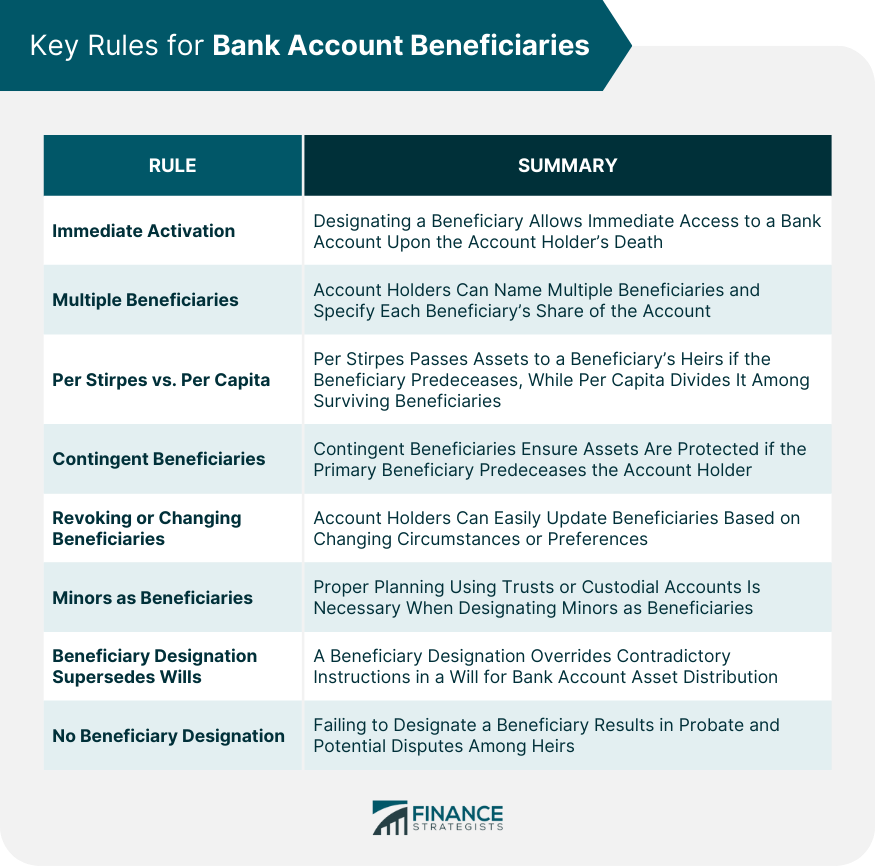

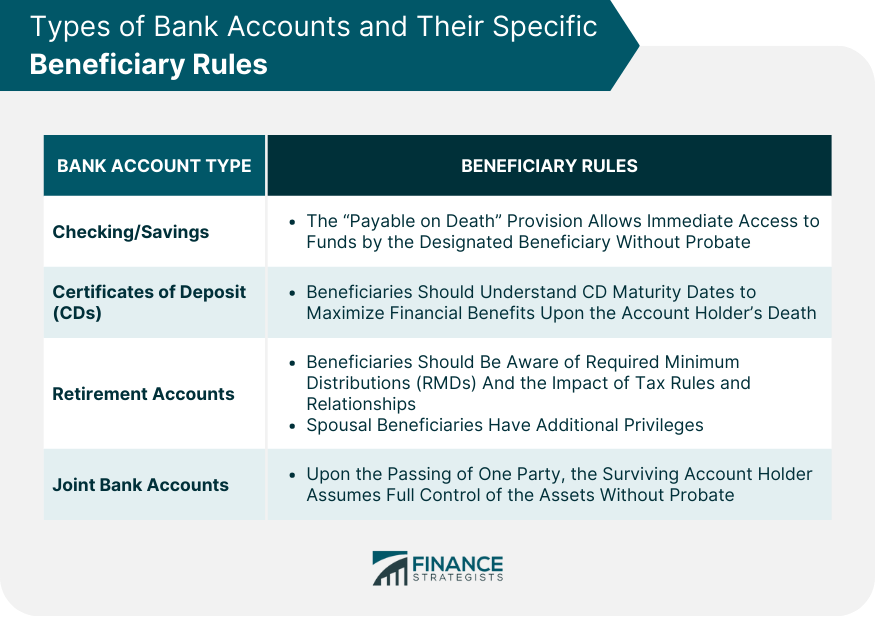

One of the most crucial aspects of designating a beneficiary for a bank account is the ability to enable immediate access to the account upon the account holder's death. By establishing a clear beneficiary, the assets within the account sidestep the often-tedious probate process. This not only speeds up the transfer of funds but also ensures that the assets reach the intended recipient without legal entanglements. Bank account holders have the option to name more than one beneficiary and specify the share of the account each beneficiary should receive. This can be broken down further: Per stirpes allows assets to be passed down to a beneficiary's heirs if the beneficiary predeceases the account holder. Per capita, on the other hand, distributes the deceased beneficiary's share among the surviving beneficiaries. A safety net in the realm of financial planning, the contingent beneficiary steps in when the primary beneficiary predeceases the account holder. By designating a contingent beneficiary, account holders ensure that their assets have a predefined path, safeguarding them from unintended distribution or probate. Life is ever-changing, and the named beneficiary today may not be the ideal recipient tomorrow. Key life events, such as marriage, divorce, or the birth of a child, can prompt account holders to reevaluate beneficiary designations. Banks usually provide straightforward procedures to make these changes, emphasizing the importance of ensuring assets align with current wishes. Designating minors as beneficiaries introduces unique challenges. Without proper planning, the assets might get entangled in legal procedures, requiring court-appointed guardians to manage them until the minor reaches legal age. Using tools like trusts or custodial accounts can streamline this process, ensuring that the minor's financial well-being is maintained without unnecessary complications. Contrary to popular belief, will doesn't hold the ultimate power in asset distribution. If a bank account has a named beneficiary, that designation will override any contradictory instructions in a will. Understanding this hierarchy is pivotal in ensuring assets are distributed according to the account holder's true intentions. Failure to designate a beneficiary can lead to several complications. The most immediate implication is that the account will go through probate, a process that can be both time-consuming and costly. Moreover, the absence of a clear beneficiary can lead to disputes among potential heirs. For these everyday accounts, many institutions offer a "payable on death" (POD) provision. This ensures that, upon the account holder's death, the funds are immediately available to the designated beneficiary without probate intervention. CDs come with maturity dates, and beneficiaries must understand these timelines. While the death of an account holder can often lead to an early withdrawal without penalty, beneficiaries should be well-acquainted with the terms to maximize financial benefits. Inheriting retirement assets like IRAs or 401(k)s comes with its own set of guidelines: Especially in the case of inherited IRAs, beneficiaries need to be aware of RMDs. Depending on the relationship to the deceased, different rules can apply, which may have tax implications. Spouses inheriting retirement accounts have unique privileges, like the ability to roll over assets into their own retirement accounts. Non-spousal beneficiaries, meanwhile, may face different distribution and tax rules. For joint bank account holders, the passing of one party typically means the surviving account holder assumes full control of the assets. This process is automatic and bypasses the probate process. Generally, inherited assets aren't subject to income tax. However, any income generated by those assets, like interest or dividends, can be taxable. Depending on the jurisdiction, beneficiaries might be subject to inheritance or estate taxes. While federal laws in many countries exempt significant amounts, local or state taxes can still apply. Inheriting retirement assets can come with a mixed bag of tax implications. While