An annuity trust is a type of irrevocable trust that provides a fixed income to one or more beneficiaries for a specified period or for the lifetime of the beneficiaries. The trust is funded with assets that generate income, and the income is distributed to the beneficiaries according to the terms of the trust. The primary purpose of annuity trusts is to provide a stable and predictable income stream to beneficiaries while protecting the trust assets from creditors and estate taxes. Annuity trusts can also be used for estate planning, wealth transfer, and charitable giving purposes. Annuity trusts are established by drafting a trust agreement that outlines the terms of the trust, including the duration of the trust, the amount of the annuity payments, and the identity of the beneficiaries. The trust agreement is then executed by the trust creator and the trustee, who will be responsible for managing the trust assets and making the annuity payments to the beneficiaries. Annuity trusts are funded with assets that generate income, such as stocks, bonds, real estate, or other investments. The trust creator transfers the assets to the trust, and the trustee invests the assets in accordance with the terms of the trust agreement and applicable law. The income generated by the trust assets is used to make the annuity payments to the beneficiaries. The trustee is responsible for calculating and distributing the annuity payments according to the terms of the trust agreement. Depending on the type of annuity trust and the terms of the trust agreement, the beneficiaries may also receive distributions of principal from the trust, either during the term of the trust or at the end of the trust term. Charitable annuity trusts are established to provide income to one or more non-charitable beneficiaries for a specified period or for their lifetimes, with the remaining trust assets ultimately passing to a designated charity. This type of annuity trust can offer significant tax benefits to the trust creator, including income tax deductions, reduced estate taxes, and potential capital gains tax savings. A Grantor Retained Annuity Trust (GRAT) is an irrevocable trust in which the trust creator (grantor) retains the right to receive a fixed annuity payment from the trust for a specified term of years. At the end of the term, the remaining trust assets pass to the beneficiaries, usually the grantor's children or other family members. GRATs are often used as an estate planning tool to transfer assets to the next generation with minimal tax consequences. Non-grantor annuity trusts are established by a third party, such as a parent or grandparent, for the benefit of one or more beneficiaries. The beneficiaries receive a fixed annuity payment from the trust for a specified period or for their lifetimes, with the remaining trust assets distributed to the beneficiaries or held in trust for their benefit. This type of annuity trust can offer asset protection and tax advantages for the trust creator and the beneficiaries. Annuity trusts can offer significant tax benefits to the trust creator and the beneficiaries, including income tax deductions for charitable annuity trusts, reduced estate taxes, and potential capital gains tax savings. By transferring assets to an annuity trust, the trust creator can remove those assets from their taxable estate, potentially reducing estate taxes and ensuring a more efficient transfer of wealth to the next generation. Annuity trusts can provide a level of asset protection for both the trust creator and the beneficiaries. Once assets are transferred to the trust, they are generally protected from the claims of creditors, lawsuits, and even divorces, ensuring that the beneficiaries will continue to receive their annuity payments as planned. Annuity trusts offer flexibility in terms of the types of assets that can be used to fund the trust, the choice of beneficiaries, and the duration of the trust. This allows the trust creator to tailor the trust to meet their specific estate planning goals and objectives, providing a customized solution for wealth transfer and asset protection. When assets are transferred to an annuity trust, the trust creator relinquishes control over those assets, as they become the property of the trust. This means that the trust creator cannot change the terms of the trust, access the trust assets, or revoke the trust once it has been established. Annuity trusts can be complex to set up and administer, often requiring the assistance of experienced legal and financial professionals. The trust agreement must be carefully drafted to ensure that the trust operates as intended and complies with applicable laws and regulations. Additionally, the trustee must be diligent in managing the trust assets and making the required annuity payments to the beneficiaries. Annuity trusts are typically irrevocable, meaning that once they are established, they cannot be changed or revoked. This can be a disadvantage for the trust creator if their circumstances or estate planning goals change after the trust has been established. When considering an annuity trust, it is essential to carefully evaluate your estate planning goals and objectives. This includes determining whether the primary purpose of the trust is to provide a stable income stream for beneficiaries, minimize taxes, protect assets, or achieve some combination of these objectives. The types of assets to be transferred to the annuity trust must also be considered, as different assets may have different tax consequences and generate different levels of income. An experienced financial professional can help you evaluate the most appropriate assets to fund the trust and ensure that your estate planning goals are met. Finally, the choice of beneficiaries is a critical consideration in setting up an annuity trust. Depending on the type of annuity trust, the beneficiaries may be family members, friends, or charitable organizations. It is essential to carefully consider the needs and circumstances of the chosen beneficiaries to ensure that the annuity trust is structured in a way that best meets their needs. Annuity trusts are irrevocable trusts that provide a fixed income to beneficiaries for a specified period or for their lifetimes. They serve a variety of estate planning purposes, including providing stable income streams, minimizing taxes, and protecting assets. Annuity trusts are established by drafting a trust agreement, transferring assets to the trust, and making annuity payments to the beneficiaries according to the terms of the trust. The trustee is responsible for managing the trust assets and making the required annuity payments. There are several types of annuity trusts, including charitable annuity trusts, grantor retained annuity trusts, and non-grantor annuity trusts. Each type of annuity trust has unique features and benefits that can help achieve specific estate planning goals. Annuity trusts offer several advantages, including tax benefits, asset protection, and flexibility. However, there are also some disadvantages to consider, such as the loss of control over assets, the complexity of establishing and managing the trust, and the irrevocable nature of the trust once established.What Are Annuity Trusts?

