A debit card is a plastic payment card that provides the cardholder with electronic access to their bank account. Debit cards allow cardholders to make purchases and withdraw cash from ATMs by directly debiting the associated account, rather than borrowing money from a credit card issuer. Debit cards have become an essential component of modern banking, offering convenience, speed, and security in financial transactions. They have revolutionized the way people manage their money and conduct everyday transactions, reducing the reliance on cash and checks. Basic debit cards are the most common type of debit card and are typically issued by banks and credit unions to customers with checking accounts. These cards allow users to make point-of-sale purchases and withdraw cash from ATMs. Prepaid debit cards are not directly linked to a checking account. Instead, cardholders load funds onto the card, which can then be used for purchases and cash withdrawals. These cards are popular among individuals who do not have a traditional bank account or want to manage their spending more closely. Rewards debit cards offer incentives to cardholders for using the card, such as cashback, points, or other rewards programs. These cards encourage frequent use by providing benefits that can be redeemed for merchandise, travel, or other rewards. Business debit cards are designed for use by businesses and organizations. They offer features tailored to the needs of business owners and managers, such as expense tracking, customizable spending limits, and the ability to issue multiple cards for employees. Debit cards are linked to a bank account, allowing users to access their funds for purchases and withdrawals. When a transaction is made, the amount is automatically deducted from the associated account, with the transaction details recorded in the account statement. Debit card transactions occur through electronic funds transfer systems, such as the Visa or MasterCard networks. When a card is swiped, inserted, or tapped at a point-of-sale terminal, the transaction information is transmitted to the cardholder's bank for authorization. If the account has sufficient funds, the transaction is approved, and the funds are transferred to the merchant's account. Personal Identification Number (PIN) based transactions require the cardholder to enter a unique numeric code to authenticate the transaction. This provides an additional layer of security, as the transaction cannot be completed without the correct PIN. Signature-based transactions require the cardholder to sign a receipt or electronic signature pad to verify their identity. While this method is less secure than PIN-based transactions, it is still widely used for in-person debit card purchases. Debit cards offer a convenient and accessible way to make purchases and access cash. They eliminate the need to carry large amounts of cash or write checks, making transactions faster and more efficient. Using a debit card can help with budgeting and expense tracking, as transactions are automatically deducted from the linked account and recorded in the account statement. This provides a clear record of spending, allowing cardholders to monitor their finances more easily. Debit cards often include security features such as chip technology, PIN authentication, and fraud monitoring systems. These measures help protect cardholders from unauthorized transactions and minimize the risk of financial loss due to fraud. Unlike credit cards, debit cards do not allow users to spend more than they have in their linked account. This can help prevent overspending and the accumulation of debt, promoting responsible financial management. Debit cards may offer less liability protection compared to credit cards in cases of unauthorized transactions. While many banks have policies in place to protect cardholders, the level of protection can vary and may depend on the cardholder's promptness in reporting suspicious activity. Using a debit card does not contribute to building a credit history or improving credit scores, as transactions are not reported to credit bureaus. For those looking to establish or improve their credit, a credit card may be a more suitable option. If a cardholder spends more than the available balance in their linked account, they may incur overdraft fees. These fees can add up quickly and become a significant financial burden if not managed carefully. Debit card usage relies on technology and network connectivity, which can sometimes lead to transaction delays or disruptions. If a point-of-sale terminal is not functioning properly or if the cardholder's bank experiences technical issues, debit card transactions may be temporarily unavailable. Cardholders should be vigilant in protecting their personal information, such as their PIN and account details, to reduce the risk of unauthorized transactions and identity theft. Regularly reviewing account statements and monitoring transaction activity can help cardholders identify and report any suspicious or unauthorized transactions, minimizing potential financial loss. Some banks allow cardholders to set spending limits on their debit cards, helping to control spending and prevent overdraft fees. It is important to keep debit card details secure, such as not sharing card numbers, PINs, or other sensitive information with anyone. Contactless debit cards enable cardholders to make payments by simply tapping their card on a compatible point-of-sale terminal. This technology offers increased convenience and speed in transactions. Many debit cards can now be integrated with mobile payment platforms, such as Apple Pay or Google Pay, allowing cardholders to make transactions using their smartphones. Some debit cards are incorporating biometric authentication, such as fingerprint or facial recognition, to enhance security and streamline the transaction process. Emerging technologies, such as tokenization and end-to-end encryption, are being implemented to improve the security of debit card transactions and protect cardholder information. Debit cards are essential tools in modern banking, providing convenience, security, and accessibility in financial transactions. They are linked to a bank account, allowing cardholders to make purchases and withdrawals without incurring debt. There are several types of debit cards, including basic debit cards, prepaid debit cards, rewards debit cards, and business debit cards, each offering different features and benefits. Debit cards offer numerous advantages, such as convenience, budgeting, and security, but also have some disadvantages, including limited liability protection, no credit-building benefits, and potential overdraft fees. Debit cards have revolutionized banking, offering a user-friendly and efficient way to manage finances and conduct everyday transactions.What Is a Debit Card?

