Crowdfunding platforms are online platforms that allow individuals, organizations, and businesses to raise funds for their projects or ventures from a large number of people, typically through small contributions from each person. These platforms provide a way for people to gather support and funding from a diverse group of individuals who are interested in their projects. Crowdfunding platforms have become a popular way for individuals and businesses to raise money for a variety of projects, from creative endeavors to social causes to business ventures. These platforms can offer a way to reach a large audience and build a community of supporters, while also providing an alternative to traditional funding sources such as loans and venture capital. However, it is important to carefully consider the terms and fees associated with each platform, as well as the potential risks and rewards of crowdfunding, before deciding to use one. Donation-based platforms are primarily focused on charitable and personal causes. These platforms allow individuals to contribute money without expecting anything in return, apart from the satisfaction of supporting a cause they believe in. Examples of donation-based platforms include GoFundMe and JustGiving. Reward-based platforms cater to creative projects and startups, where backers receive rewards or perks in return for their financial support. These rewards are often tangible items, such as products or experiences, and are typically proportional to the amount pledged. Kickstarter and Indiegogo are popular examples of reward-based platforms. Equity-based platforms enable individuals and institutions to invest in startups or growing businesses in exchange for equity or a share of the company. These platforms provide an opportunity for backers to potentially gain a financial return on their investment. SeedInvest and CircleUp are examples of equity-based crowdfunding platforms. Debt-based platforms, also known as peer-to-peer lending platforms, facilitate the process of lending and borrowing between individuals or businesses. Backers lend money to borrowers with the expectation of being repaid with interest over time. LendingClub and Prosper are examples of debt-based crowdfunding platforms. Project creators initiate the crowdfunding process by setting up a campaign on a platform of their choice. They need to establish clear funding goals, deadlines, and present their project to potential backers in an engaging and compelling manner. Backers are individuals or organizations who discover and evaluate projects on crowdfunding platforms. They make pledges or investments to support projects that resonate with their interests or values. Crowdfunding platforms play a crucial role in facilitating transactions between project creators and backers. They provide support and resources, such as guidelines, tools, and templates, to help creators effectively present their projects and reach their funding goals. Crowdfunding platforms offer numerous benefits to project creators, including: Funding Accessibility: They provide an alternative source of funding for individuals and organizations who may not have access to traditional financing options. Marketing and Audience Engagement: Crowdfunding platforms can help project creators build awareness, engage with their audience, and create a community around their project. Feedback and Validation: Project creators can receive valuable feedback from backers, which may lead to improvements and validation of their ideas. Lower Barriers to Entry: Crowdfunding platforms reduce barriers to entry by enabling individuals and organizations with limited resources to launch their projects and businesses. Despite the numerous benefits, crowdfunding platforms also pose challenges and risks, such as: Project Failure and Delivery Risks: Not all projects succeed, and some may not deliver on their promises, leading to disappointment and financial loss for backers. Fraud and Scams: Fraudulent activities and scams are a risk in the crowdfunding space, with some individuals using these platforms to deceive backers. Intellectual Property Concerns: Project creators may expose their ideas to potential intellectual property theft or infringement. Regulatory and Compliance Issues: The legal and regulatory landscape surrounding crowdfunding is complex and varies across jurisdictions, posing challenges for both platforms and project creators. To increase the chances of success for a crowdfunding campaign, project creators should consider the following factors: A well-crafted and engaging story can attract backers and generate interest in a project. Project creators should communicate their vision, goals, and the impact of their project in a clear and compelling manner. Setting realistic funding goals that accurately reflect the needs of the project is crucial. Overestimating the required funds may discourage potential backers, while underestimating may lead to an inability to complete the project as planned. Promoting a crowdfunding campaign through various channels, including social media, email, and traditional media, can increase its visibility and attract a larger audience. Engaging with influencers and leveraging existing networks can also help amplify the reach of a campaign. Project creators should actively engage with their backers, providing regular updates and responding to feedback. Building a strong community around a project can contribute to its success and create a sense of shared ownership among backers. Crowdfunding platforms have revolutionized the way individuals and organizations raise funds for their projects and businesses. They offer numerous benefits, such as funding accessibility, marketing opportunities, and the ability to receive feedback and validation. However, they also pose challenges and risks, including project failure, fraud, and intellectual property concerns. By understanding the intricacies of crowdfunding platforms and the factors that contribute to successful campaigns, project creators can maximize their chances of achieving their goals and making a lasting impact. As the crowdfunding landscape continues to evolve, new opportunities and challenges will emerge, shaping the future of entrepreneurship and innovation. The integration of social media and other technologies, the expansion of niche platforms, increased regulation and oversight, and globalization of crowdfunding platforms are all trends that will further influence the development of this fundraising method. By staying informed and adapting to these changes, project creators and backers can effectively navigate the world of crowdfunding and harness its potential to bring ideas to life.What Are Crowdfunding Platforms?

