Bank accounts offer a myriad of benefits that play a pivotal role in modern financial management. From providing a secure and convenient way to store and access money to offering a gateway to various financial services, bank accounts serve as indispensable tools for individuals and businesses alike. These accounts not only safeguard funds but also facilitate seamless transactions, promote responsible financial management, and enable individuals to build credit and savings. Whether it's the ease of payment options, the opportunity to earn interest on deposits, or the ability to manage finances through digital platforms, bank accounts have become an essential component of the financial ecosystem. In this era of ever-advancing technology and financial complexity, the benefits of having a bank account extend far beyond simple monetary storage, making them a critical asset for achieving financial security and success. Keeping your money in a bank account offers a higher level of security compared to storing cash at home. Banks employ robust security measures to protect your funds from theft and unauthorized access. Additionally, many countries have deposit insurance schemes that safeguard a certain amount of your deposits, providing an extra layer of financial protection. With a bank account, you gain access to a wide range of convenient banking services. You can use ATMs to withdraw cash anytime, pay bills online, and make purchases with a debit card, eliminating the need to carry large sums of cash. Online and mobile banking also enable you to manage your finances from the comfort of your home or on-the-go, making transactions and monitoring your account hassle-free. Bank accounts provide a detailed record of your financial transactions, giving you a clear overview of your income and expenses. Regular bank statements and online transaction histories help you track your spending habits, making budgeting and financial planning more manageable. Having a bank account allows you to use various electronic payment methods, such as online transfers and direct deposits. This makes it easier to receive payments from employers, government agencies, or friends and family. Additionally, you can set up automatic bill payments, ensuring that your recurring expenses are taken care of on time, saving you from late fees and penalties. For those aspiring to build credit history, having a bank account is a crucial step. Responsible use of your account, such as maintaining a positive balance and using credit responsibly if applicable, contributes positively to your credit score. A good credit score opens up opportunities for loans, mortgages, and better interest rates in the future. Owning a bank account opens the door to a wide range of financial products and services. From savings accounts and certificates of deposit (CDs) to loans and credit cards, having a bank account establishes your relationship with the financial institution, making you eligible for more extensive financial offerings. Interest earnings are the extra money you earn on the balance of your bank account over time. Banks offer interest as an incentive for customers to keep their money in their accounts, allowing the bank to use those funds for loans and investments. This is a crucial concept to understand when it comes to interest earnings. Compound interest means that not only do you earn interest on your initial deposit, but you also earn interest on the interest you've already accumulated. Over time, this can significantly boost your account balance, making it a powerful tool for long-term savings. Some banks offer high-yield savings accounts that provide a higher interest rate compared to regular savings accounts. These accounts may require a higher minimum balance or have specific conditions to qualify for the elevated interest rate. CDs are time-based deposits where you agree to leave your money with the bank for a fixed period, such as 6 months, 1 year, or longer. In return, you receive a higher interest rate than regular savings accounts. However, withdrawing funds before the CD matures usually incurs a penalty. Overdraft protection is a service offered by banks to protect customers from facing bounced checks or declined transactions when they try to spend more money than they have in their account. If you attempt to make a payment that exceeds your account balance, the bank will cover the difference and allow the transaction to go through. This can save you from potential embarrassment and disruptions in your financial activities. While overdraft protection can be helpful in emergencies, it's essential to be aware that banks often charge fees for this service. These fees can accumulate, so it's best to use overdraft protection sparingly and work on maintaining a sufficient account balance. Automatic bill pay is a convenient feature that allows you to set up regular payments for bills, such as utilities, mortgage, or credit card payments. Once configured, the bank will automatically deduct the necessary amount from your account on the scheduled payment dates. Automatic bill pay ensures that your bills are paid on time, avoiding late fees and potential negative impacts on your credit score. By spreading out your payments throughout the month, you can better manage your cash flow and avoid the stress of remembering multiple due dates. Direct deposit is a service provided by employers and government agencies to transfer funds directly into your bank account. This is typically used for salary payments, but it can also apply to pension payments, tax refunds, and other regular income sources. With direct deposit, you gain immediate access to your funds on payday, eliminating the need to visit a bank or cash a physical check. Direct deposit is a secure method of receiving payments, reducing the risk of lost or stolen checks. Checking accounts are primarily designed for daily use and