The management of deceased bank accounts is a crucial but often overlooked part of dealing with the death of a loved one. Handling these accounts involves legal processes and regulatory requirements, some of which can be quite complex and daunting, especially for those who are grieving. The process becomes more straightforward when the deceased has left clear instructions, but it can become a significant burden in their absence. Understanding how to properly manage a deceased individual's bank accounts is vital for multiple reasons. Primarily, it ensures the correct distribution of the deceased person's assets as per their wishes or according to the legal procedures in place. It also helps in settling debts, fulfilling the deceased's financial obligations, and preventing potential fraud. Furthermore, the right approach can significantly simplify the process, reducing stress for surviving family members during an already challenging time. It is essential to inform the bank as soon as possible about the death of the account holder. This can be done by a close relative or the executor of the will. When you notify the bank, you must provide a certified copy of the death certificate. It's important to remember that until the bank is officially notified, the deceased's bank account continues to function as usual, potentially accruing fees and charges. Apart from the death certificate, other necessary documents include a copy of the will (if one exists), proof of your own identity, and possibly additional documents depending on the specific regulations of the bank and jurisdiction. You may also need legal authorization documents that prove your right to manage the deceased's assets, such as letters of administration or testamentary letters. It's crucial to be aware that these documents might differ across jurisdictions and the specific requirements of the financial institution involved. If the deceased had a solo account, the process of accessing funds becomes more complex. It may involve probate court, where a judge supervises the distribution of the deceased's assets. If it's a joint account, however, the surviving account holder typically has the right of survivorship, meaning they automatically inherit the deceased's share of the account. Each of these account types has its unique set of rules, which influences how the funds are accessed after death. If the deceased account holder had named a beneficiary or multiple beneficiaries for the account, the funds are typically disbursed to them without going through probate. Banks usually require a death certificate and proof of identity from the beneficiary. This arrangement can simplify the process significantly and ensure that the deceased's wishes are respected and implemented promptly. Once the bank has been informed of the death, the legal wheels begin to turn. This often involves navigating through probate and dealing with executors or administrators. Probate is a legal process where a court oversees the administration of a deceased person's estate. If the deceased left a will, the court determines its validity. If no will was left, the court will decide how the assets are distributed according to the law. This process can take several months and sometimes years, depending on the complexity of the estate. Once probate is granted, the executor or administrator can start handling the deceased's bank accounts. Probate also ensures that the deceased's debts are paid off before any money is distributed to the heirs. It's a critical step in estate management, ensuring that all financial obligations are met before the distribution of assets. The executor or administrator plays a crucial role in managing the deceased's bank accounts. They are responsible for collecting all of the deceased's assets, paying any debts and taxes, and distributing the remaining assets to the beneficiaries as outlined in the will. Their role is not just administrative but also fiduciary, meaning they have a legal obligation to act in the best interests of the estate and its beneficiaries. One of the main duties of the executor is to use the deceased's assets to pay off any outstanding debts or taxes. This often involves withdrawing money from the deceased's bank accounts. It is important to understand that the deceased's estate is liable for these debts, not the executor personally. If there are funds remaining in the deceased's account after all debts have been paid, the executor is responsible for distributing the money to the beneficiaries named in the will. This is typically done via bank transfers. The process needs to be carried out according to the provisions in the will, ensuring that each beneficiary receives their rightful share. In some cases, the funds in the deceased's bank account may need to be transferred to pay outstanding debts. These could include mortgages, credit card bills, or personal loans that the deceased had taken out. It's important to prioritize these payments to avoid legal complications down the line. To close the account, the executor or administrator may need to provide the bank with documentation showing that all debts have been paid and that they have the right to close the account. This could include a court order, a certified death certificate, and proof of executor status. These documents assure the bank that all obligations have been met and it's legal to close the account. Once the necessary documentation is provided, the bank will generally allow the executor or administrator to close the account. Any remaining funds are then distributed to the beneficiaries as directed in the will. The closure of the account is usually the final step in managing a deceased person's banking affairs. If the deceased had set up a trust, then the bank accounts held in the trust are managed by the trustee, not the executor or administrator of the estate. The trust document will dictate how these accounts are to be handled. Trust accounts offer a way to manage and protect assets that are separate from the rest of the deceased's estate. If the deceased was a parent or guardian of a minor with a bank account, the process can be a bit different. In many cases, a court-appointed guardian will manage the minor's bank account until they reach legal age. This ensures the financial security of the minor and the appropriate use of the funds. In instances where the deceased was living abroad or had bank accounts in another country, international laws, and procedures would come into play. This can complicate the process and may require additional legal assistance. In these cases, it's important to seek advice from professionals familiar with international estate law. Having a will is crucial for smoother management of bank accounts after death. A will dictates who will manage the deceased's estate (the executor), as well as the beneficiaries of their assets. A clearly outlined will can help avoid potential disputes among heirs and ensure that your final wishes are honored. Assigning a POD beneficiary for bank accounts is a simple way to bypass the probate process. Upon the account holder's death, the funds in the account are automatically transferred to the POD beneficiary. It's a straightforward way to ensure that certain assets are distributed directly to your chosen beneficiaries, avoiding potential delays and complications in the probate process. A living trust is an estate planning tool that allows for the immediate transfer of assets after death, avoiding probate. Bank accounts can be put into a trust, ensuring a more seamless transfer of assets upon the owner's death. A well-structured living trust can provide clarity and ease for your beneficiaries during a challenging time. Navigating the process of managing deceased bank accounts is not a straightforward task. It requires knowledge and understanding of legal procedures, such as probate, as well as the roles and responsibilities of executors or administrators. The type of bank account—whether solo, joint or with named beneficiaries—can also significantly influence the process. Special cases, including trust accounts and accounts held by minors, require particular attention. Despite these complexities, understanding the mechanisms behind this process can bring a sense of order during an otherwise emotionally taxing period. Preparation is undoubtedly key in easing this process. Tools such as a well-structured will, the assignment of a POD beneficiary, or the creation of a living trust can help ensure a smoother transition of assets. Therefore, taking the time to engage in thoughtful estate planning is an investment in the peace of mind of your loved ones.Management of Deceased Bank Accounts: Overview

