Usury is essentially the practice of lending money at exorbitant interest rates. Historically, many religions and societies frowned upon usury, viewing it as morally repugnant or ethically questionable. The foundational idea is that profiting excessively from another's need or desperation is unjust. However, within human commerce and financial systems, usury has persisted, assuming various disguises and adopting multiple appellations. Usury works as a simple lending mechanism, but with a catch—the interest rate is unusually high. The borrower, often driven by urgent financial need, agrees to these steep terms. It could be due to limited financial knowledge, desperation, or simply the lack of better options. As the borrower repays the loan, a significant chunk of their payment is consumed by interest. Over time, the interest burden can swell, often outpacing the principal amount borrowed. While many modern societies have laws to prevent exorbitant interest rates, usurers find loopholes. These may be in the form of service charges, fees, or other ancillary costs. The end result remains the same: the borrower pays significantly more than they initially borrowed. Stepping into the realm of usury often leads borrowers down a treacherous path. These high-interest loans can quickly turn manageable debt into a crippling financial burden. A small loan intended to tide someone over until their next paycheck can evolve into a large debt due to the compounding of high interest. This financial burden isn't just about numbers on a ledger. It's about a single mother who has to decide between paying her usurious loan or buying groceries. It's about the young entrepreneur whose business dreams are smothered under the weight of crushing debt. As individuals struggle to pay off one loan, they might find themselves taking out another just to stay afloat. This cycle can stifle economic mobility, trapping hard-working individuals in a state of perpetual financial limbo. The broader economy isn't immune either. When a significant portion of the populace is ensnared in debt, consumer spending dwindles. Economic growth stagnates as money that could be invested in businesses, education, or property is instead siphoned off to pay off predatory loans. Trust in financial institutions can wane, and dreams of upward mobility can be crushed under the weight of mounting debt. Moreover, as more people get entrapped in debt, public resources may be stretched thin. Governments might find themselves spending more on welfare services or dealing with increased crime rates, as some may resort to desperate measures to escape debt. One notable benefit is increased access to credit. Traditional banks might deny loans to those with poor credit histories, but usurious lenders, with their high-interest safety net, often extend credit to these high-risk borrowers. This increased access, while fraught with peril, can sometimes be a lifeline. For someone facing a medical emergency or an unforeseen expense, these loans—despite their terms—might be the only available option. From an investor's perspective, usury can be quite appealing. The high-interest rates promise greater returns on investment. In a world where traditional savings accounts offer meager interest rates, the allure of usurious lending, with its potential for high profits, can be tempting for those looking to maximize their returns. Yet, it's a double-edged sword. While the potential for profit is high, so is the risk. Default rates can be substantial, and the moral quandaries associated with usurious practices can deter some investors. Usury can be seen as a mechanism for market efficiency. It prices loans based on risk. Those deemed riskier borrowers are charged higher interest rates. In a twisted sense, this can be seen as the market "correctly" pricing the risk associated with certain borrowers. However, the ethical implications of this efficiency are a matter of intense debate. Is it fair to charge someone more simply because they're deemed a higher risk? This question underscores the moral complexities inherent in usurious practices. High-interest rates can quickly transform a manageable loan into a financial albatross. With each passing month, the interest compounds, making the principal harder to pay down. This isn't just an abstract concept. It's a reality for countless individuals who find their dreams deferred and their financial futures in jeopardy due to usurious loans. Usury is often synonymous with exploitation. Lenders, armed