Long-term disability insurance is a type of insurance policy that provides financial protection to an individual in the event that they become unable to work due to a disability for an extended period of time. The policy pays out a percentage of the insured person's salary to help cover expenses during their recovery period. There are two primary types of long-term disability insurance coverage: Own Occupation: This type of coverage provides benefits if the insured is unable to perform the duties of their specific occupation due to a disability. Any Occupation: This type of coverage provides benefits if the insured is unable to work in any occupation for which they are reasonably suited by education, training, or experience. The benefit period refers to the duration for which disability benefits will be paid. Common benefit period options include: 2 years 5 years 10 years To age 65 Lifetime The benefit amount is the portion of the insured's income that will be replaced by the disability insurance policy. Factors that may affect the benefit amount include the insured's income, occupation, and the specific policy selected. Most long-term disability insurance policies provide a benefit amount ranging from 60% to 80% of the insured's pre-disability income. The elimination period, also known as the waiting period, is the amount of time that must pass before disability benefits will begin to be paid. Typical elimination periods range from 30 to 180 days or longer. A longer elimination period generally results in lower premium costs. Long-term disability insurance policies typically have age and occupation requirements. Most policies are available to individuals between the ages of 18 and 60, although some insurers may offer coverage to individuals up to age 65. Additionally, some occupations may be considered high-risk and may not be eligible for coverage or may be subject to higher premiums. Insurers often require applicants for long-term disability insurance to undergo a health assessment to determine their risk of becoming disabled. The underwriting process may include: Medical history review: The insurer will examine the applicant's medical history to identify any pre-existing conditions or health risks. Medical exams and assessments: Depending on the applicant's age, health, and the amount of coverage requested, the insurer may require a medical exam, blood tests, or other health assessments. Long-term disability insurance policies typically contain exclusions and limitations that may affect the scope of coverage: Pre-existing conditions: Most policies exclude disabilities resulting from pre-existing conditions, typically defined as conditions for which the insured received treatment, advice, or diagnosis within a specified period before the policy's effective date. Mental health and substance abuse limitations: Many policies limit benefits for disabilities related to mental health or substance abuse disorders. Other policy exclusions: Policies may exclude coverage for disabilities resulting from self-inflicted injuries, acts of war, or criminal activities. Several factors may affect the cost of long-term disability insurance premiums, including: Age and gender of the insured Occupation and associated risk level Health status and medical history Benefit amount and duration Long-term disability insurance premiums can be structured in different ways: Level premiums: The insured pays a fixed premium amount for the life of the policy, which does not change over time. Graded or step-rate premiums: The insured's premium starts lower and increases at regular intervals (e.g., annually) as the insured ages or as the policy's benefit amount increases. Long-term disability insurance can be obtained through a group policy, often offered by employers as an employee benefit, or through an individual policy purchased directly from an insurer. Group policies typically have lower premiums and fewer underwriting requirements but may have more limited coverage options and are not portable if the insured changes employers. Individual policies tend to have higher premiums and more extensive underwriting requirements but offer more customization and portability. To file a long-term disability insurance claim, the insured must: Notify the insurer of their disability: The insured should contact their insurance company as soon as possible to initiate the claims process and receive guidance on the required documentation. Provide documentation and evidence: The insured must submit evidence of their disability, which may include medical records, physician statements, and proof of income. Once the insurer has received the necessary documentation, the claims department will review the information to determine the insured's eligibility for benefits. This process may include additional medical examinations, assessments, or interviews with the insured's healthcare providers. Long-term disability insurance benefits may be coordinated with other sources of disability income, such as Social Security Disability Insurance (SSDI), workers' compensation, or other insurance policies. In some cases, the long-term disability benefits may be reduced by the amount received from these other sources. Some of the advantages of long-term disability insurance include: Financial protection against the loss of income due to a disability Customizable coverage options to suit the insured's needs Tax-free benefits, if premiums are paid with after-tax dollars Some potential disadvantages of long-term disability insurance include: Premium costs, particularly for individual policies or high-risk occupations Limitations and exclusions in coverage The possibility that the insured may never become disabled and not use the benefits Short-term disability insurance provides income replacement for a limited duration, typically ranging from three to six months. This type of insurance can be a viable option for individuals who have sufficient emergency savings to cover longer periods of disability or for those who only need temporary coverage. SSDI is a government program that provides financial assistance to individuals who have a qualifying disability and have paid into the Social Security system. While SSDI benefits can provide a source of income during a disability, qualifying for benefits can be challenging, and the benefit amounts may be lower than those provided by private long-term disability insurance. Workers' compensation is a state-mandated insurance program that provides benefits to employees who become injured or ill as a result of their job. While workers' compensation can provide financial assistance during a work-related disability, it does not cover disabilities that occur outside of work. Some individuals may choose to self-insure against the risk of disability by building up an emergency fund or investing in assets that can be liquidated if needed. This approach requires careful financial planning and disciplined saving habits to ensure sufficient funds are available to cover potential long-term disability expenses. Long-term disability insurance is an essential component of a comprehensive financial plan, providing income replacement for individuals who become unable to work due to illness or injury. When selecting a long-term disability insurance policy, it is essential to consider factors such as coverage options, benefit amounts, elimination periods, and premium costs. Additionally, it is important to understand the eligibility requirements, exclusions, and limitations associated with the policy. By carefully evaluating the pros and cons of long-term disability insurance and considering potential alternatives, individuals can make informed decisions to protect their income and financial well-being in the event of a disability. As with any insurance product, it is crucial to review the policy's terms and conditions and consult with a knowledgeable insurance professional to ensure that the chosen coverage meets the individual's needs and financial goals.What Is Long-Term Disability Insurance?