are suitable for managing your day-to-day financial transactions. They are highly liquid, allowing you to deposit and withdraw money whenever needed. Checking accounts often come with check-writing privileges, which allow you to write checks to make payments. They also include a debit card, which enables you to make purchases and withdraw cash from ATMs. Additionally, most checking accounts offer the convenience of electronic transfers, allowing you to send money to others or pay bills online. Some checking accounts may offer a minimal interest rate, but it is generally lower compared to savings accounts or other investment options. Savings accounts are designed to hold funds for longer periods and are suitable for building an emergency fund or saving for specific goals. Savings accounts typically offer higher interest rates than checking accounts, making them more attractive for growing your savings over time. However, they usually limit the number of withdrawals or transfers you can make each month to encourage account holders to keep their money in the account. Money market accounts combine features of both checking and savings accounts. They are ideal for individuals looking for a higher interest rate while maintaining some liquidity. Money market accounts generally offer better interest rates than regular checking accounts, similar to savings accounts. They often come with checks or a debit card, allowing some level of convenience for making payments or withdrawals. However, money market accounts usually impose a limit on the number of transactions you can make each month, similar to savings accounts. This is to ensure that account holders maintain a higher account balance and keep the account primarily for savings purposes. CDs are intended for individuals who want to earn higher interest rates and are willing to lock their money in the bank for a fixed period. CDs typically offer the highest interest rates among all bank accounts due to the longer commitment of funds. They come with a predetermined maturity date, and the interest rate is fixed during the CD's term. Unlike other bank accounts, early withdrawal from a CD usually incurs a penalty, making them suitable for individuals with long-term savings goals who can commit to leaving the money untouched for the specified duration. When choosing a bank account, several essential factors should be taken into consideration to ensure it aligns with your financial needs and preferences: Different banks and account types may have varying fee structures. It's crucial to review and understand the fees associated with the account, such as monthly maintenance fees, transaction fees, ATM fees, overdraft fees, and minimum balance requirements. Opt for an account with transparent and reasonable fees that suit your banking habits. The reputation and reliability of the bank are crucial aspects to consider. Research the bank's history, customer reviews, and financial stability to ensure that your money is safe and the bank provides excellent customer service. Accessibility refers to the ease of accessing your funds and managing your account. Evaluate the bank's physical presence with nearby branches and ATMs, especially if in-person banking is essential to you. Additionally, consider the bank's digital accessibility for online and mobile banking, including user-friendly interfaces and reliable customer support. If earning interest on your deposits is important to you, compare the interest rates offered by different account types. Look for accounts with competitive interest rates that align with your saving and spending goals. Assess the features offered by the bank account. For example, some accounts may include perks like free checks, debit card rewards, and ATM fee reimbursements. Choose an account that provides the features that are valuable to you. Depending on your financial needs, consider the availability of additional banking services, such as personal loans, credit cards, investment options, and retirement accounts. Having access to these services within the same institution can simplify your financial management. Check the bank's customer support channels and responsiveness. It's essential to have a reliable point of contact in case you encounter issues or have questions regarding your account. Some banks may have specific requirements to open and maintain certain account types. Consider if you can meet these requirements comfortably and whether they align with your financial situation. Occasionally, banks may offer promotional deals, such as sign-up bonuses or cash rewards for opening an account. While not the primary factor, these offers could be a tiebreaker if you're comparing similar accounts. Bank accounts offer numerous benefits that are vital for managing finances in today's complex financial landscape. They provide security, convenience, and accessibility, safeguarding funds and facilitating seamless transactions. With features like online and mobile banking, record-keeping becomes more efficient, aiding in budgeting and financial planning. Bank accounts also play a crucial role in building credit history, enabling individuals to access various financial services like loans and credit cards. Furthermore, they offer opportunities to earn interest through high-yield savings accounts and certificates of deposit, fostering long-term savings and investment. When selecting a bank account, it's essential to consider factors such as fee structures, reputation, accessibility, interest rates, account features, and additional services. These considerations ensure that the chosen account aligns with individual financial needs and preferences. Overall, bank accounts have become indispensable tools in achieving financial security and success, offering a comprehensive range of benefits that cater to both personal and business financial management needs.Overview of Bank Account Benefits

