A savings account is a deposit account held at a bank or other financial institution. It provides a safe place for individuals to store their money while earning interest on their balances. These accounts are typically FDIC-insured up to a certain limit, ensuring the safety of the depositor's money. Savings accounts play a pivotal role in sound financial management. They serve as a foundation for building wealth, allowing individuals to save for future goals, emergencies, or unforeseen expenses. Furthermore, the importance of a savings account extends beyond just safe money storage; it encourages disciplined saving habits. By earning interest, individuals see their money grow, further promoting the habit of saving. For many, it's the first step in understanding the power of compound interest and the importance of financial security. Every financial institution offers its own version of a savings account, with each having unique features. Interest rates, fees, accessibility, and other factors differ significantly across these accounts. Especially in this digital age, it's wise to look beyond your local banks. Online banks, fintech platforms, and credit unions frequently provide savings accounts with favorable interest rates, primarily because they don't bear the operational costs associated with traditional banking, such as maintaining physical branches. Moreover, these digital-first institutions often have user-friendly apps and features that make banking smoother. When aiming to maximize your earnings, do a comparative analysis based on the annual percentage yield (APY), minimum balance requirements, and associated fees. Consistency is the key to growing wealth. Even if you can only set aside a small amount each month, these deposits can accumulate and make a significant difference over time. By maintaining a routine, you not only contribute to the principal but also the interest earned on it. This is the essence of compound interest: you earn interest on the amount you deposit and also on the interest that your deposit has already earned. By sticking to a disciplined deposit routine, you essentially let your money work for you, maximizing the potential of your savings without exerting much effort. Many banks have hidden fees, be it for account maintenance, going below the minimum balance, or making more than the permitted number of withdrawals in a month. Over time, even small fees can take a significant bite out of your savings. Read the terms and conditions of your savings account thoroughly. If your account requires a minimum balance to avoid fees, always maintain that balance. Understand the limitations on withdrawals and be diligent about any service fees, as avoiding these fees can be as valuable as earning interest. By setting up automatic transfers from your checking account to your savings account, you can ensure that a particular sum of money is saved regularly. The beauty of automation is twofold – it eradicates the possibility of human forgetfulness, and it enforces a disciplined approach to saving. Over time, you might even forget about these automated transfers, and you'll be pleasantly surprised when you check your growing savings balance. The financial market is dynamic, with interest rates being no exception. Central bank policies, inflation rates, economic conditions, and other macroeconomic factors influence the interest rates banks offer. Regularly review the rates your bank provides and compare them with others in the market. If you discover that another bank provides significantly better rates, consider transferring your savings. However, always factor in any transfer fees or penalties that might apply. It's essential to treat your savings account differently from your checking account. Savings accounts are designed for accumulating funds, not frequent transactions. By limiting withdrawals, you let your money compound and grow. Additionally, frequent withdrawals might attract fees or reduce the interest you earn, depending on the terms of your account. Competition among banks often translates to promotions and bonuses for customers. Be on the lookout for limited-time offers, such as higher interest rates for new deposits or bonus amounts for new accounts. While these promotions can be lucrative, always ensure you understand the terms and conditions, as they might come with specific requirements or limitations. Keeping all your money in one type of savings account might not be the best strategy for maximizing earnings. Explore other low-risk investment options like money market accounts or certificates of deposit (CDs). These often have different interest rate structures and can help balance out your overall returns. Inflation is an often overlooked factor when considering savings. If the interest rate on your savings account is lower than the current inflation rate, the real value of your savings is diminishing. Seek out accounts with interest rates that outpace inflation, ensuring your money retains its purchasing power over time. To maximize your earnings, it's crucial to stay updated on the evolving sectors of banking and finance, with new products, features, and trends emerging regularly. Subscribe to financial newsletters, participate in webinars, and engage in online finance communities to keep abreast of the latest developments. Banks often reward customers who use multiple products. Consider linking your savings account with a checking account or taking out a credit card with the same bank. These linked accounts can sometimes come with higher interest rates or other financial benefits. Loyalty doesn't mean sticking with a bank that isn't serving your needs, but many banks do reward long-standing customers with better rates or other benefits. Before jumping ship for a slightly better rate elsewhere, check with your current bank to see if they can offer any incentives or match the competing rate. While high returns may seem enticing, they often come with higher risks. Instead, focus on a balanced approach to investments, considering both potential rewards and risks. Diversifying your investments can help achieve more stable and sustainable growth over time. Keep a close eye on any fees associated with your financial accounts, whether it's a savings account or an investment portfolio. Even seemingly small fees can accumulate and erode your earnings over the long term. Look for low-fee or no-fee options and consider consolidating accounts to reduce costs. Frequent trading can lead to high transaction costs and tax implications, eating away at your overall earnings. Develop a well-thought-out investment strategy and stick to it, resisting the urge to make impulsive decisions based on short-term market fluctuations. Be cautious of any investment opportunity that promises guaranteed or unrealistic returns. Thoroughly research any investment offer or financial product and be skeptical of unsolicited offers. When in doubt, consult with a trusted financial advisor or do your due diligence to verify legitimacy. Different investments and accounts may have varying tax treatments, so consider the impact on your overall tax liability. Utilize tax-efficient accounts and strategies to maximize after-tax returns. Diversifying your investments across various asset classes and sectors can help reduce risk and improve overall performance. Similarly, diversify your savings across different types of accounts, such as retirement accounts, savings accounts, and investment accounts, to ensure you're not overly exposed to one type of risk. Keep a watchful eye on your financial accounts and investments regularly. Market conditions and financial goals can change over time, so periodic reviews and adjustments are essential to stay on track. Rebalance your portfolio if necessary to maintain your desired asset allocation. Even if you feel confident in your financial knowledge, seeking advice from a qualified financial advisor can provide valuable insights and personalized strategies. They can help you navigate complex financial situations, plan for specific goals, and optimize your overall financial picture. A savings account serves as a fundamental tool for sound financial management, offering a safe place to store money while earning interest. To maximize earnings from a savings account, several key points must be considered. Choosing the right account is crucial, and exploring banking options can often yield more favorable interest rates and features. Consistent and automated deposits help harness the power of compound interest. Minimizing fees, monitoring interest rates, and limiting withdrawals are essential in preserving and growing savings. Diversification, inflation awareness, and staying informed of the banking world are also vital aspects. Avoiding pitfalls like chasing high returns, overtrading, and falling for scams while seeking professional advice can safeguard one's financial future. By implementing these strategies, individuals can make the most of their savings accounts and move closer to achieving their financial goals.What Is a Savings Account?