How Annuity Trusts Work

Establishment of Annuity Trusts

Funding Annuity Trusts

Distribution of Income and Principal

Types of Annuity Trusts

Charitable Annuity Trusts

Grantor Retained Annuity Trusts

Non-Grantor Annuity Trusts

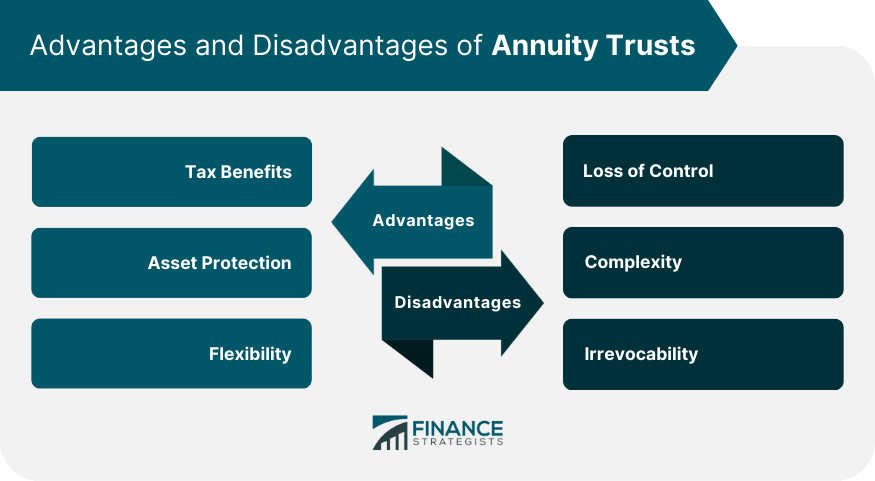

Advantages of Annuity Trusts

Tax Benefits

Asset Protection

Flexibility

Disadvantages of Annuity Trusts

Loss of Control

Complexity

Irrevocability

Factors to Consider in Setting up An Annuity Trust

Goals and Objectives

Assets to Transfer

Beneficiaries

Final Thoughts

Annuity Trusts FAQs

An annuity trust is a legal arrangement where a trust beneficiary receives a fixed amount of income annually for a specified period.

There are three main types of annuity trusts: charitable annuity trusts, grantor retained annuity trusts, and non-grantor annuity trusts.

An annuity trust provides tax benefits, asset protection, and flexibility to the grantor.

The grantor loses control over the assets transferred to the trust, and the process of establishing and managing an annuity trust can be complex and time-consuming.

Factors to consider when deciding whether to set up an annuity trust include your goals and objectives, the assets you want to transfer, and your intended beneficiaries. Consulting with a financial advisor can also help.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.