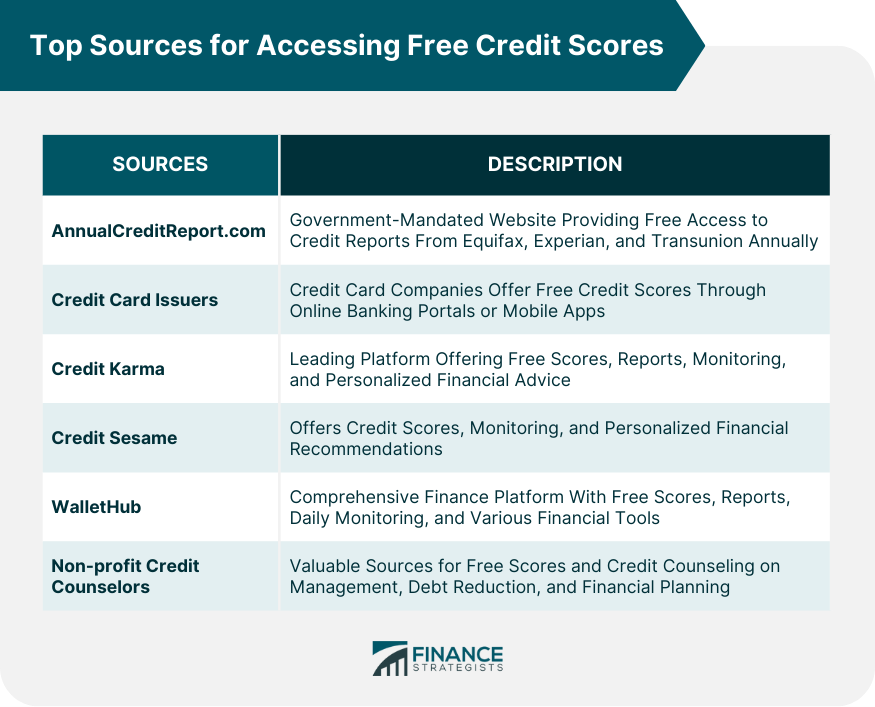

A credit score serves as a critical indicator of your creditworthiness, influencing your ability to secure loans, obtain favorable interest rates, and even impact potential employment opportunities. Traditionally, accessing credit scores used to involve a financial cost, as credit bureaus and other credit monitoring services charged consumers to obtain this crucial information. However, as financial literacy and consumer empowerment gained momentum, the demand for free and accessible credit score services grew exponentially. Free credit score services have emerged as a solution to bridge the information gap and provide consumers with easy and cost-effective access to their credit scores. These services are typically offered by financial technology companies (Fintech) and other platforms that have developed partnerships with credit bureaus. By leveraging these relationships, these services can provide users with their credit scores without charging any fees. Below are some of the top sources for accessing free credit scores, along with their unique features and benefits: AnnualCreditReport.com is a government-mandated website that offers consumers the opportunity to access their credit reports from the three major credit bureaus—Equifax, Experian, and TransUnion—once every 12 months. Although it does not provide credit scores, reviewing your credit reports from these bureaus is an essential step in understanding your credit health. By carefully examining your credit reports, you can spot inaccuracies, errors, or signs of potential identity theft. Identifying and addressing these issues promptly can help improve your creditworthiness and protect you from financial fraud. Many credit card companies have recognized the importance of offering value-added services to their customers. As a result, an increasing number of credit card issuers now provide free access to credit scores to their cardholders. You can easily check your credit score through their online banking portals or dedicated mobile apps. The advantage of accessing your credit score through your credit card issuer is the convenience and ease of use. You can view your score alongside your credit card accounts, allowing for a comprehensive view of your financial situation. Credit Karma has emerged as a leading platform in the world of free credit score services. It offers users access to their credit scores from two of the major credit bureaus, Equifax and TransUnion. In addition to credit scores, Credit Karma provides credit reports and ongoing credit monitoring. One of Credit Karma's standout features is its user-friendly interface, which presents credit information in a clear and understandable manner. Moreover, Credit Karma offers personalized financial advice based on your credit profile, helping you take steps to improve your credit standing. Similar to Credit Karma, Credit Sesame is another prominent player in the free credit score service space. Credit Sesame provides users with free credit scores, credit monitoring, and financial insights. It is committed to safeguarding its users from identity theft and fraud, making it an attractive option for those concerned about their online security. In addition to credit scores, Credit Sesame offers personalized recommendations for various financial products and services, helping users make informed choices to achieve their financial goals. WalletHub distinguishes itself as an all-in-one personal finance platform that goes beyond just offering free credit scores. Alongside credit scores and credit reports, WalletHub provides users with daily credit monitoring. This real-time monitoring ensures that users are promptly alerted to any significant changes in their credit profiles. Moreover, WalletHub offers a diverse range of financial tools, including calculators, budgeting features, and customized savings recommendations. These additional features make WalletHub a comprehensive resource for managing various aspects of personal finance. In addition to commercial platforms, non-profit credit counseling agencies are valuable sources for accessing free credit scores. These organizations are committed to educating individuals about credit management, debt reduction, and financial planning. Non-profit credit counselors typically offer free credit counseling sessions, where clients can obtain their credit scores and gain insights into credit improvement strategies. These sessions also provide personalized financial advice based on individual circumstances and financial goals. While free credit score services offer a wealth of benefits, users must exercise caution and consider certain factors to make the most of these platforms: Before using any free credit score service, individuals must ensure that the platform