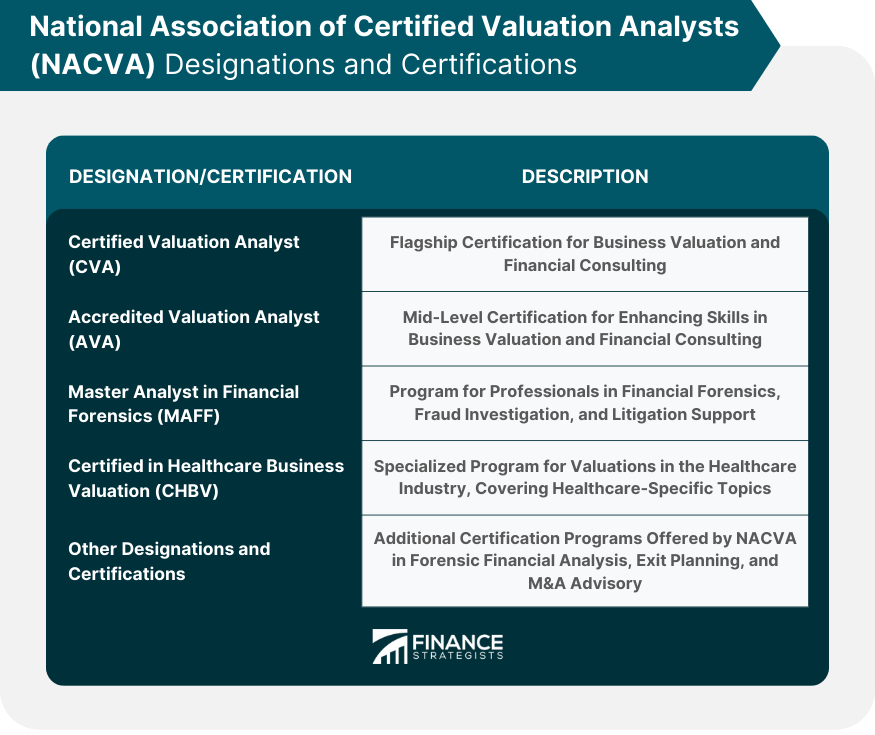

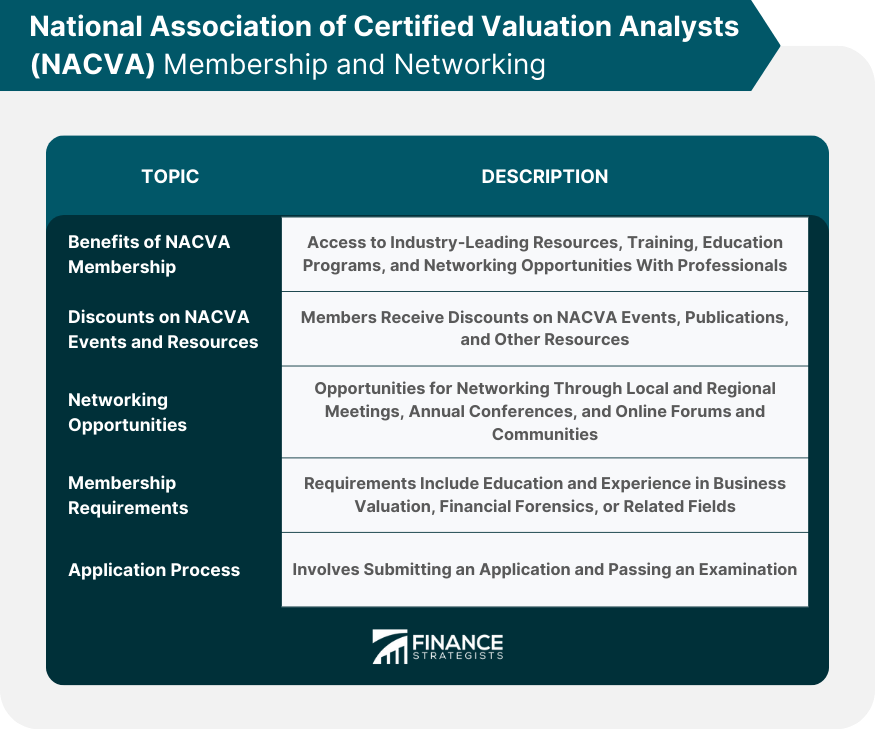

The National Association of Certified Valuation Analysts (NACVA) is a professional organization dedicated to promoting excellence and professionalism in the field of business valuation, financial forensics, and related consulting services. NACVA's mission is to advance the valuation profession by providing education, research, and standards that promote professional excellence and ethical conduct. The organization aims to be a leading authority in the valuation industry, setting standards for best practices and providing guidance and support to its members. Membership in NACVA provides numerous benefits, including access to industry-leading resources, networking opportunities with fellow professionals, and professional development through education and training programs. NACVA was founded in 1990 by a group of business valuation professionals who recognized the need for a professional organization dedicated to advancing the field. Since its founding, NACVA has grown to become a leading professional organization in the valuation industry. Over the years, NACVA has achieved many milestones and accomplishments, including developing industry-leading standards and guidelines for business valuation and financial forensics, launching several highly-regarded certification programs, and hosting annual conferences and events for industry professionals. Today, NACVA boasts a membership of over 6,000 professionals across the globe, including business valuation analysts, forensic accountants, financial consultants, and other related professionals. The Certified Valuation Analyst (CVA) is NACVA's flagship certification program, designed for professionals with experience in business valuation and financial consulting. The CVA designation signifies a high level of expertise in the field of valuation, including the ability to perform valuations for a variety of purposes, such as mergers and acquisitions, estate planning, and litigation support. The Accredited Valuation Analyst (AVA) designation is a mid-level certification program designed for professionals seeking to enhance their skills in business valuation and financial consulting. The AVA program covers a broad range of valuation topics and is ideal for professionals who may not have the experience necessary to earn the CVA designation. The Master Analyst in Financial Forensics (MAFF) designation is NACVA's program for professionals with experience in financial forensics, fraud investigation, and litigation support. The MAFF designation signifies a high level of expertise in the field of financial forensics, including the ability to conduct fraud investigations and provide expert testimony in legal proceedings. The Certified in Healthcare Business Valuation (CHBV) designation is a specialized program designed for professionals who perform valuations in the healthcare industry. The CHBV program covers topics specific to the healthcare industry, such as regulatory compliance and reimbursement issues. In addition to its flagship designations, NACVA offers several other certification programs, including the Certified Forensic Financial Analyst (CFFA), Certified Exit Planning Advisor (CEPA), and Certified Merger & Acquisition Advisor (CM&AA) programs. NACVA offers a range of core courses and training programs to help professionals build the skills necessary to excel in the valuation industry. These courses cover a broad range of topics, including valuation methodology, financial analysis, and report writing. In addition to its core courses, NACVA also offers advanced courses and specialized training programs designed to help professionals deepen their expertise in specific areas of valuation and financial consulting. These programs cover a range of topics, including business valuation in divorce cases, valuing intangible assets, and financial modeling. NACVA requires its members to complete continuing education requirements to maintain their certification and stay up-to-date with the latest industry trends and best practices. Members must complete a certain number of hours of continuing education every year to maintain their certification. NACVA offers a wide range of resources for professionals in the valuation industry, including access to industry-leading research, data, and analysis. These resources can help professionals stay up-to-date with the latest trends and developments in the valuation industry. NACVA publishes a variety of industry-leading publications focused on business valuation, financial forensics, and related topics. These publications include books, journals, and newsletters that provide valuable insights and analysis for professionals in the valuation industry. NACVA also provides resources and publications focused specifically on financial forensics and fraud investigation. These resources can help