some accounts allow for tax-free distributions, others might require beneficiaries to pay taxes upon withdrawal. In these jurisdictions, spouses have equal ownership of assets acquired during the marriage. This can influence beneficiary designations, especially if the account holder wishes to leave assets to someone other than their spouse. If a bank account has associated debts, such as an outstanding loan or credit card balance, these obligations might reduce the amount a beneficiary receives. It's essential to understand these implications to avoid unexpected financial burdens. Cross-border asset transfers come with a unique set of challenges, from fluctuating exchange rates to varying tax laws. Beneficiaries residing in different countries should be prepared for a more complex inheritance process. Understanding bank account beneficiary rules is pivotal in ensuring that one's assets are distributed accurately and promptly upon their passing. With the power to sidestep the probate process, designated beneficiaries can access funds more rapidly. The ability to name multiple beneficiaries and contingent beneficiaries and even account for special scenarios ensures comprehensive financial planning. The particularly notable point is that beneficiary designations supersede will instructions, emphasizing their paramount importance. Moreover, various account types come with unique beneficiary stipulations, and potential tax implications further highlight the need for informed decisions. From community property considerations to managing international beneficiaries, every nuance can make a significant difference in the eventual outcome. In essence, a proactive and informed beneficiary designation not only safeguards assets but ensures they reach the intended hands without legal or unnecessary complications.Key Rules for Bank Account Beneficiaries

Immediate Activation Upon Death

Multiple Beneficiaries

Per Stirpes vs Per Capita Distributions

For example, if a beneficiary who is a child of the account holder dies, their share goes to their children. Contingent Beneficiaries

Revoke or Change a Beneficiary

Minor Beneficiaries

Beneficiary Designation Supersedes Wills

No Beneficiary Designation

Types of Bank Accounts and Their Specific Beneficiary Rules

Checking and Savings Accounts

Certificates of Deposit (CDs)

Retirement Accounts

Required Minimum Distributions (RMDs) And Beneficiaries

Spousal vs Non-spousal Beneficiaries

Joint Bank Accounts

Tax Implications for Beneficiaries

Income Tax Considerations

Inheritance or Estate Tax Implications

Tax Benefits or Penalties of Inherited Retirement Accounts

Special Situations and Considerations

Community Property States

Accounts With Debt

International Beneficiaries

Final Thoughts

Bank Account Beneficiary Rules FAQs

If no beneficiary is designated, the account will likely go through the probate process, potentially leading to delays in asset distribution and potential legal costs. This can also result in disputes among potential heirs.

A beneficiary designation on a bank account will override any instructions regarding that asset in a will. So, even if a will specifies one heir for an asset if a different beneficiary is named directly on the account, the latter takes precedence.

In general, the actual inherited assets (like the balance of a bank account) aren't subject to income tax. However, any subsequent income generated by those assets (like interest or dividends) can be taxable. Additionally, depending on the jurisdiction, there may be inheritance or estate taxes to consider.

Yes, minors can be designated as beneficiaries. However, without proper arrangements, such as a trust or custodial account, the assets may require court-appointed guardianship until the minor reaches legal age.

In community property states, assets acquired during the marriage are typically considered jointly owned. While you can name someone other than your spouse as a beneficiary, your spouse might still have legal rights to a portion of those assets. It's crucial to understand local laws and possibly consult with a legal professional when making such decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.