with the knowledge that their borrowers are desperate, can implement practices that are profoundly unfair. Hidden fees, obscure terms, and aggressive collection practices are just a few of the tactics employed. It's a dynamic that's inherently imbalanced. One party holds most of the power, while the other, driven by need, is left to navigate a maze of predatory practices. On a macroeconomic scale, widespread usury can lead to economic instability. When large portions of the population are burdened with debt, consumer spending and investment decline. This can lead to economic slowdowns and in extreme cases, recessions. Moreover, the banking and financial sectors can be jeopardized. High default rates on usurious loans can weaken financial institutions, potentially leading to systemic collapses. With formal banking systems often out of reach for the average citizen, many turn to informal lenders who charge exorbitant interest rates. For a small business owner in a developing nation, a usurious loan might be the only way to finance their operations. However, the high interest can stifle growth and trap them in a cycle of debt, inhibiting economic development at both an individual and national level. In the developed world, usury often masquerades as payday lending. These short-term, high-interest loans are touted as quick fixes for those in need of immediate cash. Yet, the reality is often far more insidious. A borrower might take out a payday loan to cover an unexpected expense, thinking they'll pay it off with their next paycheck. But the exorbitant interest rates and fees can make repayment challenging, leading many to roll over their loans, accumulating more debt in the process. The battle against usury has led to a renewed focus on consumer protection. Many countries have implemented interest rate caps, limiting the amount of interest a lender can charge. Additionally, transparency regulations have been put in place, ensuring borrowers are aware of the terms of their loans. However, the fight is far from over. Usurious lenders continually evolve, finding new ways to skirt regulations and exploit vulnerable borrowers. Governments play a pivotal role in combating usury. By setting interest rate caps, they can directly limit the rates charged by lenders. Moreover, robust oversight and regulation of lending practices can ensure that borrowers are treated fairly. Yet, legislation is only one piece of the puzzle. Effective enforcement mechanisms are crucial. Regulatory bodies must be empowered to monitor lending practices, levy fines, and, when necessary, shutter institutions that engage in predatory lending. Education is a potent weapon against usury. By equipping individuals with the knowledge to recognize and avoid predatory loans, we can reduce the pool of potential victims. This involves more than just educating individuals about interest rates. It's about instilling a broader financial literacy, ensuring that people understand concepts like compounding interest, loan terms, and the long-term implications of debt. Non-profit organizations worldwide have taken up the mantle in the fight against usury. These organizations offer a range of services, from providing low-interest loans to those in need to offering financial counseling. By providing an alternative to usurious loans, these organizations can help break the cycle of debt. Moreover, their advocacy efforts can drive policy change, ensuring that usury is pushed to the fringes of our financial systems. Usury is the practice of lending money at exorbitant interest rates and has been a longstanding controversial issue in human commerce and financial systems. While historically frowned upon by many societies and religions due to its perceived moral repugnance, usury has persisted and adapted, wearing various disguises. The mechanics of usury involve simple lending with excessively high-interest rates, burdening borrowers with escalating debt over time. The impact of usury on individuals, economies, and societies is profound, creating financial hardships, perpetuating cycles of debt, and even leading to economic instability. Despite its disadvantages, usury has certain advantages, such as increased credit access for high-risk borrowers and higher returns for investors. Efforts to combat usury include government policies with interest rate caps and regulations, educational initiatives to raise awareness and promote financial literacy, and the intervention of non-profit organizations.What Is Usury?

