Decision Analysis (DA) is a systematic, quantitative, and visual approach to addressing and making optimal decisions under uncertain conditions. DA incorporates different elements, including the decision maker's values and judgments, uncertainty, trade-offs, and risk tolerance. It aids in breaking down complex decisions into comprehensible components, enabling the decision-maker to understand the decision problem better. The origins of decision analysis can be traced back to the mid-20th century when Ronald A. Howard, a pioneer in the field, began formalizing the methodology. Initially employed in operations research and management science, DA quickly found its application in various fields. Over the years, decision analysis evolved, incorporating advancements in computational techniques and decision theory. Today, it's a vital tool in many disciplines, including finance, where it's used to navigate complex investment decisions and strategic planning. Decision points, or choices, refer to the range of options available to the decision-maker. These choices play a crucial role in determining the path taken in resolving a decision problem. Uncertainties are unpredictable elements that could influence the outcomes of a decision. Understanding these unknown variables is key to preparing for different possible scenarios. Objectives represent the goals or targets that the decision-maker aims to achieve. Clear objectives can guide the decision-making process toward a desirable outcome. Outcomes represent the results or consequences of the decisions made. The evaluation of these outcomes is a critical step in the decision-analysis process. Probabilities determine the likelihood of each uncertain event happening. Understanding these probabilities can help to predict potential outcomes and assess the risk associated with each decision. Utilities reflect the decision-makers preferences for each potential outcome. This component helps in determining the value of each decision alternative, considering the individual's or organization's specific preferences or needs. The decision analysis process begins by clearly defining the problem. This stage involves understanding the context and the implications of the problem. Next, the objectives are set, and the possible decision alternatives are determined. This involves brainstorming all feasible options and defining what success looks like in the context of the problem. The third step involves identifying uncertainties linked to each decision alternative and estimating their probabilities. This process helps in understanding the risks involved with each decision point. Following this, decision trees or models are constructed to visualize the decision problem, uncertainties, probabilities, and potential outcomes. Outcomes are then evaluated based on the decision-makers preferences or utilities. This helps in understanding the desirability of each potential result. Finally, after a thorough analysis of all the above factors, the best decision alternative is selected, which aligns most with the objectives and preferences of the decision-maker. Predictive decision analysis is primarily focused on predicting outcomes based on current decisions and actions. It uses historical data, statistical models, and forecasting techniques to predict future events. Normative decision analysis is centered on identifying the ideal decision that should be made, considering rational behavior and optimal results. It typically uses mathematical models and logical reasoning to establish the 'norm' or standard. Prescriptive decision analysis aims at prescribing the optimal decisions based on specific criteria or objectives. It takes into account not just the data but also the decision-makers preferences, resources, and constraints to provide specific recommendations. The Expected Value (EV) framework is a fundamental concept in decision analysis. It calculates the average outcome of an uncertain event when the probabilities of all possible outcomes are known. In finance, the EV framework aids in making decisions under risk and