By 1933, the Great Depression had been ravaging the United States economy for years. President Herbert Hoover had attempted to use conventional tools to stabilize the economy, but nothing had worked. The Emergency Bank Act of 1933 was the tool that finally worked. It restored consumer confidence in the financial industry and put a halt to the economic tailspin the US was in with legislation that shapes the US banking industry even today. The act granted the president and treasury significant authority to combat the crisis, marking a pivotal moment in U.S. economic history. The economy was in a vicious cycle, as the situation got worse, consumers lost confidence in the banking sector so they sold their investments and withdrew their money from banks, making the situation even worse. To stop this, the Act was aimed at restoring consumer confidence in the banking sector. The Act took the following steps. It called for a 4 Day Banking Holiday: The government forced all banks to shut their doors for at least four days as each was inspected for solvency. Only after having passed an inspection was a bank allowed to reopen. It increased Executive powers during financial crises: The President and executive branch could now restrict banking operations, regulate all banking functions and make loans to banks. It created FDIC Insurance: Without a doubt the most important and lasting section of the Act was the creation of Federal Depository Insurance, a promise that any money deposited with a bank would be guaranteed by the government, even if the bank failed. In a move as audacious as it was necessary, President Roosevelt declared a nationwide "bank holiday," temporarily shuttering banks. This closure, though brief, provided a critical window for the government to take stock of the banking landscape, evaluate the health of banks, and strategize on reopening them securely and methodically. The act endowed the Federal Reserve with the authority to offer aid, ensuring that solvent banks could maintain liquidity. By distinguishing between banks that were fundamentally sound and those that were not, the government could provide targeted support, preventing unnecessary bank failures and ensuring continuity in the financial system. A central tenet of the Emergency Banking Act was its stringent stipulations for banks to resume operations. Banks had to undergo rigorous inspections, and only those meeting the capital requirements were allowed to reopen. This move not only assured the public of the bank's health but also set a precedent for more structured banking operations. Perhaps the most lasting provision of the act was the creation of the Federal Deposit Insurance Corporation (FDIC). Designed to protect depositor's funds, the FDIC offered insurance, ensuring that even in the event of a bank failure, depositors would not lose their savings. This move was pivotal in regaining public trust in the banking system. Bank failures were rampant in the early 1930s, culminating in a banking panic in early 1933. Depositors, fearing for their savings, initiated bank runs, causing even more institutions to crumble. The Emergency Banking Act was the government's answer to this dire situation. The legislation aimed to stabilize the banking sector, halt the tidal wave of bank collapses, and stymie the debilitating cycle of panic-induced bank runs. Beyond the immediate financial crisis, there was a pervasive loss of faith in the banking system. The public's trust had eroded, and with it, the very foundation of the financial sector was under threat. Through the Emergency Banking Act, the government sought to restore this lost confidence by introducing measures that would ensure the safety of the public's deposits and bring transparency to the banking operations. Almost instantly, the Emergency Banking Act started showing results. The public, witnessing the government's decisive actions, began to regain trust in the banking system. Financial markets responded positively, with stock markets experiencing a significant upturn. It was a reaffirmation of the adage that with trust comes stability. Post the mandated bank holiday, banks began reopening their doors. However, now they operated under a renewed framework, bolstered by government inspections and the assurance of the FDIC. Depositors started returning their savings to the banks, marking a turning point in the trajectory of the Great Depression. Following the act's implementation, the rate of bank failures plummeted. The banking sector, once on the verge of collapse, began to stabilize. The combined effect of increased public confidence, stringent operational requirements, and the safety net of the FDIC ensured that the sector found its footing once more. Restoring confidence in the banking sector is synonymous with guaranteeing banks will not fail. Some believe these government guarantees are what lead to the 2008 financial crisis. Banks, investors and depositors knew that governments would bail out banks with the powers created in the 1933 Act, so they were not as careful with how the banks were managed. These people knew that the systemic risk that these "too big to fail" banks posed, made them extra safe; encouraging moral hazard. The establishment of the FDIC was a game-changer for the U.S. financial landscape. Providing deposit insurance, the FDIC ensured that savings were protected, and bank runs became a thing of the past. Even today, the FDIC remains a bedrock of the U.S. banking system, exemplifying the enduring legacy of the Emergency Banking Act. The act signaled a paradigm shift in the government's role in banking regulation. Before 1933, the U.S. banking system had operated with minimal federal oversight. Post the act, there was a marked increase in government intervention, setting the stage for a more structured and secure financial system. The Emergency Banking Act was the harbinger of more comprehensive financial legislation. In its wake came a slew of reforms, including the Glass-Steagall Act, which separated commercial banking from investment banking. These legislative efforts collectively sought to safeguard the U.S. economy from future crises, drawing lessons from the tumult of the Great Depression. The Emergency Banking Act of 1933 stopped the devastating impact of the Great Depression on the U.S. economy. By addressing the banking crisis head-on, the Act restored consumer confidence in the financial industry and put an end to the destructive cycle of panic-induced bank runs. The Act's key provisions, including the 4-Day Banking Holiday, the creation of the FDIC, and increased government involvement in banking regulation, laid the groundwork for a more stable and regulated banking system that endures to this day. The immediate impact was evident as the public regained trust, and the financial markets responded positively. In the long run, the FDIC's establishment became a cornerstone of the U.S. financial landscape, protecting depositors' funds and preventing bank runs. The Act also marked a shift towards greater government intervention in banking regulation, paving the way for more comprehensive financial legislation aimed at safeguarding the economy from future crises.What Is the Emergency Banking Act?