Types of Debit Cards

Basic Debit Cards

Prepaid Debit Cards

Rewards Debit Cards

Business Debit Cards

How Debit Cards Work

Linking to a Bank Account

Transaction Process

PIN-Based Transactions

Signature-Based Transactions

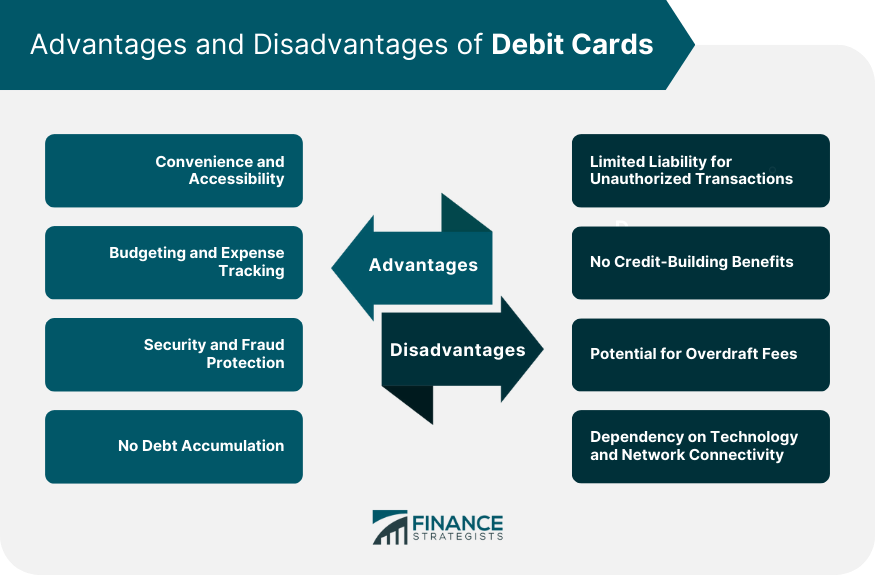

Advantages of Debit Cards

Convenience and Accessibility

Budgeting and Expense Tracking

Security and Fraud Protection

No Debt Accumulation

Disadvantages of Debit Cards

Limited Liability for Unauthorized Transactions

No Credit-Building Benefits

Potential for Overdraft Fees

Dependency on Technology and Network Connectivity

Debit Card Usage Tips

Protecting Personal Information

Monitoring Account Activity

Setting Spending Limits

Keeping Card Details Secure

Emerging Trends in Debit Card Technology

Contactless Debit Cards

Mobile Payment Integration

Biometric Authentication

Enhanced Transaction Security

Conclusion

Debit Card FAQs

A debit card allows you to spend money from your checking account, whereas a credit card allows you to borrow money from the card issuer up to a predetermined limit.

Yes, you can often use your debit card internationally for purchases and ATM withdrawals. However, it is essential to check with your bank for any fees or restrictions associated with international transactions.

If your debit card is lost or stolen, immediately contact your bank to report the loss and freeze the card. This will prevent unauthorized transactions and minimize potential financial loss. Your bank will usually issue a replacement card.

Many banks impose daily spending limits on debit cards as a security measure to protect cardholders from fraud. The daily limit varies by bank and individual account. If you need to make a purchase that exceeds your daily limit, contact your bank to request a temporary increase.

While you can generally use a debit card to rent a car or reserve a hotel room, some rental agencies and hotels may require a credit card or place a hold on a certain amount of funds in your account until the transaction is complete. It is advisable to check with the specific rental agency or hotel to understand their payment policies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.