A linked savings account refers to a type of savings account that is connected or linked to another account, typically a checking account or a money market account, within the same financial institution. This linking enables seamless transfers of funds between the accounts and provides additional benefits such as higher interest rates and integrated banking services. The purpose of a linked savings account is to promote efficient money management and maximize the benefits of saving. By linking a savings account to another account, individuals can easily transfer funds between accounts, take advantage of higher interest rates, and enjoy the convenience of integrated banking services. The linked structure encourages individuals to save and helps them achieve their financial goals more effectively. A linked savings account offers various options for account linking. It can be linked to a checking account, a money market account, or even a certificate of deposit (CD) within the same financial institution. This flexibility allows individuals to tailor their linked accounts to suit their specific financial needs and preferences. Linked savings accounts often offer higher interest rates compared to regular savings accounts. Financial institutions provide these competitive rates to incentivize individuals to maintain a linked relationship between their accounts. In addition to higher interest rates, linked savings accounts may offer benefits such as waived fees, access to premium banking services, and increased account privileges. One of the key features of a linked savings account is the convenience it offers. With linked accounts, individuals can easily transfer funds between their savings and checking accounts, making it simple to save and access their money when needed. This accessibility ensures that funds remain liquid while earning interest in the savings account. A linked savings account provides individuals with an enhanced opportunity to save and grow their money. By linking their accounts, individuals can automatically transfer funds from their checking account to their savings account, creating a systematic savings plan. This automatic transfer encourages consistent saving habits and helps individuals build their savings over time. With a linked savings account, individuals have the flexibility and control to manage their finances effectively. They can easily move funds between accounts, enabling them to allocate money for specific purposes, such as emergencies, short-term goals, or long-term savings. This flexibility allows individuals to adapt their savings strategy as their financial needs change. Linked savings accounts often offer higher interest rates compared to regular savings accounts. This means that individuals can earn more interest on their savings, helping their money grow faster. The higher interest rates can be especially advantageous for individuals with substantial savings or long-term financial goals. Linked savings accounts are often bundled with integrated banking services, providing individuals with added convenience. These services may include online banking, mobile banking, bill payment, and other digital tools that make managing finances more efficient. By consolidating accounts and services, individuals can streamline their banking activities and have a comprehensive view of their financial status. Some linked savings accounts may have minimum balance requirements to qualify for certain benefits or avoid fees. Individuals must ensure that they can meet these requirements to fully maximize the advantages of a linked savings account. Failing to maintain the minimum balance may result in the loss of benefits or the imposition of fees. While some linked savings accounts offer waived fees as a benefit, others may still have specific fees or charges associated with certain transactions or services. Individuals should review the fee schedule provided by the financial institution to understand any potential costs associated with their linked savings account. Linked savings accounts may have limited customization options compared to standalone savings accounts. Since linked savings accounts are designed to work in conjunction with another account, the customization options specific to the savings account itself may be limited. Individuals looking for more specialized savings features or account customization may find standalone savings accounts more suitable to their needs. The first step to opening a linked savings account is to research and choose a bank or financial institution that offers this type of account. Consider factors such as interest rates, account features, fees, customer service, and the institution's reputation. Comparing different options will help you select the bank that best aligns with your savings goals and preferences. Once you have chosen a bank, gather the required documentation to open a linked savings account. This typically includes personal identification documents, such as a valid ID or passport, proof of address, and your Social Security number or taxpayer identification number. Some financial institutions may also require additional documents or forms, so it's important to check their specific requirements beforehand. Complete the application process by filling out the necessary forms provided by the financial institution. Provide accurate information and review the terms and conditions associated with the linked savings account. Additionally, make an initial deposit as required by the bank. The initial deposit amount varies among institutions, so ensure you have the necessary funds available. Regularly monitor the activity in your linked savings account to stay updated on your balance, interest earned, and any transactions or transfers. Take advantage of the online or mobile banking services provided by the financial institution to conveniently access your account information and track your progress toward your savings goals. To maximize the benefits of a linked savings account, consider setting up automatic transfers from your checking account or other linked accounts. This ensures a consistent savings habit by automatically moving funds into your savings account on a regular basis. Determine an amount that aligns with your financial goals and set up the transfer frequency that works best for you. To maximize the interest earned on your linked savings account, consider keeping a sufficient balance that meets any minimum requirements to qualify for higher interest rates. Additionally, explore opportunities to increase your savings over time by increasing your contributions or exploring other investment options offered by the financial institution. A regular savings account is a basic savings account offered by banks and credit unions. It typically has lower minimum balance requirements and may offer lower interest rates compared to a linked savings account. Regular savings accounts are suitable for individuals who prioritize simplicity and accessibility over additional benefits or higher interest rates. A high-yield savings account, similar to a linked savings account, offers higher interest rates than a regular savings account. However, unlike a linked savings account, a high-yield savings account is typically not linked to another account within the same institution. High-yield savings accounts are suitable for individuals who want to earn competitive interest rates while maintaining a standalone savings account. A money market account is a type of savings account that often offers higher interest rates than regular savings accounts. It combines features of both savings and checking accounts, providing check-writing privileges and a limited number of monthly transactions. Money market accounts may require a higher minimum balance compared to a linked savings account and are suitable for individuals who seek both liquidity and a competitive interest rate. A linked savings account is a savings account that is connected or linked to another account within the same financial institution. It offers additional benefits such as higher interest rates, enhanced savings opportunities, and integrated banking services. Linked savings accounts have multiple account linking options, higher interest rates, and offer accessibility and convenience. The benefits of a linked savings account include enhanced saving opportunities, flexibility and control, higher interest rates, and integrated banking services. However, there are also drawbacks to consider, such as minimum balance requirements, potential fees and charges, and limited account customization. A linked savings account can be a valuable tool for individuals looking to optimize their savings and take advantage of additional benefits offered by financial institutions. By understanding the features, benefits, and drawbacks of a linked savings account, individuals can make informed decisions that align with their financial goals and preferences.What Is a Linked Savings Account?