uncertainty, such as investment decisions, by weighing the potential gains against the likelihood of their occurrence. Decision tree analysis is a visual tool in DA that outlines different decision paths and their possible outcomes in a tree-like model. It's particularly helpful when decisions are complex and involve several stages. In finance, decision trees are often used to evaluate investment opportunities, options pricing, and strategic business decisions. Monte Carlo simulation is a computational technique used in decision analysis to understand the impact of risk and uncertainty in prediction and forecasting models. It involves generating thousands of possible scenarios for a decision problem. In finance, Monte Carlo simulation is used for portfolio risk analysis, financial modeling, and valuation. MCDA is a subset of DA that deals with decisions involving multiple conflicting criteria. It's a structured approach that helps decision-makers trade-offs between conflicting objectives and make more informed decisions. MCDA is often used in finance for capital budgeting, portfolio selection, and strategic planning. Decision Analysis aids in capital budgeting decisions by structuring the decision-making process, accounting for risk and uncertainty, and offering quantitative methods for evaluating investment proposals. Tools like decision trees and Monte Carlo simulations can help compare different investment projects, considering their potential returns and associated risks. In investment and portfolio management, Decision Analysis assists in choosing the right mix of assets to maximize returns while minimizing risk. Quantifying uncertainties allows investors to make informed decisions, balancing the trade-off between risk and return. Risk management is a crucial aspect of finance where Decision Analysis plays a pivotal role. By modeling various risk scenarios and their potential impact, DA helps in identifying, quantifying, and managing risk effectively. Decision Analysis aids in mergers and acquisitions decisions by providing a structured approach to evaluate potential deals. It assists in assessing the strategic fit, potential synergies, risks, and financial implications of a merger or acquisition. In financial planning and forecasting, Decision Analysis offers methods to model and analyze different financial scenarios and their implications. This helps in making informed decisions about budgeting, cash flow management, and financial strategy. Despite its usefulness, Decision Analysis has limitations. One key challenge is dealing with uncertainty and risk. While DA provides methods to quantify and manage risk, it cannot eliminate it entirely. Cognitive biases can influence decision-making, potentially leading to suboptimal decisions. Decision Analysis, while providing a structured approach, cannot completely eliminate these biases. DA models and techniques have their limitations. For instance, they rely on the accuracy of input data and assumptions, which may not always hold true. Decision Analysis is a systematic, quantitative approach that assists in making optimal decisions under uncertain conditions. It encompasses various components such as decision points, uncertainties, objectives, outcomes, probabilities, and utilities. The DA process involves defining the problem, identifying objectives and decision alternatives, dealing with uncertainties, constructing decision trees or models, evaluating outcomes, and selecting the best decision alternative. There are multiple types of DA, namely predictive, normative, and prescriptive. DA employs several frameworks and models, including the Expected Value Framework, Decision Tree Analysis, Monte Carlo Simulation, and Multi-Criteria Decision Analysis. DA plays a significant role in strategic financial management, aiding in decisions related to capital budgeting, investment, risk management, and financial planning. However, despite its many advantages, DA does face challenges such as uncertainty and risk, cognitive biases, and limitations of DA models and techniques.What Is Decision Analysis (DA)?