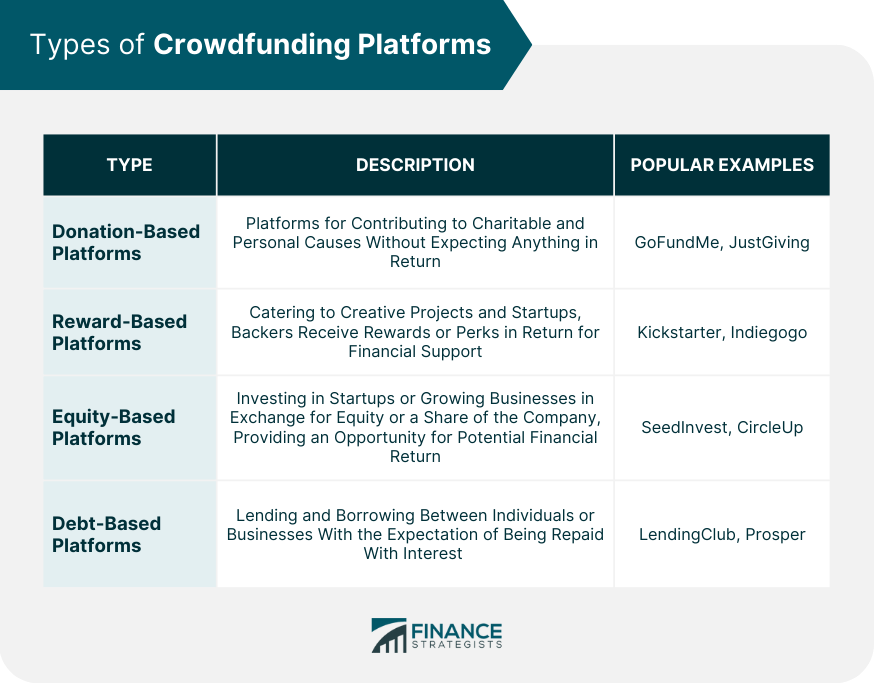

Types of Crowdfunding Platforms

Donation-Based Platforms

Reward-Based Platforms

Equity-Based Platforms

Debt-Based Platforms

How Crowdfunding Platforms Work

Project Creators

Backers

Platform Roles and Responsibilities

Benefits of Crowdfunding Platforms

Challenges and Risks of Crowdfunding Platforms

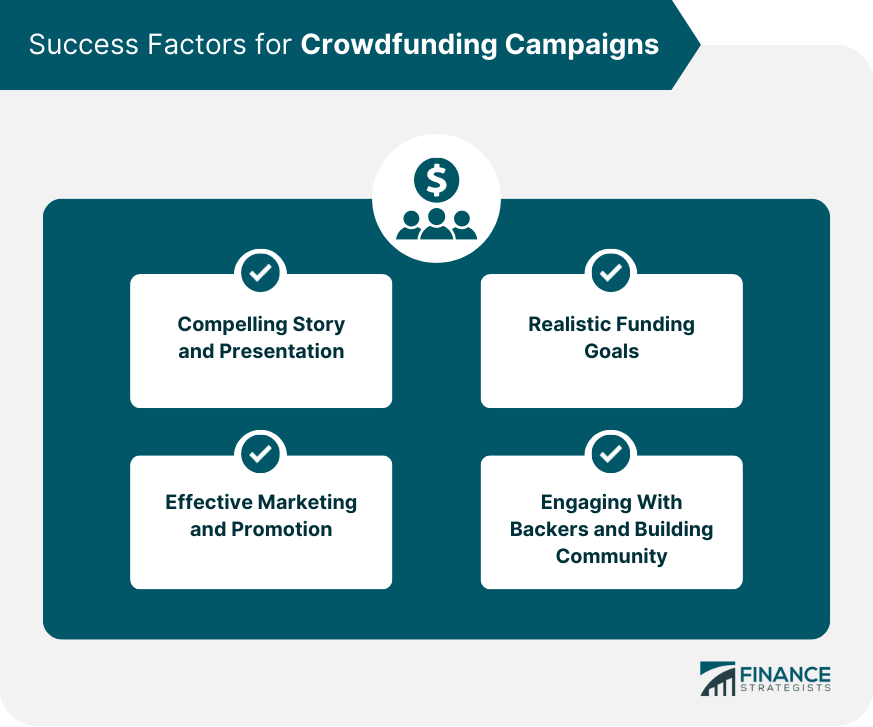

Success Factors for Crowdfunding Campaigns

Compelling Story and Presentation

Realistic Funding Goals

Effective Marketing and Promotion

Engaging With Backers and Building Community

Conclusion

Crowdfunding Platforms FAQs

A crowdfunding platform is a website or app that allows individuals or organizations to raise funds from a large group of people, often through small contributions from many donors.

There are several types of crowdfunding platforms, including donation-based, reward-based, equity-based, and debt-based platforms. Each type of platform operates differently and serves different purposes.

Crowdfunding platforms typically allow individuals or organizations to create a fundraising campaign with a specific goal and timeline. The campaign is then promoted to potential donors, who can make contributions through the platform using a variety of payment methods.

Crowdfunding platforms typically charge fees for their services, which can vary depending on the type of platform and the specific services provided. These fees may include transaction fees, platform fees, and payment processing fees.

Some popular crowdfunding platforms include Kickstarter, GoFundMe, Indiegogo, Patreon, and Crowdfunder. Each of these platforms has its own unique features and may be better suited for different types of fundraising campaigns.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.