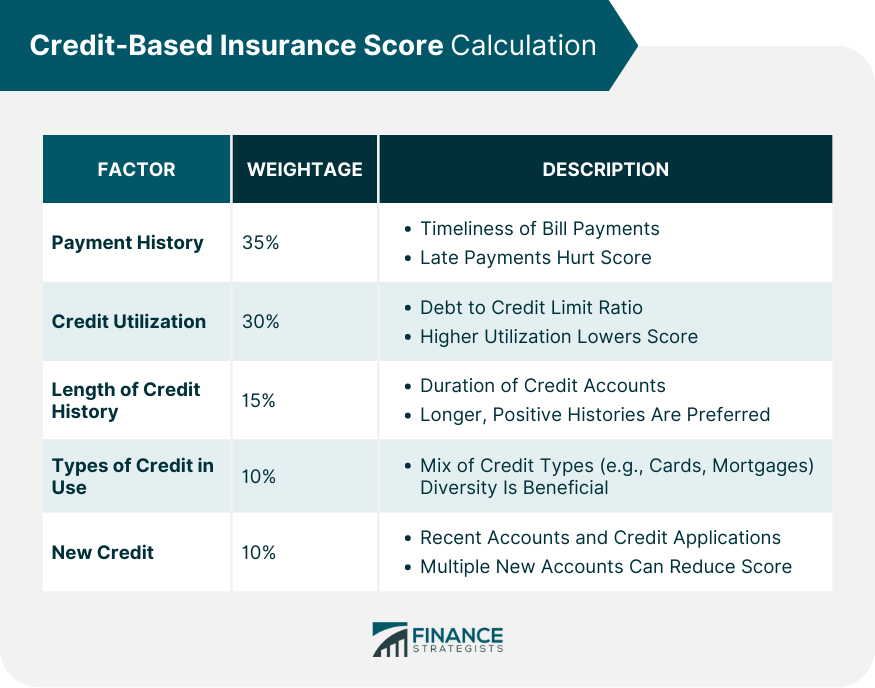

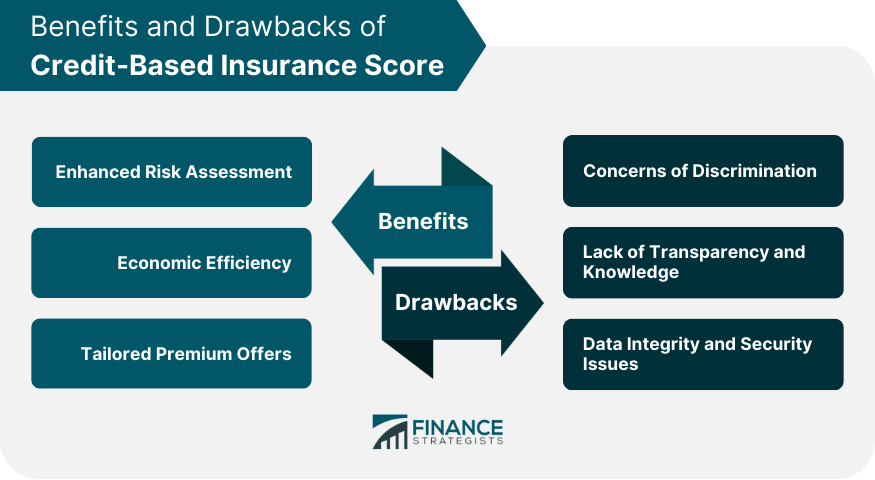

The credit-based insurance score sometimes simplified as an insurance score, is derived from an individual's credit history. While banks and credit card companies use traditional credit scores to measure financial trustworthiness, insurance companies employ the credit-based insurance score for a similar yet distinct purpose. In essence, if a credit score evaluates your ability to pay back a loan, the credit-based insurance score assesses your likelihood of lodging an insurance claim. Central to this scoring model is the concept of risk assessment. Insurers are in the business of evaluating risk, specifically gauging how likely a policyholder is to make a claim. Leveraging the credit-based insurance score enables them to refine their premium pricing, ensuring it aligns more closely with the risk associated with each individual. A credit-based insurance score and a regular credit score, while both rooted in an individual's financial history, serve different purposes and are utilized by distinct industries. The regular credit score, often familiar to most people, is primarily used by financial institutions such as banks and credit card companies to evaluate a person's financial reliability. It's an indicator of how likely someone is to repay a loan or manage credit effectively. Factors influencing this score include payment history, outstanding debt, credit utilization, length of credit history, and types of credit in use. On the other hand, the credit-based insurance score, while still drawing from one's credit history, is tailored for the insurance industry. Insurance companies use this score to predict the likelihood of a policyholder filing a claim in the future. The rationale is that there exists a correlation between financial behavior and the probability of filing an insurance claim. Thus, while both scores provide insights into aspects of an individual's financial behavior, they focus on different outcomes — one on creditworthiness and the other on potential insurance risk. To create a credit-based insurance score, a blend of financial and non-financial data points is harnessed. The heart of this score lies in an individual's credit report, detailing aspects like their credit utilization, credit inquiries, and more. However, the complexity deepens as other elements come into play. This encompasses detailed payment records for both loans and credit cards, the amount of outstanding debt, and more severe financial markers like bankruptcies or foreclosures. Beyond these credit-related data points, insurance companies might delve into a person's past insurance claims or driving history, offering a picture of potential risk. The calculation for a credit-based insurance score, like other credit scores, is determined through an algorithm that considers various factors from an individual's credit report. While each insurance company might have its proprietary model, common elements usually include: Payment History (35%): This is the record of whether someone has paid their bills on time. It's the most significant factor, making up about a third of the score. Missed or late payments can negatively impact the score. Credit Utilization (30%): This is the ratio of current total debt to the total available credit. A high utilization rate (i.e., maxing out credit cards) can be seen as risky and lower the score. Length of Credit History (15%): This considers how long someone has had credit accounts open. Longer histories with responsible credit use are seen favorably. Types of Credit in Use (10%): This evaluates the mix of credit accounts someone has, such as credit cards, mortgages, and installment loans. A diverse mix can be beneficial. New Credit (10%): This looks at how many new accounts someone has opened recently and how many times they've applied for credit. Opening many new accounts in a short time can decrease the score. Scores typically range between 200 and 997. As a general rule of thumb, scores leaning toward the higher end of the spectrum are indicative of lower risk. This translates to potentially lower insurance premiums, a direct financial benefit for consumers. On the flip side, scores on the lower end might mean higher premiums, as they represent a higher risk from the insurer's perspective. However, it's crucial to understand that this score doesn't singularly determine one's insurance premiums. Insurers use a multitude of factors, from geographic location to the type of coverage sought, in their pricing calculations. The introduction of the credit-based insurance score has undeniably improved risk profiling. Insurance companies can make more