Features of a Linked Savings Account

Multiple Account Linking Options

Interest Rates and Benefits

Accessibility and Convenience

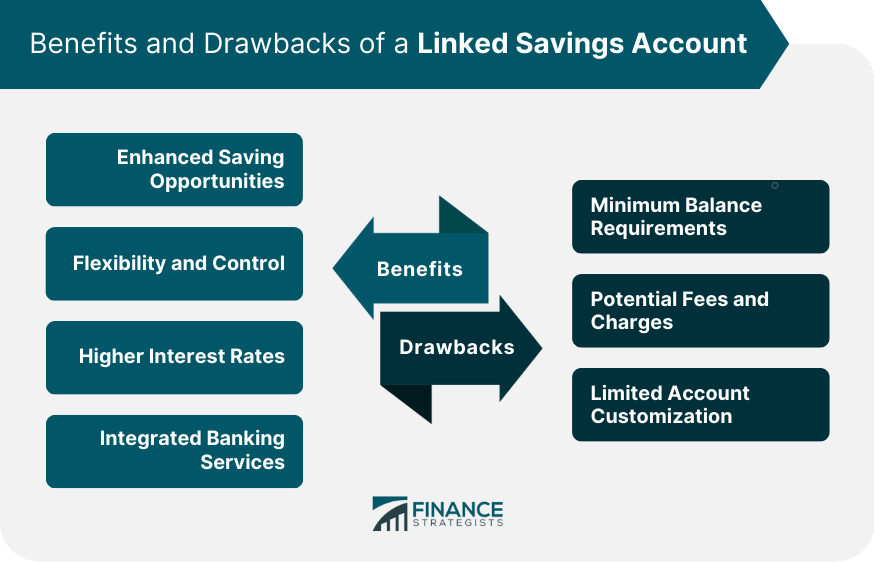

Benefits of a Linked Savings Account

Enhanced Saving Opportunities

Flexibility and Control

Higher Interest Rates

Integrated Banking Services

Drawbacks of a Linked Savings Account

Minimum Balance Requirements

Potential Fees and Charges

Limited Account Customization

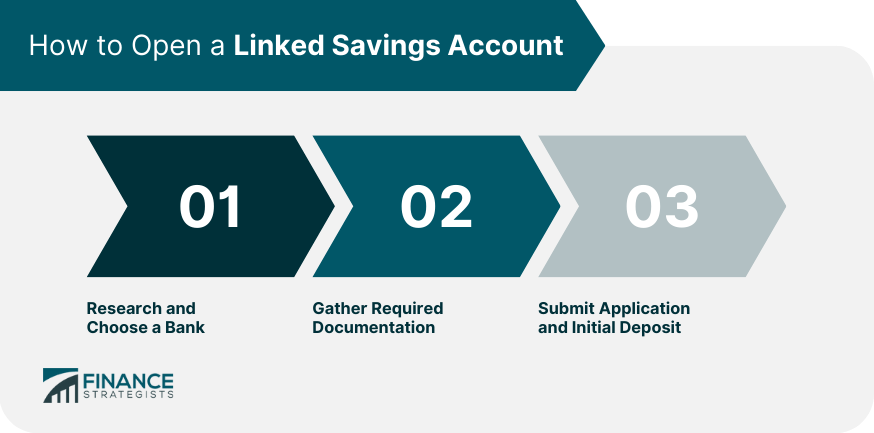

How to Open a Linked Savings Account

Research and Choose a Bank

Gather Required Documentation

Submit Application and Initial Deposit

Managing a Linked Savings Account

Monitoring Account Activity

Setting up Automatic Transfers

Maximizing Interest Earned

Comparison With Other Savings Account Types

Regular Savings Account

High-Yield Savings Account

Money Market Account

Bottom Line

Linked Savings Account FAQs

Yes, most financial institutions allow you to link multiple accounts to your linked savings account. You can link checking accounts, money market accounts, or even certificates of deposit (CDs) within the same institution. This provides flexibility in managing and transferring funds between accounts.

The interest rates on linked savings accounts can vary depending on the financial institution and market conditions. Some institutions may offer fixed interest rates for a specific term, while others may have variable rates that can change over time. It's important to review the terms and conditions of the linked savings account to understand how the interest rates are determined.

While a linked savings account provides easy access to your funds, it is primarily designed for saving rather than everyday transactions. Transactions such as bill payments and purchases are typically facilitated through a linked checking account or a debit card associated with a checking account.

Failing to meet the minimum balance requirements of your linked savings account may result in the loss of certain benefits or the imposition of fees. It's important to review the terms and conditions of the account and maintain the minimum balance to avoid any penalties.

Yes, in most cases, you can unlink your savings account from the linked account if you decide to make changes to your banking arrangement. Contact your financial institution and inquire about the process and any potential implications of unlinking the accounts.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.