A whole life annuity is a financial product that provides a guaranteed income stream for the entire duration of an individual's life. It offers a level of financial security by ensuring a stable income throughout retirement, regardless of how long the individual lives. The importance of a whole life annuity lies in its ability to provide a reliable source of income, protecting individuals from the risk of outliving their savings. It offers peace of mind, helps maintain a desired standard of living, and serves as a valuable tool for retirement planning and financial stability in the long term. The most notable characteristic of a whole life annuity is its provision of lifetime income. Once the annuity income phase begins, the annuitant receives regular payments for the rest of their life, regardless of how long they live. Whole life annuities offer a way to mitigate market risk. The income received from these annuities does not depend on market performance, providing stability even in volatile market conditions. Whole life annuities also offer tax benefits. The growth of the funds within the annuity is tax-deferred until withdrawal, which can make a significant difference in the growth of the investment over time. Depending on the specific product, whole life annuities may offer a variety of investment options, allowing the annuitant to align the annuity's performance with their risk tolerance and financial goals. Some whole life annuities also include death benefit provisions, allowing the remaining value of the annuity to pass to designated beneficiaries upon the annuitant's death. An immediate whole life annuity begins making payments shortly after the annuity is purchased, making it suitable for individuals who need income right away. A deferred whole life annuity, on the other hand, begins payments at a later date, allowing the investment to grow tax-deferred in the meantime. Single premium whole life annuities are purchased with a single, lump-sum payment, providing an immediate source of income. Flexible premium whole life annuities allow the annuitant to make contributions over time, offering more flexibility in funding the annuity. One of the primary advantages of whole life annuities is the provision of guaranteed income for life. This feature offers peace of mind for retirees, ensuring they will not outlive their savings. Whole life annuities offer protection against market volatility, as the income they provide is not directly linked to market performance. This allows retirees to maintain a steady income stream even during economic downturns. The tax-deferred growth of whole life annuities offers significant tax advantages. Taxes are only paid upon withdrawal, which means the investment can grow more quickly than it would in a taxable account. Many whole life annuities include beneficiary provisions, which allow the remaining value of the annuity to pass to designated beneficiaries upon the annuitant's death. This can provide additional financial security for the annuitant's loved ones. Despite their benefits, whole life annuities also come with potential drawbacks that should be considered before purchasing. Whole life annuities often come with higher costs and fees compared to other investment products. These can include surrender charges, administrative fees, and insurance charges, all of which can eat into the overall returns. Once funds are invested in a whole life annuity, they are typically not easily accessible without incurring penalties. This lack of liquidity can be a disadvantage for those who may need access to their funds in case of an emergency. While whole life annuities provide a steady income stream, they may not keep pace with inflation. This could erode the purchasing power of the annuity payments over time. Purchasing a whole life annuity involves a few key steps. First, it's crucial to evaluate your financial goals and risk tolerance to determine whether a whole life annuity is the right fit for your retirement plan. Next, compare different annuity providers to find one that offers the best combination of features, costs, and financial stability. Finally, consult with a financial advisor to ensure you fully understand the terms and potential implications of the annuity contract. A whole life annuity is a financial instrument that provides a lifelong income stream, serving as a cornerstone for many retirement plans. Its key characteristics, such as guaranteed lifetime income, protection from market volatility, tax benefits, and potential for beneficiary designations, provide a robust framework for long-term financial planning. Various types of whole life annuities, including immediate, deferred, single premium, and flexible premium, offer a range of options to suit diverse needs and financial situations. However, it's important to consider potential drawbacks such as high costs and fees, lack of liquidity, and inflation risk. Due diligence, including a thorough evaluation of financial goals and risk tolerance, comparison of different providers, and consultation with a financial advisor, is crucial when deciding to purchase a whole life annuity. As the financial landscape continues to evolve, so too may the role of whole life annuities. Therefore, staying informed and seeking professional advice is key to ensuring these instruments are used wisely and effectively as part of a comprehensive financial planning.What Is a Whole Life Annuity?

