Offshore trusts, also known as international trusts or foreign trusts, are legal and financial arrangements established in a jurisdiction outside the grantor's home country. These trusts provide individuals with various benefits, including asset protection, tax planning, confidentiality, and estate planning advantages. Offshore trusts involve the transfer of assets to a trustee in a foreign jurisdiction, which then administers and manages the trust according to its terms. While offshore trusts offer various benefits, they must be established and managed in compliance with both the laws of the offshore jurisdiction and the grantor's home country. Failure to comply with legal and tax requirements can lead to penalties, legal complications, and reputational risks. It is also crucial to understand the potential tax implications in the grantor's home country, as tax authorities may have reporting requirements for offshore trusts and income generated by these trusts. In a discretionary trust, the trustee has the discretion to decide how the trust's income and capital should be distributed among the beneficiaries. This flexibility allows for better asset protection and tax planning. A revocable trust allows the settlor to retain control over the trust's assets and amend or terminate the trust at any time. While this offers greater flexibility, it may not provide the same level of asset protection and tax benefits as an irrevocable trust. An irrevocable trust cannot be amended or terminated by the settlor after its creation. This provides stronger asset protection and tax benefits, as the trust's assets are considered separate from the settlor's personal assets. Asset protection trusts are specifically designed to safeguard assets from potential creditors and legal claims. These trusts often have provisions that limit a creditor's ability to access the trust's assets. Charitable trusts are established for philanthropic purposes and provide financial support to charitable organizations. These trusts can offer significant tax benefits to the settlor and may be structured as either revocable or irrevocable trusts. Cayman Islands British Virgin Islands Isle of Man Switzerland Belize Political and Economic Stability Taxation Legal Framework Confidentiality and Privacy The trustee is responsible for managing the trust's assets, making distributions to beneficiaries, and ensuring compliance with the trust deed and applicable laws. It is crucial to choose a reputable and experienced trustee. The trust deed is the legal document that outlines the terms and conditions of the trust. It is essential to have a well-drafted trust deed that addresses the specific needs and objectives of the settlor and beneficiaries. The settlor must transfer assets into the trust to fund it. This can include cash, securities, real estate, and other types of assets. The settlor must designate one or more beneficiaries who will benefit from the trust's assets. Beneficiaries can be individuals or legal entities, such as charities. Offshore trusts must comply with the laws and regulations of the chosen jurisdiction, as well as any applicable international rules and treaties. Offshore trusts can offer significant tax benefits, such as reduced income, capital gains, and inheritance taxes, depending on the chosen jurisdiction and structure. Settlors and beneficiaries may be subject to taxes in their country of residence, depending on their relationship with the trust and the local tax laws. Offshore trusts may be subject to various reporting requirements, including annual accounts, tax returns, and disclosures to regulatory authorities. Many offshore jurisdictions have double taxation agreements with other countries to prevent the same income from being taxed twice. These agreements can help reduce the overall tax burden for settlers and beneficiaries. One of the primary benefits of offshore trusts is their ability to protect assets from potential creditors, lawsuits, and other legal claims. By placing assets in an offshore trust, they are often considered beyond the reach of creditors in the settlor's home country. Various strategies can be employed to enhance the asset protection capabilities of an offshore trust, such as using multiple jurisdictions, layering legal structures, and including spendthrift provisions in the trust deed. While offshore trusts offer significant asset protection benefits, they are not immune to challenges. Creditors and claimants may still attempt to access the trust's assets through legal proceedings, and regulatory changes can impact the trust's effectiveness. Offshore trusts can be used for legitimate tax planning purposes (tax avoidance), but they can also be misused for illegal tax evasion. It is essential to distinguish between the two and ensure that the trust's structure and operations comply with applicable laws. Offshore trusts have been associated with money laundering activities due to their potential for anonymity and asset concealment. Regulatory authorities worldwide are increasingly focusing on combating money laundering and enforcing Anti-money Laundering (AML) regulations, which can affect offshore trusts. In response to concerns about tax evasion and money laundering, international organizations and governments have implemented various measures to increase transparency and information exchange between jurisdictions. These measures include the Common Reporting Standard (CRS), the Foreign Account Tax Compliance Act (FATCA), and the Automatic Exchange of Information (AEOI). Global tax transparency initiatives, such as the CRS and AEOI, have increased scrutiny on offshore trusts and their beneficiaries. This heightened transparency may lead to changes in the offshore trust industry as individuals and entities adapt their structures to comply with new regulations. Technological advancements, such as blockchain technology and digital currencies, can potentially change the offshore trust landscape. These technologies may offer new ways to structure and manage trusts while maintaining privacy and security. As regulations continue to evolve, offshore trusts will need to adapt to maintain their effectiveness as asset protection and tax planning vehicles. This may involve changes in jurisdiction, structure, or operations to ensure compliance with both local and international regulations. Offshore trusts offer valuable asset protection and tax planning benefits for individuals and entities seeking to safeguard their wealth. With various types of trusts available, each tailored to different purposes and objectives, it is essential to choose the right trust structure and jurisdiction. Although offshore trusts provide substantial benefits, they are not without limitations, ethical concerns, and legal challenges. The future of offshore trusts will be shaped by evolving regulations, global tax transparency initiatives, and technological advancements. Therefore, it is crucial for settlers, beneficiaries, and trustees to remain informed about these changes and adapt their strategies accordingly to ensure compliance with all applicable laws and regulations while maximizing the benefits of their offshore trusts.What Are Offshore Trusts?