Immediate Steps After the Death of an Account Holder

Notification of Death

Informing the Bank

Providing Necessary Documentation

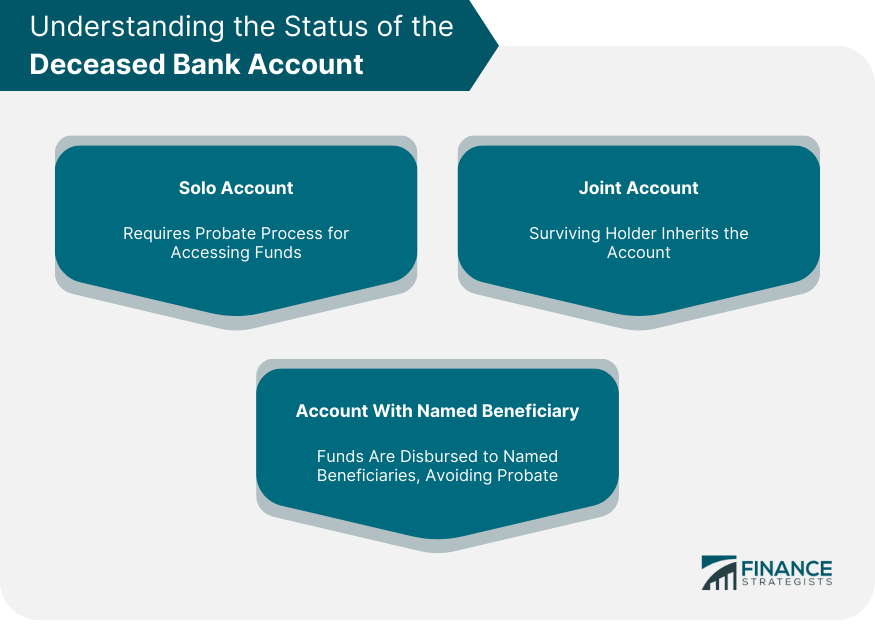

Understanding the Status of the Account

Solo Account vs Joint Account

Account With a Named Beneficiary

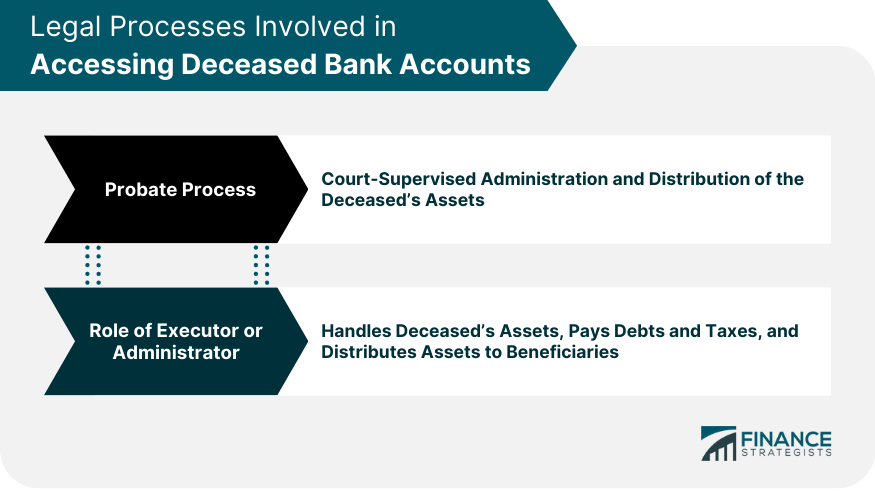

Legal Processes Involved in Accessing Deceased Bank Accounts

Probate Process

What Is Probate?

How Probate Affects the Deceased's Bank Account

Role of the Executor or Administrator

Responsibilities and Duties

Handling Outstanding Debts and Taxes

Transferring or Closing the Deceased's Bank Account

Process for Transferring Funds

For Inheritance Purposes

To Pay Outstanding Debts

Process for Closing the Account

Necessary Documentation

Steps Involved

Special Cases and Exceptions When Managing Deceased Bank Accounts

Dealing With Trust Accounts

Bank Accounts of Minors

Cases of International Death

Planning Ahead: Bank Accounts and Estate Planning

Importance of Having a Will

Benefits of Assigning a POD (Pay on Death) Beneficiary

Considering a Living Trust

Bottom Line

Managing Deceased Bank Accounts FAQs

Notify the bank about the death, providing necessary documents like the death certificate, will, and identity proof.

Probate is a legal process that decides the validity of the will and the distribution of assets. It affects how the deceased's bank accounts are handled.

The executor collects the deceased's assets, pays any debts and taxes, and distributes the remaining assets to the beneficiaries as outlined in the will.

After providing the bank with necessary documents showing all debts are paid, the executor can close the account, distributing the remaining funds to beneficiaries.

Through instruments like a will, a POD beneficiary, or a living trust, estate planning can help avoid probate and ensure smoother asset distribution.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.