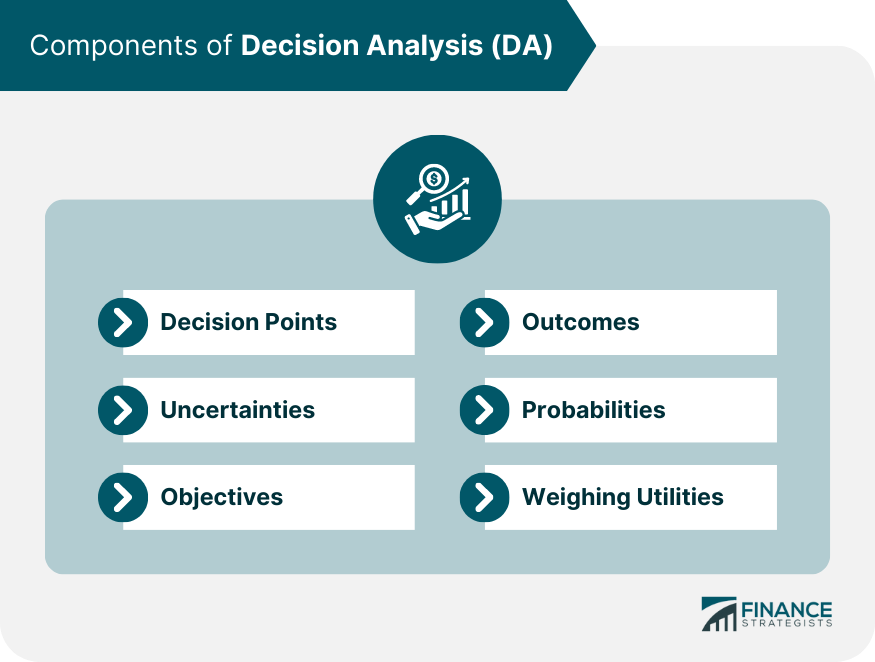

Components of Decision Analysis

Decision Points

Uncertainties

Objectives

Outcomes

Probabilities

Utilities

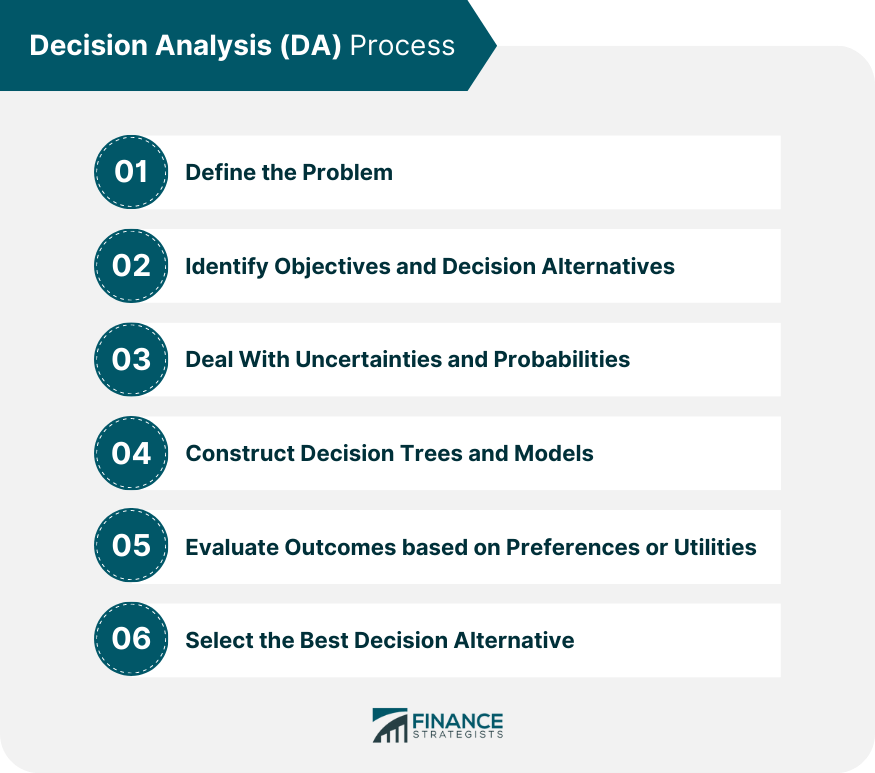

Decision Analysis Process

Defining the Problem

Identifying Objectives and Decision Alternatives

Dealing With Uncertainties and Probabilities

Constructing Decision Trees and Models

Evaluating Outcomes Based on Preferences or Utilities

Selecting the Best Decision Alternative

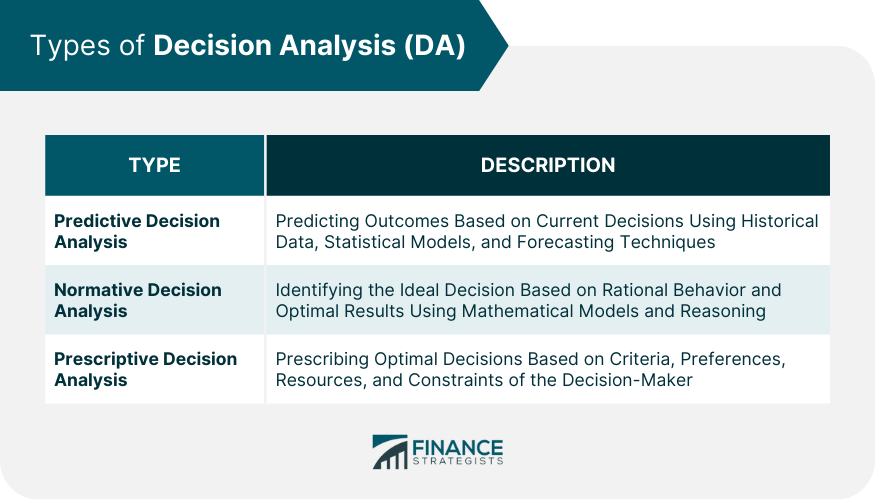

Types of Decision Analysis

Predictive Decision Analysis

Normative Decision Analysis

Prescriptive Decision Analysis

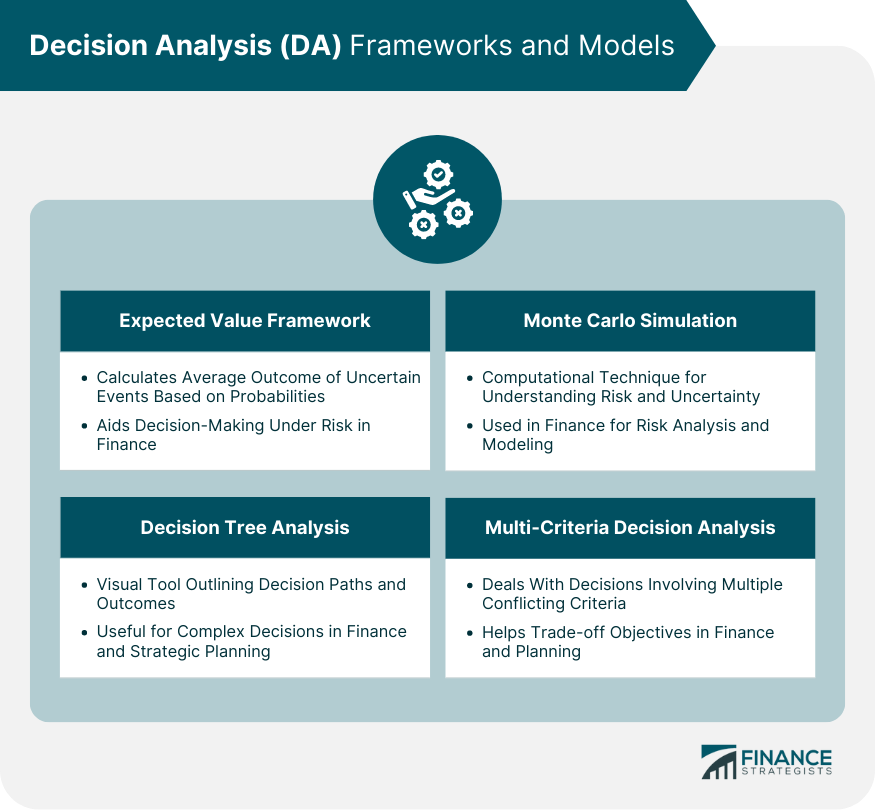

Decision Analysis Frameworks and Models

Expected Value Framework

Decision Tree Analysis

Monte Carlo Simulation in DA

Multi-Criteria Decision Analysis (MCDA)

Application of Decision Analysis in Finance

Capital Budgeting Decisions

Investment and Portfolio Decisions

Risk Management Decisions

Mergers and Acquisitions Decisions

Financial Planning and Forecasting

Challenges and Limitations of Decision Analysis in Finance

Uncertainty and Risk in Decision Analysis

Cognitive Biases and DA

Limitations of DA Models and Techniques

Final Thoughts

Decision Analysis (DA) FAQs

Decision Analysis in finance is a systematic approach to making optimal financial decisions under uncertain conditions. It involves breaking down complex decisions into simpler components, evaluating different scenarios, and selecting the best decision based on predefined criteria.

Decision Analysis is used in investment decisions to evaluate different investment options, considering their potential returns and associated risks. Tools like decision trees and Monte Carlo simulations are often used.

Decision Analysis aids in risk management by modeling various risk scenarios and their potential impact. This helps in identifying, quantifying, and managing risk effectively.

Yes, Decision Analysis can assist in long-term financial planning by modeling different financial scenarios and their implications. This helps in making informed decisions about budgeting, cash flow management, and financial strategy.

Despite its usefulness, Decision Analysis has limitations. It cannot eliminate uncertainty and risk entirely, it can be influenced by cognitive biases, and its effectiveness relies on the accuracy of input data and assumptions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.