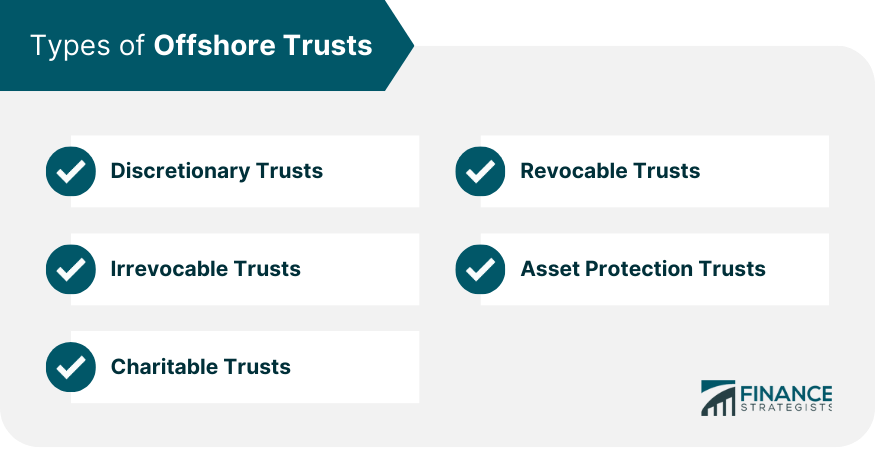

Types of Offshore Trusts

Discretionary Trusts

Revocable Trusts

Irrevocable Trusts

Asset Protection Trusts

Charitable Trusts

Offshore Trust Jurisdictions

Popular Jurisdictions

Factors to Consider When Choosing a Jurisdiction

Steps in Establishing an Offshore Trust

Selecting a Trustee

Drafting the Trust Deed

Funding the Trust

Beneficiary Designation

Compliance With Local and International Regulations

Taxation of Offshore Trusts

Tax Benefits

Tax Implications for Settlors and Beneficiaries

Reporting Requirements

Double Taxation Agreements

Asset Protection and Offshore Trusts

Safeguarding Assets From Creditors

Legal Strategies for Asset Protection

Offshore Trust Limitations and Challenges

Ethical and Legal Concerns

Tax Evasion vs Tax Avoidance

Money Laundering and Offshore Trusts

Regulatory Measures to Curb Illicit Activities

Future of Offshore Trusts

Impact of Global Tax Transparency Initiatives

Technological Advancements and Their Influence

Evolving Regulations and Their Effects on Offshore Trusts

Conclusion

Offshore Trusts FAQs

Offshore trusts offer numerous benefits, including asset protection from creditors and legal claims, tax planning advantages such as reduced income, capital gains, and inheritance taxes, and enhanced privacy and confidentiality in certain jurisdictions.

When selecting a jurisdiction for your offshore trust, consider factors such as political and economic stability, taxation, the legal framework, and confidentiality and privacy regulations. Popular jurisdictions for offshore trusts include the Cayman Islands, British Virgin Islands, Isle of Man, Switzerland, and Belize.

Offshore trusts are legal if properly structured and managed in accordance with the laws and regulations of the chosen jurisdiction and the settlor's home country. They can be ethically sound if used for legitimate tax planning and asset protection purposes rather than tax evasion or money laundering.

Global tax transparency initiatives, such as the Common Reporting Standard (CRS) and Automatic Exchange of Information (AEOI), have increased scrutiny on offshore trusts and their beneficiaries. These initiatives require jurisdictions to share financial account information, which may impact the privacy and anonymity of offshore trusts.

To establish an offshore trust, follow these key steps: select a reputable and experienced trustee, draft a well-structured trust deed, fund the trust by transferring assets, designate beneficiaries, and ensure compliance with local and international regulations, including tax and reporting requirements.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.