claimant's lien rights contingent upon receipt of the final payment. Understanding the legal aspects of lien waivers is vital for their proper execution and enforceability. Lien waiver regulations vary significantly across different jurisdictions. Some states in the U.S., for instance, provide statutory forms that parties must use, while others do not regulate the form or language of lien waivers at all. Familiarity with local and state laws is essential to ensure the use of correct and enforceable lien waivers. The enforceability of lien waivers depends on various factors, including the local and state laws, the language used in the document, and the circumstances of the waiver. Some jurisdictions might not enforce lien waivers signed before any work has been performed. As such, it is important to seek legal counsel when dealing with lien waivers to ensure their enforceability. There are instances where lien waivers can be used fraudulently or coercively. For instance, a contractor might be forced to sign an Unconditional Lien Waiver on Final Payment before actually receiving payment. This could be considered coercive and might be unenforceable. On the other hand, a subcontractor might fraudulently claim they haven't been paid despite signing a lien waiver. These instances underscore the need for careful attention to lien waiver usage. Lien waivers act as important tools for facilitating payments in construction projects. They assure the property owner and general contractor that subcontractors and suppliers will not file a lien on the property for the work performed or materials supplied up to a certain point. This reduces the risk of payment disputes and fosters smoother and more reliable payment cycles in the construction industry. Lien waivers are typically requested by the property owner or the general contractor. When a payment application is made by a subcontractor or a supplier, the party making the payment will request a lien waiver equivalent to the amount of the payment. It's crucial to specify the type of lien waiver being requested and to ensure it accurately reflects the state of payment and work completed. When providing a lien waiver, it's important for the claimant to review the document carefully. The claimant must ensure that the waiver matches the payment amount, that payment is made or secured (in the case of conditional waivers), and that the waiver does not waive rights more than intended. Timing is crucial in the lien waiver process. Lien waivers should be collected at the time of payment, and they should be issued once the payment has been confirmed (for unconditional waivers) or when payment is made or secured (for conditional waivers). Timely submission and collection of lien waivers help prevent payment disputes and foster smooth financial transactions. Lien waivers can have a significant impact on a company's cash flow, particularly in the construction industry. By assuring that payments are made without the risk of subsequent liens, they can contribute to a more predictable and steady cash flow for all parties involved. In terms of risk management, lien waivers provide a level of financial security to property owners and general contractors by mitigating the risk of lien claims. If properly implemented, they can prevent potentially costly and disruptive lien disputes, thereby protecting the financial interests of the involved parties. Lien waivers also play a crucial role in credit management within the construction industry. Suppliers and subcontractors, for instance, may consider a contractor's practice regarding lien waivers when deciding on credit terms. Contractors that consistently provide lien waivers are likely to have more favorable credit terms as they present less risk to their suppliers or subcontractors. Understanding the complexities and potential pitfalls associated with lien waivers is crucial in mitigating risks in financial transactions, particularly in the construction industry. Here's how to navigate and avoid some of these common challenges. Before signing any lien waiver, make sure to fully understand what type of waiver it is and what rights you are forfeiting. Unconditional and conditional waivers have different implications. Always ensure that the waiver type aligns with your intentions and the status of your payment. Avoid signing a lien waiver too early, particularly an unconditional waiver, which becomes effective regardless of payment. An unconditional waiver should only be signed when payment has been secured to avoid potential financial risks. Ensure the amount stated in the lien waiver matches the payment you are receiving. Issuing a waiver for a greater amount than the payment can lead to waiving rights to claim for the unpaid work or materials. Always verify that the waiver accurately reflects the amount being paid. Before signing an unconditional lien waiver, confirm receipt of the payment. This ensures that you don't waive your lien rights without receiving payment. Always check that payment has been cleared in your account before issuing an unconditional lien waiver. A lien waiver, in essence, is a crucial financial document commonly used in the construction industry. It protects property owners and general contractors from potential liens from subcontractors and suppliers, ensuring smoother and less disputed financial transactions. There are four types of lien waivers: unconditional and conditional; each further divided into progress payment and final payment waivers. The process of requesting, providing, and tracking these waivers is critical for efficient financial operations. Understanding this process, as well as the associated risks, is vital for any party involved in a construction project. To help navigate the complexities of lien waivers and other financial instruments, consider seeking professional wealth management services to protect and optimize your financial interests.What Are Lien Waivers?