How to Maximize Earnings From a Savings Account

Choose the Right Account

Regular Deposits

Minimize Fees

Automation

Monitor Interest Rates

Limit Withdrawals

Leverage Promotions

Diversification

Inflation Awareness

Stay Updated

Consider Linked Accounts

Rewards for Loyalty

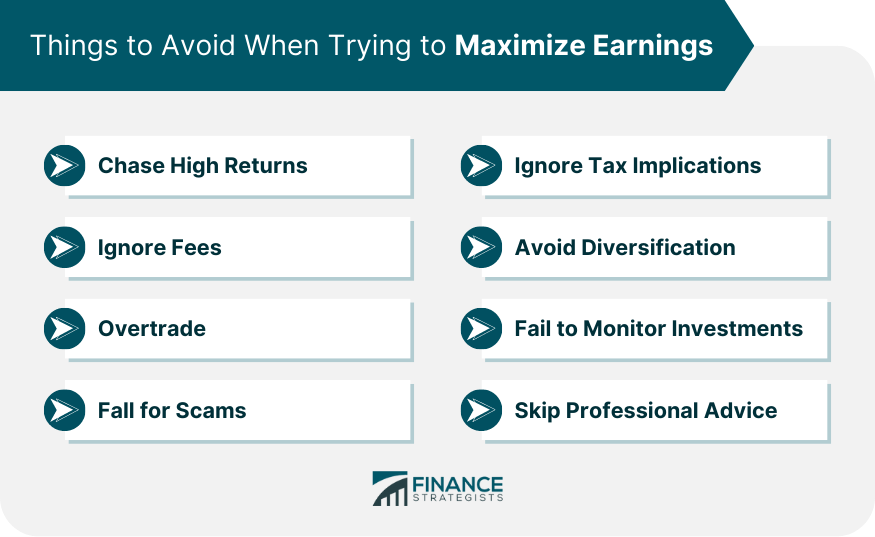

Things to Avoid When Trying to Maximize Earnings

Chasing Only High Returns

Ignoring Fees

Overtrading

Falling for Scams

Ignoring Tax Implications

Avoiding Diversification

Failing to Monitor Investments

Skipping Professional Advice

Conclusion

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.