informed decisions, ensuring that policies are priced appropriately based on individual risk. This approach reduces pricing, allowing for premiums that reflect a person's individual risk rather than generalized categories. As a result, both insurers and consumers can enjoy a more equitable insurance market. The use of these scores leads to economic benefits for both the insurer and the insured. For insurers, it optimizes premium pricing, ensuring that higher-risk individuals aren't being subsidized by lower-risk ones. For consumers, those who have a good credit-based insurance score and a responsible financial record can enjoy lower premiums, rewarding their conscientious financial behavior. Harnessing the insights from credit-based insurance scores; insurers can craft tailored premium offers for potential policyholders. By doing so, they can attract and retain customers more effectively, offering discounts or special terms for those with exceptional scores. For consumers, this level of personalization means they're more likely to receive offers and rates that align with their individual financial behavior and risk profile. In turn, this fosters a competitive insurance market where companies vie for customers through more attractive and individualized premium offers. As beneficial as these scores can be, there are concerns. Some critics argue that these scores can inadvertently discriminate against certain socioeconomic groups. Those facing financial hardships, often through no fault of their own, can see their scores decline, leading to higher insurance premiums. Additionally, there can be unintentional biases against certain demographic groups, causing them to face premium rates that may not accurately reflect their actual risk. Many individuals are unaware of the difference between traditional credit scores and credit-based insurance scores. There's also a lack of understanding about how much weight these scores carry when determining premiums. As a result, some consumers might be left in the dark, not realizing why they're being quoted a particular rate. Educating the public on these is essential to foster trust. With any system reliant on vast amounts of data, there are concerns about security. Insurance scores, based heavily on personal financial information, present a tempting target for cybercriminals. Data breaches, unauthorized access, or even just unintentional mishandling of data can compromise the integrity of the scoring system and pose personal risks for consumers. With the rise of digital threats, companies must bolster their cybersecurity measures. Timely payments of bills, especially credit card balances, and loans, can have a profound positive impact. Responsible handling of debts, avoiding excessive credit inquiries, and maintaining a mix of credit types can also uplift the score. These practices, while beneficial for insurance scores, also lead to a healthier overall financial standing. Regularly reviewing one's credit report is essential. Not only does it provide insights into factors impacting the insurance score, but it also allows for the detection and reporting of discrepancies. Reporting errors or fraudulent activities promptly can prevent unwarranted dips in the score and ensure it reflects true financial behavior. Proactive monitoring can be the difference between a favorable score and an unexpectedly low one. Understanding the elements influencing the score and the broader financial implications can lead to better decision-making. Seeking guidance from financial counselors, insurance agents, or other experts can provide valuable insights and strategies to maintain or even enhance one's credit-based insurance score. The credit-based insurance score is a tool utilized by insurance companies to assess an individual's likelihood of filing an insurance claim. It takes into account various financial and non-financial data points, including payment history, credit utilization, length of credit history, types of credit in use, and more. The score allows insurers to tailor premium pricing more accurately, reflecting individual risk profiles, leading to a fairer and more efficient insurance market. While scores offer numerous benefits, such as enhanced risk assessment, economic efficiency, and personalized premium offers, they also face drawbacks. Concerns of discrimination against certain socioeconomic groups and lack of transparency and knowledge among consumers are issues that need to be addressed. Striking a balance between risk assessment and fairness will be crucial in ensuring that credit-based insurance scores remain a valuable tool for insurers and consumers alike.What Is a Credit-Based Insurance Score?