professionals develop the skills and knowledge necessary to detect and investigate financial fraud, and provide expert testimony in legal proceedings. NACVA has established a set of professional standards and guidelines for business valuation and financial consulting. These standards help ensure that NACVA members maintain the highest level of professional excellence and ethical conduct in their work. In addition to its professional standards, NACVA has also established a Code of Ethics and Professional Conduct that all members must adhere to. This code emphasizes the importance of honesty, integrity, and objectivity in all aspects of valuation and financial consulting. NACVA takes violations of its professional standards and code of ethics seriously and has established disciplinary procedures to address any breaches of conduct. These procedures include investigations and hearings and may result in the suspension or revocation of a member's certification. Membership in NACVA provides numerous benefits, including access to industry-leading resources, training, and education programs, and networking opportunities with fellow professionals. NACVA members also receive discounts on NACVA events, publications, and other resources. NACVA offers numerous opportunities for members to network with fellow professionals in the valuation industry. These opportunities include local and regional meetings, annual conferences, and online forums and communities. To become a member of NACVA, individuals must meet certain requirements, including education and experience in business valuation, financial forensics, or related fields. The application process involves submitting an application and passing an examination. NACVA plays a crucial role in advancing the valuation industry by setting standards for best practices and providing guidance and support to its members. Its designations and certifications are highly regarded in the industry and signify a high level of expertise and professionalism. Earning a designation or certification from NACVA can provide numerous benefits, including increased credibility, opportunities for career advancement, and access to industry-leading resources and education programs. Professionals in the valuation industry are encouraged to explore the benefits of NACVA membership, including access to industry-leading resources and training programs.What Is the National Association of Certified Valuation Analysts (NACVA)?

History of NACVA

Founding of NACVA

Milestones and Achievements

Current Status and Membership

NACVA Designations and Certifications

Certified Valuation Analyst (CVA)

Accredited Valuation Analyst (AVA)

Master Analyst in Financial Forensics (MAFF)

Certified in Healthcare Business Valuation (CHBV)

Other Designations and Certifications

NACVA Training and Education Programs

Core Courses and Training Programs

Advanced Courses and Specialized Training

Continuing Education Requirements

NACVA Resources and Publications

Valuation Industry Resources

Business Valuation Publications

Forensic and Fraud Resources

NACVA Standards and Ethics

Professional Standards and Guidelines

Code of Ethics and Professional Conduct

Disciplinary Procedures and Enforcement

NACVA Membership and Networking

Benefits of NACVA Membership

Networking Opportunities

Membership Requirements and Application Process

Final Thoughts

National Association of Certified Valuation Analysts (NACVA) FAQs

NACVA stands for the National Association of Certified Valuation Analysts. It is a professional organization dedicated to promoting excellence and professionalism in the field of business valuation, financial forensics, and related consulting services.

NACVA offers several designations and certifications, including the Certified Valuation Analyst (CVA), Accredited Valuation Analyst (AVA), Master Analyst in Financial Forensics (MAFF), and Certified in Healthcare Business Valuation (CHBV), as well as several other programs.

NACVA offers a range of training and education programs, including core courses, advanced courses, and specialized training programs. These programs cover a range of topics, including business valuation methodology, financial analysis, and report writing.

NACVA provides a range of resources and publications for professionals in the valuation industry, including access to industry-leading research, data, and analysis. It also publishes books, journals, and newsletters focused on business valuation, financial forensics, and related topics.

NACVA membership provides numerous benefits, including access to industry-leading resources and education programs, networking opportunities with fellow professionals, and discounts on NACVA events and publications. NACVA designations and certifications also signify a high level of expertise and professionalism in the valuation industry.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.