A golden parachute is a financial package designed to protect top executives. The agreement provides substantial compensation and benefits in the event of job termination due to a change in company control, such as a merger or acquisition. Golden parachutes serve to attract and retain top talent. By offering financial security, executives are more likely to stay with the company and make decisions in the best interest of shareholders. Critics argue that golden parachutes can lead to excessive compensation. This may result in moral hazard, risk-taking, and potential conflicts of interest, as well as negative public and shareholder perceptions. The concept of golden parachutes has evolved over time. This section discusses its early adoption, growth, and prevalence, as well as legislative and regulatory reactions. Golden parachutes emerged in the 1970s and 1980s. They were initially intended to protect executives from hostile takeovers and ensure a smooth transition during a change in control. Over time, golden parachutes became more common and expanded in scope. By the late 1990s and early 2000s, these agreements had become a standard feature in executive compensation packages. Due to public scrutiny and concerns over excessive compensation, lawmakers introduced regulations. The Internal Revenue Code Section 280G, say-on-pay votes, and the Dodd-Frank Wall Street Reform and Consumer Protection Act all aimed to curb golden parachutes. Golden parachute agreements typically include several components. This section discusses severance pay, accelerated vesting of stock options, health and insurance benefits, and additional perks and compensation. Severance pay is a key component of golden parachutes. It provides executives with a lump-sum payment or salary continuation following their departure from the company. Another common feature is the accelerated vesting of stock options. This allows executives to exercise their options and immediately receive any associated financial gains. Executives may also receive extended health and insurance benefits. These provisions help to ensure continued coverage for the executive and their family during the transition period. Golden parachutes may include other perks, such as bonuses, pension enhancements, and financial planning assistance. These additional benefits contribute to the overall value of the package. Golden parachutes offer several benefits. They help to retain and attract top executives, provide protection during corporate takeovers, and align the interests of executives and shareholders. Offering golden parachutes helps companies retain and attract top talent. Executives are more likely to join and remain with a company that provides financial security in the event of a change in control. Golden parachutes protect executives during corporate takeovers. By ensuring financial security, executives are less likely to resist potentially beneficial mergers or acquisitions. These agreements can align the interests of executives and shareholders. By reducing personal risk, executives may be more likely to make decisions that benefit the company and its shareholders. Criticisms of golden parachutes include concerns about excessive compensation, moral hazard and risk-taking, potential conflicts of interest, and negative shareholder and public perception. Golden parachutes have been criticized for providing excessive compensation to executives. This can lead to income inequality within the company and contribute to a growing wealth gap in society. Critics argue that golden parachutes can create moral hazard. The financial security provided by these agreements may encourage executives to take excessive risks, potentially jeopardizing the company's stability. Golden parachutes may create conflicts of interest. Executives could prioritize their personal financial interests over the best interests of the company and its shareholders. Negative public and shareholder perception is a common criticism of golden parachutes. These arrangements can be seen as unfair, fueling resentment and potentially damaging a company's reputation. Legal and regulatory considerations play a significant role in shaping golden parachutes. This section discusses Internal Revenue Code Section 280G, say-on-pay and shareholder approval, and the Dodd-Frank Wall Street Reform and Consumer Protection Act. Section 280G of the Internal Revenue Code imposes tax penalties on excessive golden parachute payments. This legislation aims to discourage excessive compensation and mitigate potential abuses. Say-on-pay policies give shareholders a non-binding vote on executive compensation packages. This process can provide valuable feedback and help to address concerns about excessive compensation and golden parachutes. The Dodd-Frank Act introduced additional regulations on golden parachutes. This legislation requires companies to disclose more information about these arrangements and subjects them to greater scrutiny. There are several alternatives to traditional golden parachutes. This section discusses double-trigger provisions, performance-based compensation, and clawbacks and recovery provisions. Double-trigger provisions require two events to occur before a golden parachute is activated. This can help to ensure that the executive's departure is directly related to a change in control, reducing potential abuses. Performance-based compensation ties executive pay to specific performance metrics. This approach can help to align executive incentives with company performance and shareholder interests. Clawbacks and recovery provisions allow companies to recoup compensation in certain circumstances. This can help to hold executives accountable for their actions and discourage excessive risk-taking. A golden parachute is a financial package designed to provide substantial compensation and benefits to top executives in the event of job termination due to a change in company control. These agreements aim to attract and retain top talent and align the interests of executives and shareholders. However, they have been criticized for potentially leading to excessive compensation, moral hazard, and conflicts of interest, as well as negative public and shareholder perceptions. Legal and regulatory considerations, such as the Internal Revenue Code Section 280G, say-on-pay policies, and the Dodd-Frank Act, play a significant role in shaping golden parachutes. Alternatives to traditional golden parachutes, such as double-trigger provisions, performance-based compensation, and clawbacks and recovery provisions, are also available. It is important for companies to carefully consider the advantages and criticisms of golden parachutes and their alternatives to ensure fair and effective executive compensation practices.What Are Golden Parachutes?