Emergency Banking Act Importance

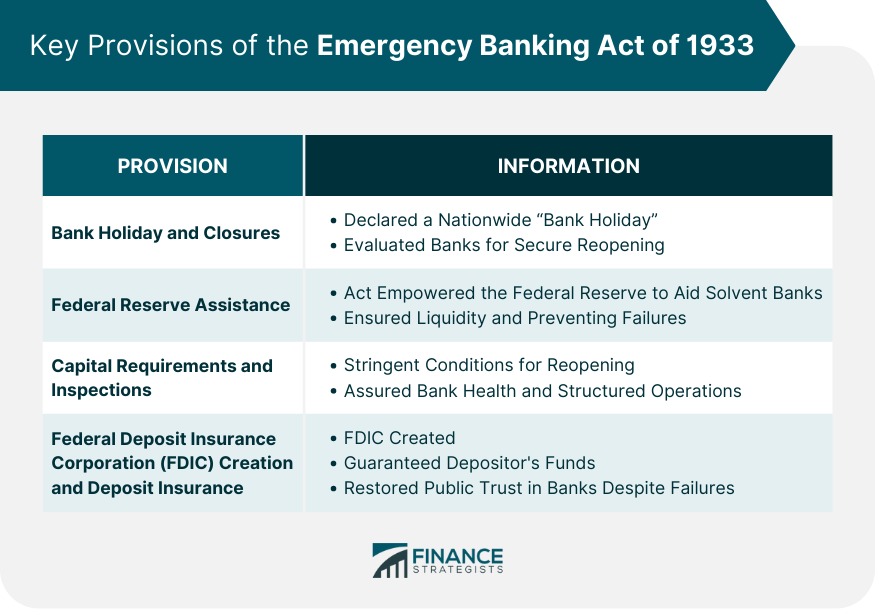

Key Provisions of the Emergency Banking Act

Bank Holiday and Temporary Closures

Federal Reserve Assistance to Solvent Banks

Capital Requirements and Inspections for Reopening

FDIC Creation and Deposit Insurance

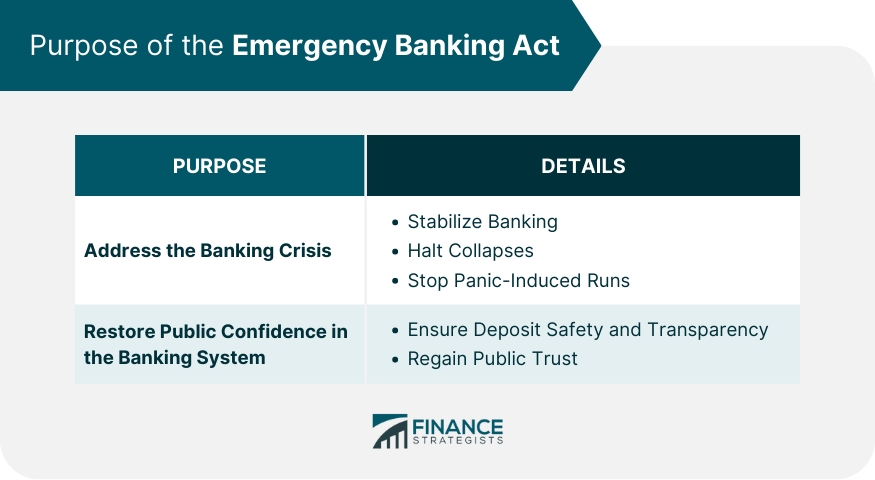

Purpose of the Emergency Banking Act

Address the Banking Crisis

Restore Public Confidence in the Banking System

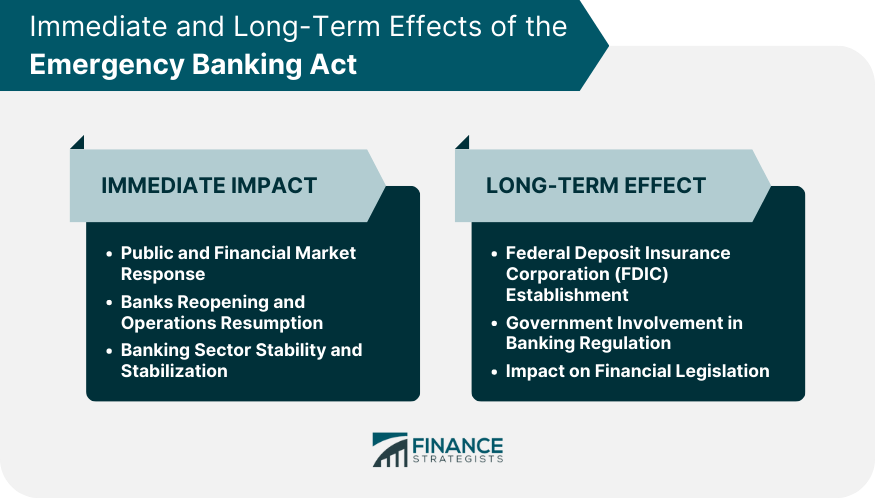

Immediate Impact of the Emergency Banking Act

Public and Financial Market Response

Banks Reopening and Operations Resumption

Banking Sector Stability and Stabilization

Long Term Implications

FDIC Establishment

Government Involvement in Banking Regulation

Impact on Financial Legislation

Conclusion

Emergency Banking Act of 1933 FAQs

The Emergency Banking Act of 1933 was introduced following the Great Depression to halt the national economic tailspin and restore consumer confidence.

The Depression was ravaging the US economy. President Hoover had unsuccessfully tried conventional tools to stabilize the economy. After his inauguration, incoming president Franklin Delano Roosevelt's Emergency Banking Act of 1933 was what finally worked.

The most important and lasting section of the Act was the creation of Federal Depository Insurance, a promise that any money deposited with a bank would be guaranteed by the government, even if the bank failed.

The President and executive branch could now restrict banking operations, regulate all banking functions and make loans to banks.

Banks, investors and depositors knew that governments would bail out banks with the powers created in the 1933 Act, so they were not as careful in their management as they should have been. They knew that the systemic risk that these “too big to fail” banks posed made them extra safe no matter how morally suspect their actions were.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.