prioritizes data privacy and employs robust security measures. Since these services require users to input sensitive financial information, such as social security numbers and credit card details, it is crucial to trust a reputable and secure provider. Check for industry-standard encryption protocols and data protection policies to safeguard your personal and financial data. Not all credit score services utilize the same credit scoring models or data sources. It's essential to verify that the platform uses reliable credit scoring models like FICO Score or VantageScore and obtains credit data from reputable credit bureaus. This helps ensure that the credit score provided accurately reflects your creditworthiness and financial standing. Some free credit score services generate revenue through advertisements and upselling financial products or services. While it is understandable for companies to seek profits, users must be cautious about aggressive marketing tactics that could lead to unnecessary financial commitments. Review the platform's terms and conditions to understand how it manages advertisements and promotional offers. Credit scores can fluctuate based on changes in credit activity and financial behavior. As such, individuals should prioritize platforms that provide frequent credit score updates, preferably on a monthly basis. Frequent updates enable users to track their credit progress and identify areas for improvement promptly. The frequency of checking your credit score depends on your financial goals and circumstances. For individuals actively working to improve their credit or managing debt, checking their credit score monthly can be beneficial. Regular monitoring allows them to track progress, assess the impact of financial decisions, and detect potential errors or unauthorized activities promptly. On the other hand, for those with stable credit and infrequent financial changes, checking credit scores every three to six months may be sufficient. Before significant financial decisions, such as applying for a mortgage or auto loan, it's essential to check your credit score to understand your creditworthiness in the eyes of potential lenders. Moreover, in the unfortunate event of identity theft or a data breach, individuals should promptly check their credit scores to identify any fraudulent activities. Overall, the key is to strike a balance between regular monitoring for proactive credit management and periodic check-ins for those with more stable credit situations. Understanding free credit score services is crucial for empowering financial well-being and making informed decisions. These services have evolved to bridge the information gap, providing individuals with easy and cost-effective access to their credit scores and reports. Top sources for accessing free credit scores include AnnualCreditReport.com, which offers annual credit reports from the major bureaus, and credit card issuers that provide free access to credit scores for their customers. Platforms like Credit Karma, Credit Sesame, and WalletHub offer comprehensive credit score information, monitoring, and personalized financial advice. Non-profit credit counselors also serve as valuable sources of credit information and guidance. By leveraging free credit score services wisely, individuals can take control of their financial health and work towards a more secure and prosperous future.Understanding Free Credit Score Services

Top Sources for Accessing Free Credit Scores

AnnualCreditReport.com

Credit Card Issuers

Credit Karma

Credit Sesame

WalletHub

Non-profit Credit Counselors

Factors to Consider When Using Free Credit Score Services

Data Privacy and Security

Credit Score Accuracy and Source

Advertisements and Upselling

Frequency of Updates

How Often Should You Check Your Credit Score?

Conclusion

Top Sources for Free Credit Scores FAQs

The top sources for free credit scores include AnnualCreditReport.com, credit card issuers, Credit Karma, Credit Sesame, WalletHub, and non-profit credit counseling agencies.

AnnualCreditReport.com offers free credit reports from Equifax, Experian, and TransUnion once a year, but it does not provide credit scores.

Many credit card companies offer free access to credit scores for their customers. You can easily check your credit score through their online banking portals or dedicated mobile apps.

Credit Karma provides free credit scores from Equifax and TransUnion, credit reports, credit monitoring, and personalized financial advice based on your credit profile.

WalletHub is an all-in-one personal finance platform that not only offers free credit scores and reports but also provides daily credit monitoring and a wide range of financial tools like calculators and budgeting features.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.