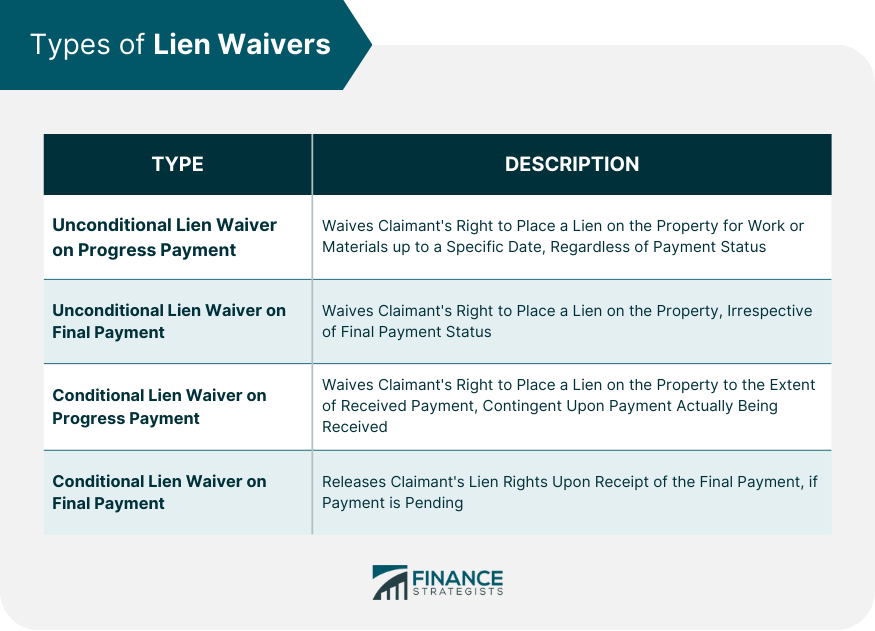

Types of Lien Waivers

Unconditional Lien Waivers

Unconditional Lien Waiver on Progress Payment

Unconditional Lien Waiver on Final Payment

Conditional Lien Waivers

Conditional Lien Waiver on Progress Payment

Conditional Lien Waiver on Final Payment

Legal Aspects of Lien Waivers

Jurisdictional Variations in Lien Waiver Regulations

Enforceability of Lien Waivers

Fraudulent and Coercive Lien Waivers

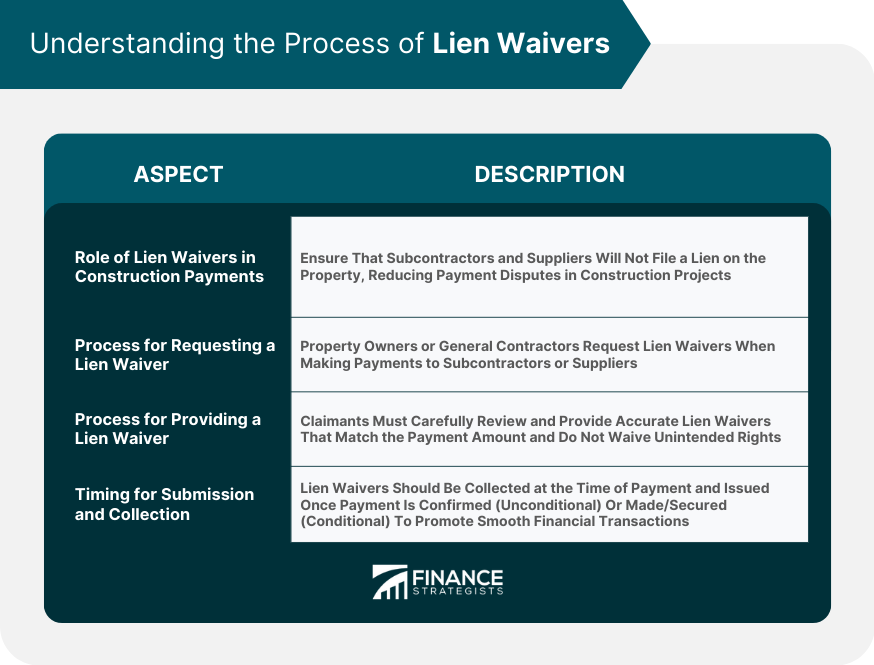

Understanding the Process of Lien Waivers

Role of Lien Waivers in Construction Payments

Process for Requesting a Lien Waiver

Process for Providing a Lien Waiver

Timing for Submission and Collection of Lien Waivers

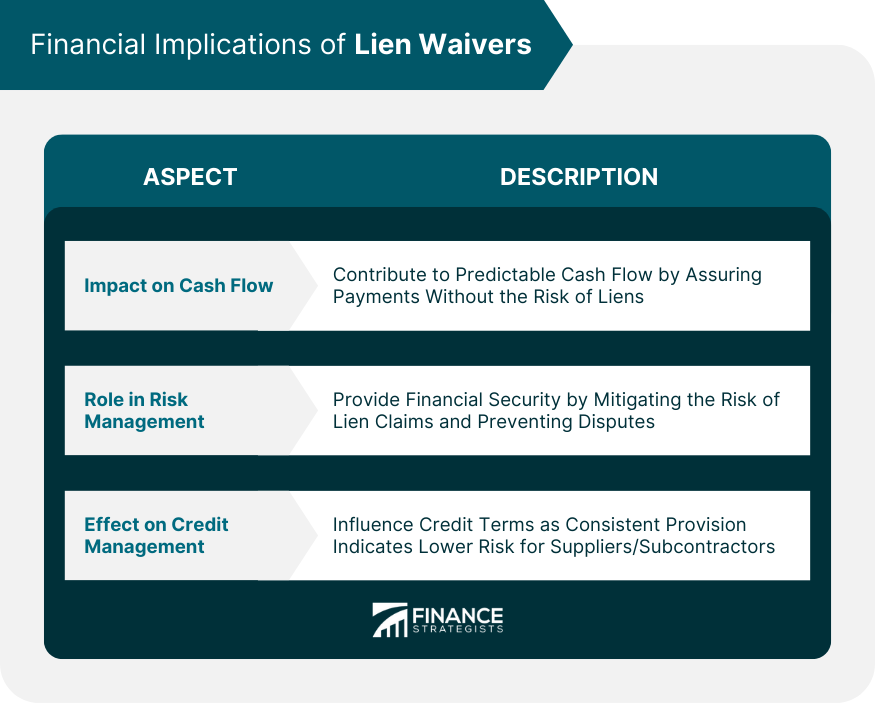

Financial Implications of Lien Waivers

Lien Waiver's Impact on Cash Flow

Lien Waiver's Role in Risk Management

Lien Waiver's Effect on Credit Management

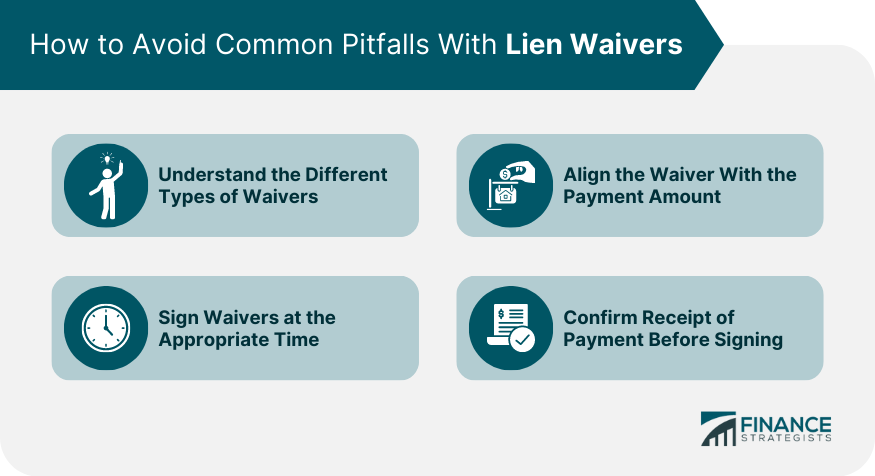

How to Avoid Common Pitfalls With Lien Waivers

Understand the Different Types of Waivers

Sign Waivers at the Appropriate Time

Align the Waiver with the Payment Amount

Confirm Receipt of Payment Before Signing

Final Thoughts

Lien Waivers FAQs

A lien waiver is a legal document from a contractor, subcontractor, or supplier that waives their right to place a lien on the property for the amount they have been paid.

There are four types of lien waivers: Unconditional Lien Waiver on Progress Payment, Unconditional Lien Waiver on Final Payment, Conditional Lien Waiver on Progress Payment, and Conditional Lien Waiver on Final Payment.

Lien waivers serve as a form of financial risk management, assuring that subcontractors and suppliers will not file a lien on the property once they have been paid, facilitating smoother financial transactions.

Lien waivers can contribute to a steady cash flow by reducing the risk of payment disputes and lien claims. They also play a role in credit management, as the consistent provision of lien waivers can lead to more favorable credit terms.

Technology can simplify the process of managing lien waivers through features for tracking waivers, sending automated requests, verifying receipt of payment, and integrating waivers into broader project management systems.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.