How Does Usury Work

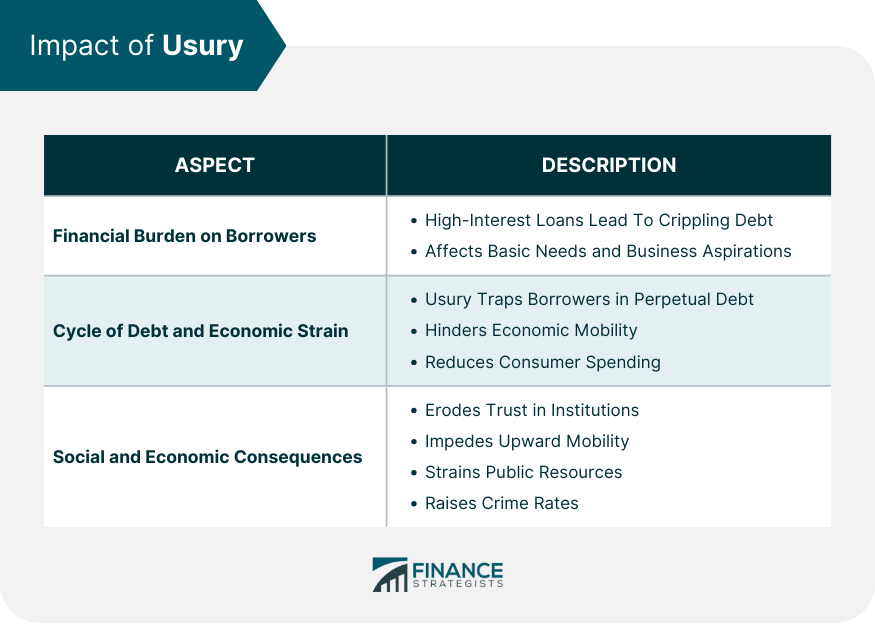

Impact of Usury

Financial Burden on Borrowers

Cycle of Debt and Economic Strain

Social and Economic Consequences for Society

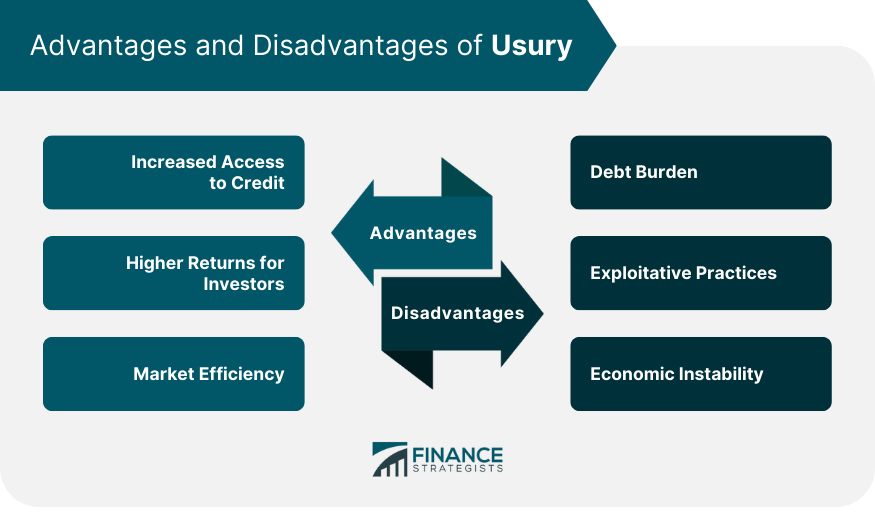

Advantages of Usury

Increased Access to Credit

Higher Returns for Investors

Market Efficiency

Disadvantages of Usury

Debt Burden

Exploitative Practices

Economic Instability

Usury in Contemporary Society

Developing Countries

Connection to Payday Lending

Consumer Protection

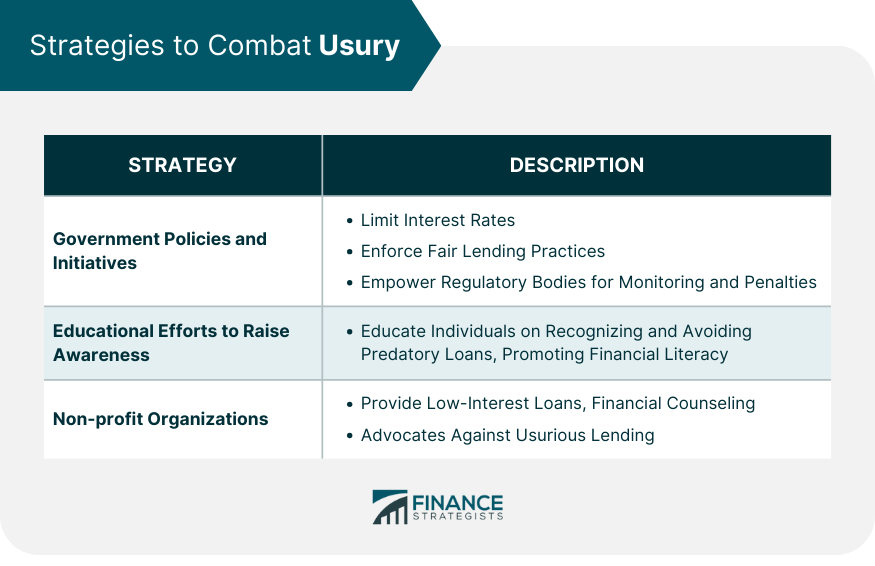

Strategies to Fight Usury

Government Policies and Initiatives

Educational Efforts to Raise Awareness

Non-profit Organizations

Conclusion

Usury FAQs

A regular loan is offered at a market rate, typically based on factors like creditworthiness and the overall financial landscape. A usurious loan, on the other hand, has an exorbitantly high interest rate, often deemed predatory.

Many opt for such loans out of desperation, lack of financial knowledge, or because they have been denied credit elsewhere due to poor credit history.

Yes, many countries have laws against usury, often in the form of interest rate caps. However, the specifics vary by country, and some usurious lenders find ways to circumvent these laws.

Educate yourself about loan terms, understand the implications of high-interest rates, and always seek out loans from reputable sources. If in doubt, consult with financial advisors or non-profit organizations that offer financial guidance.

Often, yes. While not all payday loans are usurious, many have interest rates and terms that can be considered predatory. Always read the fine print and understand the full cost of the loan before borrowing.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.