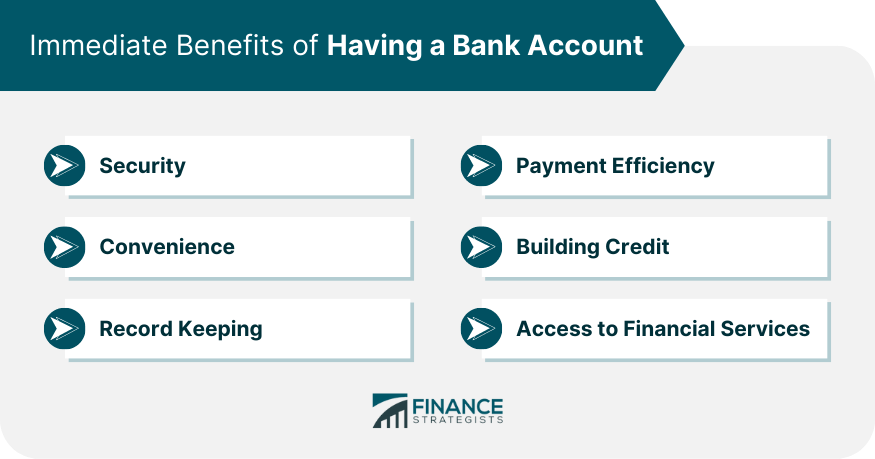

Immediate Benefits of Having a Bank Account

Security

Convenience

Record Keeping

Payment Efficiency

Building Credit

Access to Financial Services

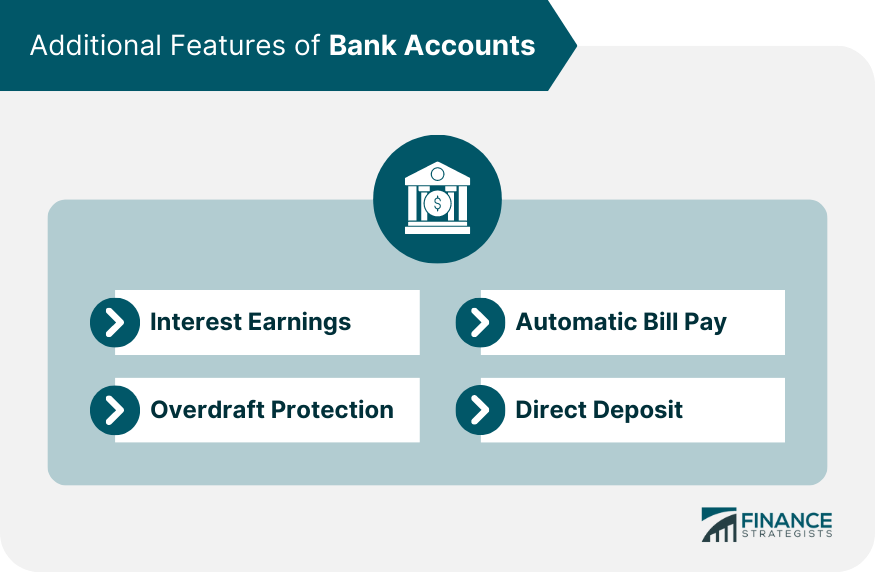

Additional Features of Bank Accounts

Interest Earnings

Compound Interest

High-Yield Savings Accounts

Certificates of Deposit (CDs)