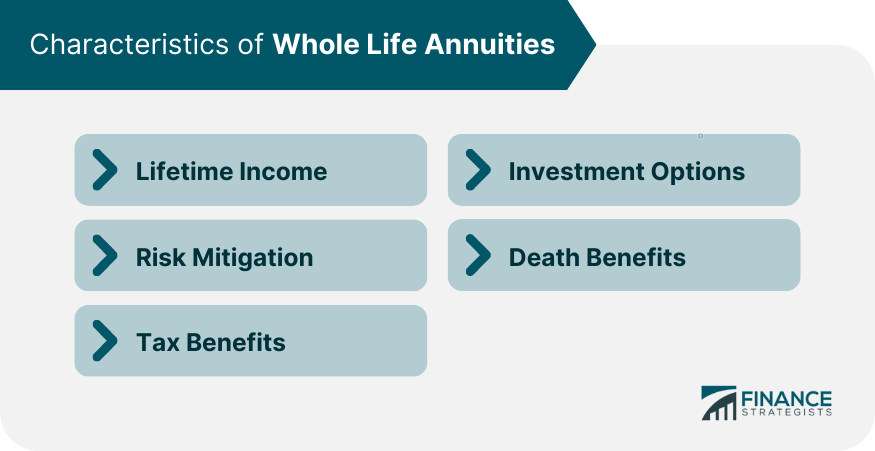

Characteristics of Whole Life Annuities

Lifetime Income

Risk Mitigation

Tax Benefits

Investment Options

Death Benefits

Types of Whole Life Annuities

Immediate Whole Life Annuity

Deferred Whole Life Annuity

Single Premium Whole Life Annuity

Flexible Premium Whole Life Annuity

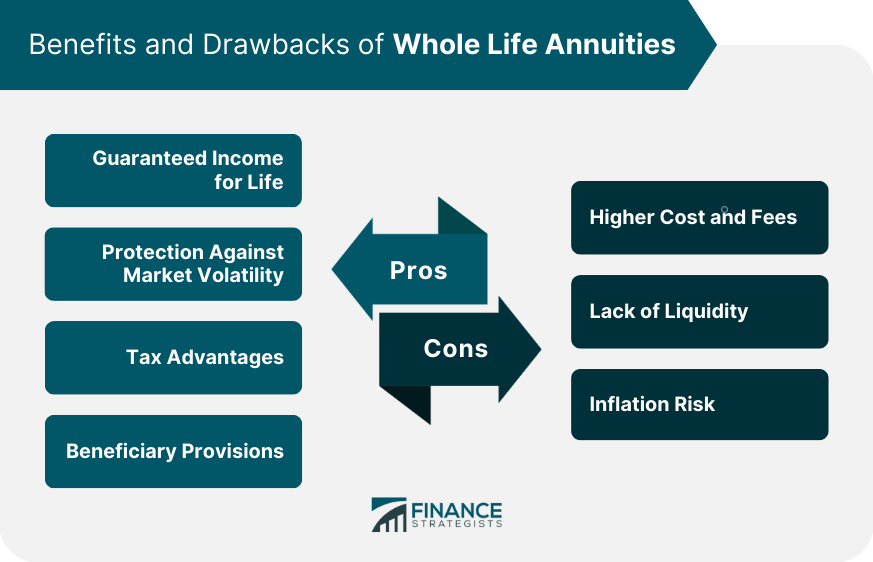

Benefits of Whole Life Annuities

Guaranteed Income for Life

Protection Against Market Volatility

Tax Advantages

Beneficiary Provisions

Drawbacks of Whole Life Annuities

Higher Cost and Fees

Lack of Liquidity

Inflation Risk

How to Purchase a Whole Life Annuity

Evaluation of Financial Goals and Risk Tolerance

Comparison of Different Annuity Providers

Consultation With a Financial Advisor

Final Thoughts

Whole Life Annuity FAQs

A whole life annuity is a type of annuity that provides guaranteed payments to the annuitant for the rest of their life. This type of annuity provides a fixed payment amount for the life of the annuitant, regardless of how long they live.

A whole life annuity works by the annuitant making a lump sum payment or series of payments to an insurance company. In exchange, the insurance company provides regular payments to the annuitant for the rest of their life. The payment amount is determined by a variety of factors, including the annuitant's age and gender at the time of purchase.

The primary benefit of a whole life annuity is that it provides guaranteed income for life, which can be especially helpful for retirees who want to ensure they will have a steady source of income in their later years. Whole life annuities can also provide tax benefits, as the payments are typically taxed at a lower rate than other types of income.

The main risk of a whole life annuity is that the payments may not keep up with inflation, meaning that the annuitant's purchasing power may decrease over time. There is also the risk that the annuitant may die soon after the purchase of the annuity, meaning that they will not receive the full value of their investment.

In general, whole life annuities are not transferable or sellable, meaning that the annuitant cannot sell their annuity to someone else. However, some annuity contracts may have provisions that allow the annuitant to transfer ownership of the annuity to a spouse or other beneficiary after their death.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.