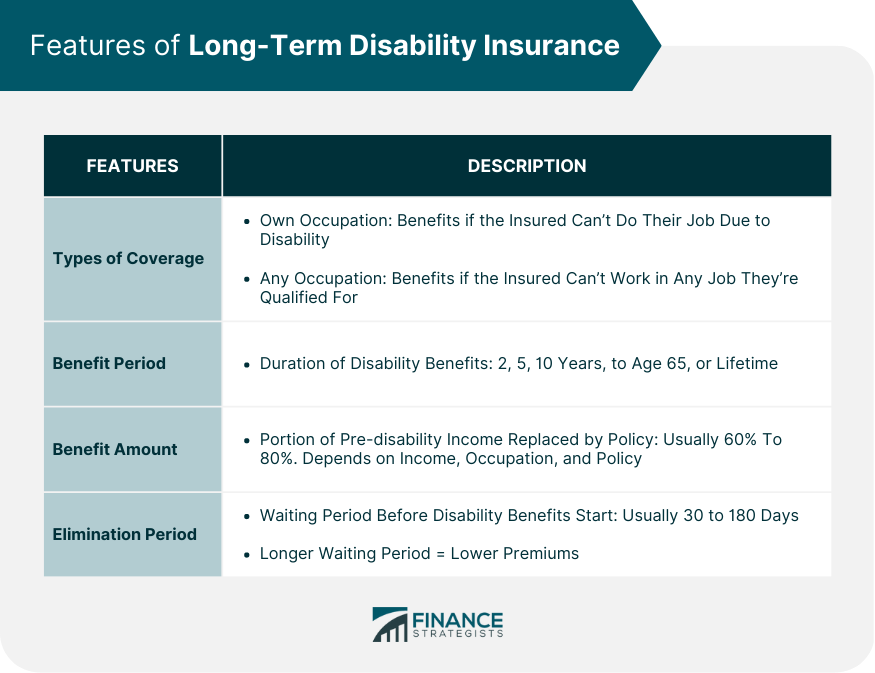

Features of Long-Term Disability Insurance

Types of Coverage

Benefit Period

Benefit Amount

Elimination Period

Eligibility for Long-Term Disability Insurance

Age and Occupation Requirements

Health Requirements and Underwriting Process

Exclusions and Limitations

Cost of Long-Term Disability Insurance

Factors Affecting Premium Costs

Premium Payment Options

Group vs Individual Policies

Claiming Long-Term Disability Insurance Benefits

Filing a Claim

Benefit Approval Process

Coordination With Other Benefits

Pros and Cons of Long-Term Disability Insurance

Advantages of Long-Term Disability Insurance

Disadvantages of Long-Term Disability Insurance

Alternatives to Long-Term Disability Insurance

Short-Term Disability Insurance

Social Security Disability Insurance (SSDI)

Workers' Compensation

Self-Insurance and Emergency Funds

Conclusion

Long-Term Disability Insurance FAQs

Long-term disability insurance is a type of insurance policy that provides a regular income to an insured person if they become disabled and cannot work for an extended period of time.

Long-term disability insurance coverage can last for a period of several years or even until retirement age, depending on the policy terms.

Anyone who relies on their income to support themselves or their family should consider getting long-term disability insurance, especially those with high-risk jobs or medical conditions that could potentially cause a disability.

Long-term disability insurance policies can cover a wide range of disabilities, including physical injuries, chronic illnesses, and mental health conditions that prevent a person from working.

The cost of long-term disability insurance can vary depending on factors such as age, occupation, and health status. However, it is typically more affordable than many people assume and can provide invaluable financial protection in the event of a disability.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.