Credit-Based Insurance Score vs Credit Score

How Credit-Based Insurance Score Works

Data Collection and Sources

Calculation and Scoring Methodology

Interpretation in the Insurance Sector

Benefits of Credit-Based Insurance Score

Enhanced Risk Assessment

Economic Efficiency

Tailored Premium Offers

Drawbacks of Credit-Based Insurance Score

Concerns of Discrimination

Lack of Transparency and Knowledge

Data Integrity and Security Issues

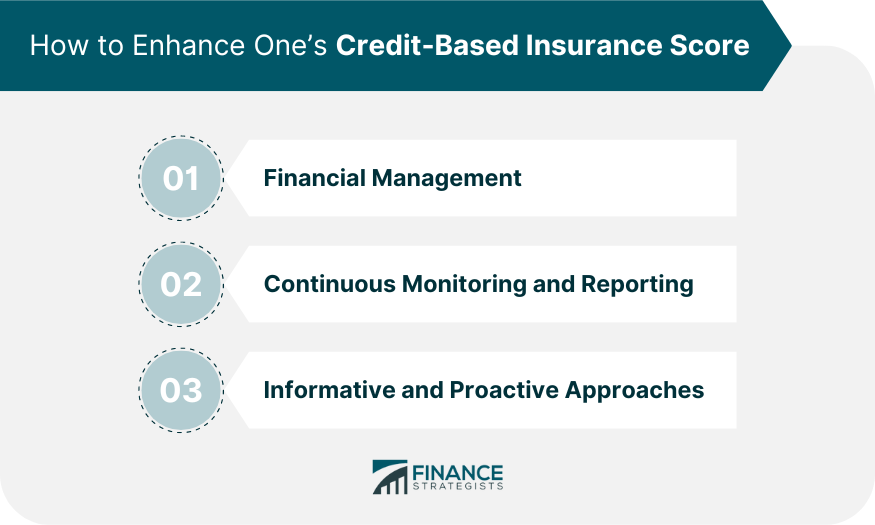

Enhancing One’s Credit-Based Insurance Score

Financial Management

Continuous Monitoring and Reporting

Informative and Proactive Approaches

Conclusion

Credit-Based Insurance Score FAQs

A Credit-Based Insurance Score is a numerical rating derived from an individual's credit history, used by insurance companies to assess the likelihood of the person filing an insurance claim in the future.

While both are based on financial history, a regular credit score evaluates financial reliability for loans and credit cards, whereas a Credit-Based Insurance Score predicts insurance risk.

The factors include payment history, credit utilization, length of credit history, types of credit in use, and recent credit inquiries.

A higher score indicates lower insurance risk, potentially leading to lower insurance premiums, providing a financial advantage for policyholders.

There are concerns about unintentional discrimination based on socioeconomic factors, as some individuals facing financial hardships may see lower scores and higher premiums.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.