Historical Development of Golden Parachutes

Early Adoption

Growth and Prevalence

Legislative and Regulatory Reactions

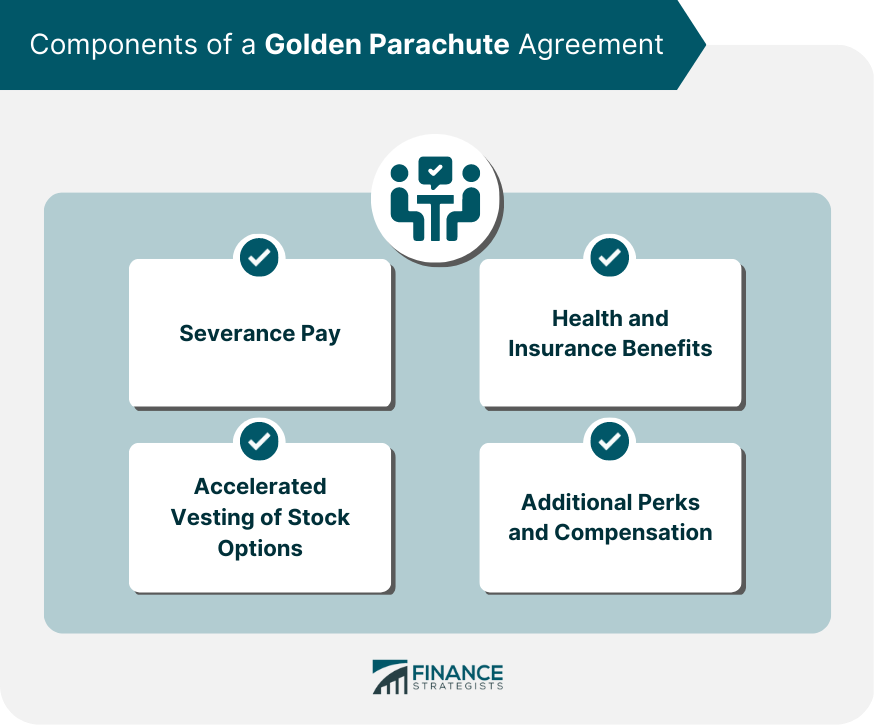

Components of a Golden Parachute Agreement

Severance Pay

Accelerated Vesting of Stock Options

Health and Insurance Benefits

Additional Perks and Compensation

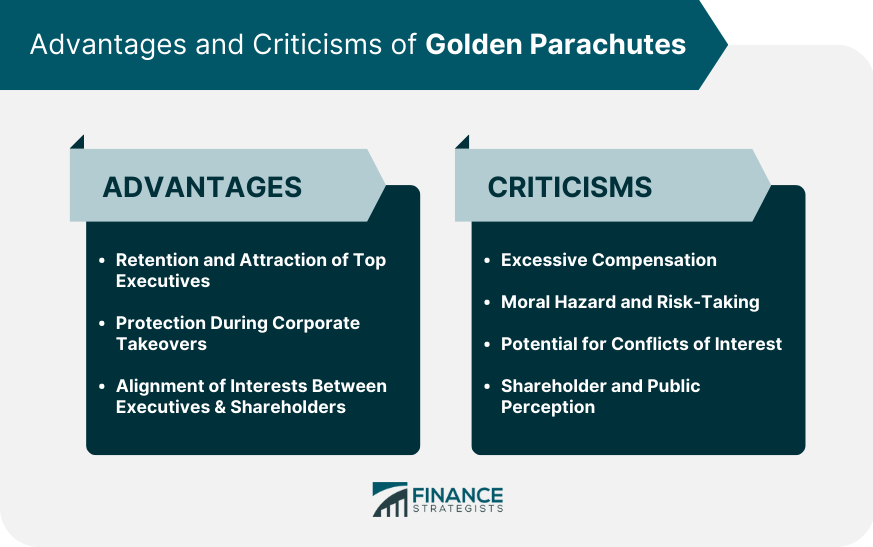

Advantages of Golden Parachutes

Retention and Attraction of Top Executives

Protection During Corporate Takeovers

Alignment of Interests Between Executives and Shareholders

Criticisms of Golden Parachutes

Excessive Compensation

Moral Hazard and Risk-Taking

Potential for Conflicts of Interest

Shareholder and Public Perception

Legal and Regulatory Considerations

Internal Revenue Code Section 280G

Say-on-Pay and Shareholder Approval

Dodd-Frank Wall Street Reform and Consumer Protection Act

Alternatives to Golden Parachutes

Double-Trigger Provisions

Performance-Based Compensation

Clawbacks and Recovery Provisions

Conclusion

Golden Parachutes FAQs

A golden parachute agreement is a compensation package offered to top executives in the event of a change in ownership or control of a company.

A golden parachute typically includes cash payments, stock options, and other benefits that are triggered when certain conditions are met, such as a merger or acquisition.

Golden parachutes primarily benefit top executives, such as CEOs and senior managers, who may face job loss or reduced compensation following a change in ownership or control of a company.

Yes, golden parachutes have been criticized by some for providing excessive compensation to executives, regardless of their performance, and for potentially discouraging mergers and acquisitions.

Golden parachutes are typically included in employment contracts or severance agreements, and their enforceability depends on the specific terms and conditions outlined in those agreements.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.