Overdraft Protection

Automatic Bill Pay

Timely Payments

Cash Flow Management

Direct Deposit

Faster Access

Security

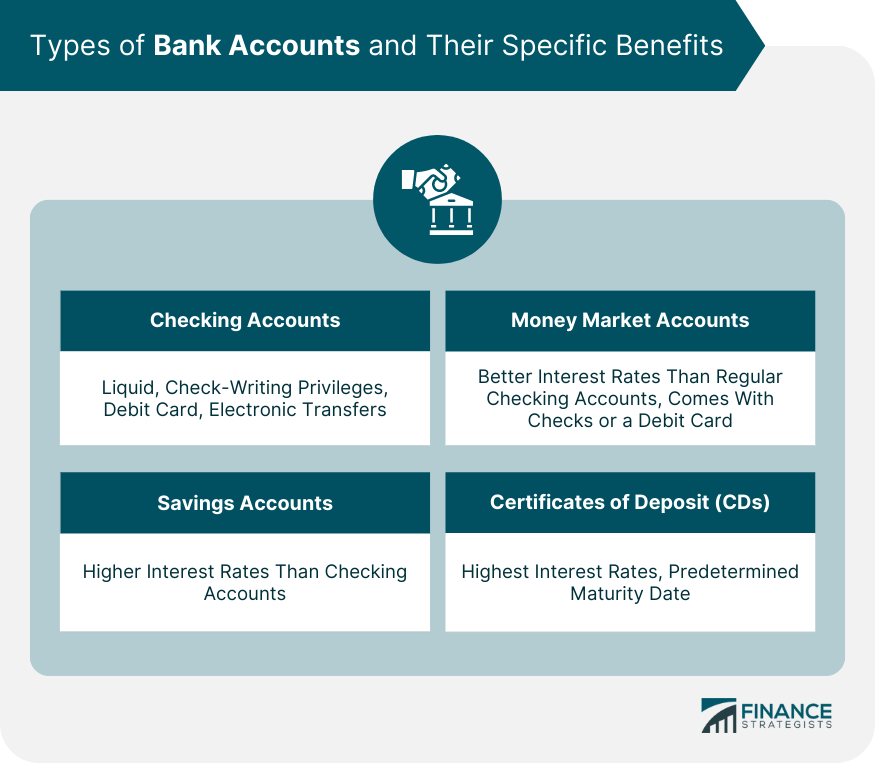

Types of Bank Accounts and Their Specific Benefits

Checking Accounts

Savings Accounts

Money Market Accounts

Certificates of Deposit (CDs)

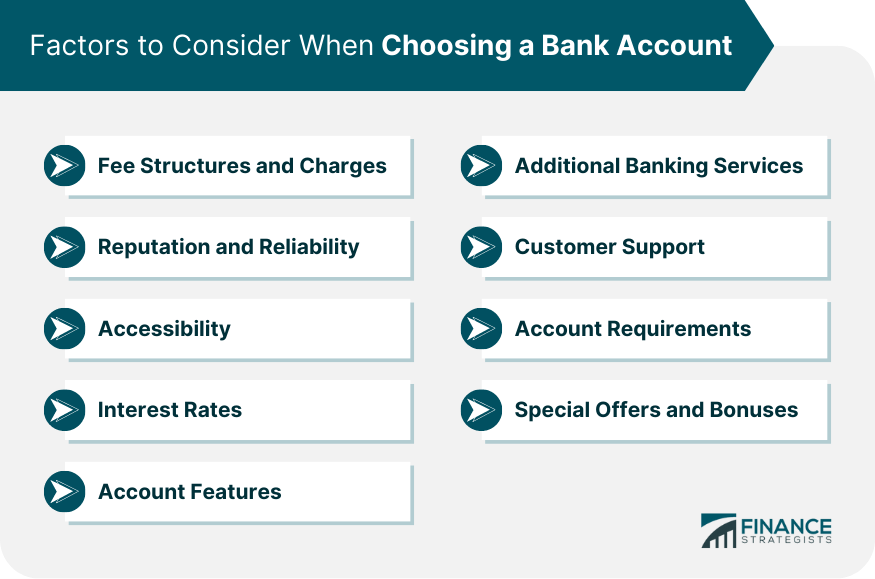

Factors to Consider When Choosing a Bank Account

Fee Structures and Charges

Reputation and Reliability

Accessibility

Interest Rates

Account Features

Additional Banking Services

Customer Support

Account Requirements

Special Offers and Bonuses

Conclusion

Bank Account Benefits FAQs

Bank accounts offer security, convenience, interest earnings, easier record-keeping, and access to financial services.

Bank accounts safeguard funds with robust security measures and deposit insurance schemes, protecting against theft and unauthorized access.

Bank accounts provide easy access to cash via ATMs, online bill payments, and digital banking, reducing the need to carry cash.

Bank accounts may offer interest on deposits, allowing your savings to grow over time with compound interest.

Responsible account usage, maintaining positive balances, and timely payments contribute positively to building a good credit score.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.